DIpil Das

On May 13, 2021, Deborah Weinswig, CEO and Founder of Coresight Research, presented the Livestreaming Playbook for Beauty at the Cosmetic Executive Women (CEW)’s State of the Industry: Retail Acceleration to Transformation event, which was held digitally this year.

The event featured presentations from leading experts—from retailers to tech providers—about how innovation in the beauty sector has accelerated amid the Covid-19 pandemic and what this means for the future of beauty shopping.

In this report, we present key insights from Weinswig’s presentation, covering an overview of livestreaming e-commerce in China and the US and selected recommendations for US beauty brands and retailers to excel in this innovative sales channel.

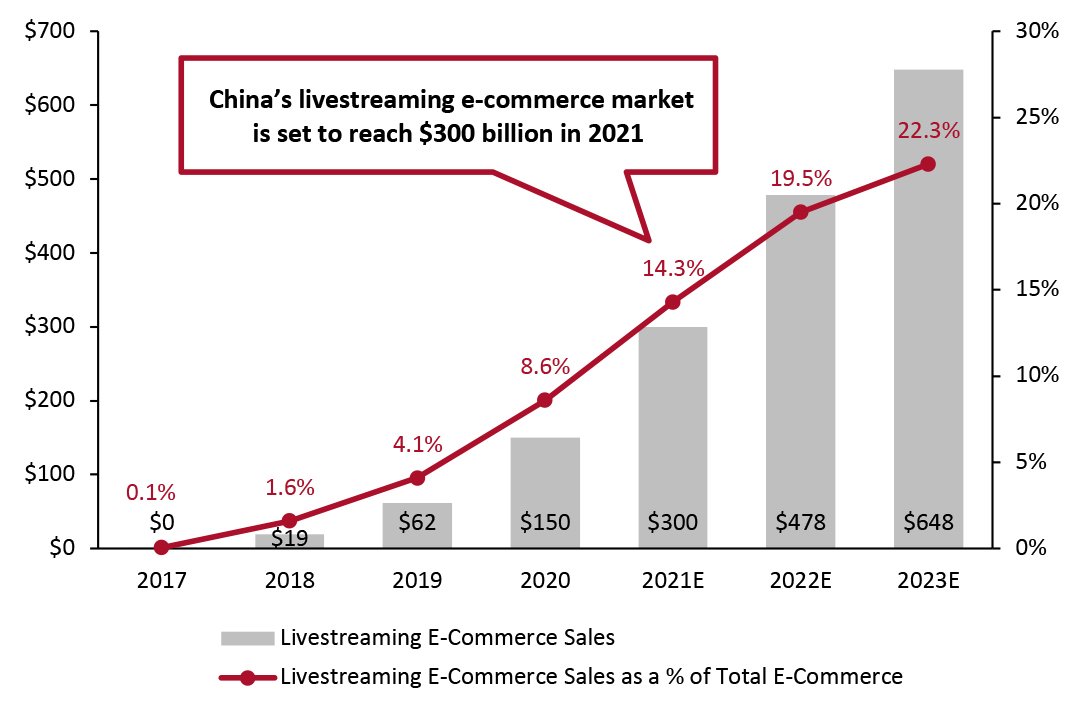

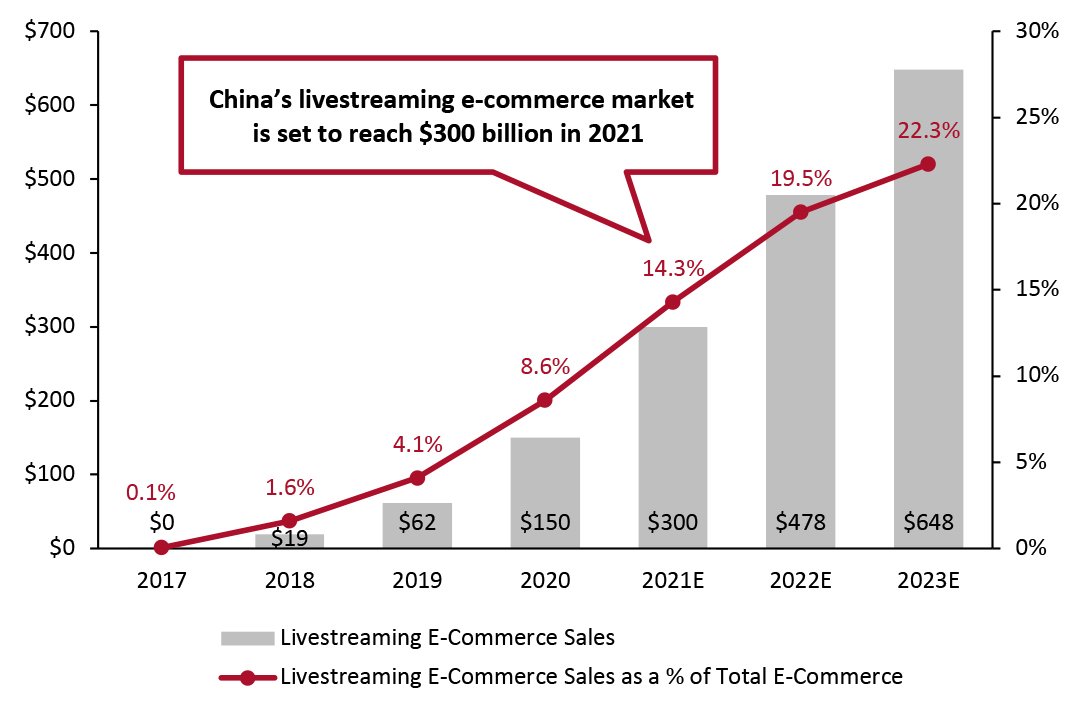

Figure 1. Livestreaming E-Commerce Sector Size (USD Bil; Left Axis) and Penetration (% of Total E-Commerce; Right Axis) in China [caption id="attachment_127497" align="aligncenter" width="725"] Source: Coresight Research [/caption]

