Source: Company reports/Coresight Research

FY17 Results

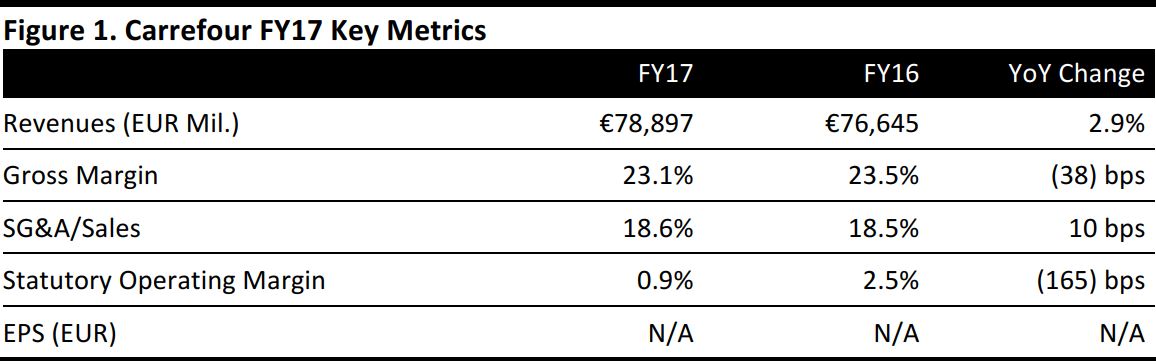

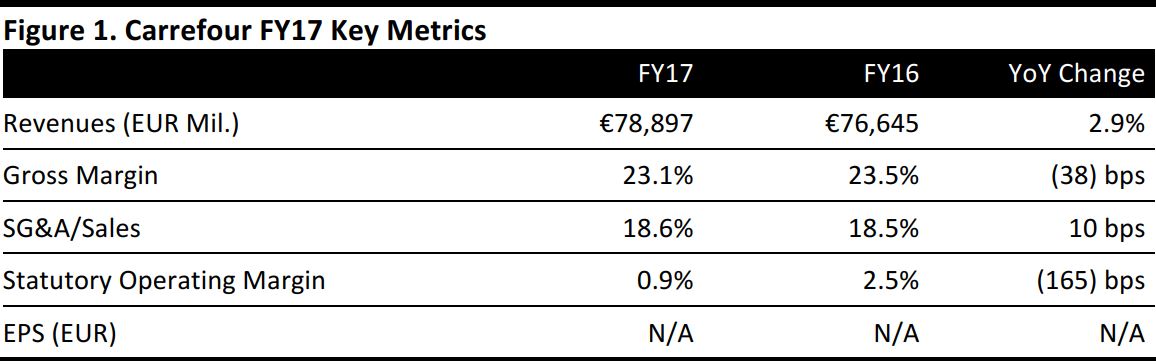

Carrefour announced absolute net sales and profit data for FY17 on February 28. The company had already announced FY17 revenue growth

in January. Carrefour reported then that it grew comparable sales by 1.6% in FY17, with French comps up 0.8% and international comps up 2.2%. The latest announcement provided the following additional details:

- Group net sales were €78.9 billion, up 2.9% as reported and up 2.6% at constant exchange rates. Despite prereporting revenue growth, the company saw net sales come ina whisker short of analysts’ expectations of €79.1 billion, as recorded by S&P Capital IQ.

- Recurring operating income of €2.0 billion was down 14.7% year over year, but was broadly in line with analysts’ expectations. This yielded an operating margin of 2.5%, down from 3.1% in the previous year. The company’s statutory operating margin, as shown in the table above, was considerably weaker.

- Adjusted net income of €773 million was down 25% year over year and well below expectations of €833 million.

- The company reported a non adjusted group net loss of €531 million, principally due to nonrecurring charges of €1.3 billion. This included €1 billion of write-offs: a €700 million goodwill impairment in Italy and a €333 million impairment related to the former DIA store network in France. The remainder was largely €279 million in reorganization costs in several countries.

Management noted several factors that contributed to operating margin contraction:

- Price pressures, particularly in France.

- Higher distribution costs in its main markets, including cost inflation in Latin America.

- Higher depreciation costs following a period of investments; depreciation costs increased by almost €95 million.

- A tough Argentinian market.

In France, operating losses of former DIA stores continued to “weigh strongly” on profitability in the country.

Alexandre Bompard, Chairman and CEO of Carrefour, said that the weak results “demonstrate the necessity of implementing without delay Carrefour’s transformation plan.” In January, the company unveiled its Carrefour 2022 plan, which is based on four pillars, and management added further details in its latest release:

- A simplified organization, with a slimmed-down headquarters and new partnerships, such as with FnacDarty, Showroomprive.com, and Tencent.

- Productivity and competitiveness gains, with overall investments of €2 billion per year partially offset by €2 billion cost savings by 2020. The company will divest or close 273 former DIA stores in France.

- An omnichannel “universe of reference,” including more convenience stores, more cash-and-carry stores and “massive” investments in digital. In 2018, Carrefour will open 20 new Atacadão stores in Brazil, convert 16 hypermarkets in Argentina, open 170 new Drive collection points in France and extend grocery home delivery to 15 more French cities.

- Promote food quality to attract 1 million more fresh-food customers in France by 2022 as well as more organic sales and more private-label sales. It will deploy blockchain technology in its Carrefour “quality lines” to improve traceability.

Outlook

The company provided no numerical guidance for FY18. Management stated that in FY18, “the group’s results will remain closely linked to the evolution of foreign exchange rates, in particular that of the Brazilian real.” Depreciation costs will again increase in FY18. The company declared 2018 to be a “pivotal year” in its transformation as the Carrefour 2022 plan kicks in.

For FY18, analysts expect Carrefour to grow revenues by 1.2%, EBIT by 7.6% and statutory pretax profit by 5.0%.