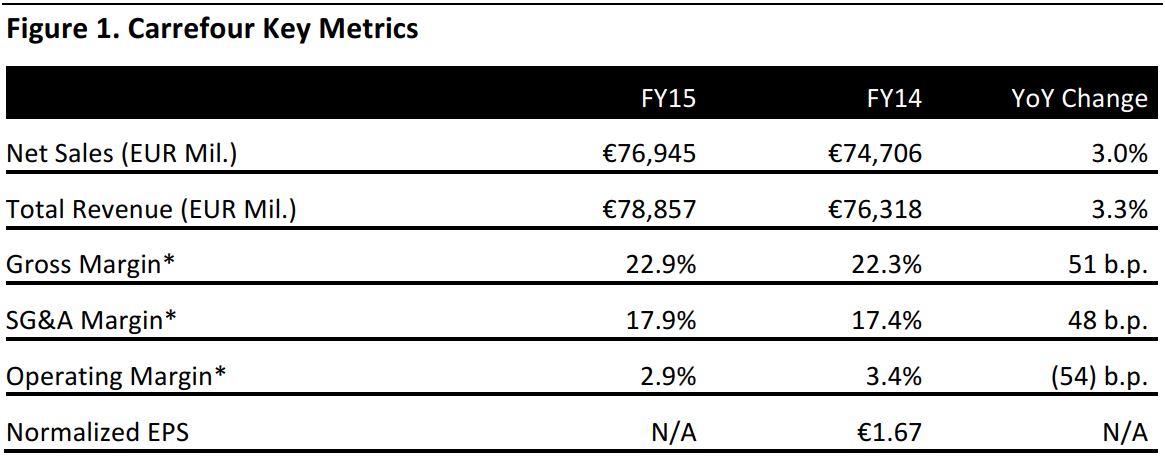

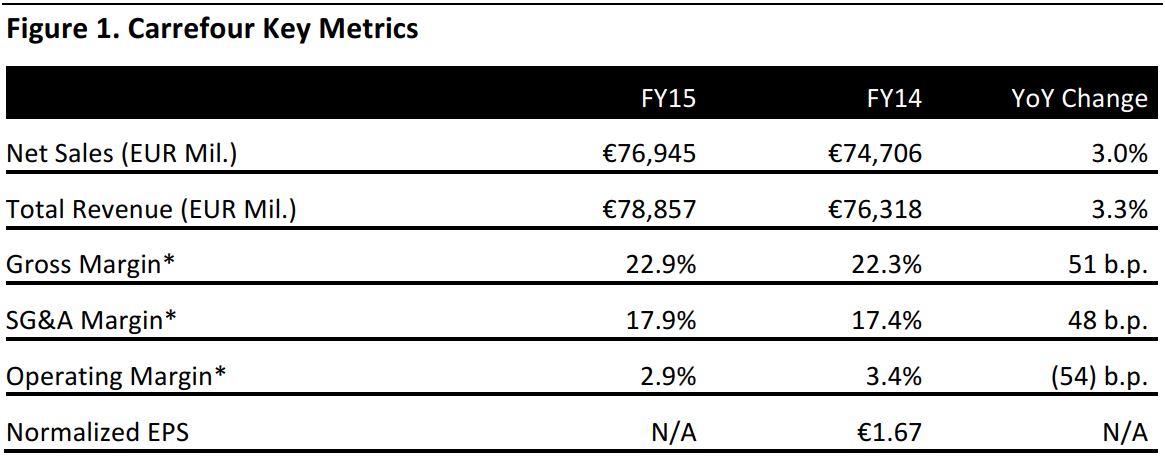

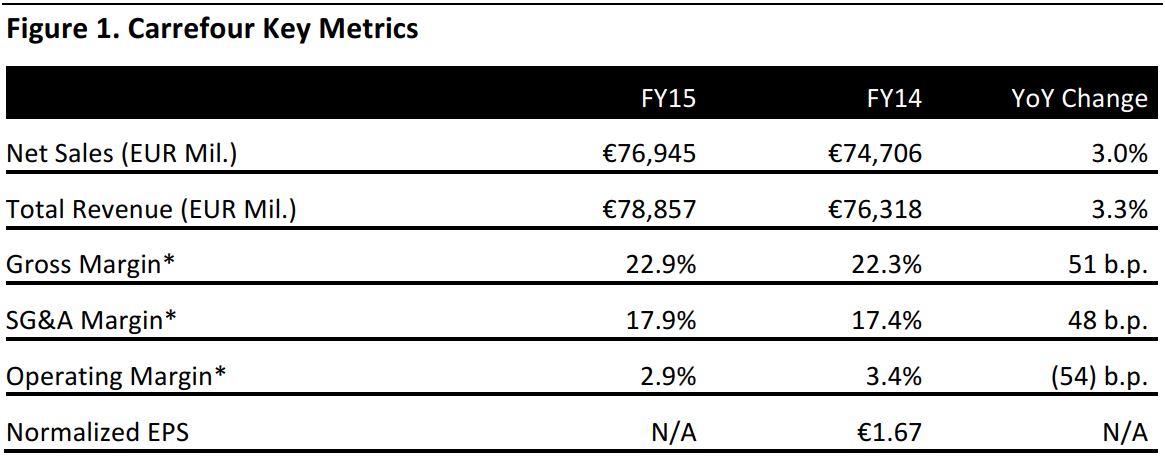

Fiscal years end December 31.

*Calculated based on total revenue.

Source: Company reports

FY15 RESULTS

French multinational retailer Carrefour reported a FY15 net sales increase of 3.0%, to €76.9 billion, which was below the consensus estimate of €77.6 billion. Faster growth in Spain and Italy and the performance of Latin America underpinned revenue growth. Adjusted net income increased by 7.1%, to €1.1 billion, slightly below consensus.

Carrefour reported growth of 4.0% in EBITDA, to €4.0 billion, slightly above the consensus estimate. Recurring operating income was up 2.4%, to €2.4 billion, just below consensus. However, operating income after nonrecurring income and expenses was down 13.2%, to €2.2 billion, due to costs incurred following the company’s recent acquisition of DIA stores in France.

The company did not disclose EPS for the fiscal year, which analysts expect to be €1.62, but it did state that the dividend per share will be €0.70.

The retailer continued to invest in the modernization and expansion of its store network during the fiscal year, with a particular focus on the expansion of its convenience store formats. During FY15, Carrefour invested €2.4 billion in capex and opened 1,123 stores, 850 of which were convenience stores.

Together with its organic store network expansion, Carrefour continued to integrate its recently acquired DIA stores in France and Billa stores in Romania.

PERFORMANCE BY GEOGRAPHY

Sales in France, which account for 47% of Carrefour revenue, were up 2.6%, to €36.3 billion. Recurring operating income in France declined by 6.4%, to €1.2 billion, due to costs incurred in the DIA acquisition at the end of FY14 and higher taxes on large commercial spaces.

