DIpil Das

Coresight Research attended Capri Holdings’ 2019 investor day on June 4, 2019, in New York City. The event featured showroom tours at Jimmy Choo and Michael Kors, a store tour at Versace and presentations from Capri’s management team.

These are some of the highlights:

John Idol, Chairman and CEO

Idol kicked off the presentation with a discussion of Capri’s strategic focus on Versace, Jimmy Choo and Michael Kors and the strength of these brands. He cited several characteristics of each brand including Versace’s rock and roll spirit, Jimmy Choo’s instinctively seductive style and Michael Kors’s vitality. Idol also outlined the following goals:

Source: Company reports[/caption]

Thomas Edwards, CFO and COO

Edwards provided a deeper discussion on the company’s future development:

Source: Company reports[/caption]

Thomas Edwards, CFO and COO

Edwards provided a deeper discussion on the company’s future development:

Source: Company reports[/caption]

2. Brand awareness & engagement

Source: Company reports[/caption]

2. Brand awareness & engagement

Pierre Denis introduces bag collections in the showroom tour

Pierre Denis introduces bag collections in the showroom tour

Source: Coresight Research [/caption] 2. Brand awareness and engagement The company has already sold 800 Choo Diamond sneakers – at a retail price tag of $1,100

The company has already sold 800 Choo Diamond sneakers – at a retail price tag of $1,100

Source: Jimmy Choo [/caption] John Idol, Chairman and CEO Idol finished up the day discussing Michael Kors’ growth and future plans: 1. Michael Kors brand Michael Kors Manhattan small contrast-trim leather crossbody bag is highly popular

Michael Kors Manhattan small contrast-trim leather crossbody bag is highly popular

Source: Cools.com [/caption] 2. Brand awareness & engagement

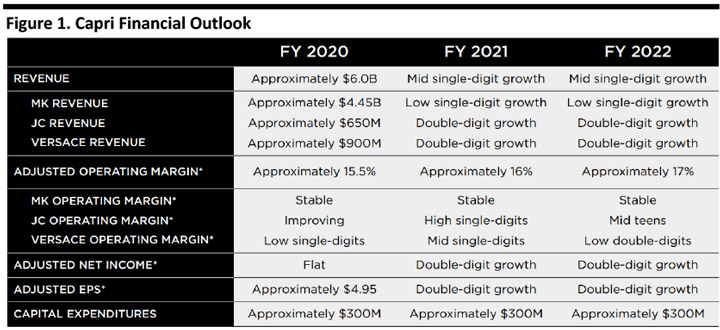

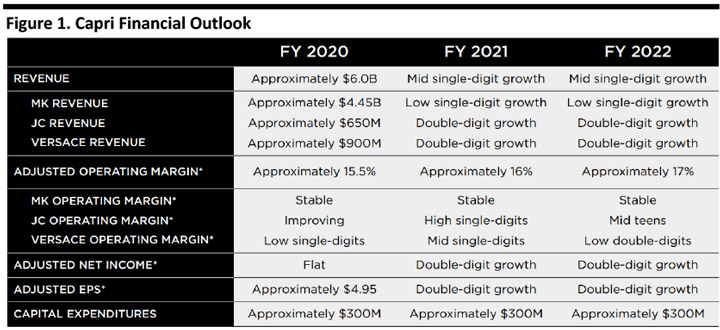

- The company hopes to achieve $6 billion in sales in FY20, a 15.4% increase compared to FY19.

- By geography, management projects sales in the Americas will account for 56% of total company sales in FY20, exceed 25% in EMEA and 19% in Asia. The store count for Capri is 1,249 as of June 2019.

- The company has set an $8 billion sales goal for FY20, with $5 billion targeted to come from Michael Kors, $2 billion from Versace and $1 billion form Jimmy Choo.

- By product mix, the company expects approximately 51% of total sales to come from accessories, 18% from footwear, 13% men’s, 11% ready-to-wear and 7% licensed products/others in FY20. Management believes footwear is one of the fastest-growing categories in luxury.

- Idol quoted from a Bain & Company report that the CAGR for the global luxury market from 2018 through 2025 will be approximately 4%, and he believes Capri will grow faster than this, with the accessories category growing in particular.

- The company predicts a 15.5% operating margin in FY20, compared to 17.0% in FY19. The expected EPS in FY20 is $4.95, versus $4.97 in FY19.

Source: Company reports[/caption]

Thomas Edwards, CFO and COO

Edwards provided a deeper discussion on the company’s future development:

Source: Company reports[/caption]

Thomas Edwards, CFO and COO

Edwards provided a deeper discussion on the company’s future development:

- Grow revenue at a double-digit rate: But management expects approximately flat earnings, reflecting anticipated dilution from the Versace acquisition.

- Michael Kors is expected to achieve $4.45 billion revenue with stable operating margin in FY20. For Jimmy Choo and Versace, management expect double-digit revenue growth in the long term.

- The company is creating synergy opportunities and actively developing plans to realize savings in the following areas: design and prototyping; raw materials procurement; indirect materials procurement; manufacturing synergies; and, sourcing optimization.

