Nitheesh NH

Introduction

On July 20, 2022, fashion luxury group Capri Holdings hosted its Investor Day in New York City, with presentations from seven senior executives:- Group: Chairman and CEO John Idol; CFO and COO Thomas Edwards

- Versace: CEO Cedric Wilmotte; Chief Brand Officer Jenny Phan

- Jimmy Choo: CEO Hannah Colman; Chief Client Officer Helene Phillips

- Michael Kors: Chief Brand Officer Francesca Leoni

Capri Holdings Investor Day 2022: Coresight Research Insights

At the outset, Idol highlighted that revenue for fiscal 2022 (FY22), ended April 2, 2022, exceeded pre-pandemic revenues, underscoring consumers’ strong desire for luxury. He laid out the company’s five strategic pillars, which create the foundation of its targets:- Maximize the full potential of its three brands: Versace, Jimmy Choo and Michael Kors

- Continue to develop innovative fashion products, led by designers and artistic directors Donatella Versace, Sandra Choi and Michael Kors

- Increase consumer desire and engagement with “exciting and impactful communication”

- Use omnichannel capabilities to drive revenue growth

- Build upon corporate values that drive environmental and social change, both internally and externally

Figure 1. Capri Holdings’ Revenue Metrics for FY20–FY22 and Revised Guidance for FY23 and Beyond [wpdatatable id=2149]

Source: Company reports

- By brand—The company is maintaining its future revenue target of $2 billion for Versace and $1 billion for Jimmy Choo, indicating annual double-digit growth for both brands. For Michael Kors, the company is focused on a long-term target of $5 billion, denoting mid- to high-single-digit annual revenue growth for the brand.

- By geography—Capri Holdings expects growth for all regions that it operates in; however, it is particularly excited by Asia in the long term, where it aims to grow penetration from 17% to 25% and add revenue of $1 billion. Capri Holdings has observed a faster-than-expected rebound in Europe, the Middle East and Africa (EMEA) and now anticipates continued growth driven by local consumers and international travelers. In EMEA, the group expects an incremental $400 million in revenue and penetration growth in the mid-20s in percentage terms. In the Americas, the company expects growth driven by e-commerce, leading to $550 million in revenue, with the region accounting for 50% of revenue in the long term.

- By channel—The company aims to have its retail business account for 76% of total revenue, up from the current 67%, with e-commerce forming an incremental $1 billion revenue opportunity.

- Brand heat—Maintain brand heat by capitalizing on current momentum and increasing consumer engagement

- Product desirability—Continue impactful product placement, making sure Versace products are “seen on fashion’s most influential people”

- Client acquisition—Keep building fast-growing consumer base, growing it to 20 million in the long term, by focusing on high-net-worth individuals, luxury clienteling, brand storytelling and loyalty-building

