albert Chan

What’s the Story?

On June 29, 2021, global fashion luxury group Capri Holdings hosted its virtual Investor Day. Three of the company’s leaders presented at the event: Chairman and CEO John Idol; EVP, CFO and COO Thomas Edwards; Versace CEO Jonathan Akeroyd; and Jimmy Choo CEO Hannah Colman. Donatella Versace, Artistic Director for Versace, and Sandra Choi, Creative Director for Jimmy Choo, also spoke briefly at the event about the brands’ upcoming collections.

We present key insights from the Investor Day in this report, covering Capri Holdings’ five strategic pillars, its financial outlook and primary initiatives by brand—across Jimmy Choo, Michael Kors and Versace.

Capri Holdings Investor Day 2021: Key Insights

Five Strategic Pillars

There are five strategic pillars at the heart of the goals and initiatives for each Capri Holdings brand:

- Maximize the full potential of the three fashion luxury houses: Jimmy Choo, Michael Kors and Versace. Idol said, “While each brand is unique, with its own heritage, they all have consistent philosophies on fashion leadership and luxury.”

- Develop innovative fashion luxury products led by the concepts of designers and artistic directors Sandra Choi, Michael Kors and Donatella Versace.

- Create arresting marketing communications to increase consumer engagement.

- Utilize omnichannel capabilities to drive revenue growth.

- Build upon corporate values that drive environmental and social change, both internally and externally.

Raised Guidance for FY22, Prompted by Greater Clarity and Global Sales Momentum

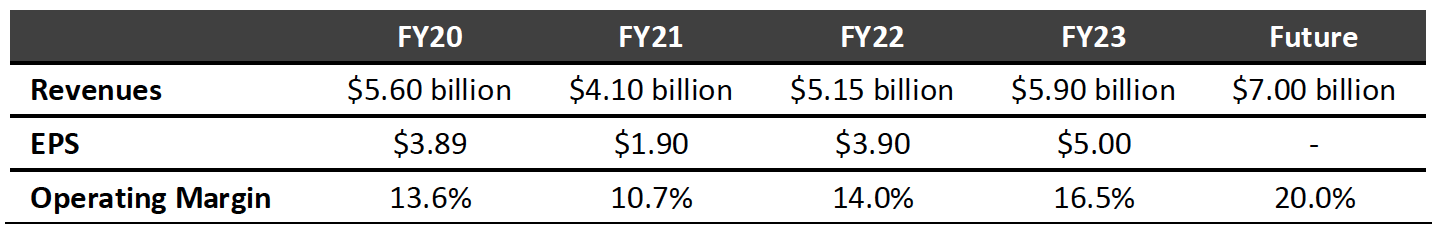

Edwards said that the company now has greater clarity around global reopenings and momentum behind its strategic pillars, which has prompted a raise in guidance and a more specific longer-term outlook.

In fiscal 2022 (FY22), ending April 2, 2022, Capri Holdings expects revenues to grow by about 27% year over year, to $5.15 billion, versus the previous guidance of $5.10 billion. The company also expects EPS (earnings per share) to reach $3.80–$3.90, versus the previously announced $3.70–$3.80.

Capri Holdings forecasts steady operating-margin expansion in the medium and long term, reflecting stronger gross margins and sales leverage on its fixed costs and store base.

Figure 1. Capri Holdings’ Revenue Metrics for FY20 and FY21, Plus Revised Guidance for FY22, FY23 and Beyond [caption id="attachment_129489" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

By brand:

- The company expects Jimmy Choo and Versace to post strong growth and eventually comprise about 40% of total revenue, prompted by robust e-commerce growth, a growing retail store fleet and increased retail store sales densities.

- Capri Holdings expects Michael Kors’ revenues to hit $4 billion in FY23—ahead of initial forecasts. Management stated that the revenue level aligns with its strategic direction for Michael Kors, to deliver greater margins on a smaller business. Beyond FY23, the company anticipates mid-single-digit revenue growth for the brand while maintaining a 25% margin target.

By region:

- Capri Holdings envisages Asia to be its fastest growing region across all brands, with the region contributing nearly $1 billion in revenues. The company expects revenue contribution from the region to grow from the current 21% to about 30% in the longer term.

- In EMEA (Europe, the Middle East and Africa), the company expects “solid” revenue growth but expects share of total revenues to remain at a consistent 25%.

- In the Americas, Capri Holdings forecasts revenue growth from FY21 levels but expects the region to contribute a lower share to total revenues, declining from the current 54% to 47%.

By channel, the company plans to maintain its licensing revenues at a constant 4% while reducing its wholesale revenues—from 25% of the total to about 22% in the long term—and growing its retail revenues to 74% of the total.

Capri Holdings announced plans to invest approximately $200 million per year on capital expenditures, of which 60% will be on new stores and renovations and 25% will be on building digital analytics capabilities and enhancing omnichannel technologies. The rest will be spent on developing the company’s corporate IT platforms.

