Nitheesh NH

Introduction

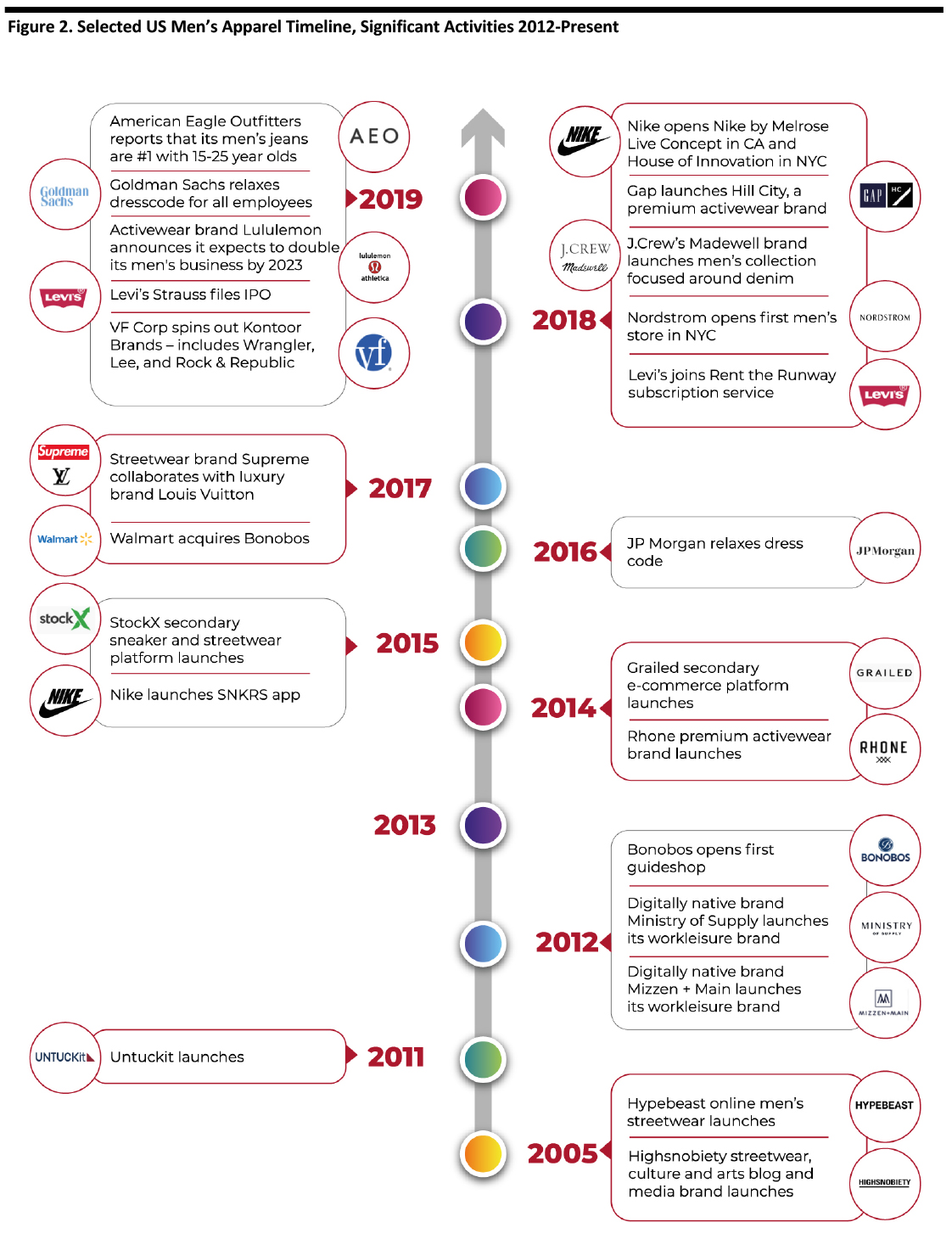

Casualization is influencing every aspect of society, and menswear is no exception. The category is becoming more athletic, casual and rooted in peformance wear. Men’s apparel is becoming a category to watch due to the changes and opportunities – particularly in performance technologies, streetwear, athletic wear, denim and resale platforms. Driven by these changes, the category continues to grow at a steady pace.What has Changed in the Menswear Market?

