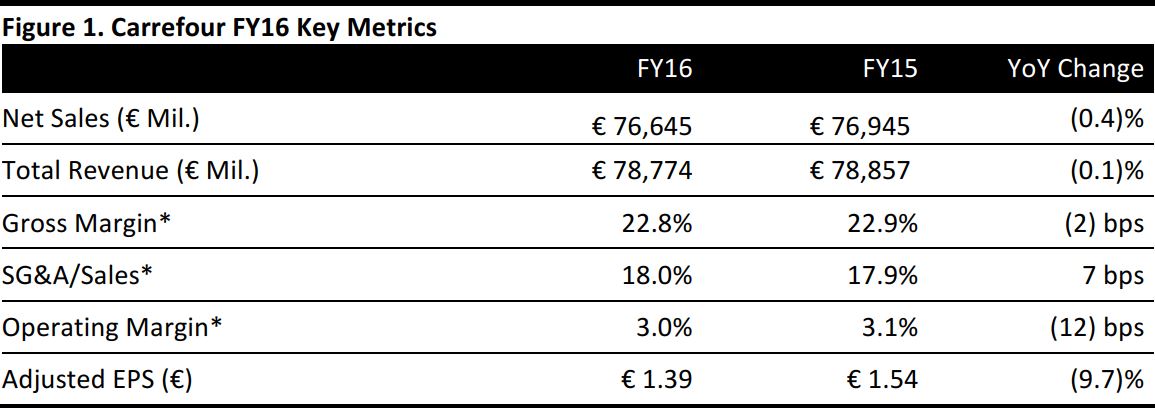

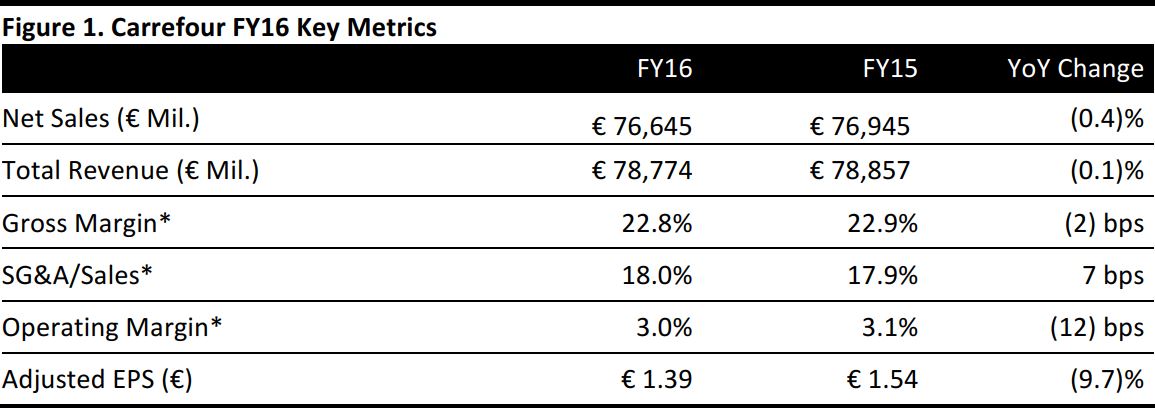

December 31 fiscal year-end.

*Calculated based on total revenue.

Source: Company reports/Fung Global Retail & Technology

FY16 Results

French retail giant Carrefour reported FY16 net sales (including fuel) of €76,645.0 million, a slight decline of 0.4% year over year (up 2.7% at constant currency) and above the consensus estimate of €76,484 million. Excluding fuel, net sales rose by 3.3% to €70,204 million, at constant currency.

Comps grew by 3.0%, excluding fuel and calendar effects. The gross margin softened by 2 basis points and the operating margin declined by 12 bps, while SG&A as a portion of sales edged up 7 bps. Carrefour confirmed that the 1.7% fall in EBITDA to €3,886 million and 3.8% fall in recurring operating income to €2,351 million was in line with its forecast for FY16.

Carrefour said that robust food sales across its global markets, strong sales growth in Brazil and a continuing positive trend in Europe (excluding France) helped drive overall performance.

Adjusted EPS declined by 9.7% to €1.39, significantly missing the consensus estimate of €1.49.

During the year, Carrefour incurred capex of €2.5 billion (excluding Cargo, its logistics property company), opened 871 new stores and launched new e-commerce websites and apps in all countries where it operates. In order to expand its online presence in France, Carrefour acquired nonfood e-commerce site Rue du Commerce and organic food website Greenweez.

Performance by Geography

France

- Sales in France declined by 1.1% to €35,877 million. Comps declined by 0.9%.

- The company stated that it experienced a difficult trading environment in France and that the transformation of stores acquired from Dia, to the Carrefour banner, is almost complete, with 622 stores fully converted to date.

- It completed the integration of Rue du Commerce, which it acquired earlier in 2016.

Other European Countries

- Sales grew by 2.3% at constant exchange rates, to €20,085 million and comps increased by 2.2%.

- Carrefour attributed the growth to the continued recovery in business in Spain and improved performance in Italy and Poland.

Latin America

- Carrefour’s Latin America businesses posted the best performance, with sales up by 16.0% at constant currency to €14,507 million. Comps grew by an impressive 16.2% during the year.

- Brazil drove growth in this segment, with a significant improvement in profitability, due to new store openings and the introduction of a nonfood e-commerce website in the country.

- Carrefour acknowledged that Argentina’s volatile economy, marked by high inflation, continued to impact the company’s profitability in the region.

Asia

- Performance in Asia was disappointing, as sales decreased by 3.6% at constant currency to €6,176 million and comps fell by 3.8%.

- Carrefour stated that it has been working on transforming its stores in China, and that the first positive effects were only reflected in sales during 2H16.

Outlook

In FY17, Carrefour aims to continue expanding its physical presence across all of its markets, with a major focus on opening convenience stores. It also plans to expand its e-commerce business further, and work to develop its offer in nonfood and services.

Carrefour’s financial targets for FY17 are:

- To grow total sales by 3%–5% at constant currency.

- To incur capex of around €2.4 billion and increase free cash flow from the current €1,039 million (excluding cargo property).

- To continue making strategic acquisitions.

- To launch IPOs of its Brazilian business and Carmila (Carrefour’s shopping center business in Europe), market conditions permitting.

For FY17, analysts expect:

- Net sales of €79,746 million, representing 4.3% growth.

- Operating income of €2,647 million, representing 10.4% growth.

- Adjusted EPS of €1.73, representing 16.1% growth.

Note that the above consensus figures were collated before the FY16 results.