In other European countries, net sales were up 2.8%, to €19.7 billion. Profitability increased significantly in Europe (excluding France), with recurring operating income growing by 33.4%, to €567 million. The performance in Europe was driven by the recovery in Spain and an improvement in Italy.

Net sales in Latin America grew by 2.9%, to €14.3 billion. Unfavorable exchange rates impacted the growth, which remained strong despite the difficult macroeconomic environment in Brazil, Carrefour’s second-largest market. In terms of organic growth, sales in the region were up 15.7% and profitability was strong, with recurring operating income up 23.5% at constant exchange rates, to €705 million. The company commented that comps in Brazil underpinned the performance of the region.

Sales in Asia increased by 5.9%, to €6.7 billion, but declined by 9.5% in terms of organic growth. The company continued the repositioning of its business model in China in an effort to successfully navigate the country’s economic slowdown and changing consumer needs.

GUIDANCE

For FY16, Carrefour announced that it will continue to invest in expansion. It plans to open new stores and grow its convenience store format, in particular, “at [a] sustained pace.” In France, the company will operate an additional 500 stores as a result of the conversion of DIA outlets. Carrefour will allocate capex of €2.5–€2.6 billion to support its expansion efforts in FY16.

The company also aims to accelerate the development of its e-commerce offering in order to strengthen its multi-channel operations, as evidenced by its recent acquisition of Rue du Commerce, which was finalized on January 1, 2016.

Analysts estimate that Carrefour will generate €77.7 billion in net sales in FY16, €2.6 billion in EBIT and €1.3 million in net income.