A number of factors are influencing the menswear market, from casual workplaces to the growth in athleisure and the revival of denim. [caption id="attachment_93460" align="aligncenter" width="720"] Source: Coresight Research[/caption]

This is what is happening in each of the above:

Source: Coresight Research[/caption]

This is what is happening in each of the above:

- The Casual Workplace is influencing new wardrobes, often called “workleisure” or “performance professional.” Business casual is not just for Fridays and is spanning almost every industry.

- Streetwear interest has spawned a culture of enthusiasts that spans luxury, sportswear and sometimes includes collaborations.

- Resale Markets/Drop Models are drawing increasing numbers of men, where items are frequently purchased through drop models that require customers to be in a line or instore to get the first product that is “dropped.” This creates exclusivity and demand.

- Athleisure is helping athletic menswear brands take market share from traditional menswear brands and retailers.

- Fabric technology has enabled professional attire to be made like performance wear – with stretchable fabrics, breathable, non-iron, and machine washable.

- Denim Revival is driving changes as new players enter the market and traditional retailers offer new collections, sizes and denim through alternative channels.

- Subscriptions are growing in popularity: Stitch Fix, an online personal styling company, strengthened its men’s business by increasing its assortment and adding exclusives.

Source: Coresight Research, Company Reports, Company Websites[/caption]

Source: Coresight Research, Company Reports, Company Websites[/caption]

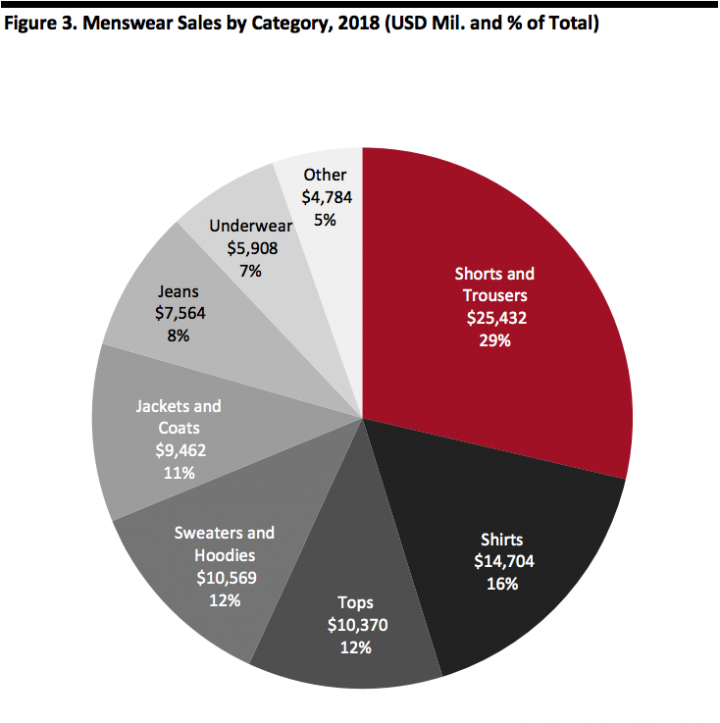

Shorts and Pants Comprise 29% of the $88.8 Billion US Menswear Market

The US menswear market was worth $88.8 billion in 2018 and is expected to increase to $106.8 billion in 2023, according to Euromonitor International, representing a 3.8% compound annual growth rate (CAGR). By category, shorts and pants comprise 29% of menswear, followed by men’s shirts (with buttons) at 17%; tops at 12%; sweaters and sweatshirts at 12%; and, jackets and coats at 12, according to Euromonitor. [caption id="attachment_93463" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

Which Menswear Categories are Growing? Which are Slowing?

