DIpil Das

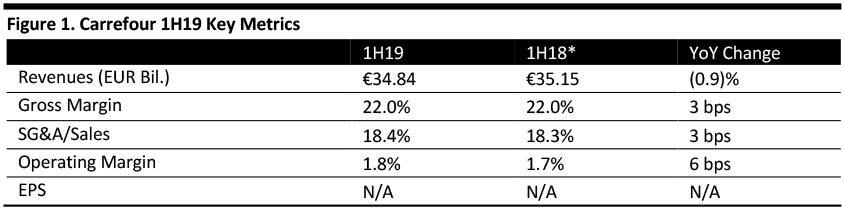

*Restated to exclude China

*Restated to exclude China Source: Company reports/Coresight Research [/caption]

1H19 Results and 2Q19 Update

In 1H19, Carrefour reported recurring operating income of €618 million, up 2.7% year over year but below the consensus estimate of €622 million recorded by StreetAccount. Including €593 million of nonrecurring costs mainly related to reorganization costs and provisions for tax litigation in Brazil, 1H19 operating income stood at €23 million versus €(169) million in the year-ago period. Adjusted net income (group share) came in at €179 million, up by one-third year over year.

1H19 gross sales were up 2.1% at constant exchange rates, down 1.2% as reported and up 3.5% on a comparable basis.

Carrefour reported consensus-beating comparable sales growth in the second quarter: Group comparable sales climbed 3.9%, versus 3.2% in 1Q19 and consensus of 2.6%. Growth in most regions improved sequentially, though comp growth slowed a little in its core French market. In 2Q19:

- In France, Carrefour grew comparable sales 0.7% versus 1.0% in the prior quarter and the 0.3% consensus recorded by StreetAccount. French hypermarket sales were down 1.1% and supermarket sales were up 2.5%, both slightly ahead of expectations. Food comps were up 1.9% and nonfood comps down 7.1%.

- In Europe ex France, comps were flat, versus a decline of 1.5% in the prior quarter and the consensus of a 0.9% decline. Comparable sales were flat in Spain and down 2.2% in Italy (both ahead of consensus); comps were down 1.6% in Belgium vs expectations of a 1.0% decline.

- Latin America comparable sales were up 15.9%, accelerating from 14.5% in the prior quarter and ahead of the 13.6% consensus. Brazil comparable sales were up 7.7% versus 6.6% in the prior quarter and the 7.0% consensus.

- Asia comps were up 3.0% compared to expectations of a 1.5% rise. This segment reflects Taiwan operations only, following Carrefour’s agreement to sell a majority stake in its China operations.

Carrefour is showing a clear improvement in performance, half-year results are growing. This strong momentum is accompanied by an intensification of our transformation plan. We are multiplying concrete initiatives to better serve our customers: We are investing in prices to support their purchasing power, we are offering them a more extensive range of services and more innovative formats.

Management pointed to progress in its Carrefour 2022 plan:

- Organic sales saw growth of over 25% in 2Q19. In France, the company opened eight new Bio Experience areas in hypermarkets in 1H19.

- In February 2019, Carrefour launched "Loyalty rewards" and "Large Brand rewards" across its formats and channels in France, to reward customer loyalty.

- In France in April, the Group launched the "Unbeatable Prices" in hypermarkets on 10 everyday fruits and vegetables. In May, Carrefour launched "Saturday fuel at cost" in hypermarkets and supermarkets. From June, Carrefour offered "Unbeatable Prices" on 500 key FMCG products.

- The company launched price campaigns in Italy and Spain as it invested “heavily” in price in Europe.

- The company reduced under-productive selling space by almost 100,000 square meters at the end of June, including around 30,000 square meters in 1H19. Selling space has been reallocated to dedicated e-commerce preparation areas, outlets and shopping malls.

- In e-commerce, Carrefour launched a new Order Preparation Platform on the outskirts of Paris in early January. Another opening is planned in the autumn south of Paris. In July, the company opened its 100th pedestrian Drive in France (versus 62 at the end of March). In total, the group operates 1,501 Drives worldwide (adding 155 in 1H19). Carrefour is rolling out home delivery in France, aiming to provide the service in all urban areas with populations exceeding 10,000 by 2022.

On June 25, Carrefour announced it had agreed to sell 80% of Carrefour China to Suning.com. The China operations were treated as discontinued operations in the company’s 1H19 results and in its restatement for the year-ago period.

On July 10, Carrefour announced it had agreed to sell its stake in real estate company Cargo Property Assets to Argan. Management said the transaction will contribute to achieving the objective of divesting €500 million of non-strategic real estate assets. The transaction valued the real estate assets held by Cargo at €900 million. Carrefour will receive remuneration equivalent to about €290 million, about 80% in cash and 20% in Argan stock. Carrefour will hold about 5% of Argan's share capital. Completion of the transaction is expected by the end of 2019.

Outlook

The company did not provide quantitative guidance for FY19. Management reaffirmed the financial targets of its Carrefour 2022 plan, including achieving €2.8 billion in cost reductions by 2020, lowered to €2.6 billion ex China; €5 billion in food e-commerce sales in 2022, lowered to €4.2 billion ex China; €5 billion in sales of organic product in 2022, lowered to €4.8 billion ex China; and, disposal of nonstrategic real estate assets for €500 million by 2020.