- The company is transforming warehousing and logistics, IT (ongoing progress in building a global ERP platform), and back office shared services.

- Capri will invest approximately $300 million annually over the next several years, with 61% going to stores/shops. The company expects to grow the number of stores from 200 to 300 for both Versace and Jimmy Choo, while also investing in e-commerce and other revenue-generating capabilities.

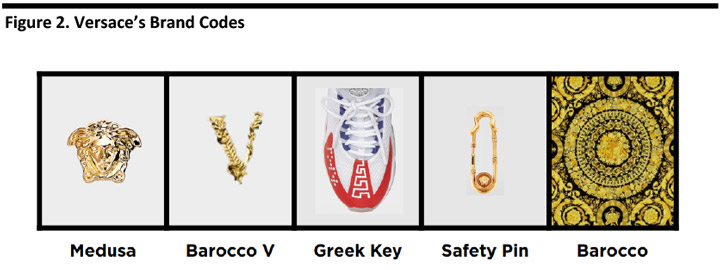

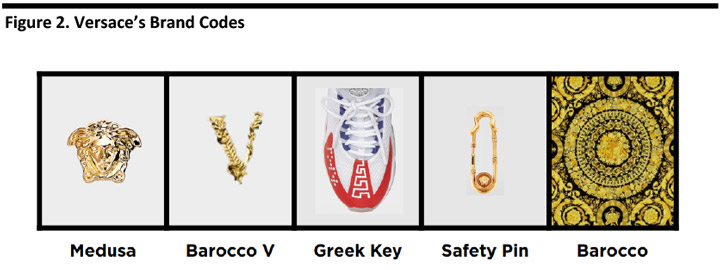

- Versace is leveraging the fashion house’s codes: signature hardware, prints, materials and aesthetic tropes.

Source: Company reports[/caption]

2. Brand awareness & engagement

Source: Company reports[/caption]

2. Brand awareness & engagement

- The company is using a 360° marketing approach to better convert buying touchpoints and improve marketing efficiency.

- Versace has 17.5 million followers on Instagram, 5.3 million followers on Facebook and 4.6 million followers on Twitter. The total number of followers globally has grown 28% YoY from 2018 to 2019.

- The brand is expected to increase the number of retail stores to 300 from 188 and accelerate e-commerce and omni-channel development.

- For women’s ready-to-wear, Versace will leverage red carpet expertise to add more glamor elements. For men’s ready-to-wear, the company will continue to capitalize on menswear market share and relaunch the underwear business. The company wants to expand men’s and women’s accessories and footwear from 35% to 60% of revenues, and leverage key house codes in footwear. For licensed products, Versace aims to keep fragrances and eyewear as powerful revenues drivers.

- Versace is significantly improving store productivity through store renovations, accessories expansion and focused merchandising.

- Denis shared Sandra Choi’s design vision and collections, which mainly center around being sexy and glamour.

Pierre Denis introduces bag collections in the showroom tour

Pierre Denis introduces bag collections in the showroom tour Source: Coresight Research [/caption] 2. Brand awareness and engagement

- Jimmy Choo has 10.3 million followers on Instagram, 3.6 million followers on Facebook, 1.5 million followers on Twitter and 43,000 followers on LINE. The brand also has a strong presence in China, with 473,000 followers on Weibo and 192,000 followers on WeChat. The total number of followers globally has grown 13% YoY from 2018 to 2019.

- Jimmy Choo launched e-commerce on LINE.com in March, and a China e-commerce platform in May 2019, and plans to grow omni-channel platforms globally.

- For footwear, Jimmy Choo will continue expanding its sneaker business with a goal of having it account for 20% of the whole footwear business. For accessories, the brand will launch a new logo and expand the breadth of offering. For its men’s line, the brand will grow the bag line and expand its sneaker offering.

- The brand is expected to increase the number of retail stores to 300 from 208

The company has already sold 800 Choo Diamond sneakers – at a retail price tag of $1,100

The company has already sold 800 Choo Diamond sneakers – at a retail price tag of $1,100 Source: Jimmy Choo [/caption] John Idol, Chairman and CEO Idol finished up the day discussing Michael Kors’ growth and future plans: 1. Michael Kors brand

- Michael Kors’s new jet set encompasses a generation of women and men who travel the world, showing speed, energy and optimism.

Michael Kors Manhattan small contrast-trim leather crossbody bag is highly popular

Michael Kors Manhattan small contrast-trim leather crossbody bag is highly popular Source: Cools.com [/caption] 2. Brand awareness & engagement

- Michael Kors has 45 million engaged fans on more than 12 social media globally. The brand has 669,000 followers on Weibo and 1.5 million followers on WeChat. The total number of followers globally has grown 45% YoY from 2016 to 2019.

- The key growth initiative for Michael Kors will be in Asia: E-commerce is growing in both China and Japan.

- Michael Kors expects to grow its business in Asia to $1 billion in revenue and expand the number of stores to about 450 globally.

- The brand is accelerating its accessories and menswear business with iconic and functional products