Bottoms, Collared Shirts and Tops, and Jeans are Expected to Grow to 2023 The top growing menswear categories from 2018 to 2023 are expected to be underwear and men’s standard and economy jeans, growing at 4.8% and 4.2% respectively. From 2013 to 2018, casual tops grew fastest, at a 3.1% CAGR, while men’s jeans performed weakest, declining 1.9%. Men’s suits are expected to grow most slowly of all categories over the five years from 2018, while premium and super premium jeans are expected to decline, further emphasizing that casualization is on the rise.Athletic Menswear Brands Taking Market Share from Traditional Menswear Brands

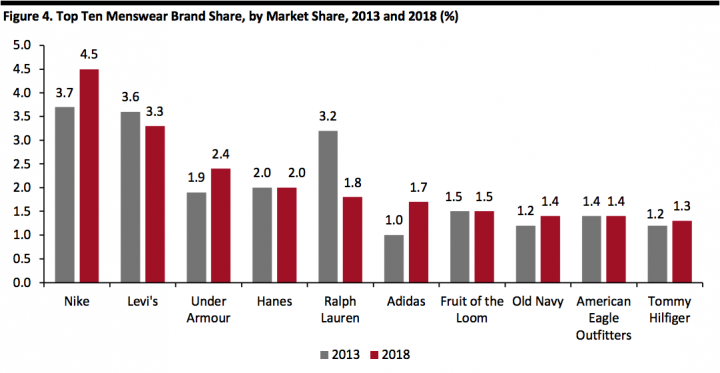

The top ten menswear brands comprised 21.3% of the market in 2018. While this has remained relatively unchanged since 2013, with the top ten brands and retailers comprising 21.8% of the market, there have been changes among the top ten. Most notably, major athletic brands in total gained 2.0 points of market share from 2013 to 2018: Nike grew from 3.7% market share to 4.5%, Under Armour from 1.9% to 2.4% and Adidas from 1.0% to 1.7%. [caption id="attachment_93464" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

Levi’s and Ralph Lauren saw a combined 1.7-percentage-point decline in market share from 2013 to 2018. Levi’s went from 3.6% to 3.3% and Ralph Lauren from 3.2% to 1.8%. The top underwear brands – Hanes and Fruit of the Loom – maintained market share.

Below are notable highlights from a few athletic brands and retailers:

Nike has Held the Most Market Share of Any Menswear Brand Since 2013, when it Overtook Levi’s

Nike is the leading brand in US menswear, holding 4.5% of the market. The company has grown market share by 0.8 percentage points over the past five years and 2.1 percentage points over the past ten years – more than any other men’s brand or retailer. The company invests in the customer experience through its stores, personalization, product innovations and collaborations. Nike opened its Nike by Melrose Live concept store in 2018, an experiential store open only to members of the NikePlus loyalty program. The store is hyper-localized, targeted the customers in the local market, leveraging data it collects via its mobile app. Customers can use the app to reserve products and use loyalty points, while Nike collects valuable consumer data to help it refine product offerings. Similarly, Nike launched its House of Innovation in New York City in 2018, aimed at personalizing and customizing the customer experience. For example, the store includes a “Speed Shop” that uses local data to stock the floor.

Lululemon Expects to Double its Men’s Business by 2023

Lululemon does not feature in the top ten men’s apparel brands: It held 0.4% of market share in 2018, ranking it #29, according to Euromonitor International. That said, Lululemon doubled its market share from 0.2% in 2013 to 0.4% in 2018 in menswear and is becoming a premium competitor in the space. At Lululemon’s Investor Day on April 24, 2019, the company reported it expects to double its men’s sales by 2023. In 2018, 21% of its revenue was from its $690 million men’s category. Management highlighted that its brand has low awareness with men, providing a significant opportunity. The company is focusing on guest acquisition and building brand awareness. The company’s new running franchise includes thermal properties, while its new training line for men features products that won’t abrade while working out. The company is also working on a line that is “taking cues from streetwear.” The company signed former Philadelphia Eagles quarterback Nick Foles to be its first men’s brand ambassador.

[caption id="attachment_93465" align="aligncenter" width="720"]

Source: Euromonitor International[/caption]

Levi’s and Ralph Lauren saw a combined 1.7-percentage-point decline in market share from 2013 to 2018. Levi’s went from 3.6% to 3.3% and Ralph Lauren from 3.2% to 1.8%. The top underwear brands – Hanes and Fruit of the Loom – maintained market share.