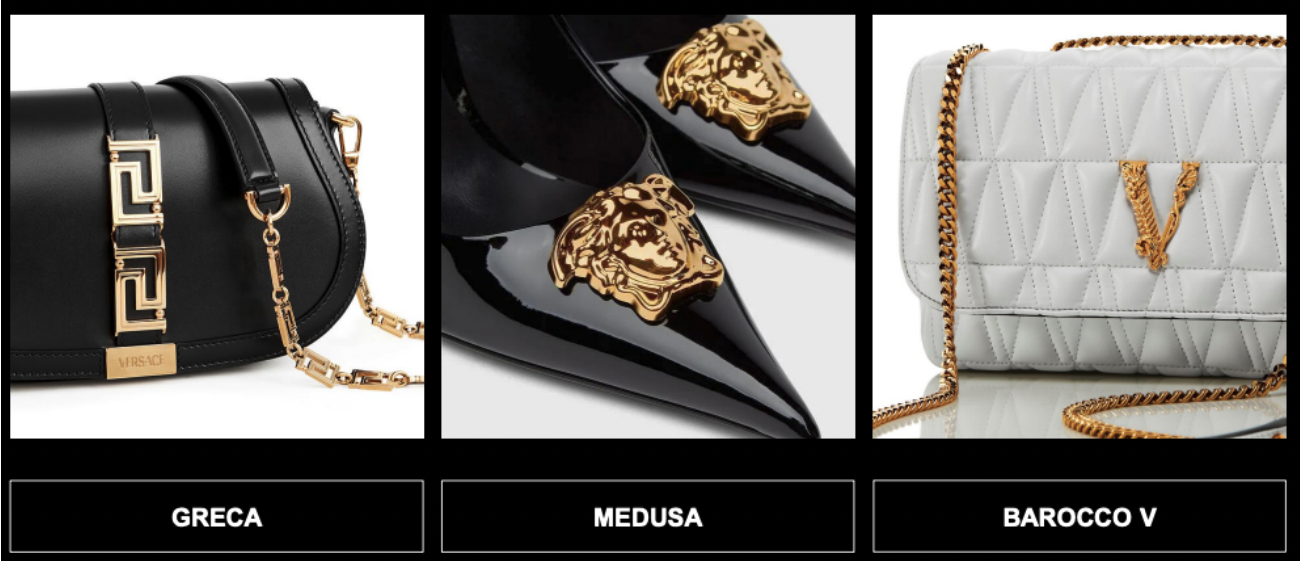

1. Reinforce iconic brand codes—Wilmotte stated that this pillar reinforces and amplifies the emblematic brand codes that Versace has developed, such as Barocco V, Greca and Medusa. Greca remains one of the newer codes, seen primarily in the women’s departments, while Medusa and Barocco V have expanded into other departments since their launch. Wilmotte explained that these codes define the design and merchandising of Versace’s products.

[caption id="attachment_152308" align="aligncenter" width="700"] Examples of Versace’s brand codes Greca, Medusa and Barocco V

Examples of Versace’s brand codes Greca, Medusa and Barocco VSource: Capri Holdings Investor Day 2022 presentation[/caption]

2. Grow accessories into a $1 billion business—The company plans to grow its accessories businesses by leveraging its authority in the luxury segment and expanding its assortment, starting with the upcoming launch of its Greca Goddess bag in August.

3. Increase footwear revenue to $300 million—Versace’s footwear business follows the same logic and consistency as the brand’s other products. Wilmotte stated that the Versace team has been “innovating while refreshing and reinforcing the iconic styles,” including developing the Odissea sneaker line. The brand will continue to capitalize on the success of its formal footwear segment while promoting the success of its sneaker lines, such as Odissea.

4. Expand men’s accessories—To drive success within this segment, Versace will leverage the success of its women’s business to drive desirability for men’s products.

Wilmotte also highlighted four of Versace’s new customer-experience initiatives, which will help the brand make headway toward its revenue targets:1. Create customer engagement—Versace aims to strengthen its customer experience with new technology, including launching a new clienteling application and a virtual assistant and rolling in-store order fulfillment out to more locations (it did not provide a timeline).

2. Focus on store traffic drivers—The brand plans to increase geo-marketing at key store locations to learn more about customers and deliver the right messages. It will also continue increasing in-store engagement with pop-ups and events in stores.

3. Leverage global retail locations—Versace aims to expand its retail network from 225 stores to 300 in the long term by leveraging global luxury retail locations and rolling out a new store concept, while renovating open stores. By 2025, the group expects to have fully renovated 90% of its total fleet.

4. Drive store productivity—The brand hopes to increase its store productivity from $1,000 per square foot to $2,000 per square foot via the above initiatives and increased in-store capacity. Jimmy Choo To Leverage Lifestyle Opportunities and Grow Consumer Base to 10 Million

At Jimmy Choo, Capri Holdings aims to grow its revenue to $1.0 billion in the long term, with the brand accounting for 12.5% of group revenue. Phillips highlighted that the brand’s vision, titled “A Time to Dare,” comprises three prongs:1. Consistent visual identity—All of the brand’s marketing campaigns will embrace its “DNA of glamor, daring and confidence” by combining storytelling with data analytics. How different brand ambassadors and marketing strategies exemplify the brand’s tagline of “glamor every day, anytime” will vary, she said.

2. Capitalize on brand heat—The brand has increased investment in regional marketing and built localized ambassador programs to drive local client focus moving forward.

3. Reach new audiences through influence—A majority of Jimmy Choo stores have a suite of clienteling tools, which prompts 25% higher average spending. The brand plans to continue to build on its brand loyalty and clienteling culture to expand its consumer base from 4.8 million (current) consumers to 10 million in the long term.

Colman laid out the brand product strategy, anchored by four pillars:1. Reinforce brand codes—Jimmy Choo plans to reinforce its codes, including Crystal, JC Monogram and Pearl, across various product categories

[caption id="attachment_152309" align="aligncenter" width="700"] Examples of Jimmy Choo’s brand codes JC Monogram, Crystal and Pearl

Examples of Jimmy Choo’s brand codes JC Monogram, Crystal and PearlSource: Capri Holdings Investor Day 2022 presentation[/caption]

2. Expand accessories—The brand aims to expand accessories to 30% of its mix by reinforcing brand codes, building on the success of key product families, such as the Varenne and BON BON lines, and consolidating its leadership in evening products.

