DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

1Q20 Results

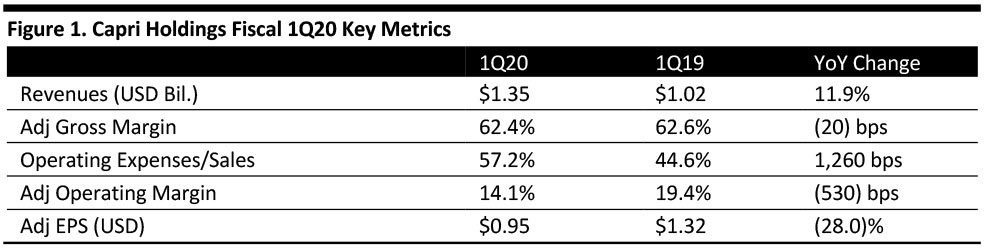

Capri Holdings reported fiscal 1Q20 adjusted EPS of $0.95, down 28.0% year over year and above the $0.90 estimate. Total revenues were $1.35 billion, an 11.9% increase on a reported basis and below the $1.37 billion estimate. On a constant-currency basis, total revenue increased 13.8%.

By brand, Michael Kors revenues were $981 million, down 4.8% (down 3.0% currency neutral) due to headwinds in watches. Jimmy Choo revenues were $158 million, down 8.7% (down 5.8% currency neutral), reflecting a negative foreign currency impact, lower wholesale shipments and flat comparable store sales driven by late active footwear deliveries. Versace (acquired on December 31, 2018) revenues were $207 million, driven by strong ready-to-wear and active footwear performance.

Comparable store sales declined low single digits in Michael Kors; were flat at Jimmy Choo; and, grew double digits compared to stand-alone results from the prior year at Versace.

By region, comparable sales expanded in Asia and Europe, offset by declines in the Americas. Global e-commerce drove comparable sales up 130 basis points.

Adjusted gross margin contracted 20 bps to 62.4%.

The company’s adjusted operating margin was 14.1%, compared to 19.4% last year, reflecting the addition of Versace and lower margins for other brands.

Inventories increased 45.8%, to $1.02 billion on a year-over-year basis.

Capri Holdings ended 1Q20 with 1,264 store locations, consisting of: 853 Michael Kors stores, 215 Jimmy Choo store locations and 196 Versace store locations, up from last quarter’s 1,249 store locations and 1,038 in the same period last year.

The company increased Versace stores by a net of eight over the prior quarter, including a new China World Beijing flagship, the largest Versace store in Asia. The company plans to accelerate retail expansion. In addition, Jimmy Choo launched its own brand website and opened a WeChat store in China.

The company authorized a new $500 million share repurchase program in August 2019.

Outlook

The company provided the following guidance for FY20 and 2Q20:

- FY20 total revenues of around $5.8 billion, reduced from previous guidance of $6 billion due to additional unfavorable foreign currency impact and lower Michael Kors revenue.

- FY20 operating margin of around 15.5%.

- EPS of $4.95, including around $0.20 per diluted share from Versace and recently announced tariff impact.

- 2Q20 total revenue of about $1.45 billion. Some $220 million will come from Versace, with a mid-single digit growth in comparable store sales. For Jimmy Choo, revenue is expected to be $125 million, including flat comparable sales. Michael Kors is forecast to have $1.1 billion revenue and flat comparable sales.

- 2Q20 operating margin of around 15%: The company predicts positive operating margin for Versace, due to normal seasonality and increased investments to support growth initiatives; a negative operating margin for Jimmy Choo, reflecting normal seasonality; and, a less than 180 bps decline in operating margin for Michael Kors.

- 2Q20 EPS guidance for diluted EPS is $$1.21-1.26, including approximately $0.05 per share of dilution from Versace.