Below are notable highlights from a few athletic brands and retailers:

Nike has Held the Most Market Share of Any Menswear Brand Since 2013, when it Overtook Levi’s

Nike is the leading brand in US menswear, holding 4.5% of the market. The company has grown market share by 0.8 percentage points over the past five years and 2.1 percentage points over the past ten years – more than any other men’s brand or retailer. The company invests in the customer experience through its stores, personalization, product innovations and collaborations. Nike opened its Nike by Melrose Live concept store in 2018, an experiential store open only to members of the NikePlus loyalty program. The store is hyper-localized, targeted the customers in the local market, leveraging data it collects via its mobile app. Customers can use the app to reserve products and use loyalty points, while Nike collects valuable consumer data to help it refine product offerings. Similarly, Nike launched its House of Innovation in New York City in 2018, aimed at personalizing and customizing the customer experience. For example, the store includes a “Speed Shop” that uses local data to stock the floor.

Lululemon Expects to Double its Men’s Business by 2023

Lululemon does not feature in the top ten men’s apparel brands: It held 0.4% of market share in 2018, ranking it #29, according to Euromonitor International. That said, Lululemon doubled its market share from 0.2% in 2013 to 0.4% in 2018 in menswear and is becoming a premium competitor in the space. At Lululemon’s Investor Day on April 24, 2019, the company reported it expects to double its men’s sales by 2023. In 2018, 21% of its revenue was from its $690 million men’s category. Management highlighted that its brand has low awareness with men, providing a significant opportunity. The company is focusing on guest acquisition and building brand awareness. The company’s new running franchise includes thermal properties, while its new training line for men features products that won’t abrade while working out. The company is also working on a line that is “taking cues from streetwear.” The company signed former Philadelphia Eagles quarterback Nick Foles to be its first men’s brand ambassador.

[caption id="attachment_93465" align="aligncenter" width="720"] Source: Lululemon Investor Day Slides, April 2019[/caption]

Source: Lululemon Investor Day Slides, April 2019[/caption]

Premium Activewear Brands are Launching to Capture “White Space” in an Underserved Market

Premium activewear brands are trying to move into the “white space” in a menswear market that remains underserved for high-quality performance brands focused on functionality, materials, quality and connecting with consumers. Rhone, a Digitally Native Brand Based in Connecticut, Launched in 2014 with a Focus on Premium Men’s Activewear Rhone is a premium clothing brand for men that integrates fit, form and function. The clothing is made for the gym and the office and “inspires men to live healthy, strong and free.” Rhone was founded in 2014 in Connecticut. According to Rhone’s Cofounder and CEO, Nate Checketts, premium men’s activewear is an underserved market. In 2018, Checketts said that he found over 50 female-focused premium activewear brands at an average price index of 140-160% to Nike, but there were almost no brands for men in this same price category. The company also found that 40% of men indicated that they wanted a higher quality men’s-specific activewear brand. So, Rhone developed a fabric technology called GoldFusion in 2017, which helps to combat odor and remains 98-percent effective after 100 washes. The company originated as a digitally native brand but is now sold in all Equinox and Barry's Bootcamp locations, at select Nordstrom, REI and JackRabbit locations, as well as Peloton Studios, and more than 200 specialty stores and gyms. Rhone has three physical retail stores. Gap Launches Hill City, a Community-based Brand, due to Market White Space In October 2018, Gap launched Hill City, a digitally native lifestyle and performance-wear menswear brand. The company said in a press release that it saw white space for “a men's, premium performance active brand.” The brand began with a user-based experience. Hill City has “integrated sustainability” into its products, such as using renewable, recycled fabrics to create its performance fabrics. The company’s products “transition, transform and multi-task” according to the website. Each season, the company relies on users to test its products: The company releases a limited run of free products, invites consumers to test and asks for feedback. Prices range from $58 shorts to $128 slim-fit pants. The products are performance based: made with water repellant, sweat wicking and stretch fabrics.Denim is Rising and Expected to Grow to $9.0 Billion by 2023 with New (and Traditional) Players In the Market

