Nitheesh NH

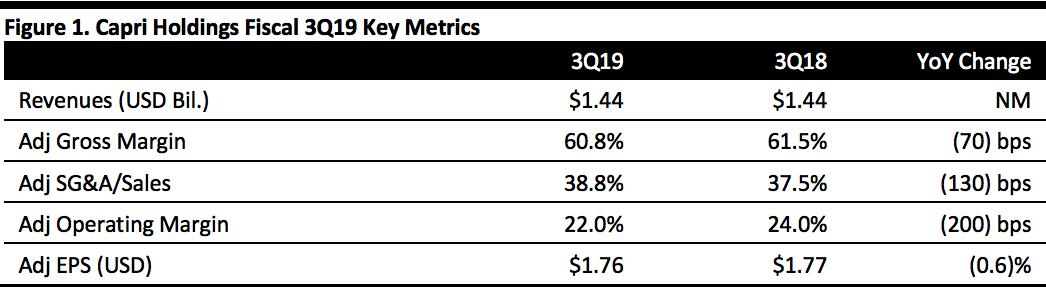

[caption id="attachment_71298" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Capri Holdings reported fiscal 3Q19 adjusted EPS of $1.76, versus $1.77 in the year-ago quarter and above the $1.58 consensus estimate. Total revenues were $1.44 billion, approximately flat year over year and below the $1.46 billion consensus estimate.

By brand, Michael Kors revenues were $1.28 billion, down 3.7% year over year, offset by a 40.9% increase in Jimmy Choo revenues to $162 million (Jimmy Choo was acquired November 1, 2017 and the 40.9% increase reflects an additional month in 2018; on a stand-alone basis, Jimmy Choo revenues increased mid-single digits.) MK Retail revenues declined 1% to $838 million. MK Wholesale declined 8.3% to $395 million and MK Licensing revenues declined 9.9% to $44 million.

Comparable store sales in MK accessories declined in the low single digits and in MK Footwear, comps rose double digits, reflecting a positive consumer response to the brand’s fashion active offerings. Jimmy Choo comps increased low single digits, driven by strength in footwear and partly offset by weaker handbag trends.

Gross margin contracted 70 bps to 60.8%, reflecting a 50 bp benefit from the inclusion of Jimmy Choo but offset by a 120 bp decline in Michael Kors brand gross margin. Additional markdowns during the holiday season drove a 280 bp decline in gross margin at MK Retail. MK Wholesale gross margins expanded 120 bps, mirroring higher gross margins in Europe.

Total company operating margin was 22%, down 200 bps from last year. Jimmy Choo's operating margin was 10.1%, versus 13.7% in the year ago period. Michael Kors' operating margin was 23.5%, a 140 bp decline, reflecting a 350 bp decline at MK Retail to 19.4%; a 320 bp increase in operating margin at MK Wholesale, to 28.2% and a 230 bp increase at MK Licensing, to 60.7%.

Inventories increased by $88 million, or 12.9%, to $765 million on a year-over-year basis. Inventories at Michael Kors rose 8.2% to $606 million and increased 35.3% at Jimmy Choo to $159 million.

Management noted the Michael Kors database has approximately 34 customers globally, a 27% year over year increase. THE KORSVIP , a 50% increase, and the brand enjoys a global social media audience of over 44 million followers.

Capri Holdings ended 3Q19 with 1,076 store locations; 870 Michael Kors stores, of which 401 are in the Americas, 198 in Europe and 271 in Asia; and, 206 Jimmy Choo store locations.

Outlook

The company updated guidance for FY19 to reflect the Versace acquisition.

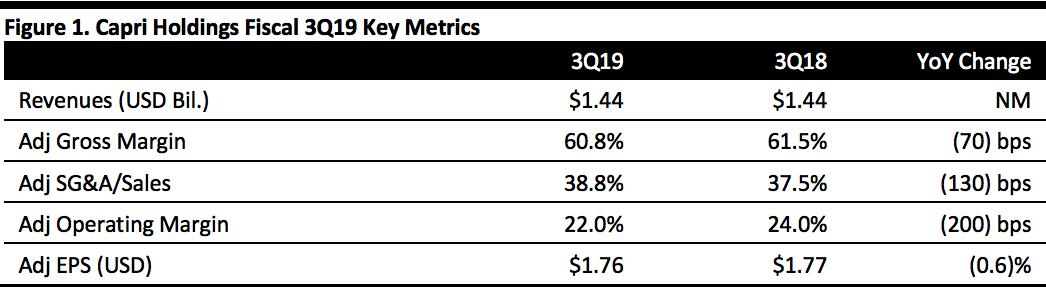

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Capri Holdings reported fiscal 3Q19 adjusted EPS of $1.76, versus $1.77 in the year-ago quarter and above the $1.58 consensus estimate. Total revenues were $1.44 billion, approximately flat year over year and below the $1.46 billion consensus estimate.

