albert Chan

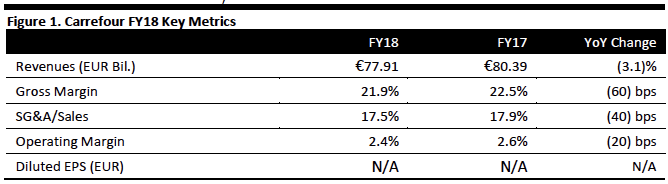

[caption id="attachment_78486" align="aligncenter" width="668"] Source: Company reports/Coresight Research[/caption]

FY18 Results

Carrefour reported better than expected FY18 results:

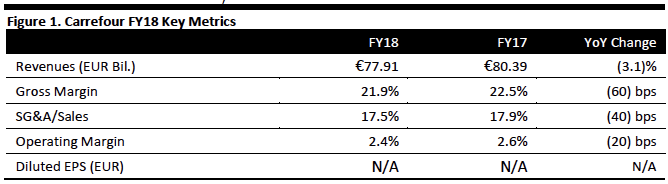

Source: Company reports/Coresight Research[/caption]

FY18 Results

Carrefour reported better than expected FY18 results:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Carrefour reported better than expected FY18 results:

Source: Company reports/Coresight Research[/caption]

FY18 Results

Carrefour reported better than expected FY18 results:

- Carrefour grew total sales 3.3% year over year at constant exchange rates to €77.9 billion (down 3.1% as reported), beating the consensus estimate of €76.6 billion recorded by StreetAccount. Growth at constant currency was boosted by strong international sales.

- The gross margin contracted 60 basis points (bps) to 21.9%, due to an evolving integrated/franchise mix, and commercial investments in competitive markets.

- Recurring operating margin contracted slower than gross margin by 20 basis points to 2.4%, due to lower distribution costs.

- The company reported adjusted net income of €802 million, down 11.2% year over year but ahead of consensus of €747.8 million by StreetAccount.

- Carrefour’s cost-reduction programs in all countries and delivered savings of €1,050 million in 2018.

- Carrefour concluded several transactions valued at more than €160 million in 2018 as part of its objective of selling €500 million of non-strategic real estate assets by 2020.

- France net revenues were up 1.0% year over year to €35.6 billion. Underlying operating income for France fell 43.3% to €466.0 million due to weaker same-store sales growth, intense competition, investments in online order preparation platforms and the impact of the Yellow Vests protests in the fourth quarter. The underlying operating income was below the consensus of €518.8 million by StreetAccount.

- For the Rest of Europe, net revenues stood flat at constant currency to €21.1 billion. Underlying operating income fell 1.7% at constant currency to €664.0 million (down 1.9% as reported), below the consensus of €668.0 million by StreetAccount.

- Net sales in Latin America were €13.8 billion, up 15.7% year over year at constant currency (down 13.9% as reported). Underlying operating income grew 23.6% at constant currency to €767.0 million (up 7.2% as reported), beating the consensus of €760.3 million by StreetAccount. The company noted that in Argentina, the implementation of a transformation and commercial turnaround plan allowed recurring operating income to reach breakeven.

- For Asia, net sales fell 4.1% year over year at constant exchange rates to €5.5 billion (down 6.9% as reported). Underlying operating income was €45 million compared to €4 million in 2017, beating the consensus of €36.0 million by StreetAccount, driven by improved performance in China.

- Carrefour signed more than 200 contracts to help farmers convert to organic farming in 2018. With the success of the “Bio Experience” organic food commercial concept in Chambourcy (about 8,000 organic SKUs over 600 square meters), Carrefour plans to deploy the concept in at least 30 additional hypermarkets in 2019.

- In 2018, Carrefour generated strong growth in organic product sales, which reached €1.8 billion. The Group targets organic products sales of €5 billion by 2022.

- After reducing its assortments by about 6% in 2018, Carrefour now plans to reduce them by 15% in 2020 globally (compared to 10% as initially planned), with a strong focus on the quality and price of private label products.

- The group has a target of generating one-third of sales through Carrefour-branded products by 2022.

- Carrefour is hoping to increase competitiveness tactics such as the “Large Brand rewards” program (200 products with discounts up to €1.5) and “Loyalty rewards” (10% discounts on 10,000 Carrefour-branded products), both launched in February 2019.

- The company hopes to modernize stores and plans to cut sales area by 400,000 square meters by 2022.

- Carrefour plans to open a new digital hub in March 2019. It will host teams from the Carrefour-Google Lab, experts in artificial intelligence and machine learning, and more than 300 Carrefour employees specialized in digital and e-commerce.

- In 2018, Carrefour opened more than 470 convenience stores. The company originally planned to open 2,000 by 2022, but raised this target to 3,000. The company plans to open another 20 Atacadao stores in Brazil in 2019.

- Cost reduction plan raised from €2.0 billion to €2.8 billion on an annual basis by 2020.

- €5 billion of food e-commerce sales by 2022.

- €5 billion in sales of organic products by 2022.

- Dispose of €500 million in non-strategic real estate assets by 2020.