Nitheesh NH

[caption id="attachment_89519" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

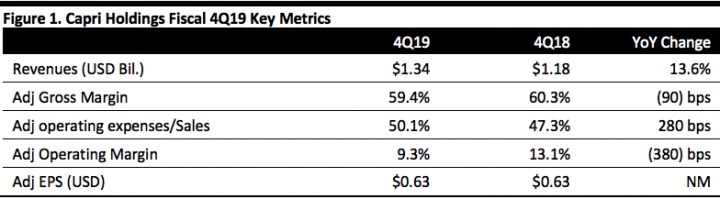

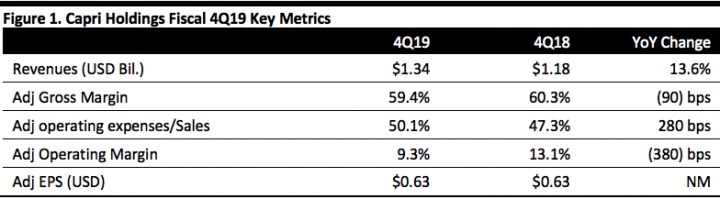

Capri Holdings reported fiscal 4Q19 adjusted EPS of $0.63, the same as the year-ago quarter and above the $0.56-0.61 estimate. Total revenues were $1.34 billion, a 13.6% increase on a reported basis and above the $1.33 billion estimate. On a constant-currency basis, total revenue increased 16.5%.

By brand, Michael Kors revenues were $1.07 billion, down 0.4%. Jimmy Choo revenues were $139 million, up 28.7%, driven by iconic footwear offerings. Versace revenues were $137 million (Versace was acquired December 31, 2018; on a stand-alone basis, Versace revenues increased by high-single digits).

Comparable store sales declined 1% in Michael Kors; increased mid-single digits at Jimmy Choo; and, grew at a high single digit pace at Versace, driven by strength in ready-to-wear and footwear.

Gross margin contracted 90 bps to 59.4%, reflecting an anticipated decline in Michael Kors brand gross margin compared to the prior year, partially offset by a benefit from the inclusion of Versace.

The company’s adjusted operating margin was 9.3%, compared to 13.1% last year, driven primarily by the Versace business, which reported an operating loss of $11 million.

Inventories increased $292 million, or 44.2%, to $953 million on a year-over-year basis.

Capri Holdings ended 4Q19 with 1,249 store locations, consisting of: 853 Michael Kors stores, 208 Jimmy Choo store locations and 188 Versace store locations.

At Jimmy Choo, footwear collections Bing and Lavish showed strong performance. In fashion active, the newly introduced Raine sneaker highlighted the spring campaign featuring Kaia Gerber, quickly became a bestseller. In accessories, the company introduced a new collection named Helia, and highlighted it in spring campaign as well.

Versace promoted brand awareness via the Kith and 2 Chainz collaborations with extensive social media coverage. The brand also held two runway shows during the quarter. The Helia bag and Raine sneaker launches were supported by broad marketing and social media campaigns featuring Kaia Gerber. Capri will accelerate Versace’s e-commerce and omnichannel development in 2019.

At Michael Kors, growth was seen in all categories including women’s ready to wear, menswear, sportswear, accessories and watch. The Michael Kors Signature styles continued to show strong demand and the company plans to grow Signature to approximately 30% of the retail fleet accessory sales by the end of 2019. Michael Kors was the most engaged brand during New York Fashion Week on social media, according to ListenFirst, a data and analytics company.

FY19 Results

For FY19, the company’s revenues increased 11% on a reported basis to $5.2 billion. By region, revenue in the Americas increased 5.5% on a reported basis to $3.2 billion; EMEA revenue increased 18.9% to $1.3 billion on a reported basis; Asia revenue was $800 million. Full year adjusted earnings per share of $4.97 increased 10.0% above prior year, including a $0.13 dilution from Versace.

By brand, Michael Kors revenues were $4.5 billion, up 0.3% year over year. Jimmy Choo revenues were $590 million, up 164.6%. Versace revenues were $137 million.

Outlook

The company provided the following guidance for FY20 and 1Q20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Capri Holdings reported fiscal 4Q19 adjusted EPS of $0.63, the same as the year-ago quarter and above the $0.56-0.61 estimate. Total revenues were $1.34 billion, a 13.6% increase on a reported basis and above the $1.33 billion estimate. On a constant-currency basis, total revenue increased 16.5%.

By brand, Michael Kors revenues were $1.07 billion, down 0.4%. Jimmy Choo revenues were $139 million, up 28.7%, driven by iconic footwear offerings. Versace revenues were $137 million (Versace was acquired December 31, 2018; on a stand-alone basis, Versace revenues increased by high-single digits).

Comparable store sales declined 1% in Michael Kors; increased mid-single digits at Jimmy Choo; and, grew at a high single digit pace at Versace, driven by strength in ready-to-wear and footwear.

