Nitheesh NH

[caption id="attachment_90206" align="aligncenter" width="720"] Source: Company reports/Coresight Research.[/caption]

4Q19 Results

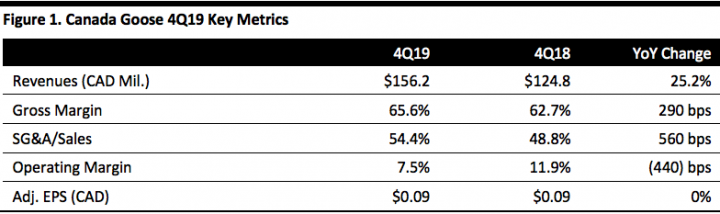

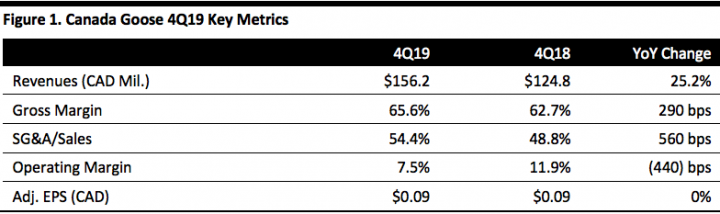

Canada Goose reported adjusted EPS of C$0.09, in line with last year, beating the consensus estimate of C$0.05. Total revenues for the quarter were up 25.2% to C$156.2 million, a 23.2% increase at constant exchange rates, missing the consensus estimate of C$157.5 million.

Wholesale revenue increased 12.7% (9.7% currency-neutral) to C$33.8 million, driven by strong demand from partners, incremental revenues from Baffin and a positive foreign exchange impact. Direct-to-consumer (DTC) revenues were up 29.1% (27.5% currency neutral) to C$94.8 million.

By region, Canada represented 35.3% of total sales, with revenue growth of 28.2%. Sales in the US represented roughly 30% of total sales, with revenues growing 36.3%. The rest of the world, including Europe and Asia, represented about 35% of total sales with revenue growth of 60.5%.

Gross margin expanded 290 bps to 65.6%. Gross profit increased to C$102.4 million from C$78.2 million. For fiscal 2019, gross margin expanded to 62.2% from 58.8% last year, driven by higher proportion of DTC revenue.

The operating margin contracted 440 bps to 7.5%, driven by investments to support growth as well as incremental fees to operating partners in Greater China.

At the end of March 2019, the company recorded C$267.3 million in inventory, up 62% year over year. Canada Goose experienced significantly longer lead times for getting products into Europe and Greater China, particularly PRC, than for North America. The company expects to build up inventory before the peak season.

Canada Goose opened two manufacturing facilities during fiscal 2019, one in Winnipeg and one in Montreal, and acquired winter-boot firm Baffin. Currently the company has eight in-house facilities manufacturing 47% of total down-filled jacket volume, up from 43% in fiscal 2018.

The company has 11 directly operated stores and will have eight new retail stores in operation for the winter selling season. In addition, Canada Goose will open a new digital concept store to drive local online sales in the greater Toronto area. The store will serve as an experiential showroom, instead of a traditional retail store.

Last year, the company launched two retail stores and a Tmall store in Greater China and will continue to expand in the region. Previously the company announced a plan to open six stores in Greater China; it will add three further retail stores there in the upcoming year.

Outlook

The company gave the following guidance for fiscal 2020:

Source: Company reports/Coresight Research.[/caption]

4Q19 Results

Canada Goose reported adjusted EPS of C$0.09, in line with last year, beating the consensus estimate of C$0.05. Total revenues for the quarter were up 25.2% to C$156.2 million, a 23.2% increase at constant exchange rates, missing the consensus estimate of C$157.5 million.

Wholesale revenue increased 12.7% (9.7% currency-neutral) to C$33.8 million, driven by strong demand from partners, incremental revenues from Baffin and a positive foreign exchange impact. Direct-to-consumer (DTC) revenues were up 29.1% (27.5% currency neutral) to C$94.8 million.

By region, Canada represented 35.3% of total sales, with revenue growth of 28.2%. Sales in the US represented roughly 30% of total sales, with revenues growing 36.3%. The rest of the world, including Europe and Asia, represented about 35% of total sales with revenue growth of 60.5%.

Gross margin expanded 290 bps to 65.6%. Gross profit increased to C$102.4 million from C$78.2 million. For fiscal 2019, gross margin expanded to 62.2% from 58.8% last year, driven by higher proportion of DTC revenue.

The operating margin contracted 440 bps to 7.5%, driven by investments to support growth as well as incremental fees to operating partners in Greater China.

At the end of March 2019, the company recorded C$267.3 million in inventory, up 62% year over year. Canada Goose experienced significantly longer lead times for getting products into Europe and Greater China, particularly PRC, than for North America. The company expects to build up inventory before the peak season.

Canada Goose opened two manufacturing facilities during fiscal 2019, one in Winnipeg and one in Montreal, and acquired winter-boot firm Baffin. Currently the company has eight in-house facilities manufacturing 47% of total down-filled jacket volume, up from 43% in fiscal 2018.

The company has 11 directly operated stores and will have eight new retail stores in operation for the winter selling season. In addition, Canada Goose will open a new digital concept store to drive local online sales in the greater Toronto area. The store will serve as an experiential showroom, instead of a traditional retail store.

