1H17 Results

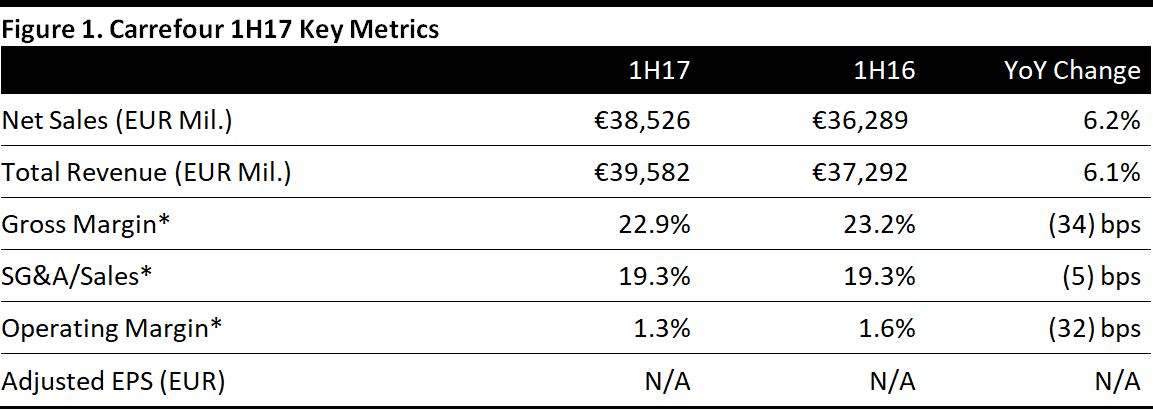

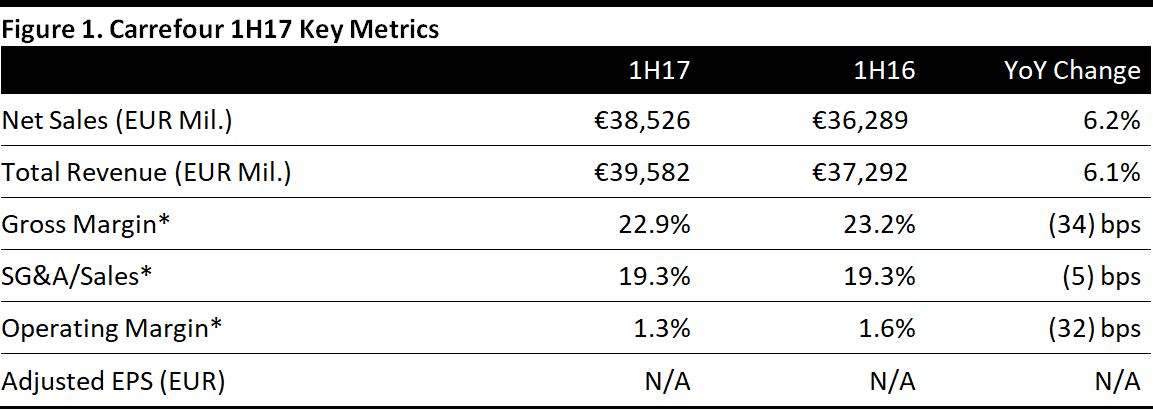

French retailer Carrefour reported 1H17 net sales growth of 6.2% (up by 3.2% at constant currency) to €38,526 million.

Excluding fuel and calendar effects, comps grew by 2.1% and organic growth (comparable sales growth plus net store openings over the last 12 months) was 2.6%. Carrefour said that “good” comparable sales performance and business expansion drove overall sales.

The gross margin diminished by 34 bps and SG&A expenses as a percentage of sales fell by 5 bps. The operating margin decreased by 32 bps, due to a fall in the operating margin in France, an increase in losses in Argentina and arrested profit growth in Europe ex-France.

Carrefour did not publish EPS figures for 1H17.

Performance by Geography

The below figures exclude fuel and calendar effects.

France: Comparable sales increased by 1.3% and organic growth was 0.1%.

Other European countries: Comparable sales in Europe ex-France grew by 2.2% and organic growth was 2.8%.

Latin America: Carrefour’s Latin America businesses performed best, as comps increased by 7.3% and organic growth was 11.3%.

Asia: Performance in Asia was less positive, as comps declined by 4.3% and organic growth was (2.9)%.

Outlook

For FY17, Carrefour warned that the results will be impacted by its performance in 1H17. It now expects to grow total sales by 2%–4% at constant currency, a downward revision from the 3%–5% range it had stated at the start of the fiscal year. The company expects capex to be between €2.2 billion and €2.3 billion (the initial forecast was €2.4 billion) and to maintain free cash flow at the same level as 2016.

For FY17, analysts expect:

- Net sales of €79,930 million, representing 4.3% growth.

- EBITDA of €3,968 million, representing 2.1% growth.

- Adjusted EPS of €1.43, representing 2.9% growth.

Note that the above consensus figures were collated before the 1H17 results.