Gross margin contracted 90 bps to 59.4%, reflecting an anticipated decline in Michael Kors brand gross margin compared to the prior year, partially offset by a benefit from the inclusion of Versace.

The company’s adjusted operating margin was 9.3%, compared to 13.1% last year, driven primarily by the Versace business, which reported an operating loss of $11 million.

Inventories increased $292 million, or 44.2%, to $953 million on a year-over-year basis.

Capri Holdings ended 4Q19 with 1,249 store locations, consisting of: 853 Michael Kors stores, 208 Jimmy Choo store locations and 188 Versace store locations.

At Jimmy Choo, footwear collections Bing and Lavish showed strong performance. In fashion active, the newly introduced Raine sneaker highlighted the spring campaign featuring Kaia Gerber, quickly became a bestseller. In accessories, the company introduced a new collection named Helia, and highlighted it in spring campaign as well.

Versace promoted brand awareness via the Kith and 2 Chainz collaborations with extensive social media coverage. The brand also held two runway shows during the quarter. The Helia bag and Raine sneaker launches were supported by broad marketing and social media campaigns featuring Kaia Gerber. Capri will accelerate Versace’s e-commerce and omnichannel development in 2019.

At Michael Kors, growth was seen in all categories including women’s ready to wear, menswear, sportswear, accessories and watch. The Michael Kors Signature styles continued to show strong demand and the company plans to grow Signature to approximately 30% of the retail fleet accessory sales by the end of 2019. Michael Kors was the most engaged brand during New York Fashion Week on social media, according to ListenFirst, a data and analytics company.

FY19 Results

For FY19, the company’s revenues increased 11% on a reported basis to $5.2 billion. By region, revenue in the Americas increased 5.5% on a reported basis to $3.2 billion; EMEA revenue increased 18.9% to $1.3 billion on a reported basis; Asia revenue was $800 million. Full year adjusted earnings per share of $4.97 increased 10.0% above prior year, including a $0.13 dilution from Versace.

By brand, Michael Kors revenues were $4.5 billion, up 0.3% year over year. Jimmy Choo revenues were $590 million, up 164.6%. Versace revenues were $137 million.

Outlook

The company provided the following guidance for FY20 and 1Q20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Capri Holdings reported fiscal 4Q19 adjusted EPS of $0.63, the same as the year-ago quarter and above the $0.56-0.61 estimate. Total revenues were $1.34 billion, a 13.6% increase on a reported basis and above the $1.33 billion estimate. On a constant-currency basis, total revenue increased 16.5%.

By brand, Michael Kors revenues were $1.07 billion, down 0.4%. Jimmy Choo revenues were $139 million, up 28.7%, driven by iconic footwear offerings. Versace revenues were $137 million (Versace was acquired December 31, 2018; on a stand-alone basis, Versace revenues increased by high-single digits).

Comparable store sales declined 1% in Michael Kors; increased mid-single digits at Jimmy Choo; and, grew at a high single digit pace at Versace, driven by strength in ready-to-wear and footwear.

Gross margin contracted 90 bps to 59.4%, reflecting an anticipated decline in Michael Kors brand gross margin compared to the prior year, partially offset by a benefit from the inclusion of Versace.

The company’s adjusted operating margin was 9.3%, compared to 13.1% last year, driven primarily by the Versace business, which reported an operating loss of $11 million.

Inventories increased $292 million, or 44.2%, to $953 million on a year-over-year basis.

Capri Holdings ended 4Q19 with 1,249 store locations, consisting of: 853 Michael Kors stores, 208 Jimmy Choo store locations and 188 Versace store locations.

At Jimmy Choo, footwear collections Bing and Lavish showed strong performance. In fashion active, the newly introduced Raine sneaker highlighted the spring campaign featuring Kaia Gerber, quickly became a bestseller. In accessories, the company introduced a new collection named Helia, and highlighted it in spring campaign as well.

Versace promoted brand awareness via the Kith and 2 Chainz collaborations with extensive social media coverage. The brand also held two runway shows during the quarter. The Helia bag and Raine sneaker launches were supported by broad marketing and social media campaigns featuring Kaia Gerber. Capri will accelerate Versace’s e-commerce and omnichannel development in 2019.

At Michael Kors, growth was seen in all categories including women’s ready to wear, menswear, sportswear, accessories and watch. The Michael Kors Signature styles continued to show strong demand and the company plans to grow Signature to approximately 30% of the retail fleet accessory sales by the end of 2019. Michael Kors was the most engaged brand during New York Fashion Week on social media, according to ListenFirst, a data and analytics company.