By brand, Michael Kors revenues were $1.28 billion, down 3.7% year over year, offset by a 40.9% increase in Jimmy Choo revenues to $162 million (Jimmy Choo was acquired November 1, 2017 and the 40.9% increase reflects an additional month in 2018; on a stand-alone basis, Jimmy Choo revenues increased mid-single digits.) MK Retail revenues declined 1% to $838 million. MK Wholesale declined 8.3% to $395 million and MK Licensing revenues declined 9.9% to $44 million.

Comparable store sales in MK accessories declined in the low single digits and in MK Footwear, comps rose double digits, reflecting a positive consumer response to the brand’s fashion active offerings. Jimmy Choo comps increased low single digits, driven by strength in footwear and partly offset by weaker handbag trends.

Gross margin contracted 70 bps to 60.8%, reflecting a 50 bp benefit from the inclusion of Jimmy Choo but offset by a 120 bp decline in Michael Kors brand gross margin. Additional markdowns during the holiday season drove a 280 bp decline in gross margin at MK Retail. MK Wholesale gross margins expanded 120 bps, mirroring higher gross margins in Europe.

Total company operating margin was 22%, down 200 bps from last year. Jimmy Choo's operating margin was 10.1%, versus 13.7% in the year ago period. Michael Kors' operating margin was 23.5%, a 140 bp decline, reflecting a 350 bp decline at MK Retail to 19.4%; a 320 bp increase in operating margin at MK Wholesale, to 28.2% and a 230 bp increase at MK Licensing, to 60.7%.

Inventories increased by $88 million, or 12.9%, to $765 million on a year-over-year basis. Inventories at Michael Kors rose 8.2% to $606 million and increased 35.3% at Jimmy Choo to $159 million.

Management noted the Michael Kors database has approximately 34 customers globally, a 27% year over year increase. THE KORSVIP , a 50% increase, and the brand enjoys a global social media audience of over 44 million followers.

Capri Holdings ended 3Q19 with 1,076 store locations; 870 Michael Kors stores, of which 401 are in the Americas, 198 in Europe and 271 in Asia; and, 206 Jimmy Choo store locations.

Outlook

The company updated guidance for FY19 to reflect the Versace acquisition.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Capri Holdings reported fiscal 3Q19 adjusted EPS of $1.76, versus $1.77 in the year-ago quarter and above the $1.58 consensus estimate. Total revenues were $1.44 billion, approximately flat year over year and below the $1.46 billion consensus estimate.

By brand, Michael Kors revenues were $1.28 billion, down 3.7% year over year, offset by a 40.9% increase in Jimmy Choo revenues to $162 million (Jimmy Choo was acquired November 1, 2017 and the 40.9% increase reflects an additional month in 2018; on a stand-alone basis, Jimmy Choo revenues increased mid-single digits.) MK Retail revenues declined 1% to $838 million. MK Wholesale declined 8.3% to $395 million and MK Licensing revenues declined 9.9% to $44 million.

Comparable store sales in MK accessories declined in the low single digits and in MK Footwear, comps rose double digits, reflecting a positive consumer response to the brand’s fashion active offerings. Jimmy Choo comps increased low single digits, driven by strength in footwear and partly offset by weaker handbag trends.

Gross margin contracted 70 bps to 60.8%, reflecting a 50 bp benefit from the inclusion of Jimmy Choo but offset by a 120 bp decline in Michael Kors brand gross margin. Additional markdowns during the holiday season drove a 280 bp decline in gross margin at MK Retail. MK Wholesale gross margins expanded 120 bps, mirroring higher gross margins in Europe.

Total company operating margin was 22%, down 200 bps from last year. Jimmy Choo's operating margin was 10.1%, versus 13.7% in the year ago period. Michael Kors' operating margin was 23.5%, a 140 bp decline, reflecting a 350 bp decline at MK Retail to 19.4%; a 320 bp increase in operating margin at MK Wholesale, to 28.2% and a 230 bp increase at MK Licensing, to 60.7%.

Inventories increased by $88 million, or 12.9%, to $765 million on a year-over-year basis. Inventories at Michael Kors rose 8.2% to $606 million and increased 35.3% at Jimmy Choo to $159 million.

Management noted the Michael Kors database has approximately 34 customers globally, a 27% year over year increase. THE KORSVIP , a 50% increase, and the brand enjoys a global social media audience of over 44 million followers.

