Nitheesh NH

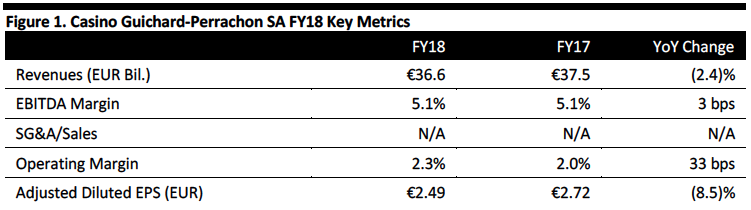

[caption id="attachment_80427" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

FY18 Results

Casino Group reported FY18 results with in-line sales while EPS slightly missed consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY18 Results

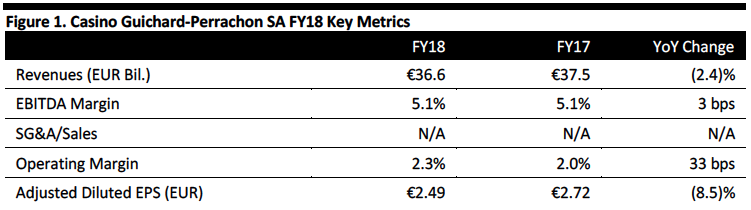

Casino Group reported FY18 results with in-line sales while EPS slightly missed consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Casino Group reported FY18 results with in-line sales while EPS slightly missed consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Casino Group reported FY18 results with in-line sales while EPS slightly missed consensus. The highlights are as follows:

- Casino Group reported net sales of €6 billion, up 4.7% year over year at constant currency (down 2.4% year over year as reported) and largely in-line with the consensus estimate of €36.69 billion by StreetAccount . Net sales exclude fuel and calendar effects. On a constant currency basis, net sales were driven by strong performance in the Latin America retail segment.

- By segment, the retail segment in France showed organic sales growth of 2% year over year (up 1.4% year over year as reported) to €19.1 billion. Retail net sales in Latin America were up 8.9% year over year on organic basis (down 7.2% year over year as reported) to €15.6 billion. E-commerce net sales were up 2.6% year over year on organic basis (up 3.0% year over year as reported) to €2.0 billion. Organic revenues exclude fuel and calendar effects.

- The company grew trading profit by 9.8% year over year at constant currency (down 0.3% year over year as reported) to €21 billion.

- EBITDA expanded marginally by 3 basis points (bps) year over year to 5.1%.

- Operating margin expanded 33 bps year over year to 2.3%, led by a decline in operating expenses (net).

- The company reported adjusted diluted EPS of €2.49, up 0.2% year over year at constant currency (down 8.5% year over year as reported) and slightly missing the consensus estimate of €53 by StreetAccount.

- Net debt decreased to €42 billion from €4.13 billion in the previous fiscal year.

- Open 300 premium and convenience stores by 2021.

- Increase in the share of “buoyant formats” and reduce exposure to hypermarkets to 15% of gross sales under banner (vs. 21% in 2018).

- Become the leading player in organic products in 2021, with net sales of €1.5 billion (compared to €1 billion in 2018).

- Increase the proportion of e-commerce sales to 30% in 2021 (compared to 18% at end-2018), underpinned by the “development of Cdiscount, with a marketplace contribution above 50%” and “faster digitalisation of customer relationships through mobile apps.”

- Grow food e-commerce GMV from €300 million in 2018 to €1 billion in 2021 and grow Cdiscount GMV from €3.6 billion in 2018 to €5.0 billion in 2021.

- Attain leadership in grocery home delivery aided by Ocado and Amazon Prime Now partnerships.

- To expand EBITDA and trading margins in the retail business by 0.2 percentage points per year.

- Latin America: to expand EBITDA margin by over 30 bps in Brazil and an improve EBITDA margin in Colombia.

- To grow trading profit for the retail business by 10% per year.

- To dispose of at least €2.5 billion worth of non-strategic assets in France by 1Q20.

- To generate free cash flow of €500 million per year with gross retail CAPEX below €350 million per year.