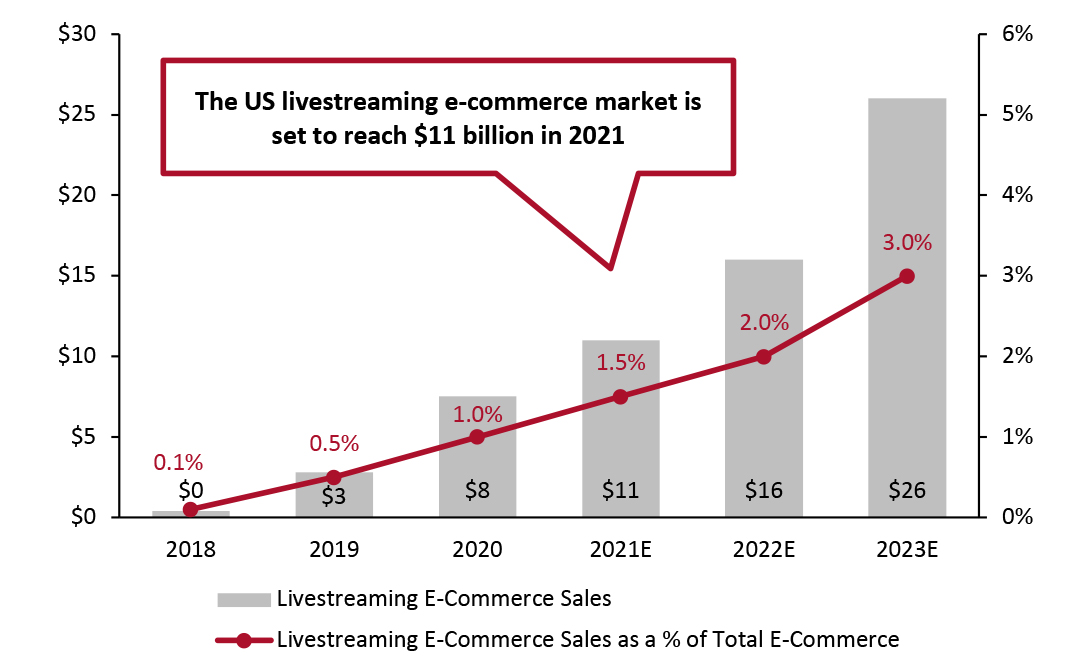

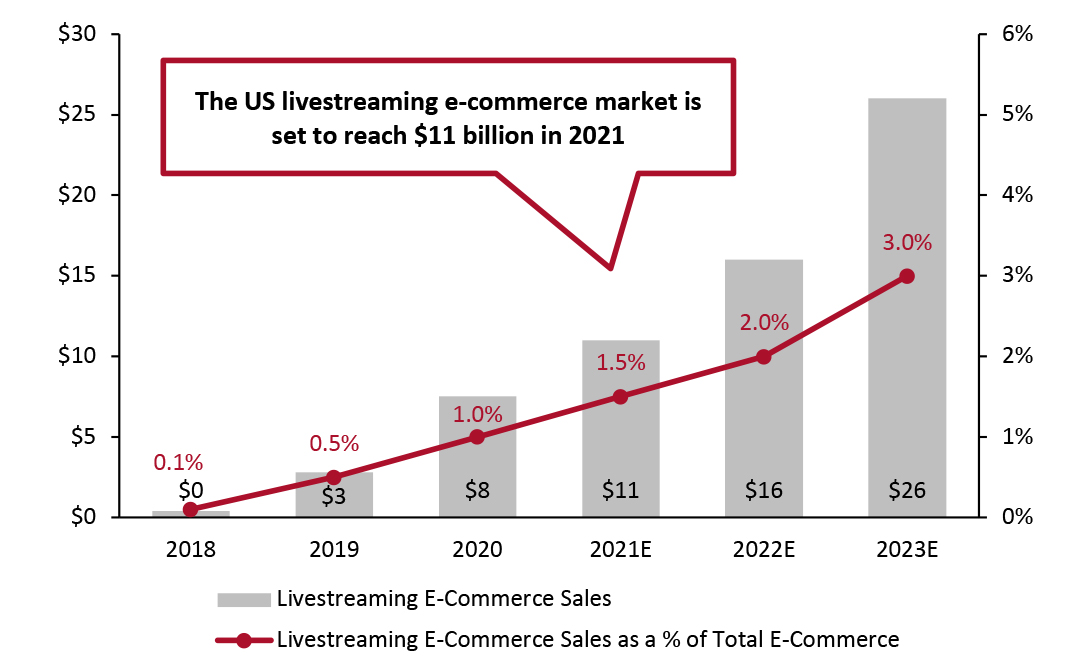

Livestreaming shopping has just started to take off in the US. According to a Coresight Research survey conducted in March 2021, almost half of US consumers (47%) had not yet heard of livestreaming shopping—presenting tremendous opportunity for market growth. Even with conservative growth assumptions, we estimate that the US livestreaming e-commerce market will be worth around $11 billion this year, representing 1.5% of all e-commerce sales (see Figure 2).

Source: Coresight Research [/caption]

Livestreaming shopping has just started to take off in the US. According to a Coresight Research survey conducted in March 2021, almost half of US consumers (47%) had not yet heard of livestreaming shopping—presenting tremendous opportunity for market growth. Even with conservative growth assumptions, we estimate that the US livestreaming e-commerce market will be worth around $11 billion this year, representing 1.5% of all e-commerce sales (see Figure 2).

Figure 2. Livestreaming E-Commerce Sector Size (USD Bil; Left Axis) and Penetration (% of Total E-Commerce; Right Axis) in the US [caption id="attachment_127498" align="aligncenter" width="725"] Source: Coresight Research [/caption]

Unlike in China, where Alibaba’s Taobao Live platform dominates, there is no definitive livestreaming platform in the US. Weinswig explained that the current livestreaming ecosystem in the US comprises three layers: platforms, infrastructure and integration:

Source: Coresight Research [/caption]

Unlike in China, where Alibaba’s Taobao Live platform dominates, there is no definitive livestreaming platform in the US. Weinswig explained that the current livestreaming ecosystem in the US comprises three layers: platforms, infrastructure and integration:

CEW’s State of the Industry: Coresight Research’s Livestreaming Playbook for Beauty—Key Insights

