Nitheesh NH

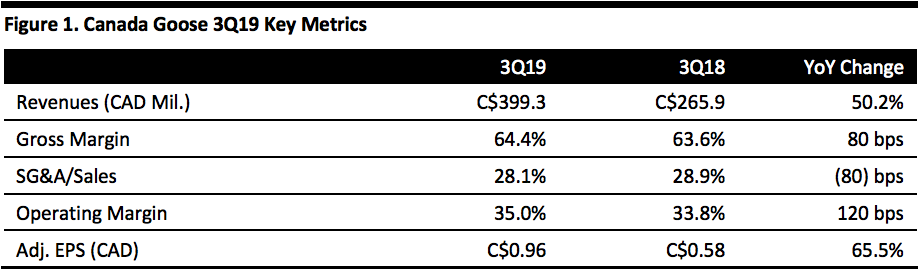

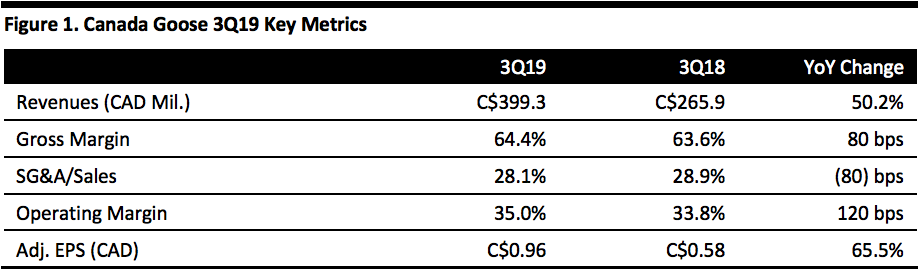

[caption id="attachment_75870" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Canada Goose reported adjusted EPS of C$0.96 for fiscal 3Q19, up 65.5% year over year and beating the consensus estimate of C$0.82.

Total revenue for the quarter was up 50.2% to C$399.3 million, a 49.0% increase at constant exchange rates and beating the consensus estimate of C$361.0 million.

Direct-to-consumer (DTC) sales increased to C$235.3 million from C$131.7 million, driven by five new retail stores and one new e-commerce site. Existing retail stores and e-commerce sites also contributed to the increase in sales.

Wholesale revenue increased to C$164.0 million from C$134.2 million, driven by higher order values from existing partners, earlier shipment timing compared to last year, revenue from the recent acquisition of Baffin and favorable foreign exchange rate changes.

Gross margin was 64.4%, up 80 basis points year over year. Gross profit increased from C$169.1 million to C$179.0 million, driven by higher proportion of sales going direct to consumer.

DTC operating margin improved 10 basis points to 60.1%. The strong sales productivity in all channels partially offset the negative impact from higher incremental SG&A expenses coming from greater China.

Wholesale operating margin decreased 300 basis points to 39.7%, driven by the decline in wholesale gross margin, offset partially by the lower SG&A as a percentage of sales.

In total, the company will have eight manufacturing facilities in Canada.

Operating Income grew 55.6% to C$139.9 million due to revenue growth and gross margin expansion, partially offset by SG&A growth investments.

Unallocated corporate expenses were C$61.3 million, up 39.3% year over year, due to investments to support growth in marketing, corporate headcount and IT, including Greater China operations.

Outlook

Following the strong results, the company revised its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Canada Goose reported adjusted EPS of C$0.96 for fiscal 3Q19, up 65.5% year over year and beating the consensus estimate of C$0.82.

Total revenue for the quarter was up 50.2% to C$399.3 million, a 49.0% increase at constant exchange rates and beating the consensus estimate of C$361.0 million.

Direct-to-consumer (DTC) sales increased to C$235.3 million from C$131.7 million, driven by five new retail stores and one new e-commerce site. Existing retail stores and e-commerce sites also contributed to the increase in sales.

Wholesale revenue increased to C$164.0 million from C$134.2 million, driven by higher order values from existing partners, earlier shipment timing compared to last year, revenue from the recent acquisition of Baffin and favorable foreign exchange rate changes.

Gross margin was 64.4%, up 80 basis points year over year. Gross profit increased from C$169.1 million to C$179.0 million, driven by higher proportion of sales going direct to consumer.

