Interview with Moroccanoil CEO JuE Wong

Coresight Research sat down with Moroccanoil CEO JuE Wong to gather her insights on doing business in China. From 2015 to 2017, Wong served as President of Elizabeth Arden. The company decided to pull out of brick-and-mortar operations in China in order to primarily focus on its Tmall business in the country. As a result of those efforts, the company shot up from a double-digit ranking in beauty sales on Taobao in its category to a top-five ranking on Taobao.

Wong said that she translated her experience growing Elizabeth Arden’s Chinese sales to Moroccanoil. She saw an opportunity for the Moroccanoil brand to take part in Alibaba’s Singles’ Day shopping event in 2017, even though the festival was scheduled for just a month after she joined Moroccanoil as CEO.

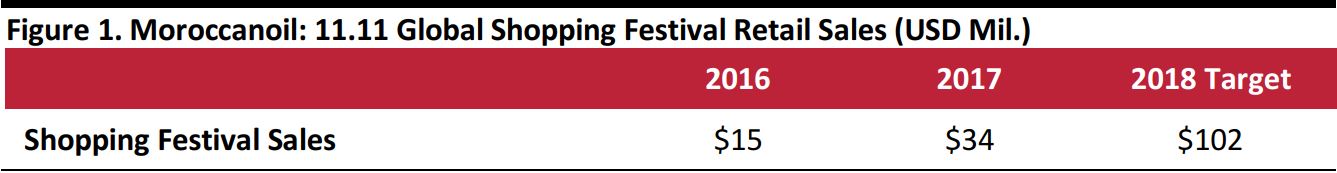

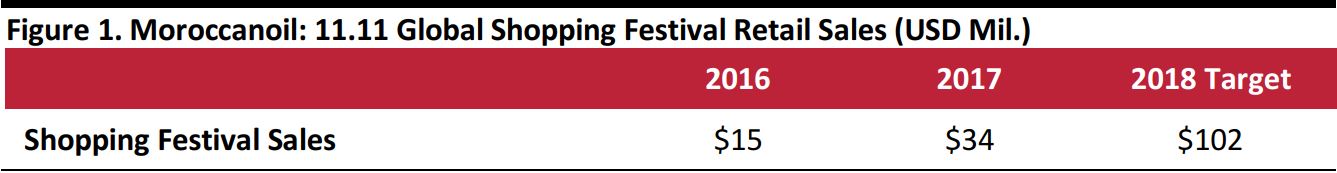

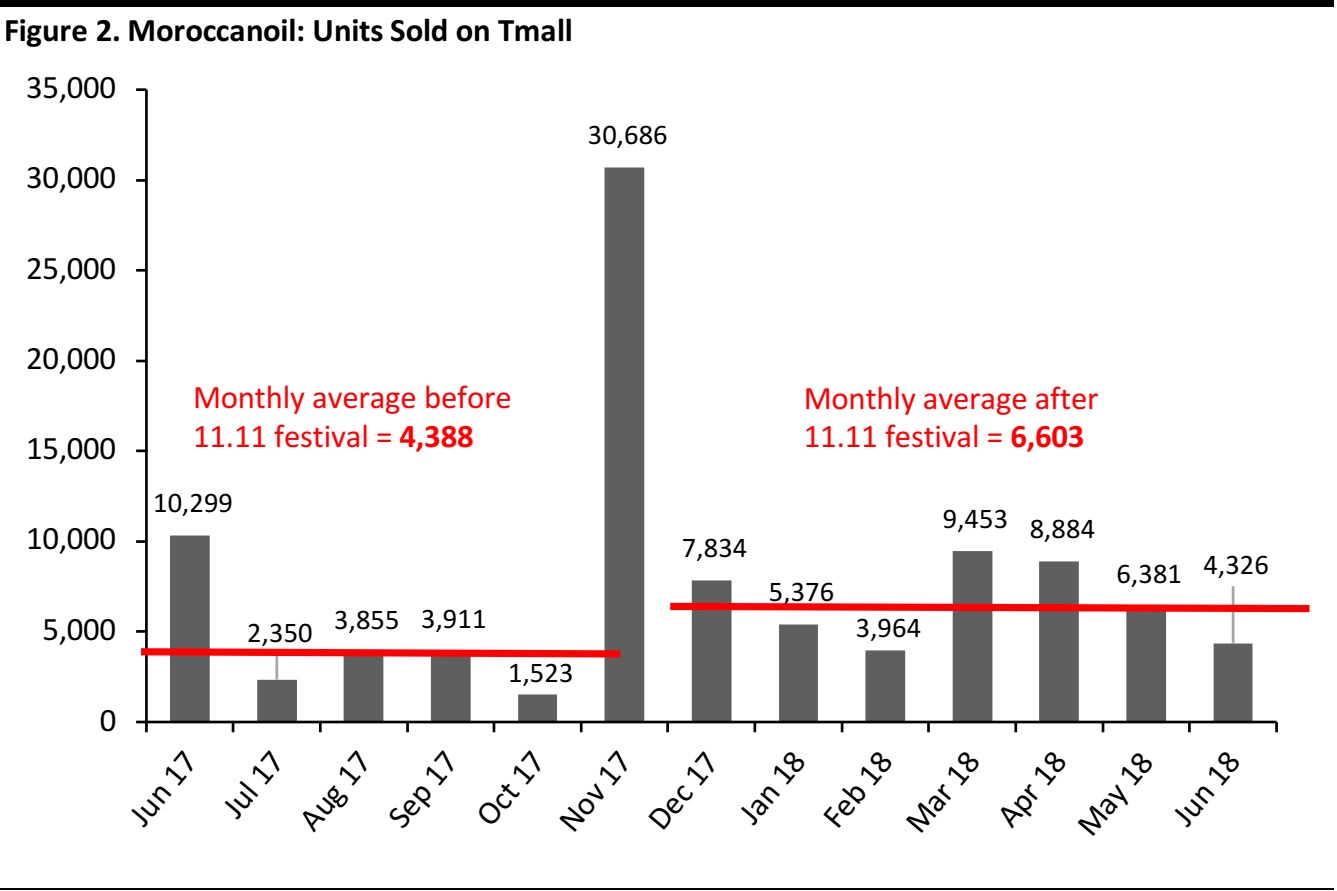

Moroccanoil had first entered the China market via Tmall Global in 2014, but Wong said that she saw an opportunity for fast growth and aggressive marketing in China. She sought to use the 11.11 shopping festival as a stepping-off point to achieve growth. When she asked the Moroccanoil team what the 11.11 festival revenue goal was, she thought it was very low. Not only did the company meet its goal in 2017, but also doubled its one-day revenue year over year, to $34 million, thanks to an aggressive marketing strategy and value gift packages that were offered all day throughout the festival. Wong estimates that Moroccanoil’s 11.11 Global Shopping Festival revenue this year will be three times that generated during the festival last year and will total $102 million.

