Web Developers

We attended the Chico’s FAS analyst and investor event in New York on September 28. Below, we provide our key takeaways from the day.

Chico’s is also now in the process of rolling out iPads to stores so in-store associates can utilize in real time the data the company has collected. Associates will have visibility into customers’ buying habits and their category of loyalty. iPads also provide the capability to buy items online and contact customers individually or in groups. The initial results from this program include incremental appointment sales and higher average dollar spend.

The brand’s plans through 2018 include connection campaigns, loyalty integration, style surveys, beacon integration and connection suggestions.

Chico’s is also now in the process of rolling out iPads to stores so in-store associates can utilize in real time the data the company has collected. Associates will have visibility into customers’ buying habits and their category of loyalty. iPads also provide the capability to buy items online and contact customers individually or in groups. The initial results from this program include incremental appointment sales and higher average dollar spend.

The brand’s plans through 2018 include connection campaigns, loyalty integration, style surveys, beacon integration and connection suggestions.

Portfolio of Brands Targets Demographic with More Wealth

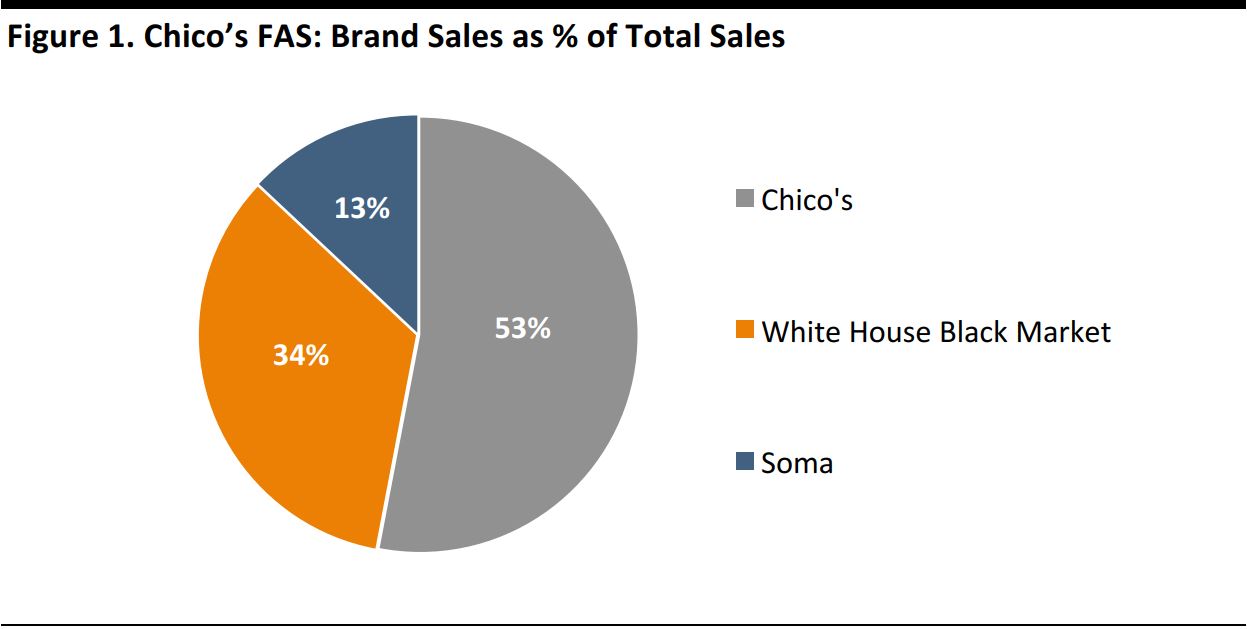

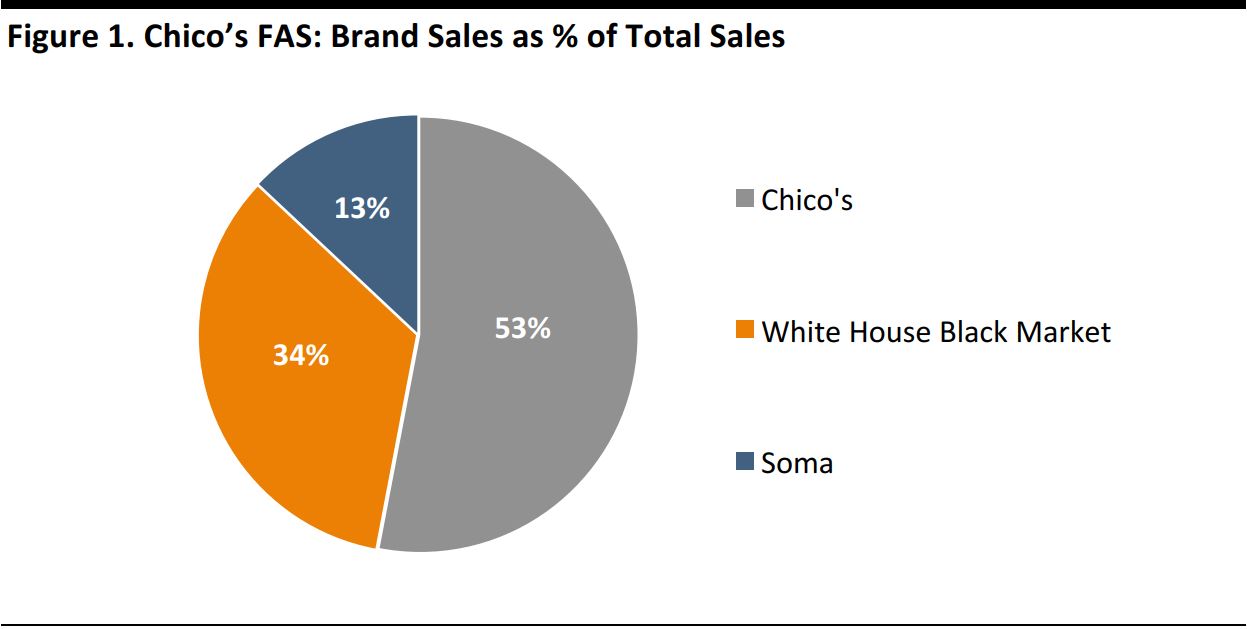

Chico’s FAS has a portfolio of differentiated brands that include Chico’s, White House Black Market and Soma. Each of these targets women older than 35 (and older than 45, in the case of Chico’s). These consumers are an attractive cohort, given that people in these age groups generally have significantly more wealth than millennials and Gen Zers do. At each of its brands, Chico’s FAS differentiates itself through its personalized in-store customer service, which complements its product offerings.

Source: Company reports

The Chico’s brand has a cultlike following of loyal customers among women aged 45 and older. The assortments are comfortable, offering relaxed fits combined with modern style. The Chico’s customer is very focused on being “outfitted.” The brand is currently trialing new merchandise initiatives, such as offering petite sizes, based on online and in-store testing. White House Black Market offers aspirational styles for women 35 and older. Assortments are feminine and affordable, and are offered as an alternative to designer fashion. Colors are primarily black and white, accented with seasonal splashes of color. New initiatives include a renewed focus on the special occasion segment and a revived and expanded accessories business. Soma is an intimate apparel brand that caters to an underserved intimates market focused on women 35 and older. The brand offers lingerie that is very focused on comfort. New initiatives include the rollout of swimwear to all stores and online following a successful test.New Retail Landscape, New Customer Culture

