DIpil Das

[caption id="attachment_96177" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q20 Results

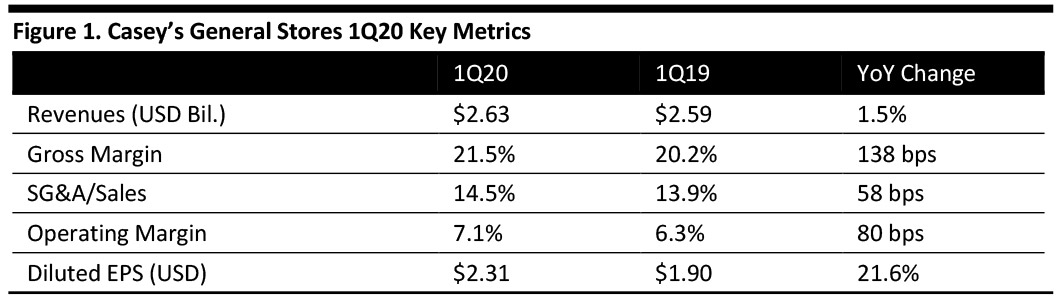

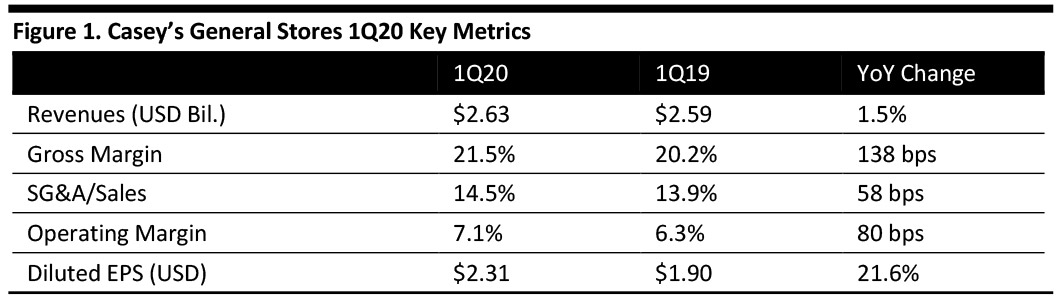

Casey’s General Stores reported 1Q20 revenue of $2.63 billion, up 1.5% year over year and above the consensus estimate of $2.61 billion. The company reported diluted EPS of $2.31, up 21.6% year over year and beating the consensus estimate of $2.05. Management attributed the strong growth in diluted EPS to the company’s fuel price optimization initiative, store growth, and a continued focus on controlling operating expenses. Gross margin increased 138 basis points (bps) year over year to 21.5%, and the operating margin increased 80 bps year over year to 7.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Casey’s General Stores reported 1Q20 revenue of $2.63 billion, up 1.5% year over year and above the consensus estimate of $2.61 billion. The company reported diluted EPS of $2.31, up 21.6% year over year and beating the consensus estimate of $2.05. Management attributed the strong growth in diluted EPS to the company’s fuel price optimization initiative, store growth, and a continued focus on controlling operating expenses. Gross margin increased 138 basis points (bps) year over year to 21.5%, and the operating margin increased 80 bps year over year to 7.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Casey’s General Stores reported 1Q20 revenue of $2.63 billion, up 1.5% year over year and above the consensus estimate of $2.61 billion. The company reported diluted EPS of $2.31, up 21.6% year over year and beating the consensus estimate of $2.05. Management attributed the strong growth in diluted EPS to the company’s fuel price optimization initiative, store growth, and a continued focus on controlling operating expenses. Gross margin increased 138 basis points (bps) year over year to 21.5%, and the operating margin increased 80 bps year over year to 7.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Casey’s General Stores reported 1Q20 revenue of $2.63 billion, up 1.5% year over year and above the consensus estimate of $2.61 billion. The company reported diluted EPS of $2.31, up 21.6% year over year and beating the consensus estimate of $2.05. Management attributed the strong growth in diluted EPS to the company’s fuel price optimization initiative, store growth, and a continued focus on controlling operating expenses. Gross margin increased 138 basis points (bps) year over year to 21.5%, and the operating margin increased 80 bps year over year to 7.1%.

Performance by Segment

- Fuel: Total gallons sold for the quarter climbed 2.9% to 619.1 million gallons, while gross profit increased 22.3% to $151.0 million. For the quarter, average fuel margin was 24.4 cents per gallon, while same-store gallons sold were down 2.0%. The company attributed growth in gross profit to advances in fuel price optimization and additional fuel margin captured.

- Grocery and other merchandise: 1Q20 revenue was up 6.7% YoY to $687.9 million. Same-store sales were up 3.2% YoY with an average margin of 31.3%. Gross profit was up 3% to $215.5 million. Management is encouraged by the momentum in this category and is optimistic about the current rollout of an in-store price optimization tool.

- Prepared food and fountain: 1Q20 revenue was up 5.3% year over year to $295.9 million while total gross profit grew 5.6% to $184.0 million. Same-store sales for the quarter were up 1.6% with an average margin of 62.2% in 1Q20, which management attributed to the company’s previously launched e-commerce website and new mobile app.

- FY20 same-store sales growth for fuel to be between (0.5)% and 1.0% YoY.

- FY20 same-store sales for grocery and other merchandise to increase 2.5-4.0% YoY.

- FY20 same-store sales for prepared food and fountain to increase 3.0-6.0% YoY.

- To complete construction on 60 new stores by the end of FY20.

- To acquire 25 stores by the end of FY20.