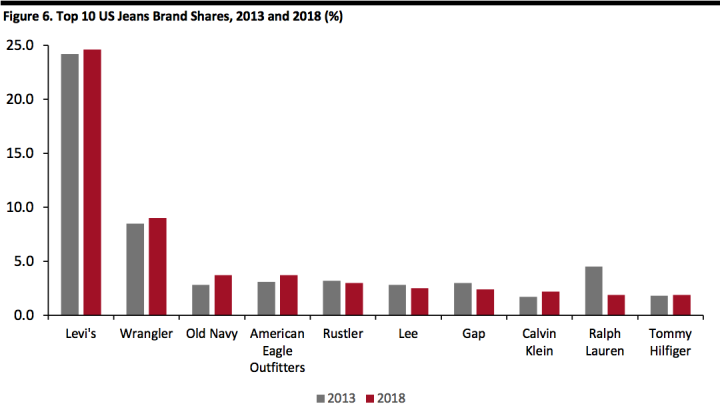

After a period of decline, the denim category is growing, again. From 2013 to 2018, the men’s jeans market shrunk 1.9% from $8.3 billion to $7.6 billion. However, the jeans category is on the rise again, and expected to climb to $9.0 billion by 2023, a 3.6% CAGR. In the past few years, premium and super premium jeans have lost momentum to economy and standard jeans: Levi’s remains overwhelmingly the top menswear brand, holding 24.6% of the market in 2018. [caption id="attachment_93466" align="aligncenter" width="720"] Source: Euromonitor International[/caption]

The men’s denim market is changing as new players are entering the market – while traditional retailers offer new collections, sizes and denim through alternative channels.

Source: Euromonitor International[/caption]

The men’s denim market is changing as new players are entering the market – while traditional retailers offer new collections, sizes and denim through alternative channels.

- In September 2018, Madewell launched a men’s collection centered around men’s denim. The company introduced 21 styles of denim with three denim fits: skinny, slim and straight. The merchandise is available online and in selected Nordstrom stores.

- American Eagle Outfitters reported on its 1Q19 earnings call that the company had its 23rd straight quarter of record jeans sales and that the company is increasing share in its men’s business, in which management reported AE jeans are the number one seller among its core 15- to 25-year-old age group. Management announced that before back-to-school 2019, American Eagle will expand its denim into inclusive jeans, will launch new fabric innovations, new fits and broaden the size range up to a 48-inch waist with more offerings in length across all sizes.

- In May 2019, VF Corp spun out Kontoor brands which includes Wrangler, Lee and Rock & Republic Brands. Wrangler, the number two men’s brand, held 9.0% of the market in 2018, up from 8.5% in 2013, while Lee held 2.5% of the market in 2018, down from 2.8% in 2018.

- Levi’s partnered with Rent the Runway in November 2018 as another revenue stream. Consumers can rent Levi’s as part of Rent the Runway’s monthly rental platform.

Changing of the Guard: Suits are No Longer Official Dress Code for Men

Suits are no longer the official dress code for work, and when worn, suits are worn with sneakers and T-shirts. Work attire has changed forever. Suits are on the decline. Comprising only 2.2% of the men’s apparel market in 2018, at $1.9 billion, men’s suits are the slowest growing category outside of premium and super premium jeans: Sales of suits are expected to grow at a 1.0% CAGR through 2023 to $2.07 billion, according to Euromonitor International. Driving this has been the casualization of society, a trend which has included the rise of athleisure and its infiltration into workwear. Suits are no longer the norm, even in traditional sectors such as financial services.- In 2016, JP Morgan relaxed its dress code to business casual after the CEO came back from a trip to Silicon Valley and felt the dress code was “out of date.” Some believe that informal dress is also a way to lure a millennial workforce that desires more informal work attire.

- In March 2019, Goldman Sachs relaxed its dress code, writing “we believe this is the right time to move to a firm-wide flexible dress code.” The memo cited the “changing nature of workplaces generally in favor of a more casual environment.” Over three-quarters of the company are reportedly millennials.