Capri Holdings ended 3Q19 with 1,076 store locations; 870 Michael Kors stores, of which 401 are in the Americas, 198 in Europe and 271 in Asia; and, 206 Jimmy Choo store locations.

Outlook

The company updated guidance for FY19 to reflect the Versace acquisition.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Capri Holdings reported fiscal 3Q19 adjusted EPS of $1.76, versus $1.77 in the year-ago quarter and above the $1.58 consensus estimate. Total revenues were $1.44 billion, approximately flat year over year and below the $1.46 billion consensus estimate.

By brand, Michael Kors revenues were $1.28 billion, down 3.7% year over year, offset by a 40.9% increase in Jimmy Choo revenues to $162 million (Jimmy Choo was acquired November 1, 2017 and the 40.9% increase reflects an additional month in 2018; on a stand-alone basis, Jimmy Choo revenues increased mid-single digits.) MK Retail revenues declined 1% to $838 million. MK Wholesale declined 8.3% to $395 million and MK Licensing revenues declined 9.9% to $44 million.

Comparable store sales in MK accessories declined in the low single digits and in MK Footwear, comps rose double digits, reflecting a positive consumer response to the brand’s fashion active offerings. Jimmy Choo comps increased low single digits, driven by strength in footwear and partly offset by weaker handbag trends.

Gross margin contracted 70 bps to 60.8%, reflecting a 50 bp benefit from the inclusion of Jimmy Choo but offset by a 120 bp decline in Michael Kors brand gross margin. Additional markdowns during the holiday season drove a 280 bp decline in gross margin at MK Retail. MK Wholesale gross margins expanded 120 bps, mirroring higher gross margins in Europe.

Total company operating margin was 22%, down 200 bps from last year. Jimmy Choo's operating margin was 10.1%, versus 13.7% in the year ago period. Michael Kors' operating margin was 23.5%, a 140 bp decline, reflecting a 350 bp decline at MK Retail to 19.4%; a 320 bp increase in operating margin at MK Wholesale, to 28.2% and a 230 bp increase at MK Licensing, to 60.7%.

Inventories increased by $88 million, or 12.9%, to $765 million on a year-over-year basis. Inventories at Michael Kors rose 8.2% to $606 million and increased 35.3% at Jimmy Choo to $159 million.

Management noted the Michael Kors database has approximately 34 customers globally, a 27% year over year increase. THE KORSVIP , a 50% increase, and the brand enjoys a global social media audience of over 44 million followers.

Capri Holdings ended 3Q19 with 1,076 store locations; 870 Michael Kors stores, of which 401 are in the Americas, 198 in Europe and 271 in Asia; and, 206 Jimmy Choo store locations.

Outlook

The company updated guidance for FY19 to reflect the Versace acquisition.

- For FY19. Capri provided guidance of total revenues of around $5.22 billion; around $4.51 billion for Michael Kors with reported comparable sales down low single digits; Jimmy Choo revenue of $580 million; and, around $130 million in revenue at Versace (closed December 31, 2018).

- Capri forecasts FY19 operating margin of around 17.3%; a blend of operating margins of around 19.5% for Michael Kors; around 4.8% for Jimmy Choo, and a slightly negative operating margin for Versace.

- For 4Q19, the company expects total company revenue of about $1.33 billion; $1.07 billion at Michael Kors, including a low single-digit decline in reported comparable store sales. For Jimmy Choo, revenue of approximately $130 million, including a comparable sales increase in the low single digits on a reported basis (mid-single digits on a constant currency basis). Versace is forecast to add about $130 million in revenue.

- 4Q19 operating margin is expected to be around 10.3%; 13.6% at Michael Kors brand, reflecting a reduction in gross margin of approximately 100 bp versus prior year and timing of $20 million in expenses into 4Q from 3Q. Jimmy Choo is expected to incur an operating margin loss of around 4.5%, reflecting normal seasonality. Versace is expected to have a slightly negative operating margin.

- FY19 EPS guidance is in the range of $4.90 to $4.95, which includes $0.15 dilution from Versace and reflects a $0.05 increase to previous EPS guidance of $4.95 to $5.05 preacquisition, reflecting better-than-anticipated 3Q.

- 4Q19 EPS guidance is in the range of $0.56 to $0.61 and includes anticipated Versace dilution of approximately $0.15.

- Longer term: F2020 updated for Versace acquisition. Revenues of around $6.1 billion resulting from $4.55 billion at Michael Kors; $650 million at Jimmy Choo and $900 million at Versace. An adjusted operating margin of about 15.5% and adjusted EPS of around $4.95.