DIpil Das

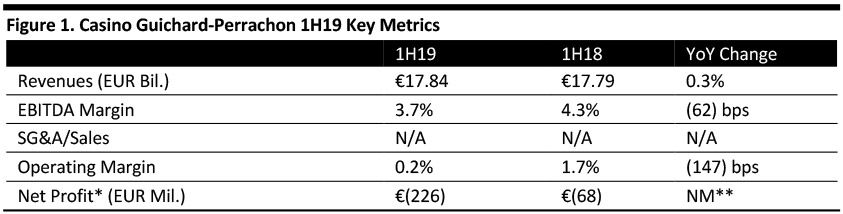

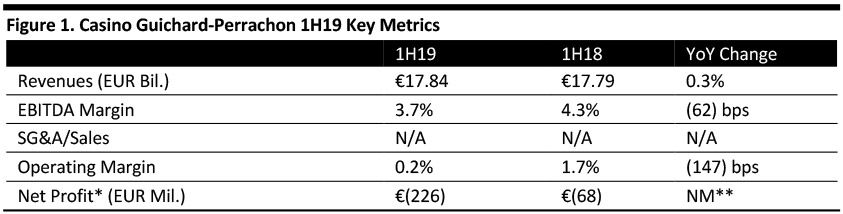

[caption id="attachment_93587" align="aligncenter" width="700"] * from continuing operations attributable to company’s shareholders **not meaningful

* from continuing operations attributable to company’s shareholders **not meaningful

Source: Company reports/Coresight Research [/caption]

* from continuing operations attributable to company’s shareholders **not meaningful

* from continuing operations attributable to company’s shareholders **not meaningful Source: Company reports/Coresight Research [/caption]

1H19 Results

Casino Group reported 1H19 results with sales missing the consensus and losses deepening. The highlights are as follows:

- Casino Group reported net sales of €17.84 billion, up 3.5% year over year on an organic basis which excludes the impact of currency fluctuation and consolidation (up 0.3% year over year as reported) and missing the consensus estimate of €17.93 billion. Net sales also exclude fuel and calendar effects.

- On an organic basis, net sales were driven by strong performance in the Latin America retail segment.

- The company’s trading profit fell 12.1% year over year on organic basis (down 20.6% year over year as reported) to €347 million, reflecting an unfavorable basis of comparison due to the seasonality of tax credits in Brazil (€100 million in 1H18 and €112m for the full year). Excluding tax credits, consolidated trading profit was up 12.9% on an organic basis and up 2.9% as reported.

- The EBITDA margin contracted 62 basis points (bps) year over year to 3.7%.

- The operating margin contracted 147 bps year over year to 0.2%, led by higher “other” operating expenses (net). Other operating expenses grew 125% year over year to €308 million.

- The company reported a net loss from continuing operations attributable to the company’s shareholders of €226 million compared to a net loss of €68 million in the same period of the previous year, and missing the consensus net profit of $26 million.

1H19 Segment Performance

- By segment, France retail segment sales fell 1.6% year over year on organic basis (down 2.9% year over year as reported) to €9.04 billion. EBITDA margin contracted two basis points to 3.3%. Organic revenues exclude fuel and calendar effects.

- Latin America retail net sales were up 10.1% year over year on organic basis (up 4.0% year over year as reported) to €7.91 billion. Organic revenues exclude fuel, calendar effects and the impact of currency fluctuations. EBITDA margin contracted 158 basis points to 4.6%.

- E-commerce net sales (via the company’s cDiscount platform) decreased 0.5% year over year on an organic basis (up 1.5% year over year as reported) to €889 million. Organic revenues exclude fuel, calendar effects and the impact of currency fluctuations. EBITDA margin expanded 102 basis points to 0.2%.

Other Highlights

- The company achieved €60 million in cost savings in first half of the fiscal year.

- At the end of 2018, the group launched a plan to close and dispose of loss-making stores called the Rocade Plan. To date, the company has disposed of 56 stores of which 39 were integrated with other stores including 15 hypermarkets, and closed 118 stores, including 56 integrated stores. These transactions represent a €52 million gain in trading profit on a full year basis for integrated stores and €27 million for the master-franchisees in which the group has a 49% interest (a €13 million gain in group share of net profit). The company incurred non-recurring costs of €85 million in connection with the plan (€35 million in 2H18 and €50 million in 1H19). The company will continue the plan in the second half, to support its objective of a €90 million total gain in trading profit on a full-year basis.

- The company opened 30 new premium and convenience stores in in 1H19.

- It completed disposal of Via Varejo on June 14, 2019, with the sale of GPA’s (the company’s Brazilian subsidiary) stake in Via Varejo for €615 million.

2Q19 Performance

Same-Store Sales Performance (ex Fuel, ex Calendar Effects)

- The group reported same-store sales growth of 2.3%.

- The group’s France retail comps were 0.7% versus flat consensus; within France retail, Monoprix comps were 0.2%, beating the consensus of 0.1%; Franprix comps were 0.1% versus the consensus of 0.2%; convenience and other division comps were 1.7%; Casino Supermarkets comps were 1.2%, beating the consensus of 0.3%; hypermarket comps were 1.4% versus the consensus of 0.1%; Leader Price comparable sales were down 1.6% vs the consensus of (2.2%).

- Cdiscount posted flat comparable sales growth.

- Latin America retail grew same-store sales 3.8%, beating the consensus of 3.4% growth.

Sales Performance

- The group reported net sales of €8.99 billion, up 2.9% on an organic basis (up 1.1% as reported), beating the consensus of €8.95 billion.

- France retail posted net sales of €4.64 billion, down 1.8% on an organic basis (down 2.4% as reported) and in line with the consensus. Within the France retail segment, Monoprix net sales were €1.14 billion, up 0.5% on an organic basis (up 1.3% as reported), missing the consensus of €1.15 billion. Casino Supermarkets net sales were €790 million, down 1.1% on an organic basis (down 1.8% as reported) versus the consensus of €792.7 million. Franprix net sales were €399 million, down 2.2% on an organic basis (down 4.1% as reported) and missing the consensus of €401.9 million. Convenience and other net sales were €595 million, up 0.5% on an organic basis (up 0.3% as reported) missing the consensus of €600.1 million. Leader Price net sales were €551 million, down 13.7% on organic basis (down 14.1% as reported) and missing the consensus estimate of €565.1 million. Hypermarket net sales were €1.16 billion, up 2.2% on an organic basis (down 0.9% as reported) versus the consensus of €1.15 billion.

- Cdiscount segment net sales were €412 million, flat on an organic basis (up 2.4% as reported), beating the consensus estimate of €403.6 million.

- Latam Retail net sales were €3.93 billion, up 8.8% on an organic basis (up 5.6% as reported) and in line with consensus.

Outlook

Casino Group has the following targets:- For fiscal 2019, 10% growth in trading profit (excluding property development).

- A cost savings of €130 million in France in the current fiscal year, up from the earlier target of €100 million. It hopes to achieve €200m in savings by 2020.

- To open 50 stores in 2H19 in France.

- To accelerate its debt reduction plan to reach net debt in France of less than €1.5 billion by the end of 2020.

- To dispose of at least €2.5 billion in non-strategic assets in France by Q1 2020.

- To generate free cash flow of €0.5 billion per year.

In FY19, consensus estimates recorded by StreetAccount predict Casino Group will report revenues of €37.46 billion and EPS of €2.88.