Source: Company reports/Coresight Research

1H18 Results

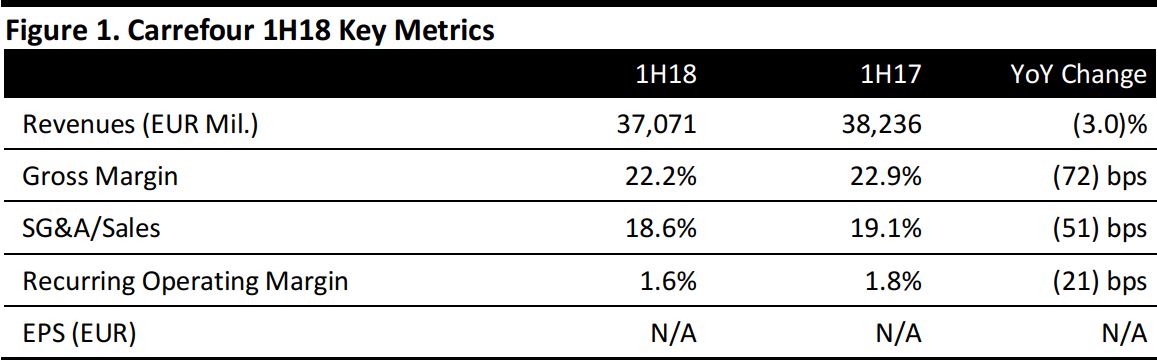

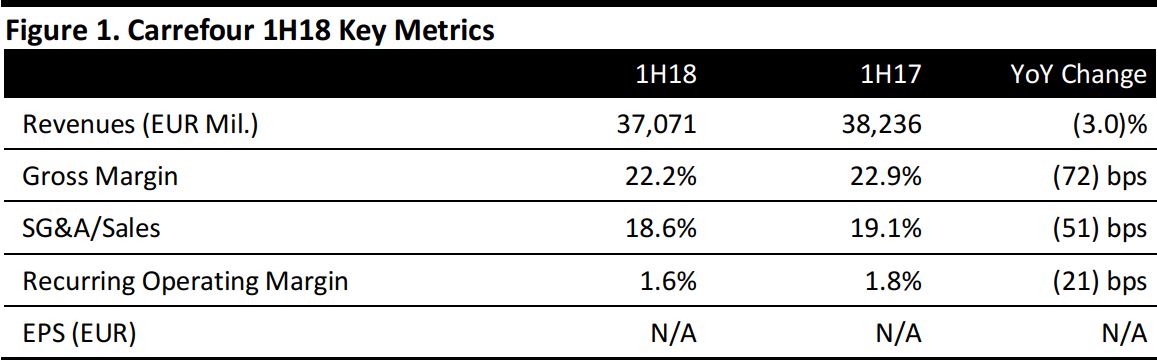

Carrefour reported a disappointing top-line performance in 1H18, although recurring operating income came in slightly ahead of expectations.

- Group net sales were €37.07 billion, down fully 3.0% as reported and down 2.1% at constant exchange rates. Analysts had expected the company to report a 0.7% rise in total revenues, to €38.8 billion.

- Recurring operating income of €597 million was down 14.1% year over year. Analysts had penciled in €545 million.

- Adjusted net income of €131 million was slightly below consensus expectations of €133.5 million.

Group comparable sales were up 0.7% in 1H18. Comparable sales were down 0.1% in France, down 2.5% in Southern Europe and up 0.2% in Northern Europe. Latin America comps came in at 6.4%, with underlying growth strengthening sequentially in the second quarter. Asia comps were down 3.9%.

Comps in France were down 1.6% in hypermarket formats, up 0.8% in supermarkets, and up 2.6% in convenience and other formats. French margins were pressured by the competitive market and “investments in competitiveness.”

Management noted an improvement in net debt and strong free cash flow. The company pointed to the signing of strategic partnerships with Système U, Tesco, Google and Tencent and to a “solid dynamic” in its cost-reduction program. Carrefour is implementing a multipronged turnaround strategy called

Carrefour 2022.

Outlook

The company provided no numerical guidance for FY18. Management stated that the company will “continue the cost-reduction momentum” in the second half and that it expects to begin its planned disposal of €500 million of nonstrategic real estate by 2020. Management reaffirmed the previously stated targets under the Carrefour 2022 plan.

For FY18, analysts expect Carrefour’s revenues to fall by 0.3%, to €78.7 billion, and for its EBIT to slide by 7.3%, yielding an EBIT margin of 2.4%. Consensus calls for the company to report a 5.3% fall in adjusted net income for FY18.