Last year, the company launched two retail stores and a Tmall store in Greater China and will continue to expand in the region. Previously the company announced a plan to open six stores in Greater China; it will add three further retail stores there in the upcoming year.

Outlook

The company gave the following guidance for fiscal 2020:

Source: Company reports/Coresight Research.[/caption]

4Q19 Results

Canada Goose reported adjusted EPS of C$0.09, in line with last year, beating the consensus estimate of C$0.05. Total revenues for the quarter were up 25.2% to C$156.2 million, a 23.2% increase at constant exchange rates, missing the consensus estimate of C$157.5 million.

Wholesale revenue increased 12.7% (9.7% currency-neutral) to C$33.8 million, driven by strong demand from partners, incremental revenues from Baffin and a positive foreign exchange impact. Direct-to-consumer (DTC) revenues were up 29.1% (27.5% currency neutral) to C$94.8 million.

By region, Canada represented 35.3% of total sales, with revenue growth of 28.2%. Sales in the US represented roughly 30% of total sales, with revenues growing 36.3%. The rest of the world, including Europe and Asia, represented about 35% of total sales with revenue growth of 60.5%.

Gross margin expanded 290 bps to 65.6%. Gross profit increased to C$102.4 million from C$78.2 million. For fiscal 2019, gross margin expanded to 62.2% from 58.8% last year, driven by higher proportion of DTC revenue.

The operating margin contracted 440 bps to 7.5%, driven by investments to support growth as well as incremental fees to operating partners in Greater China.

At the end of March 2019, the company recorded C$267.3 million in inventory, up 62% year over year. Canada Goose experienced significantly longer lead times for getting products into Europe and Greater China, particularly PRC, than for North America. The company expects to build up inventory before the peak season.

Canada Goose opened two manufacturing facilities during fiscal 2019, one in Winnipeg and one in Montreal, and acquired winter-boot firm Baffin. Currently the company has eight in-house facilities manufacturing 47% of total down-filled jacket volume, up from 43% in fiscal 2018.

The company has 11 directly operated stores and will have eight new retail stores in operation for the winter selling season. In addition, Canada Goose will open a new digital concept store to drive local online sales in the greater Toronto area. The store will serve as an experiential showroom, instead of a traditional retail store.

Last year, the company launched two retail stores and a Tmall store in Greater China and will continue to expand in the region. Previously the company announced a plan to open six stores in Greater China; it will add three further retail stores there in the upcoming year.

Outlook

The company gave the following guidance for fiscal 2020:

Source: Company reports/Coresight Research.[/caption]

4Q19 Results

Canada Goose reported adjusted EPS of C$0.09, in line with last year, beating the consensus estimate of C$0.05. Total revenues for the quarter were up 25.2% to C$156.2 million, a 23.2% increase at constant exchange rates, missing the consensus estimate of C$157.5 million.

Wholesale revenue increased 12.7% (9.7% currency-neutral) to C$33.8 million, driven by strong demand from partners, incremental revenues from Baffin and a positive foreign exchange impact. Direct-to-consumer (DTC) revenues were up 29.1% (27.5% currency neutral) to C$94.8 million.

By region, Canada represented 35.3% of total sales, with revenue growth of 28.2%. Sales in the US represented roughly 30% of total sales, with revenues growing 36.3%. The rest of the world, including Europe and Asia, represented about 35% of total sales with revenue growth of 60.5%.

Gross margin expanded 290 bps to 65.6%. Gross profit increased to C$102.4 million from C$78.2 million. For fiscal 2019, gross margin expanded to 62.2% from 58.8% last year, driven by higher proportion of DTC revenue.

The operating margin contracted 440 bps to 7.5%, driven by investments to support growth as well as incremental fees to operating partners in Greater China.

At the end of March 2019, the company recorded C$267.3 million in inventory, up 62% year over year. Canada Goose experienced significantly longer lead times for getting products into Europe and Greater China, particularly PRC, than for North America. The company expects to build up inventory before the peak season.

Canada Goose opened two manufacturing facilities during fiscal 2019, one in Winnipeg and one in Montreal, and acquired winter-boot firm Baffin. Currently the company has eight in-house facilities manufacturing 47% of total down-filled jacket volume, up from 43% in fiscal 2018.

The company has 11 directly operated stores and will have eight new retail stores in operation for the winter selling season. In addition, Canada Goose will open a new digital concept store to drive local online sales in the greater Toronto area. The store will serve as an experiential showroom, instead of a traditional retail store.

Last year, the company launched two retail stores and a Tmall store in Greater China and will continue to expand in the region. Previously the company announced a plan to open six stores in Greater China; it will add three further retail stores there in the upcoming year.

Outlook

The company gave the following guidance for fiscal 2020:

- Revenue growth of at least 20% from this year’s C$830.5 million.

- At least 40 bps expansion in adjusted EBIT margin from fiscal 2019’s 24.9%.

- Capital expenditure of C$75 million.

- Adjusted EPS growth of at least 25% from this year’s C$1.36.

- The company sees materially larger losses in adjusted EBIT and adjusted net income per diluted share in 1Q20 due to a larger number of retail stores operating during off-peak periods and higher corporate SG&A investments to support growth, including local market activation ahead of planned retail openings, new product and Greater China operations.

- At least 20% average annual revenue growth.

- At least 100 bps expansion in adjusted EBIT margin in 2022 from this year’s 24.9%.

- At least 25% average annual adjusted EPS growth.