Retail is changing rapidly and Chico’s FAS is working to adapt to address the needs of the evolving consumer. The new consumer has gotten used to a culture of immediate access to information, the ability to shop from anywhere, instant gratification and spending on experiences. New technologies and platforms have made shopping more convenient for consumers, and expectations and the culture have changed as a result. Easy access to information, a higher guarantee of availability and, most importantly, convenience have all contributed to the rise of the “shop from anywhere” culture. Consumers today are less likely to wait for an out-of-stock item, preferring to pay a premium for instant gratification. Prioritization of personal experiences has led retailers to increase their focus on improving the shopping experience.Data Is Driving Decisions; High Loyalty Allows for Capture of Information

Chico’s FAS has one of the most loyal customer bases in the industry, with more than 90% of its revenues generated from members of its loyalty program. The company’s net promoter scores, which measure the willingness of customers to recommend a company’s products or services to others on an index ranging from -100 to 100, are well above the average for the retail sector: the company saw scores in the mid-to-high 70s in 2015 (77 for Chico’s, 75 for White House Black Market and 75 for Soma) versus an average of 51 across retail. That loyalty gives Chico’s FAS access to a large amount of data it can use to be more informed about who is shopping and what and when they are buying, among other things. Chico’s FAS has customer data going back 15 years and has been tying purchases directly to specific customer names. So, the company has an ability to leverage deep customer analytics to maximize profitability. One thing the company recently learned was that it was changing its floor sets at its Chico’s stores more often than its best customers were shopping in them. The brand’s most desirable customers visit a store once every seven to 10 weeks. The more frequent in-store changes resulted in costs that were higher than necessary in the design process, in shipping, and in stores in terms of labor and markdowns. Even if a product had been selling well, the company would mark it down just to clear it to make way for new assortments. In all, customers loved the newness, but they often did not have the opportunity to see it before new product was brought in again. The company has now been able to adjust the frequency of new product sets by up to 30% and layer in new product to still drive newness, but also keep existing base product lines for longer. Chico’s is also now in the process of rolling out iPads to stores so in-store associates can utilize in real time the data the company has collected. Associates will have visibility into customers’ buying habits and their category of loyalty. iPads also provide the capability to buy items online and contact customers individually or in groups. The initial results from this program include incremental appointment sales and higher average dollar spend.

The brand’s plans through 2018 include connection campaigns, loyalty integration, style surveys, beacon integration and connection suggestions.

Chico’s is also now in the process of rolling out iPads to stores so in-store associates can utilize in real time the data the company has collected. Associates will have visibility into customers’ buying habits and their category of loyalty. iPads also provide the capability to buy items online and contact customers individually or in groups. The initial results from this program include incremental appointment sales and higher average dollar spend.

The brand’s plans through 2018 include connection campaigns, loyalty integration, style surveys, beacon integration and connection suggestions.

The Intersection of Digital and Physical

The future is at the intersection of digital and physical. Chico’s FAS is continuing to expand its omni-channel capabilities, beginning with enterprise-wide inventory visibility starting in 2017. In fiscal 2018, the company will pilot a program to offer buy online, pick up in-store and reserve online, pick up in-store, both of which will be new offerings for the company. The full rollout of the program is expected in fiscal 2019.Store Fleet to Be Trimmed: 175 Stores to Be Closed Through 2017

