Source: Company reports/Coresight Research

2Q18 Results

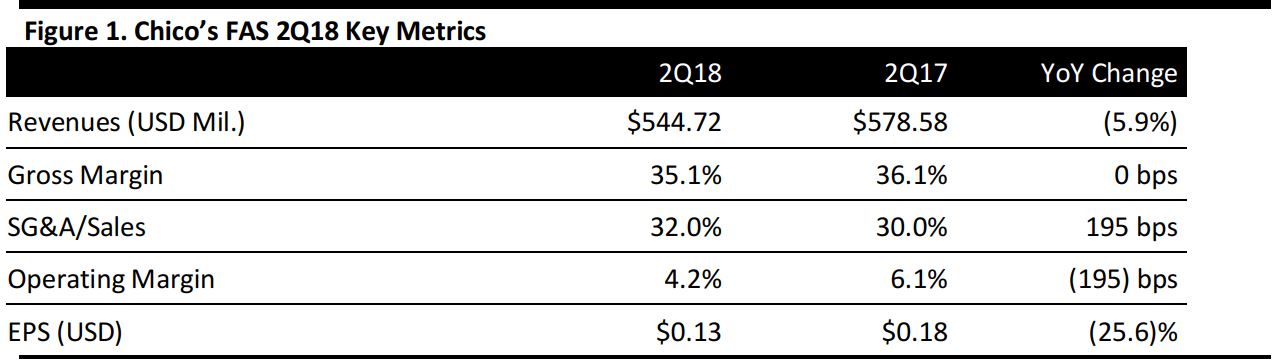

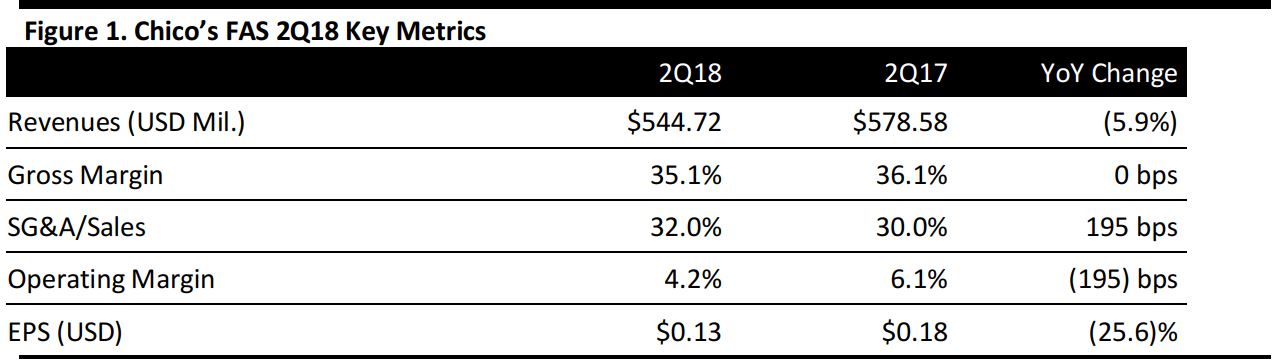

Chico’s FAS reported 2Q18 revenues $544.72 million, down by 5.9% year over year and beating the consensus estimate of $541.0 million.

Comps were down 3.2%, beating the consensus estimate of down 4.5%.

EPS was $0.13, beating the consensus estimate by a penny.

Segment Performance

- Chico’s sales were $286.8 million, down 5.1%. Comps were down 3.8%.

- White House Black Market sales were $168.9 million, down 8.4%. Comps were down 3.5%.

- Soma sales were $89.0 million, down 3.3%, and comps were 0.9%.

Details from the Quarter

Management commented that results were in line with expectations, reflecting momentum on top-line initiatives.

- Growth initiatives drove improved comparable sales trends across all brands and fueled a double-digit increase in its digital sales.

- The company made considerable progress toward becoming a fully integrated omnichannel retailer. All front-line stores have been converted to the new "Locate" tool, enhancing the ability to ship an in-store order directly to the customer.

- The company made substantial progress in its roll out of the “Endless Aisle” tool, which leverages shared inventory for purchase online and ship from store.

- Intimate apparel brand Soma launched Enbliss, a new innovative bra that offers superior soft comfort and support. The collection has exceeded expectations, with healthy sales, increased customer traffic and reactivation.

- Management is balancing marketing efforts between brand-building and transaction-driving initiatives to more effectively engage with its existing customers and to reach new and lapsed customers, which is resulting in an improvement in trends, particularly in customer reactivation.

- Partnerships, including ShopRunner, Amazon.com and QVC, are making progress. Sales are increasing, and these channels of distribution are being effective in driving increased customer awareness and consideration. Combined with the ability to leverage shared inventory, management is confident that these channels will contribute meaningfully to sales and earnings over the long term.

- Chico’s: The company saw increased demand, including travelers, no-iron, basic knits and denim in the second quarter. However, its fashion component in knits, primarily pattern and novelty, was softer than anticipated. Management has adjusted the assortment to include more modern trends with elevated fabrics, as well as reemphasizing clean, work-appropriate options this fall.

- White House Black Market: The company saw a healthy improvement in comparable sales trends, driven by strength in polished workwear. There is a significant opportunity to continue driving sales growth in the popular categories of polished casual and special-occasion dressing. Customer response has been positive to polished casual; in dresses, the category overall performed well. The focus for the fall is on the continued execution of brand positioning, improving quality and building a good, better, best assortment.

- Soma: The team has made tremendous progress in repositioning the Soma brand. The company saw improved momentum in the business, driven by Cool Nights sleep separates, the core Vanishing collections and the new Enbliss bra. The performance of Enbliss has been quite strong, second only to the Vanishing Back bra, the #1 bestseller.

- The company also recently launched Style Essentials, which replaces the loungewear assortment. Style Essentials offers effortless outfitting with easy-care and easy-wear flattering pants and tops with on-the-go lifestyle.

- In special sizes, petites continue to be strong and generated over $3 million in incremental sales for Chico’s and White House Black Market in the quarter. Chico’s rolled out its extensive sizes to 150 stores. Management is pleased with early results, which are trending above plan.

Outlook

The company offered the following guidance:

3Q:

- Sales and comps are expected to decline in the low single digits.

Full year:

- Sales are expected to decline in the mid-single digits, and comps are expected to decline in the low-to-mid single digits.