3. Maximize casual opportunity—Jimmy Choo will attempt to double its casual footwear business; Colman remarked that the brand has a significant opportunity to grow its sneaker business to 25% of its footwear sales. Beyond sneakers, the brand also has the potential to scale its casual boot assortment.

4. Continue to build on lifestyle business—Colman stated the brand’s fragrance and eyewear licenses generate roughly $160 million annually. Meanwhile, it launched beauty and jewelry products in the last year, and both categories are performing beyond expectations.

Colman also discussed four of Jimmy Choo’s new customer experience initiatives:1. Leverage global luxury retail locations—Introduce new retail concept stores in selected cities and equip stores with clienteling tools, defined category zones and new visual merchandising

2. Drive store traffic—Employ 360-degree marketing campaigns, new clienteling tools, high-touch loyalty programs and a strong calendar of store events to bring customers into stores

3. Expand sales density—Grow sales density from $1,200 per square foot to $1,400 per square foot, driven by expansions to its accessories and footwear segments

4. Grow retail network—Increase its retail store network from 243 stores to 300, focusing on Asia, a high-growth opportunity, according to the company

Michael Kors’ Revenue To Grow to $5.0 Billion and Account for 62.5% of Group Business Capri Holdings plans to grow Michael Kors into a $5.0 billion business, with the brand accounting for 62.5% of group revenue in the long term. Leoni presented three pillars of the brand’s “Jet Set” vision:1. Engage and excite new and existing consumers—Michael Kors will seek to establish more strategic partnerships to reinforce the “Jet Set lifestyle.” For example, according to Leoni, the brand received tremendous engagement last year because it collaborated on the latest James Bond movie, No Time to Die.

2. Combine storytelling with data analytics—The brand plans to continue to use data to create targeted, personalized marketing and storytelling, which has helped turn occasional purchasers into regular customers. Since its launch in the US four years ago, the Kors VIP loyalty program has grown to 7.4 million members.

3. Accelerate database growth—Leoni explained that the brand has averaged over 20% annual compound growth for its consumer base since 2018, leading to its current 61 million consumer base. Now, it aims to expand its consumer base to 100 million.

Idol explained Michael Kors’ product strategy, which is based on four objectives:1. Reinforce brand codes—The brand plans to elevate its positioning by reinforcing its signature logo, MK Hardware and MKGO brand codes, reducing the overall number of SKUs by a significant amount (the company has already reduced SKUs by over 30%) and raising the prices and quality of its products. Idol pointed out that the brand achieved its goal of the signature logo accounting for 50% of its accessories business. Now, its goal is to expand MK Hardware’s positioning to account for 25% of its accessories business.

[caption id="attachment_152311" align="aligncenter" width="700"] Examples of Michael Kors’ brand codes signature logo, MK Hardware and MKGO

Examples of Michael Kors’ brand codes signature logo, MK Hardware and MKGOSource: Capri Holdings Investor Day 2022 presentation[/caption]

2. Grow accessories to a $3 billion business—The brand plans to increase its accessories revenue by generating excitement around new fashion platform launches, elevating its product assortment and raising prices.

3. Develop footwear into a $750 million business—Similarly to its accessories business plan, the brand hopes to create excitement with new product launches and brand elevation. The brand also plans to expand its existing retail stores, creating more luxurious environments, similar to those in Jimmy Choo stores.

4. Accelerate men’s department to a $500 million business—The brand plans to expand its men’s department both in-store and online, leading with accessories that show promising results.

Idol also outlined four of Michael Kors’ customer-experience initiatives:1. Expand store fleet—Michael Kors currently has 825 stores globally, with plans to increase this to 845 in FY23. However, in the long term, it actually aims to reduce its global store count to 800. Idol remarked that most of the upcoming openings will take place in Asia, where the brand hopes to expand its footprint from 315 stores to 375. The company plans to keep the store count stable in EMEA and the Americas, although the North American fleet may see some optimization.

2. Focus on global luxury retail locations—The brand is also focused on opening global flagship stores and debuting a new store concept, with current spaces reconfigured to support growth categories, at 100 key locations globally.

3. Drive store traffic—Michael Kors hopes to drive in-store traffic with targeted digital marketing campaigns, exciting window presentations, new clienteling services and in-store events.

4. Increase store density—The brand plans to increase its store density from the current $800 per square foot to $1,200 per square foot.