DTC operating margin improved 10 basis points to 60.1%. The strong sales productivity in all channels partially offset the negative impact from higher incremental SG&A expenses coming from greater China.

Wholesale operating margin decreased 300 basis points to 39.7%, driven by the decline in wholesale gross margin, offset partially by the lower SG&A as a percentage of sales.

In total, the company will have eight manufacturing facilities in Canada.

Operating Income grew 55.6% to C$139.9 million due to revenue growth and gross margin expansion, partially offset by SG&A growth investments.

Unallocated corporate expenses were C$61.3 million, up 39.3% year over year, due to investments to support growth in marketing, corporate headcount and IT, including Greater China operations.

Outlook

Following the strong results, the company revised its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Canada Goose reported adjusted EPS of C$0.96 for fiscal 3Q19, up 65.5% year over year and beating the consensus estimate of C$0.82.

Total revenue for the quarter was up 50.2% to C$399.3 million, a 49.0% increase at constant exchange rates and beating the consensus estimate of C$361.0 million.

Direct-to-consumer (DTC) sales increased to C$235.3 million from C$131.7 million, driven by five new retail stores and one new e-commerce site. Existing retail stores and e-commerce sites also contributed to the increase in sales.

Wholesale revenue increased to C$164.0 million from C$134.2 million, driven by higher order values from existing partners, earlier shipment timing compared to last year, revenue from the recent acquisition of Baffin and favorable foreign exchange rate changes.

Gross margin was 64.4%, up 80 basis points year over year. Gross profit increased from C$169.1 million to C$179.0 million, driven by higher proportion of sales going direct to consumer.

DTC operating margin improved 10 basis points to 60.1%. The strong sales productivity in all channels partially offset the negative impact from higher incremental SG&A expenses coming from greater China.

Wholesale operating margin decreased 300 basis points to 39.7%, driven by the decline in wholesale gross margin, offset partially by the lower SG&A as a percentage of sales.

In total, the company will have eight manufacturing facilities in Canada.

Operating Income grew 55.6% to C$139.9 million due to revenue growth and gross margin expansion, partially offset by SG&A growth investments.

Unallocated corporate expenses were C$61.3 million, up 39.3% year over year, due to investments to support growth in marketing, corporate headcount and IT, including Greater China operations.

Outlook

Following the strong results, the company revised its FY19 outlook:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Canada Goose reported adjusted EPS of C$0.96 for fiscal 3Q19, up 65.5% year over year and beating the consensus estimate of C$0.82.

Total revenue for the quarter was up 50.2% to C$399.3 million, a 49.0% increase at constant exchange rates and beating the consensus estimate of C$361.0 million.

Direct-to-consumer (DTC) sales increased to C$235.3 million from C$131.7 million, driven by five new retail stores and one new e-commerce site. Existing retail stores and e-commerce sites also contributed to the increase in sales.

Wholesale revenue increased to C$164.0 million from C$134.2 million, driven by higher order values from existing partners, earlier shipment timing compared to last year, revenue from the recent acquisition of Baffin and favorable foreign exchange rate changes.

Gross margin was 64.4%, up 80 basis points year over year. Gross profit increased from C$169.1 million to C$179.0 million, driven by higher proportion of sales going direct to consumer.

DTC operating margin improved 10 basis points to 60.1%. The strong sales productivity in all channels partially offset the negative impact from higher incremental SG&A expenses coming from greater China.

Wholesale operating margin decreased 300 basis points to 39.7%, driven by the decline in wholesale gross margin, offset partially by the lower SG&A as a percentage of sales.

In total, the company will have eight manufacturing facilities in Canada.

Operating Income grew 55.6% to C$139.9 million due to revenue growth and gross margin expansion, partially offset by SG&A growth investments.

Unallocated corporate expenses were C$61.3 million, up 39.3% year over year, due to investments to support growth in marketing, corporate headcount and IT, including Greater China operations.

Outlook

Following the strong results, the company revised its FY19 outlook:

- Revenue growth is expected to be in the mid to high thirties on a percentage basis, revised up from

- EPS growth is expected to be in the mid to high forties on a percentage basis, also revised up from at least 40% forecast last quarter.

- Adjusted EBITDA margin guidance remains unchanged at a 150-basis-point expansion over FY18.