She noted that brands with a certain level of awareness and equity in China need to leverage those strengths on Tmall in order to increase conversion on the platform. She said that brands need to focus on revenue and strategy in order to achieve goals, noting that Tmall is an ultracompetitive platform geared toward showcasing larger brands and that search algorithms on the platform favor products with strong sales records.

Source: JuE Wong

Source: JuE Wong

Strategically Use Gift Packages to Increase Average Order Value and Drive 11.11 Success

Wong said that timing is critical during the 24-hour 11.11 shopping festival. Many brands start out the day with strong sales thanks to promotions and preorders in the weeks leading up to the event. However, too many brands lose momentum later in the day because they fail to plan activities that will engage consumers throughout the entire 24 hours, Wong said.

Moroccanoil knew that it needed to hit the ground running at the start of the shopping festival day in order to do really well, but that it also needed to offer special promotional packages throughout the 24 hours. Moroccanoil emphasized that customers buying a value package were essentially getting the hero product included in the package for free. The company’s strategy was to offer its best promotions at the beginning of the 11.11 festival, in order to “come out with a bang,” Wong said. In China, the company’s hero product is called, “Little Black Cap” by consumers, a treatment oil for hair. The company paired its hero product, the Little Black Cap in promotional gift packages throughout 11.11 and continues to promote it today in campaigns.

