albert Chan

Source: Company reports/Coresight Research.[/caption]

1Q20 Results

Source: Company reports/Coresight Research.[/caption]

1Q20 Results

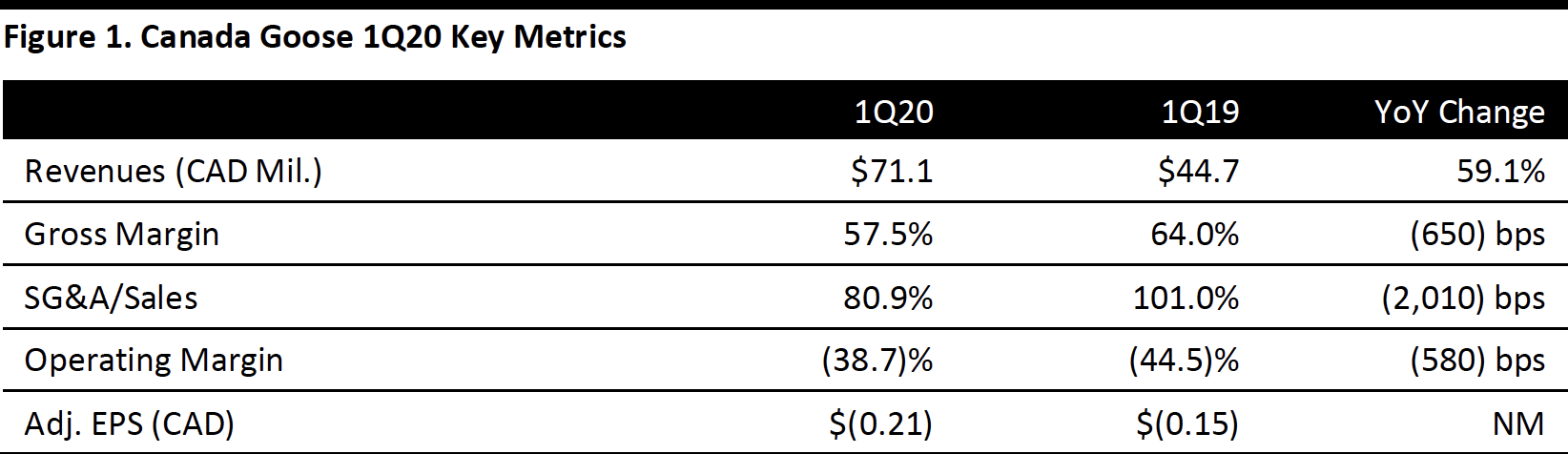

Canada Goose reported adjusted EPS of C$(0.21), in line with last year and beating the consensus estimate of C$(0.24). Total revenue for the quarter was up 59.1% to C$71.1 million, beating the consensus estimate of C$55.1 million.

Wholesale revenue increased 14.8% to C$36.3 million, driven by the higher order value from existing partners, incremental revenue from Baffin and earlier order shipments in Europe and Asia relative to last year. Direct-to-consumer (DTC) revenue was up 11.6% to C$34.8 million, driven by incremental revenue from five new retail stores and one new e-commerce market opened during fiscal 2019.

The US saw sales growth of 15.8%, reflecting a comparable level of shipments to last year and one additional store in Short Hills, New Jersey. Revenue in Canada grew 40.4%. Sales in Asia almost tripled to C$18.1 million, driven by the addition of DTC operations in Greater China. Revenue grew 79.7% in Europe and the rest of the world.

The gross margin declined by 650 bps to 57.5%, reflecting a greater proportion of wholesale revenue. The gross margin shift was offset by positive operating leverage with lower channel SG&A as a percentage of revenue. The operating loss increased to C$27.5 million from C$19.9 million. The operating margin was (38.7)%, compared to (44.5)% in the year-ago period. At the end of March 2019, the company recorded C$366.1 million of inventory, up from C$239.5 million a year-ago. The company opened five new retail stores this quarter, including one in a premier shopping mall in northeast China. Outlook The company reiterated its fiscal 2020 outlook:- Revenue growth of at least 20% from this year’s C$830.5 million.

- At least 40 bps expansion in adjusted EBIT margin from fiscal 2019’s 24.9%.

- Capital expenditure of C$75 million.

- Adjusted EPS growth of at least 25% from this year’s C$1.36.

- The company sees materially larger losses in adjusted EBIT and adjusted net income per diluted share in 1Q20 due to a larger number of retail stores operating during off-peak periods and higher corporate SG&A investments to support growth, including local market activation ahead of planned retail openings, new product and Greater China operations.

- At least 20% average annual revenue growth.

- At least 100 bps expansion in adjusted EBIT margin in 2022 from this year’s 24.9%.

- At least 25% average annual adjusted EPS growth.