Source: Hugo Boss[/caption]

Source: Hugo Boss[/caption]

Work Attire has Transitioned to “Performance Professional” or Workleisure, Borrowing the Best Technology from Sports Apparel

New Technology has Enabled Professional Attire to be Made Like Performance wear – with Stretchable Fabrics, Breathable, Non-Iron and Machine-Washable. A growing number of brands are looking to athletic and performance brands to inspire workwear in what has been coined “workleisure” and “performance professional” wear. The men’s apparel industry is designing with performance elements that include more modern technical performance materials to appeal to comfort and style. Apparel makers are making work-wear from technical materials for comfort, versatility and durability. For example, dress shirts are made with stretch, non-iron, sweat-wicking material that can even be thrown into the dryer. Untuckit is a digitally native brand, founded in 2011 that targeted millennials who dress more casually in the workplace. The premise of the shirt is that it looks good and fits properly while it is untucked. On a panel presentation at the National Retail Federation (NRF) in January 2019, the company’s founder, Aaron Sanandres, said the brand discovered that after a few years selling online, the brand’s customers were far more wide reaching than they initially anticipated – reaching men in their early 60s even. This shows the market for casualwear was larger than the brand anticipated. Untuckit has used this data to plan the brands’ distribution: Untuckit has since opened over 50 physical locations in the US and Canada. The company has launched Untuckit Performance shirt that include moisture wicking, stretch and anti-odor. Ministry of Supply is a digitally native brand, founded in 2012 in Boston, by former Massachusetts Institute of Technology students. The company’s technology includes performance apparel which uses temperature regulating materials that NASA astronauts use which store and release heat based on surroundings. The company was launched to create technologically advanced office apparel – a vision for everyday clothing that could be as capable as athletic gear. In 2012, Ministry of Supply introduced its first performance dress shirt. The company uses new materials, aerospace, robotic engineering and thermal analysis to create a new category in the design of better-fitting men’s business attire. The company calls the category “performance professional,” which includes stretch, breathability and no ironing. Mizzen + Main is a digitally native US men’s performance apparel brand founded in 2012. The company uses performance technology in its apparel. Its performance dress shirt was inspired when the company’s founder, Kevin Lavelle, saw a man running in a dress shirt on a hot day in Washington DC; his shirt was wrinkled and wet with sweat. Lavelle said he set on a mission to design a shirt for work that was made of moisture-wicking materials, is machine-washable, wrinkle-free and has four-way stretch for movement. Lavelle tested his shirt by playing golf, mowing the lawn and 9of course) running. The company’s marketing campaigns often feature athletes wearing its shirts, emphasizing the performance capabilities of its products. The company has two physical retail stores in Texas, and its products are also sold at Nordstrom and other selected retailers.Younger Consumers are Spending Five Times More per Month for Streetwear than for Non-Streetwear