Overview of Livestreaming E-Commerce: China and the US Livestreaming e-commerce is an innovative way of buying products online through real-time, shoppable videos. It blends entertainment and e-commerce to provide consumers with an engaging and fun shopping experience. Livestreaming is well established in China and is now becoming the must-to-have marketing tool for brands and retailers in the US to reach a wider audience and drive sales. Coresight Research has identified livestreaming e-commerce as one of the key retail trends to watch in 2021. Livestreaming e-commerce is seeing explosive growth in China, and shows no signs of slowing down. Coresight Research estimates that livestreaming e-commerce sales will total $300 billion in China in 2021—up from $150 million in 2020. This will see livestream shopping account for around 14% of China’s total e-commerce market in 2021 (see Figure 1).Figure 1. Livestreaming E-Commerce Sector Size (USD Bil; Left Axis) and Penetration (% of Total E-Commerce; Right Axis) in China [caption id="attachment_127497" align="aligncenter" width="725"]

Source: Coresight Research [/caption]

Livestreaming shopping has just started to take off in the US. According to a Coresight Research survey conducted in March 2021, almost half of US consumers (47%) had not yet heard of livestreaming shopping—presenting tremendous opportunity for market growth. Even with conservative growth assumptions, we estimate that the US livestreaming e-commerce market will be worth around $11 billion this year, representing 1.5% of all e-commerce sales (see Figure 2).

Source: Coresight Research [/caption]

Livestreaming shopping has just started to take off in the US. According to a Coresight Research survey conducted in March 2021, almost half of US consumers (47%) had not yet heard of livestreaming shopping—presenting tremendous opportunity for market growth. Even with conservative growth assumptions, we estimate that the US livestreaming e-commerce market will be worth around $11 billion this year, representing 1.5% of all e-commerce sales (see Figure 2).

Figure 2. Livestreaming E-Commerce Sector Size (USD Bil; Left Axis) and Penetration (% of Total E-Commerce; Right Axis) in the US [caption id="attachment_127498" align="aligncenter" width="725"]

Source: Coresight Research [/caption]

Unlike in China, where Alibaba’s Taobao Live platform dominates, there is no definitive livestreaming platform in the US. Weinswig explained that the current livestreaming ecosystem in the US comprises three layers: platforms, infrastructure and integration:

Source: Coresight Research [/caption]

Unlike in China, where Alibaba’s Taobao Live platform dominates, there is no definitive livestreaming platform in the US. Weinswig explained that the current livestreaming ecosystem in the US comprises three layers: platforms, infrastructure and integration:

- Possible platforms through which to launch livestreaming cover social media, marketplaces and owned websites, as well as dedicated livestreaming sites such as Popshop Live. It is essential for retailers, brands and shopping malls to use the most appropriate platform to connect with their target consumers.

- Brands and retailers can work with tech partners such as Bambuser, Lisa, Livescale or Omnyway to set up their livestreaming infrastructure and thus enable digital commerce.

- The new shopping format involves the integration of e-commerce systems, influencer networks and social technology, and store systems to offer consumers a seamless shopping journey—helping brands and retailers to boost engagement and drive conversion.

- In December 2020, JCPenney launched a live shopping series, JCP Live, on its website, YouTube and via Facebook Live to showcase a wide range of products for the holiday season. The series was hosted by different JCPenney staff as well as influencer guests. Viewers could engage with the hosts with comments and questions, and have the chance to win JCPenney gift cards.

- Clean-beauty brand bareMinerals hosted a shoppable “Virtual Villa” event on its e-commerce site on March 2, 2021. Guided by the brand’s ambassador Hailey Bieber, the video game-like tour allowed users to participate in interactive activities and purchase products via the virtual storefront.

- In China, retailers on Taobao Live tend to create flash sales and lucky draws to combine entertainment with shopping incentives to attract and reward shoppers.

- In the US, Fred Segal Live is a weekly shoppable livestream created using TalkShopLive, through which the retailer offers incentives to buy featured products within 72 hours.

- On March 1, 2021, Cosmopolitan magazine collaborated with flexible payment provider Klarna to hold a two-day live shopping event for Gen Z and millennial consumers on livestreaming platform ShopShops. The event featured exclusive deals from top apparel, footwear and beauty brands.