Moroccanoil Gift Package featuring hero product Little Black Cap

Source: Tmall.com

Moroccanoil Gift Package featuring hero product Little Black Cap

Source: Tmall.com

Moroccanoil packages that include a hair hydration mask and a headband (left) and a light hydration mask (right), as featured on Tmall.com in June, 2018

Source: Tmall.com

Moroccanoil packages that include a hair hydration mask and a headband (left) and a light hydration mask (right), as featured on Tmall.com in June, 2018

Source: Tmall.com

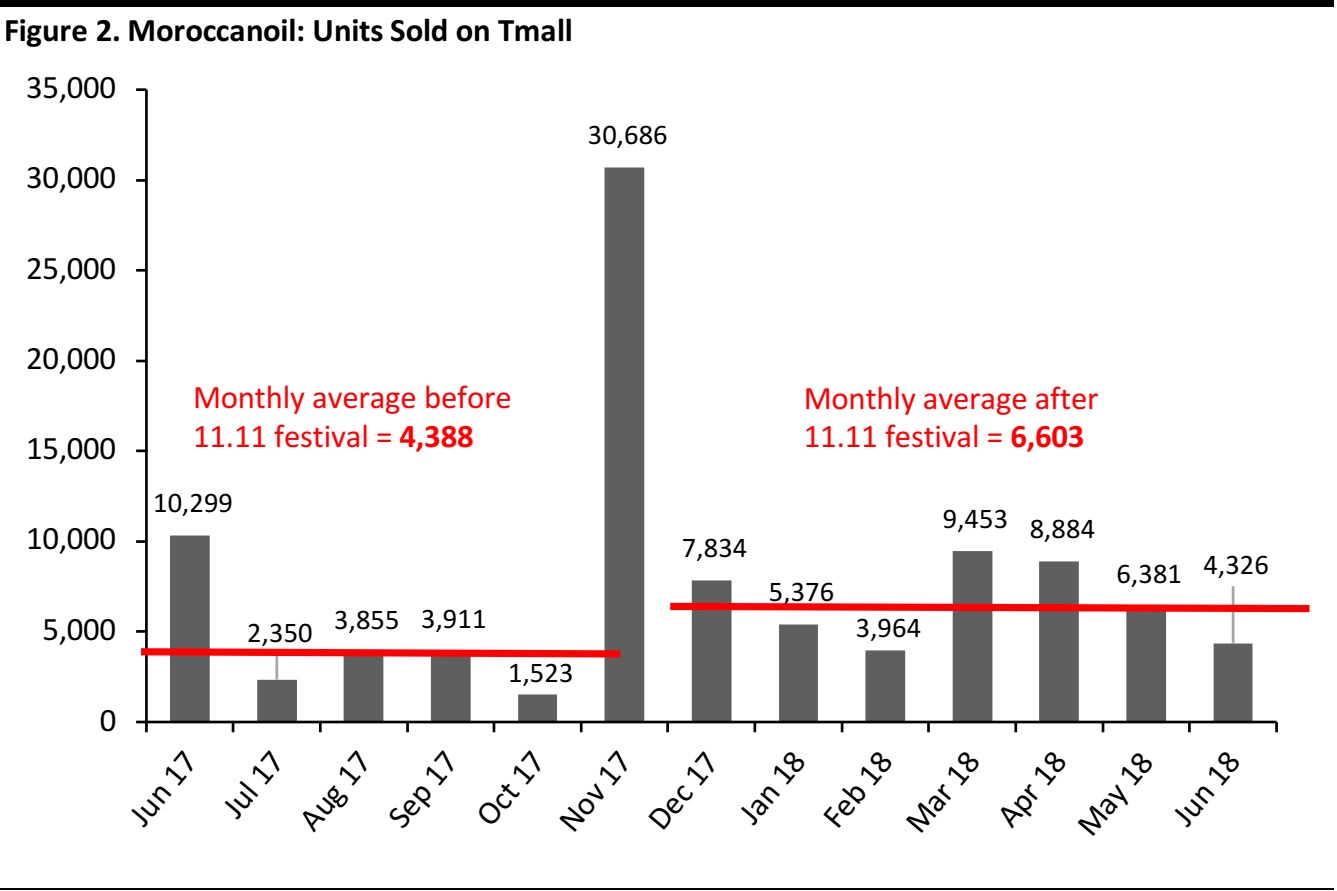

The graph below shows the number of units that Moroccanoil sold per month on Tmall from June 2017 through June 2018. The company sold 30,686 units on Tmall in November 2017, the month in which the 11.11 Global Shopping Festival was held, compared with 1,523 units in the preceding month. In the months following November 2017, the company experienced a boost in the average number of units sold per month on Tmall. Moroccanoil attributes that uplift to the 11.11 festival promotional packages and the exposure it received from participating in the shopping festival.