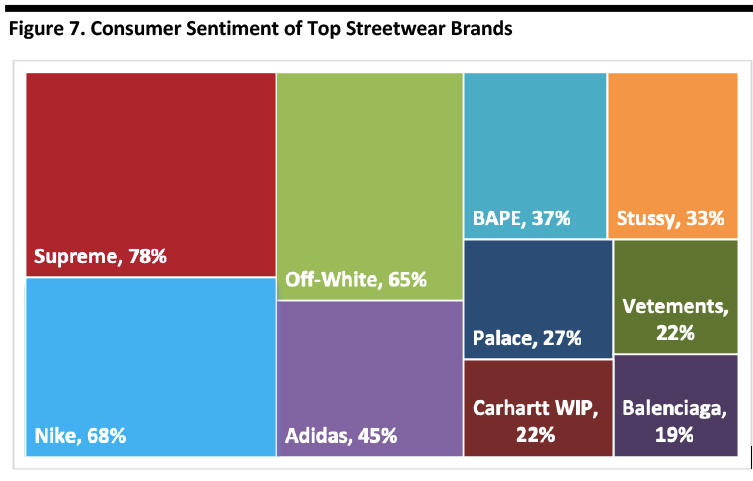

Consumers Value Exclusivity, Community and Status when Purchasing Streetwear, According to Hypebeast Streetwear, which includes fashionable casual clothes such as hoodies, t-shirts and sneakers, has gained great popularity and become a global fashion movement. This may be attributed in part to social media, and also in part to exclusivity. The drop model is emerging as particularly popular, in which customers have to be queued in line or in a store to get new product drops. According to a Hypebeast survey in conjunction with PwC, one half of the 40,000 global streetwear consumers surveyed reported they would be willing to wait in line for a product release. This exclusivity creates demand and has allowed some streetwear brands to collaborate with large retailers, artists and luxury brands. According to the Hypebeast report, the force behind streetwear is its spirit. The core streetwear consumer does not have a lot of money to spend, but is discerning about where he or she spends and spends on authentically “cool” brands that have built themselves from the ground up, instead of retailers and brands that are trying “too hard” to fit into this space. According to the survey question, “which brands represent streetwear to you the most?” the top three streetwear brands are Supreme, Nike and Off-White as shown in figure 7. [caption id="attachment_93505" align="aligncenter" width="700"] Base: There were a total of 40,960 global streetwear consumers that participated in the survey, 80.7% male; 18.4% female, 0.9% non-binary

Base: There were a total of 40,960 global streetwear consumers that participated in the survey, 80.7% male; 18.4% female, 0.9% non-binaryThere were a total of 13,372 recorded responses to this question

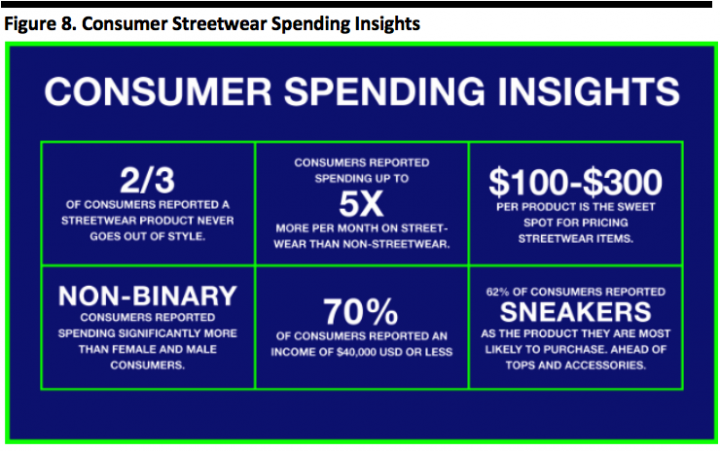

Source: Hybebeast and PwC Streetwear Impact Report Survey[/caption] According to the survey insights, both consumer and industry executives believe that streetwear will continue to grow significantly over the next five years, with 76% of respondents in both groups reporting this. Figure 8 highlights consumer spending insights from streetwear enthusiasts, 70% of consumers reporting an annual income of less than $40,000; yet streetwear enthusiasts responded that they spend more than five times more on average per month on streetwear than on non-streetwear. [caption id="attachment_93470" align="aligncenter" width="720"]

Base: 40,960 global consumers, 80.7% male; 18.4% female, 0.9% non-binary

Base: 40,960 global consumers, 80.7% male; 18.4% female, 0.9% non-binarySource: Hybebeast and PwC Consulting, Streetwear Impact Report Survey[/caption]

The Future of How Men Buy: Peer-to-Peer Menswear E-Commerce Resale Platforms

Fashion Resale Markets such as Grailed, Stadium Goods and StockX are Catering to Gen Zers’ and Millennials’ Desire for the Latest Fashion Styles. Fashion resale e-commerce platforms devoted to menswear apparel (and footwear) are thriving. This is due in part to the exclusivity of the apparel drop model – where streetwear and sneaker brands release new models every week (or month) in limited quantities. This limited, and exclusive, supply creates the resale opportunity. Gen Zers and millennials in particular shop resale for the latest styles in streetwear, skatewear and luxury. Listed below are a few of the major market players: Grailed, founded in 2013, is a menswear e-commerce marketplace where consumers can sell and buy luxury merchandise. Grailed raised $16.5 million in June 2018 from Index Ventures and is backed by Thrive Capital and Simon Ventures. The company calls itself “a community-driven marketplace for men’s fashion and streetwear, making great clothing affordable and available to everyone.” The company takes a commission only when items sell. [caption id="attachment_93471" align="aligncenter" width="720"] Source: Grailed.com[/caption]

Stadium Goods is a global premium sneaker and resale luxury fashion marketplace founded in 2015, acquired by luxury marketplace Farfetch in December 2018 for $250 million. The retailer hosts limited edition product releases and special events to attract crowds. According to a Highsnobiety article dated December 12, 2018, Stadium Goods sold $100 million in gross merchandise volume in 2017. Stadium Goods has two physical stores in New York, and has announced in plans to open one store in Chicago.

