albert Chan

Capri Holdings Limited

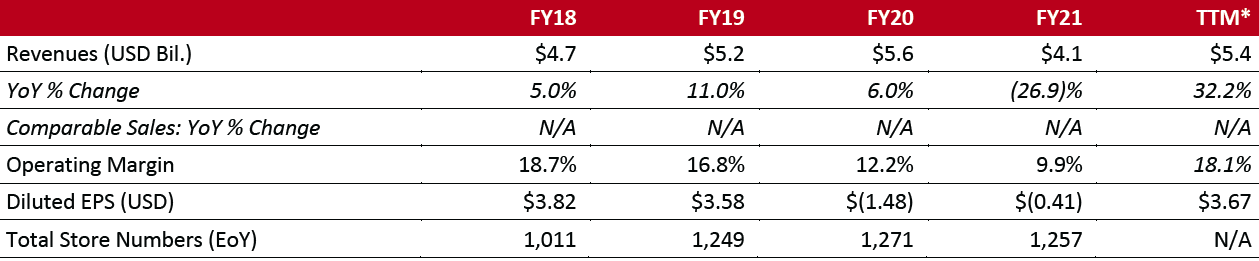

Sector: Luxury Countries of operation: Australia, Canada, China, France, Japan, Korea, the UK, the US and over 93 other countries Key product categories: Accessories, apparel, footwear and jewelry Annual Metrics [caption id="attachment_143943" align="aligncenter" width="700"] Last fiscal year ended March 27, 2021

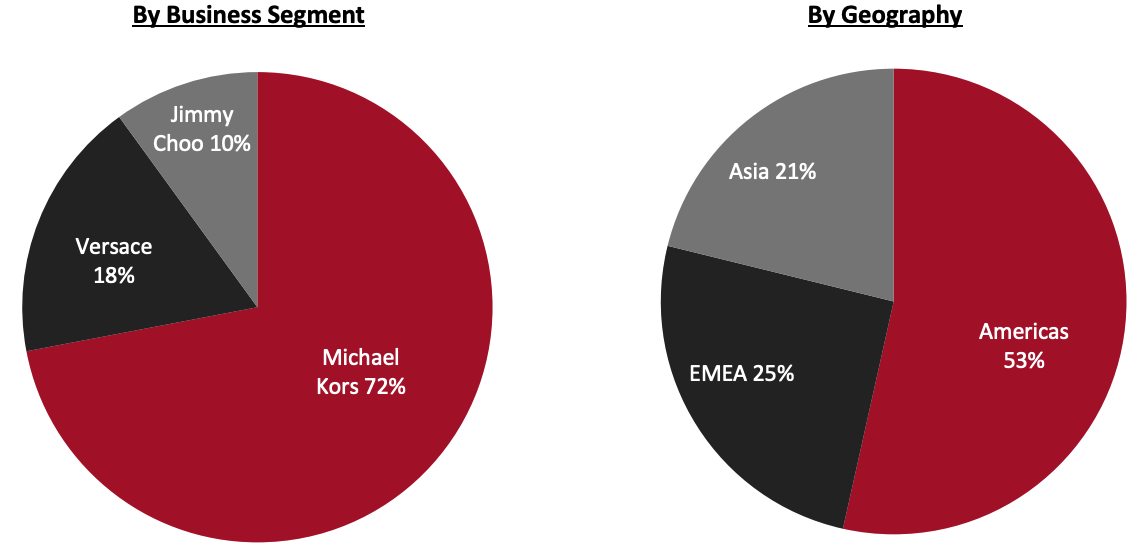

Last fiscal year ended March 27, 2021*Trailing 12 months ended December 25, 2021[/caption] Summary Headquartered in London and founded in 1981, Capri Holdings Limited is a global fashion luxury group that sells accessories, apparel and footwear. The company operates in more than 100 countries. Previously known as Michael Kors Holdings Limited, the company changed its name (and stock ticker) on January 2, 2019, following its acquisition of Italian luxury goods house Versace for $2.1 billion. Before the acquisition, the company operated four segments: MK Retail, MK Wholesale, MK Licensing and Jimmy Choo. The company acquired luxury brand Jimmy Choo in 2017—the brand’s core product offering is women’s footwear. Company Analysis Coresight Research insight: Capri has strategically grown and managed its assortment in recent years, via the acquisitions of Jimmy Choo and Versace and through pruning its less profitable categories in Michael Kors, to further focus on key areas—accessories and footwear. Historically, Capri relied on Michael Kors’ handbag market positioning; however, it lacks the strength that brands from competitor groups command, such as Coach from Tapestry. Although Capri’s acquisitions of Jimmy Choo and Versace have bolstered the company, their revenue shares pale in comparison to Michael Kors’, which accounted for 72% of group revenues in fiscal 2021 (ended March 27, 2021). It remains to be seen how Capri tides over existing supply chain challenges and inventory deficits caused by the pandemic—and whether it will command a stronger market position within the luxury segment.

| Tailwinds | Headwinds |

|

|

- Expand Jimmy Choo accessories mix from $90 million to $300 million—forming 30% of brand revenues.

- Expand the Michael Kors core Signature line from $1 billion to $2 billion, to contribute 50% of brand revenues.

- Expand Versace’s accessories business to $1 billion, from its current $200 million, to comprise 50% of brand revenue.

- Focus on core Jimmy Choo lines of JC Monogram, Crystal and Pearl, and its handbags Varenne, Madeleine and Bon Bon. Expand the brand’s product categories, such as in beauty, launch a ready-to-wear casual clothing capsule collection and introduce its first jewelry collection in 2022.

- Expand Michael Kors sports lifestyle brand MK Go and increase awareness of men’s lines with a focus on accessories.

- Focus on Versace’s iconic Virtus and La Medusa handbag lines and expand its sneaker and women’s footwear offering.

- Use global and local influencers, targeted social media campaigns and data analytics to drive customer traffic to its site and stores across all brands.

- Leverage the existing momentum in e-commerce to further grow its digital channels.

- Grow its store count for Jimmy Choo and Versace by 150 stores and trim its Michael Kors store count by 120 in the long term.

- Implement sustainability policies across its business—the company believes that “that sound environmental and social policies are both ethically correct and fiscally responsible.”

Company Developments

Company Developments

| Date | Development |

| November 23, 2021 | Acquires a 30% stake in Mexican cactus leather manufacturer Desserto for $6.2 million. |

| November 17, 2021 | Announces that Cedric Wilmotte has been appointed as Interim CEO of Versace, effective January 17, 2022. The company will continue to search for a permanent CEO. |

| October 20, 2021 | Announces that Jonathan Akeroyd will step down as Versace CEO on March 31, 2022. |

| September 30, 2021 | Announces that Versace has extended its license agreement with EuroItalia, a global fragrance and cosmetics company, for another 15 years. Additionally, Michael Kors and EuroItalia enter into a 15-year agreement to make EuroItalia the exclusive worldwide men’s and women’s fragrance licensee for the brand. |

| August 24, 2021 | Announces that Joshua Schulman has been appointed CEO of Michael Kors—he will become CEO of Capri Holdings in September 2022 and current CEO John Idol will become Executive Chairman. |

- John Idol—Chairman and CEO

- Thomas Edwards—CFO, COO and EVP

- Jenna Hendricks—Chief People Officer

- Krista McDonough—SVP, General Counsel and Chief Sustainability Officer

- Daniel Purefoy—SVP, Global Operations and Head of Diversity and Inclusion

- Joshua Schulman—CEO Michael Kors

Source: Company reports/S&P Capital IQ