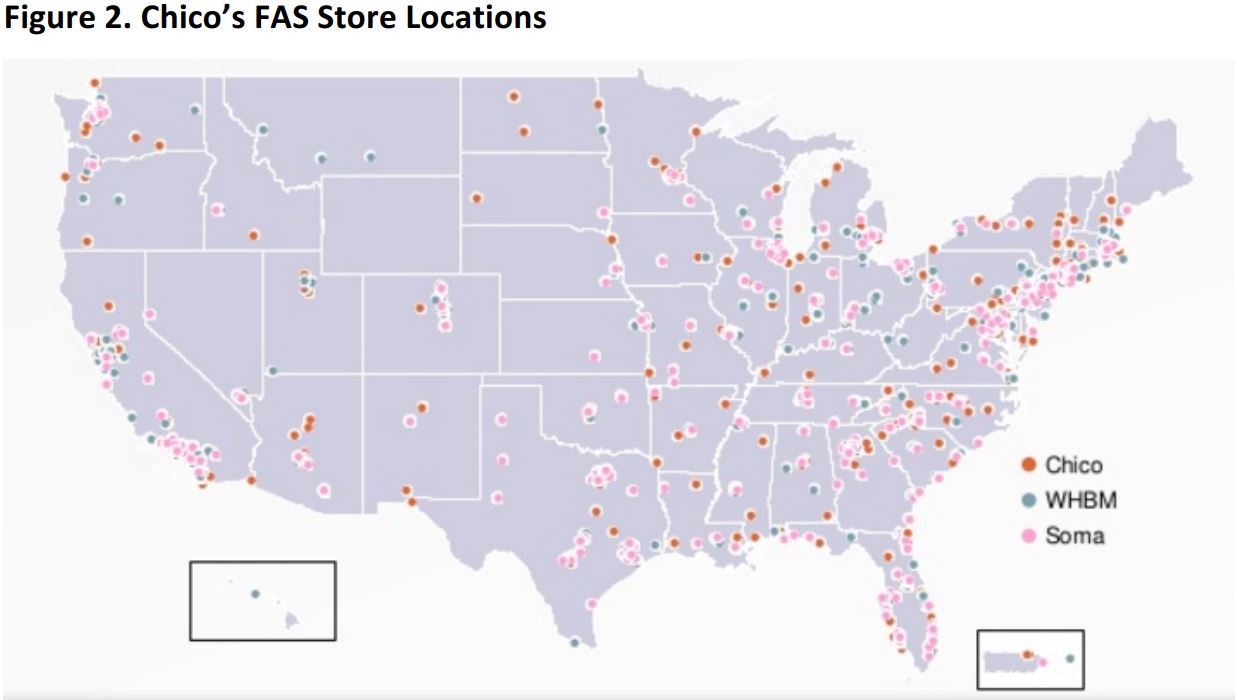

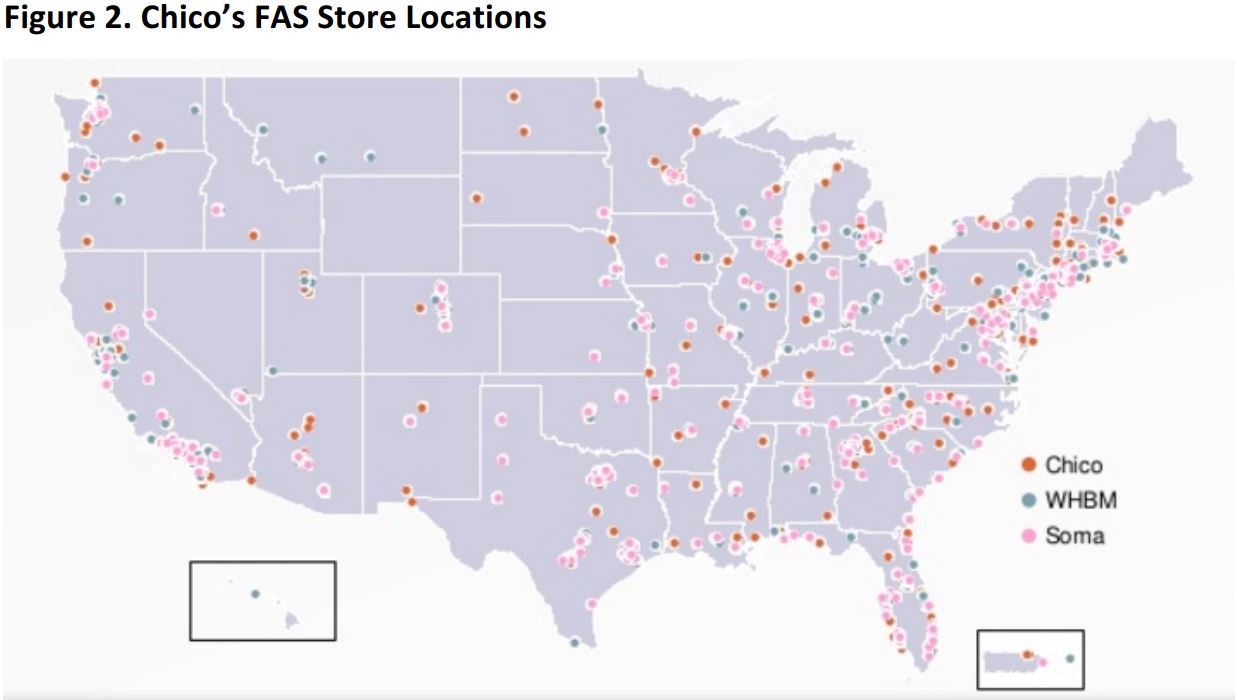

Chico’s FAS is working to “future-proof” its business, in particular its store fleet. The Chico’s brand has 602 boutiques in the US and Canada as well as 118 outlets and 47 franchise locations in Mexico. The White House Black Market brand has 432 boutiques in the US and Canada as well as 72 outlet locations. There are 274 Soma boutiques in the US and Canada as well as 19 outlet stores and 31 franchise locations in Mexico. That is a total of 1,595 locations. The company is focused on its most productive locations and on reducing and improving its overall store base. Square footage growth is expected to slow, and 175 stores are expected to be closed through the end of 2017. That should result in improved store productivity. While less-profitable stores will be closed, the locations to be closed are not necessarily cash-flow negative or unprofitable. A key consideration is the recapture rate, where the sales from the closed store can potentially be recaptured either by another nearby location or online. The company discussed a recapture rate in the range of 50% versus the overall retail average of 20%–30%.

Source: Company reports

International Markets Virtually Untapped

The Chico’s brand has 47 franchise locations in Mexico and Soma has 31 franchise locations in the country. However, after testing and learning in its owned and franchised operations, Chico’s FAS is deepening its existing market penetration and focusing on entering selected new markets. Phase 1 of its expansion plan involves establishing a presence in selected lower-risk markets such as Canada (given its geographical and cultural proximity to the US) and Mexico (for the same reasons). Phase 2 involves expanding and establishing deeper penetration in existing markets (as established in Phase 1) and deploying the same business model in geographically distant markets that have some cultural proximity. Phase 3 involves driving productivity and operational efficiencies.Four-Point Plan to Drive Operating Improvement

Under the leadership of recently appointed CEO and President Shelley Broader, Chico’s FAS is executing a new strategic plan. The plan centers on four key areas: 1) strengthen the company’s brand positioning, 2) evolve the customer experience, 3) leverage actionable retail science and 4) sharpen the company’s financial principles. The company expects to improve its operating margin to a double-digit rate by 2019 (up from 5.2% for the year ended July 2016).- To strengthen the positioning of its brands, the company is working to leverage the connection it has with its most loyal customers while at the same time attracting new customers and continuing to deliver strong customer service.

- Evolving the customer experience will involve integrating the digital and physical retail environments so as to have the agility to meet customers’ expectations as their relationship with digital platforms evolves.

- In terms of leveraging actionable retail science, the company is developing algorithms and models to drive and enable real-time decision making to improve its go-to-market strategy, how it stocks its product and how it interacts with its customers.

- Chico’s FAS plans to drive additional cost savings by leveraging its shared services model, optimizing expenses, driving a high ROI on marketing spend and facilitating value creation. The company expects total annual cost savings of $90–$100 million, equivalent to approximately 4% of 2015 revenues. Cost-saving initiatives include supply chain efficiency, marketing spend optimization and non-merchandise procurement reduction, and an organizational redesign.