[caption id="attachment_93472" align="aligncenter" width="720"]

Source: Grailed.com[/caption]

Stadium Goods is a global premium sneaker and resale luxury fashion marketplace founded in 2015, acquired by luxury marketplace Farfetch in December 2018 for $250 million. The retailer hosts limited edition product releases and special events to attract crowds. According to a Highsnobiety article dated December 12, 2018, Stadium Goods sold $100 million in gross merchandise volume in 2017. Stadium Goods has two physical stores in New York, and has announced in plans to open one store in Chicago.

[caption id="attachment_93472" align="aligncenter" width="720"] Source: Stadiumgoods.com[/caption]

StockX is a menswear marketplace platform that operates like a stock market: buyers set a bid price and sellers set an asking price. Most of the products are footwear, but also include streetwear and accessories. StockX raised $50 million with investments from GV (formerly Google Ventures) and Battery Ventures.

[caption id="attachment_93473" align="aligncenter" width="720"]

Source: Stadiumgoods.com[/caption]

StockX is a menswear marketplace platform that operates like a stock market: buyers set a bid price and sellers set an asking price. Most of the products are footwear, but also include streetwear and accessories. StockX raised $50 million with investments from GV (formerly Google Ventures) and Battery Ventures.

[caption id="attachment_93473" align="aligncenter" width="720"] Source: StockX.com[/caption]

Source: StockX.com[/caption]

Subscription Services are a Growing Opportunity for Men

Stitch Fix, An Online Personal Styling Company, Strengthens its Men’s Business by Increasing Assortment and Adding Exclusives Subscription rental boxes are a fairly new category for men, but are gaining traction. The Rent the Runway (women’s) rental service platform reported it had over 10 million members in a 2018 Fast Company article. We believe there is an equal opportunity in the men’s category, as evidenced by Stitch Fix’s early success in menswear subscriptions. In its June 2019 earnings call, online personal styling company Stitch Fix reported its seventh consecutive quarter of 20% growth in revenue. The company reported it had more than 3.1 million active clients that had received a clothing subscription box in the preceding 12-month period, an increase of 17% year over year. The company credited its “Style Pass” service for improving client retention. Style Pass offers unlimited styling for a yearly $49 fee, which is credited towards a purchase. Renewal rates for Style Pass were 70% across both the company’s men’s and women’s businesses. Stitch Fix said it strengthened its men’s business by increasing product assortment and adding more exclusive brands to its selection.Key Insights

- The $88.8 billion US menswear market is becoming more casual. Reflecting this, suits are expected to be the slowest-growing of all menswear categories over the five years from 2018.

- Athletic menswear brands are taking market share from traditional menswear brands and retailers. Of the top ten retailers and brands, the top three athletic brands, Nike, Adidas, and Under Armour, gained a combined 2.0% market share over five years while traditional retailers Ralph Lauren and Levi’s lost 1.7%.

- Denim is rising (again) and expected to grow to $9.0 billion by 2023, with new and traditional players in the market. Levi’s is overwhelmingly the top menswear denim brand, holding 24.6% of the market in 2018.

- Premium activewear brands are launching due to “white space” and an underserved menswear market for high quality performance brands focused on functionality, materials, quality and connecting with consumers.

- Fashion resale markets such as Grailed, Stadium Goods and StockX are catering to Gen Zers’ and millennials’ desire for the latest fashion styles.

- Younger streetwear enthusiasts spend five times more per month for streetwear than they do for non-streetwear. Consumers value exclusivity, community and status.

- Subscription rental boxes are a new category for men but are gaining traction. The Rent the Runway (women’s) rental service platform reported it had over 10 million members in a 2018 Fast Company article. We believe there is an equal opportunity in the men’s category, as evidenced by Stitch Fix’s early success in menswear subscriptions.