Source: Fung Omni Services

Source: Fung Omni Services

Use KOLs Who Love Your Brand

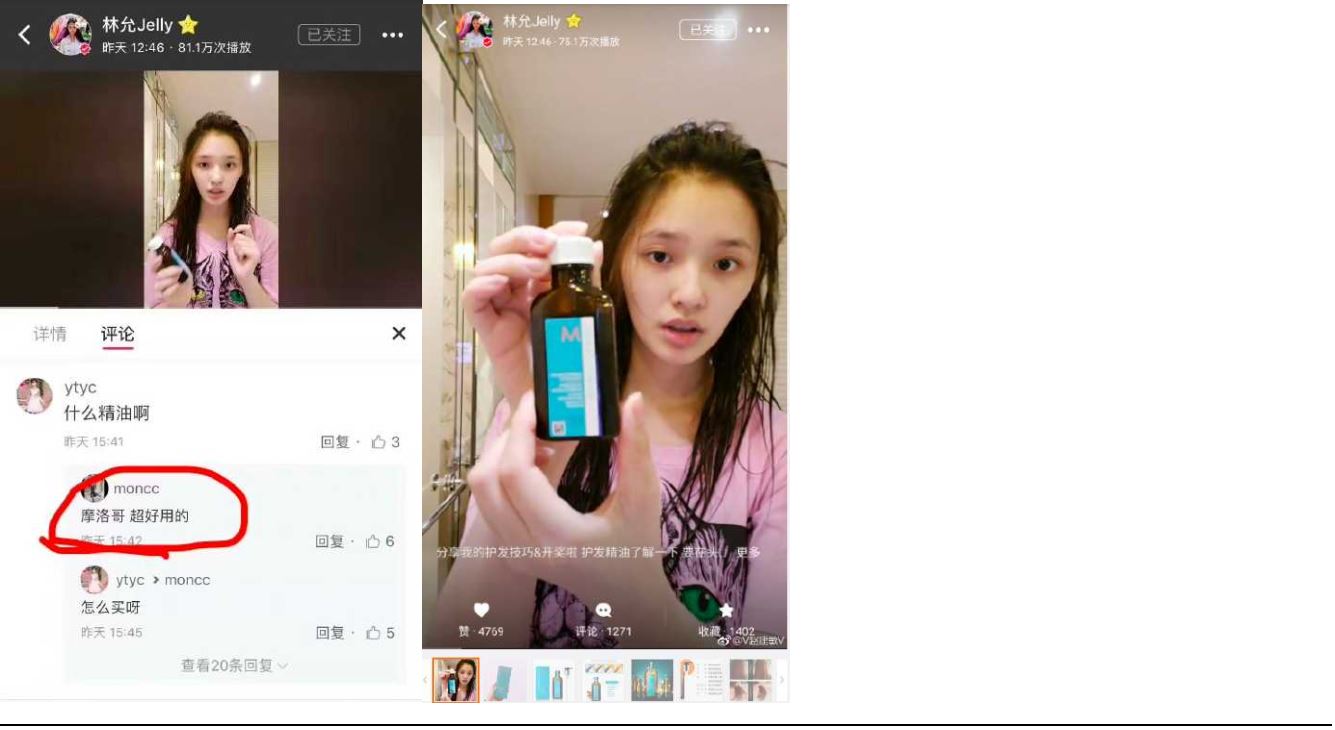

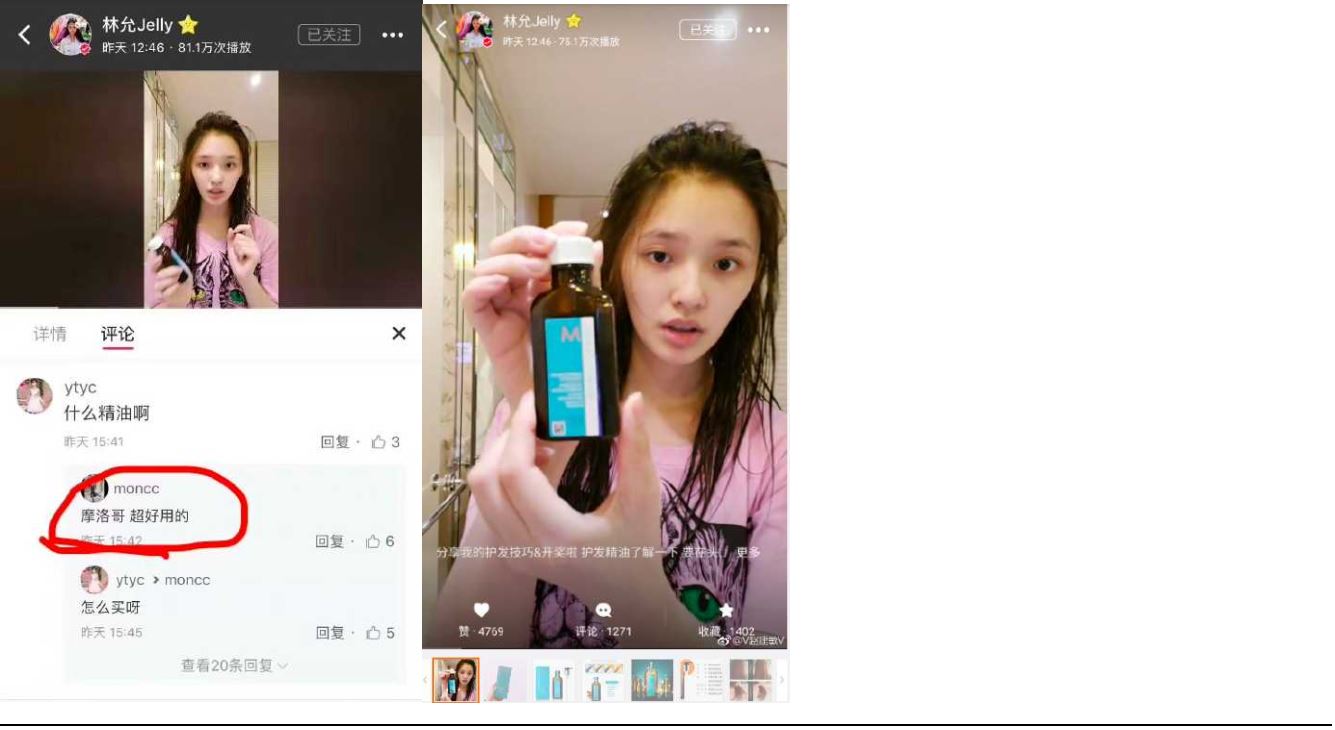

Wong said that, for most brands, KOLs are the most logical place to start on social media. Moroccanoil uses KOLs to enforce its brand’s “exotic” appeal, she said.

Chinese actress Lin Yun, a Moroccanoil KOL, shares her opinion of a Moroccanoil product on Chinese social media site Little Red Book

Source: Little Red Book (www.xiaohongshu.com)

Chinese actress Lin Yun, a Moroccanoil KOL, shares her opinion of a Moroccanoil product on Chinese social media site Little Red Book

Source: Little Red Book (www.xiaohongshu.com)

When asked about using influencers, Wong said, “The people who love your brand are going to advocate for it much more strongly than a banner ad can. It’s better to work with people who have followers.” For example the brand is working with Chinese actress Lin Yun who shares product reviews on Little Red Book. Moroccanoil is working with Huang Yi Lin, a Chinese actress, and is also working in cooperation with a Hunan TV show called

Queen to drive sales and engagement.