Capri Holdings’ near-term capital-allocation priorities include investing in business and reducing its net debt to $300 million by FY23, from $1.1 billion in FY21. Its longer-term capital-allocation priorities include returning cash to shareholders and exploring acquisitions in luxury.

Primary Initiatives, by Brand

At the Investor Day, Capri Holdings outlined the growth goals for its three fashion houses under four categories: communication, product, omnichannel and regional. Colman discussed the goals for Jimmy Choo, Idol for Michael Kors and Akeroyd for Versace.

Jimmy Choo: Expand Accessories Range and Capitalize on Casual Fashion Trends

- Communication: Capri Holdings plans to double its existing customer database to 7.5 million in the long term using global influencers and targeted social media campaigns, such as #IDoInChoo, which combines data analytics and storytelling to drive engagement in the bridal sector.

- Product: The company intends to expand its Jimmy Choo accessories mix from $90 million to $300 million—forming 30% of brand revenues—by capitalizing on its core lines of JC Monogram, Crystal and Pearl, and its hero handbag families of Varenne, Madeleine and Bon Bon. Jimmy Choo plans to expand its product categories through various initiatives: offering more products in beauty, a category it first entered in 2020; launching a ready-to-wear casual clothing capsule collection; and introducing its first jewelry collection in 2022.

- Omnichannel: The company plans to triple its Jimmy Choo e-commerce revenues from $60 million in FY21 to $200 million in the long term by growing its customer database and redesigning its digital touchpoints for enhanced customer experiences and localization. Capri Holdings plans to grow its Jimmy Choo store count from 227 to 300 and grow sales density by 25% to $1,500 per square foot in the long term.

- Regional: Asia continues to drive growth for the brand and contributes about 40% of brand revenues. Jimmy Choo plans to expand its store network in China and South Korea, and use its local ambassador program in the region to drive sales to $400 million from the current $170 million. In EMEA, the company plans to increase its Jimmy Choo travel retail stores and grow its e-commerce business. In the Americas, the brand plans to expand its store fleet and digital business, using aggressive marketing communications to grow its customer database.

Michael Kors: Grow Signature Line to 50% of Business and Optimize Brand Store Fleet

- Communication: In the last year, Michael Kors’ global customer database grew by 18% to 50 million; the brand plans to grow this to 75 million “in the near future,” with targeted social media campaigns and data analytics to drive customer traffic to its site and stores.

- Product: Michael Kors intends to expand its core Signature line from $1 billion to $2 billion in the long term, to contribute 50% of brand revenues and deliver higher operating margins. It also plans to expand its sports lifestyle brand MK Go, introduced in 2019, to a $500 million business, using marketing strategies to drive online and in-store sales. Likewise, the brand intends to increase awareness of its men’s category to drive sales to $500 million, led by accessories.

- Omnichannel: Capri Holdings plans to grow its Michael Kors e-commerce business to over $1 billion by growing its global customer database, increasing consumer engagement and expanding its lifestyle categories, as outlined above. The company plans to close underperforming stores in North America and open stores in Asia, where sales densities are higher, to grow sales densities from $900 per square foot to $1,200 per square foot. It plans to close approximately 40 stores by the start of FY23 and reduce the total store count from 820 to around 700 in the long term.

- Regional: In Asia, the company plans to double brand revenues from $450 million to $1 billion in the long term, using localized communication strategies, accelerated store openings in China and a focus on e-commerce. In EMEA, the company expects to resume revenue growth driven by e-commerce and a gradual increase in store traffic as tourism returns to the region. In the Americas the company expects the Michael Kors brand to resume revenue growth, fueled by e-commerce and better sales density, with a shrinking store fleet over time. Capri Holdings expects its Michael Kors business in Asia to grow the quickest, to about 23% of revenues from 15%, while brand revenues in the Americas decline from 64% to 57% in the long term.

Versace: Expand Accessories Range and Grow E-Commerce and Store Footprint

- Communication: Capri Holdings saw strong sales in accessories by using seeding strategies with celebrities and PR strategies using global and local influencers showcasing Versace products. Versace plans to continue similar engagement strategies to grow its global customer base to 10 million in the long term, from 3 million in 2021.

- Product: The company plans to grow Versace’s accessories business to $1 billion in the long term, from the current $200 million, to comprise 50% of brand revenue, by focusing on its iconic Virtus and La Medusa handbag lines. The brand expects to double its current footwear business by expanding its sneaker and women’s footwear offering.

- Omnichannel: Versace plans to use its existing momentum to grow its e-commerce channel into a $500 million business, and increase its global store fleet to 300 from the current 210. It has remodeled about 40% of its fleet to a new format and expects to increase sales density from the current $1,400 per square foot to $3,000 per square foot.

- Regional: In Asia, the company plans to increase its Versace travel retail store count, refurbish existing stores and invest in localized marketing to drive revenue growth. In the Americas and EMEA, Versace plans to increase concessions at department stores and grow its digital commerce capabilities.