FY19 Results

For FY19, the company’s revenues increased 11% on a reported basis to $5.2 billion. By region, revenue in the Americas increased 5.5% on a reported basis to $3.2 billion; EMEA revenue increased 18.9% to $1.3 billion on a reported basis; Asia revenue was $800 million. Full year adjusted earnings per share of $4.97 increased 10.0% above prior year, including a $0.13 dilution from Versace.

By brand, Michael Kors revenues were $4.5 billion, up 0.3% year over year. Jimmy Choo revenues were $590 million, up 164.6%. Versace revenues were $137 million.

Outlook

The company provided the following guidance for FY20 and 1Q20:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Capri Holdings reported fiscal 4Q19 adjusted EPS of $0.63, the same as the year-ago quarter and above the $0.56-0.61 estimate. Total revenues were $1.34 billion, a 13.6% increase on a reported basis and above the $1.33 billion estimate. On a constant-currency basis, total revenue increased 16.5%.

By brand, Michael Kors revenues were $1.07 billion, down 0.4%. Jimmy Choo revenues were $139 million, up 28.7%, driven by iconic footwear offerings. Versace revenues were $137 million (Versace was acquired December 31, 2018; on a stand-alone basis, Versace revenues increased by high-single digits).

Comparable store sales declined 1% in Michael Kors; increased mid-single digits at Jimmy Choo; and, grew at a high single digit pace at Versace, driven by strength in ready-to-wear and footwear.

Gross margin contracted 90 bps to 59.4%, reflecting an anticipated decline in Michael Kors brand gross margin compared to the prior year, partially offset by a benefit from the inclusion of Versace.

The company’s adjusted operating margin was 9.3%, compared to 13.1% last year, driven primarily by the Versace business, which reported an operating loss of $11 million.

Inventories increased $292 million, or 44.2%, to $953 million on a year-over-year basis.

Capri Holdings ended 4Q19 with 1,249 store locations, consisting of: 853 Michael Kors stores, 208 Jimmy Choo store locations and 188 Versace store locations.

At Jimmy Choo, footwear collections Bing and Lavish showed strong performance. In fashion active, the newly introduced Raine sneaker highlighted the spring campaign featuring Kaia Gerber, quickly became a bestseller. In accessories, the company introduced a new collection named Helia, and highlighted it in spring campaign as well.

Versace promoted brand awareness via the Kith and 2 Chainz collaborations with extensive social media coverage. The brand also held two runway shows during the quarter. The Helia bag and Raine sneaker launches were supported by broad marketing and social media campaigns featuring Kaia Gerber. Capri will accelerate Versace’s e-commerce and omnichannel development in 2019.

At Michael Kors, growth was seen in all categories including women’s ready to wear, menswear, sportswear, accessories and watch. The Michael Kors Signature styles continued to show strong demand and the company plans to grow Signature to approximately 30% of the retail fleet accessory sales by the end of 2019. Michael Kors was the most engaged brand during New York Fashion Week on social media, according to ListenFirst, a data and analytics company.

FY19 Results

For FY19, the company’s revenues increased 11% on a reported basis to $5.2 billion. By region, revenue in the Americas increased 5.5% on a reported basis to $3.2 billion; EMEA revenue increased 18.9% to $1.3 billion on a reported basis; Asia revenue was $800 million. Full year adjusted earnings per share of $4.97 increased 10.0% above prior year, including a $0.13 dilution from Versace.

By brand, Michael Kors revenues were $4.5 billion, up 0.3% year over year. Jimmy Choo revenues were $590 million, up 164.6%. Versace revenues were $137 million.

Outlook

The company provided the following guidance for FY20 and 1Q20:

- For FY20, Capri provided guidance of total revenues of around $6 billion: around $4.45 billion for Michael Kors, slightly down from prior guidance due to unfavorable foreign currency impact and lower wholesale revenue; Jimmy Choo revenue of $650 million; and, around $900 million in revenue at Versace.

- Capri forecasts FY20 operating margin of around 15.5% based on expected operating margins of around 21.4% for Michael Kors, a slightly improved operating margin for Jimmy Choo and an operating margin of positive low single digits for Versace.

- For 1Q20, the company expects total revenue of about $1.36 billion. Some $200 million will come from Versace, with a mid-single digit growth in comparable store sales. For Jimmy Choo, revenue is expected to be approximately flat, including a comparable sales increase in the low single digits. Michael Kors is forecast to have lower revenue and negative low single digits growth in comps.

- 1Q20 operating margin is expected to be around 13%: The company predicts a negative operating margin for Versace, due to normal seasonality and increased investments to support growth initiatives; a positive operating margin for Jimmy Choo but below prior year primarily due to higher investments; and, a lower operating margin for Michael Kors due to reduction in wholesale and licensing revenue.

- 1Q20 EPS guidance for diluted EPS is $0.85 to $0.90, including approximately $0.15 per share of dilution from Versace.

- Longer term: Revenues are forecast to grow at a mid-single-digit rate in FY2021 and FY2022.