A recommendation that comes from a friend is always the best recommendation, Wong said, and that is the idea behind microinfluencer marketing on social media today. Microinfluencers are real people who have effective reach and engagement with a relatively small, but enthusiastic, following on social media. They post and repost content to share with their network of followers. Unlike the bigger KOLs, who have hundreds of thousands of followers, microinfluencers generally post content that is seen by only a few thousand followers. But because their followers consider them trusted friends or advisors, microinfluencers’ recommendations hold great weight and are seen as authentic.

Partner with a Social Media Agency in China that Understands the Chinese Consumer’s Psyche

Wong recommends that brands use a Chinese social media agency to help identify which consumers and influencers their brand will appeal to most. Local agencies will be in touch with what local consumers want and how they are likely to perceive a foreign brand, which will help brands determine the optimal messaging, content and platform in order to resonate with local consumers. Wong said that a good social media agency can help brands communicate with Chinese consumers who are asking, “What’s in it for me?” She explained that, for Chinese consumers, “value” equates to a competitive price, a competitive product and product performance.

Social media is very crowded in China today, and it is important to have critical mass, according to Wong. But the number of platforms is not the important thing, she said, suggesting that brands focus their social media efforts on a few meaningful platforms. The most important thing, Wong said, is to identify what customers find compelling rather than trying to be everything at once and trying to do too much. Wong specifically recommended that beauty brands use Tmall Global and Little Red Book as their go-to social media platforms.

Wong said that Moroccanoil went to a social media agency with its brand profile in search of influencers. The company was seeking influencers who knew the brand and loved the haircare category. Wong said it was important for the company to understand what was in various KOLs’ social fabric and what they believed the brand should do. She sought to determine if “natural ingredients” and “no sulfates” were important to specific influencers and said, “You want a group of people who know you and love your brand, and who will go the extra mile for you.” She recommended that brands look beyond just the top 100 influencers, because that group represents many brands. Some of them may also love your brand, Wong said, but finding KOLs who really care is important, as consumers can tell when brand promotion is not genuine.

Emphasize Product Efficacy and Education About Natural Ingredients

Wong said that animal testing is less of an issue in China than in other markets, although she believes it may become a bigger issue at some point. What Chinese consumers really want is to see efficacy in products and to be educated on product ingredients. For example, Chinese consumers want to understand the role of sulfates, formaldehyde and preservatives in products, she said. If beauty brands can show that their products are safe, made with natural ingredients and good for the skin, then they should work to educate consumers about those benefits. Wong highlighted that finding a KOL with a passion for natural products can be a differentiator for a brand.

Understand Your Brand’s DNA and How Consumers Are Searching for Your Product

Consumers are searching for solutions to their problems, Wong said. “In search engines, many consumers may type in the problem that they are trying to solve, such as ‘oily hair.’ If they’re looking for apparel, they may type in a color, pattern or style, such as ‘bomber jacket.’” Therefore, brands must ensure that search engine optimization (SEO) and social commerce platforms are working in their favor. They must know what customers are searching for, and how. Wong said that doesn’t mean brands need to pay a lot for SEO; they just have to understand their brand’s DNA and what people are searching for. She suggested that many brands assume consumers are searching for their brand by name, but that that is not always the case. Whereas some brands may have a hero product that everyone knows by name and searches for, like Moroccanoil’s Little Black Cap, other brands are found by customers who are just searching for solutions to everyday problems.

Source: JuE Wong

Source: JuE Wong Moroccanoil Gift Package featuring hero product Little Black Cap

Source: Tmall.com

Moroccanoil Gift Package featuring hero product Little Black Cap

Source: Tmall.com Moroccanoil packages that include a hair hydration mask and a headband (left) and a light hydration mask (right), as featured on Tmall.com in June, 2018

Source: Tmall.com

Moroccanoil packages that include a hair hydration mask and a headband (left) and a light hydration mask (right), as featured on Tmall.com in June, 2018

Source: Tmall.com Source: Fung Omni Services

Source: Fung Omni Services Chinese actress Lin Yun, a Moroccanoil KOL, shares her opinion of a Moroccanoil product on Chinese social media site Little Red Book

Source: Little Red Book (www.xiaohongshu.com)

Chinese actress Lin Yun, a Moroccanoil KOL, shares her opinion of a Moroccanoil product on Chinese social media site Little Red Book

Source: Little Red Book (www.xiaohongshu.com)