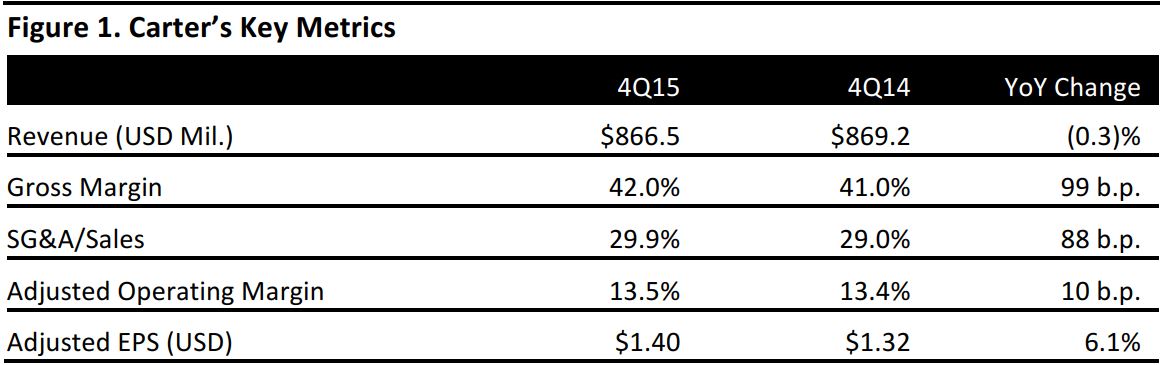

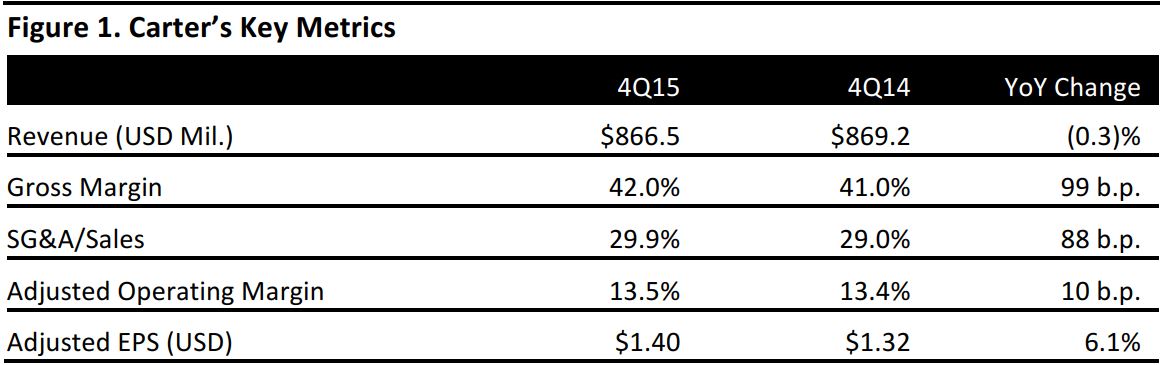

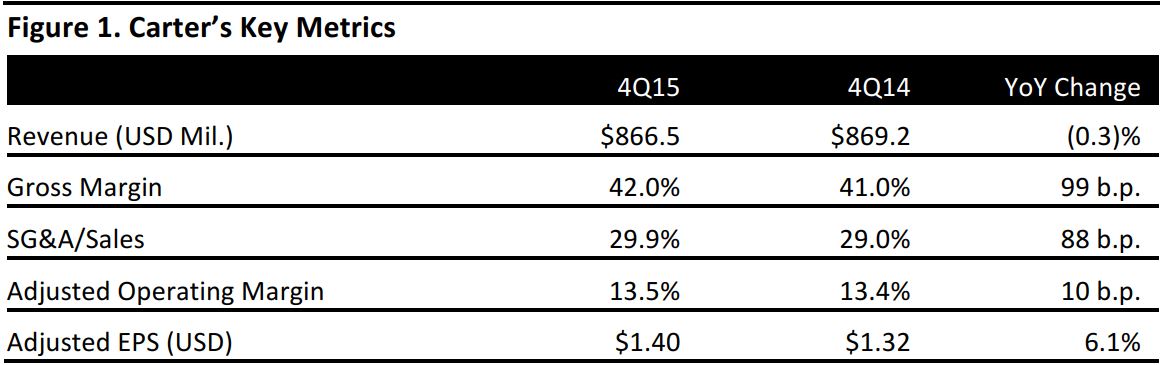

Source: Company reports

Carter’s recorded adjusted EPS of $1.40 for 4Q15, up 6.1% year over year and beating the consensus estimate of $1.29. This increase reflects growth in the domestic retail division, specifically the Carter’s and OshKosh retail segments, which was partially offset by declines in the domestic wholesale segments.

The

Carter’s retail segment reported sales of $351.6 million, up 2.9%, or 7.9% year over year on a 13-week comparable basis. Comparable sales increased by 5.7%, reflecting e-commerce sales growth of 34.4%, which was partially offset by a 1.7% decline in retail comps. The consensus called for a 3.0% decline in retail comps. Comp sales were negatively impacted by lower demand from international tourists, likely due to the strength of the US dollar.

In the

Carter’s wholesale segment, sales decreased by 5.8%, to $283.1 million. On an aligned basis, sales increased by 0.7%, reflecting increased seasonal product demand, a new playwear initiative and favorable replenishment trends.

The

OshKosh retail segment’s sales increased by 5.0% (or 9.7% on an aligned basis), to $118.3 million. OshKosh’s comp sales increased by 4.0%, reflecting e-commerce sales growth of 24.0% and a retail store sales decline of 2.5%, which exceeded the consensus estimate of a 1.6% decline. Comp sales were negatively impacted by lower demand from international tourists shopping in US stores.

Merchandise inventories were $469.9 million, up 5.6% year over year.

2015 RESULTS

The company reported 2015 revenues of $3.0 billion, up 4.1% from 2014. On a constant-currency basis, sales increased by 5.4%. On a 52-week aligned basis (53 weeks were reported for 2014), sales were up 5.8%.

For the year, the Carter’s retail segment saw a 5.9% increase in sales (7.2% on an aligned basis), to $1.2 billion. Comps were up 1.2%, driven by 18.9% sales growth in e-commerce, which was partially offset by a 3.1% decline in retail store sales. The Carter’s wholesale segment reported sales of $1.1 billion, up 2.4% year over year (4.3% on an aligned basis). The OshKosh retail segment led growth, with sales up 8.3% (or 9.9% on an aligned basis), to $363.1 million. OshKosh comparable sales increased by 2.4%, comprising e-commerce sales growth of 24.0% and a retail store sales decline of 2.5%.

GUIDANCE

For 1Q16, the company expects sales to increase by approximately 4% year over year, to $712.2 million, versus the consensus estimate of $726.6 million. Adjusted EPS is expected to be $0.95, below the consensus estimate of $1.10.

For 2016, Carter’s expects sales to increase by 6%–7% year over year, to $3.19–$3.22 billion, in line with the consensus estimate of $3.20 billion. The company expects adjusted EPS to increase by 8%–10%, to $4.98–$5.07, compared to the consensus estimate of $5.12. Carter’s expects over $4.0 billion in sales by 2020.