Source: Company reports/FGRT

2Q17 Results

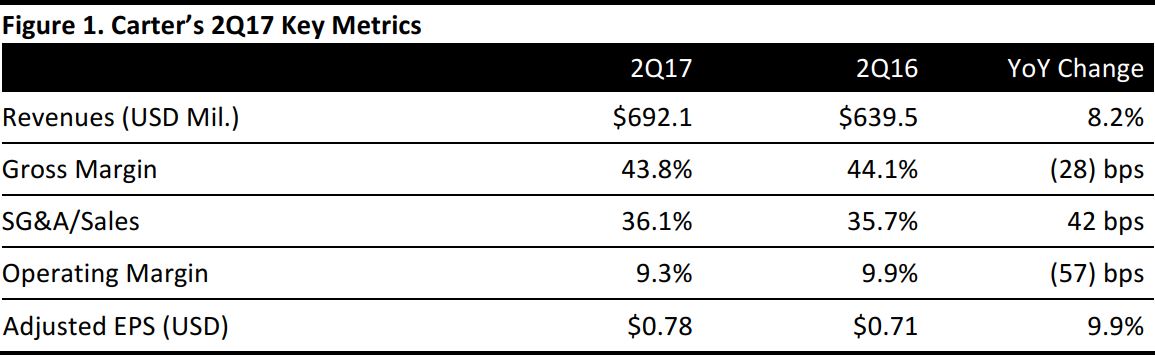

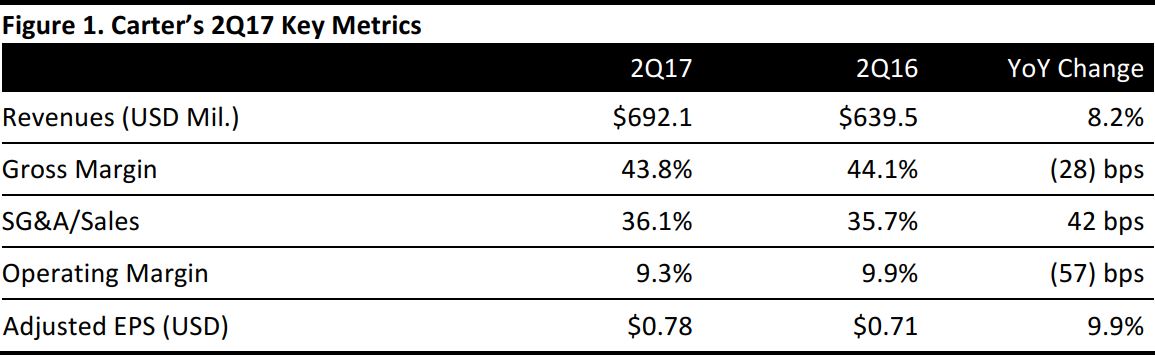

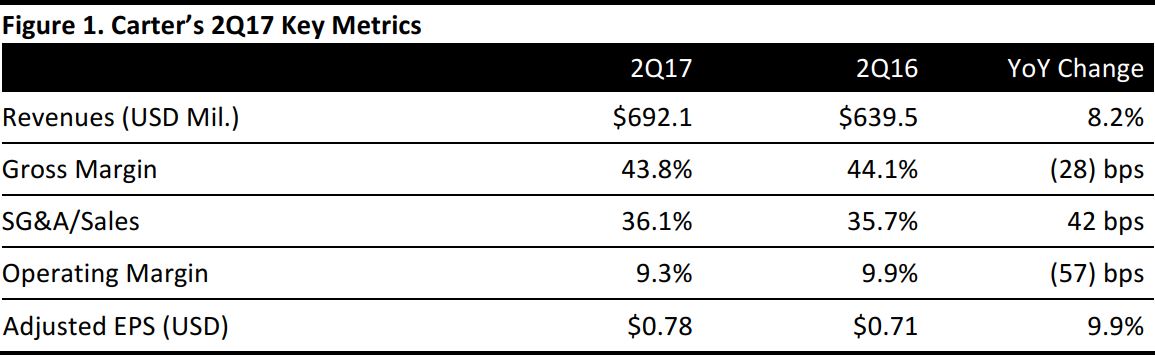

Revenue growth for Carter’s in 2Q17 was driven by the retail and international businesses as well as by the contribution from the Skip Hop brand, which was acquired in February 2017. Net sales increased by $52.6 million year over year, to $692.1 million. On a constant-currency basis, consolidated net sales increased by 8.6% year over year.

At the beginning of fiscal 2017, the company combined its Carter’s Retail and OshKosh Retail segments into a single US Retail operating segment, and its Carter’s Wholesale and OshKosh Wholesale segments into a single US Wholesale operating segment. The company’s reportable segments are now US Retail, US Wholesale, and International.

The Carter’s Retail segment reported sales of $391.8 million in 2Q17, up 11.1% from the same quarter last year. US Retail comparable sales increased by 6.0%, which includes comparable store sales growth of 0.4% and comparable e-commerce sales growth of 27.6%.

In the Carter’s Wholesale segment, sales increased by 1.2%, to $217.7 million, reflecting the benefit of the Skip Hop acquisition and partially offsetting a decrease in demand for OshKosh and Carter’s products.

The OshKosh International segment’s sales increased by 15.4% year over year, to $82.6 million. The growth reflected the benefit of the Skip Hop acquisition and also growth in Canada and China, and was partially offset by decreased wholesale demand.

In the quarter, the company opened 11 stores in the US and closed three stores.

Outlook

For 3Q17, Carter’s expects net sales to increase by approximately 5% year over year ($45 million), to $946.1 million, which is below the consensus estimate of $960 million. The company expects adjusted earnings per diluted share for 3Q17 to be roughly in line with the $1.61 recorded in 3Q16.

For FY17, the company reaffirmed its revenue guidance of 4%–6% growth, implying a range of $3.3–$3.4 billion, compared with the consensus estimate of $3.38 billion. The company estimates its adjusted earnings per diluted share will increase by approximately 8%–10%, implying a range of $5.55–$5.65 versus the consensus estimate of $5.62.