Canada Goose Holdings Inc.

Sector: Luxury

Countries of operation: Over 50 countries through owned stores and wholesale

Key product categories: Outerwear apparel and accessories

Annual Metrics

[caption id="attachment_131037" align="aligncenter" width="700"]

Latest fiscal year end: March 28, 2021

Latest fiscal year end: March 28, 2021[/caption]

Summary

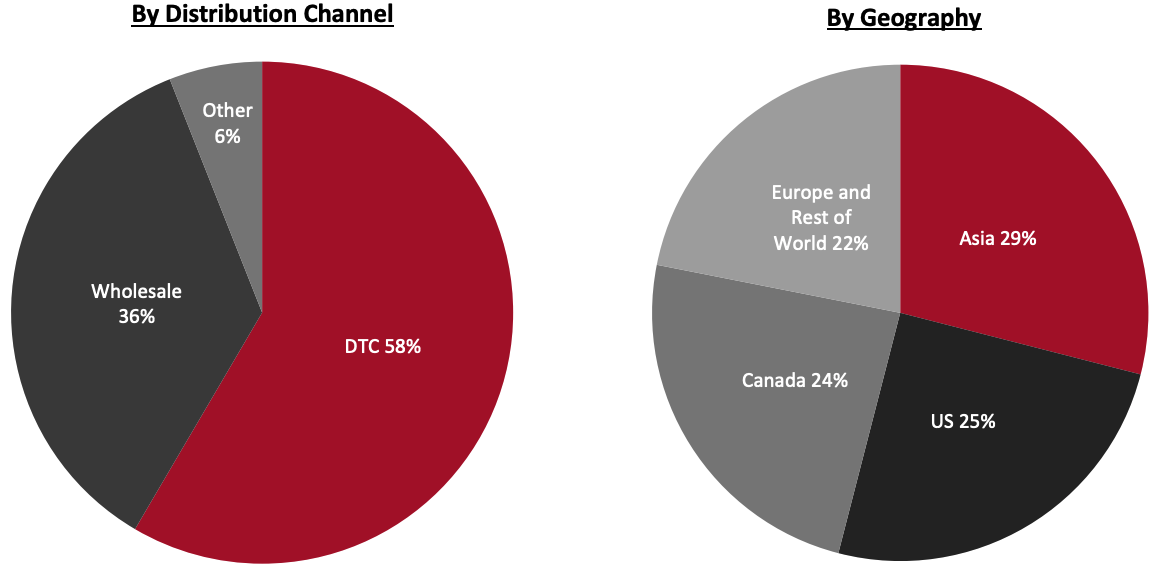

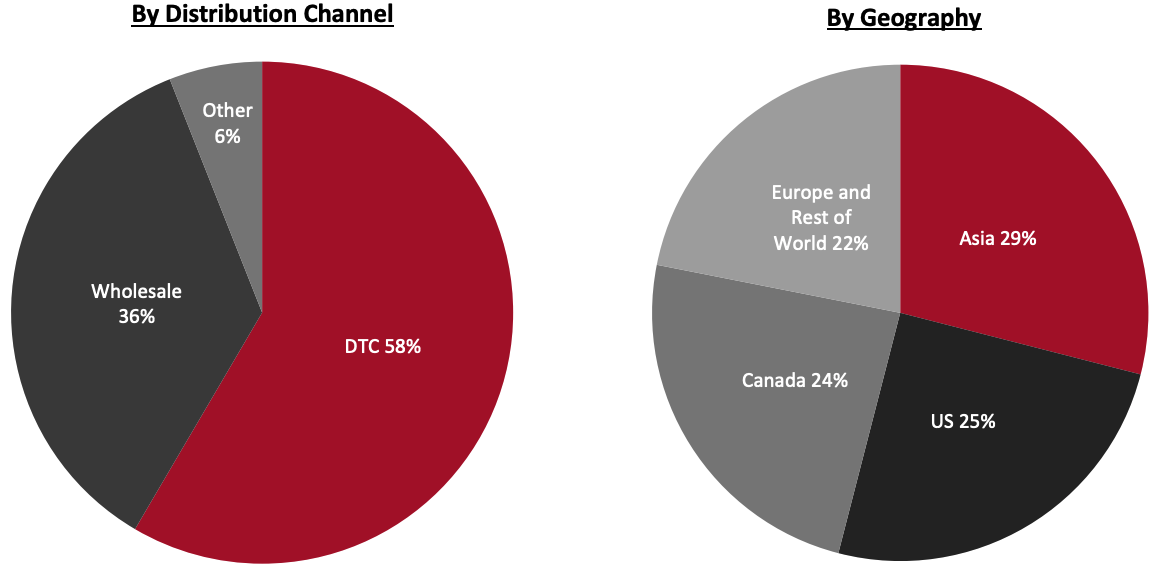

Canada Goose Holdings Inc. is a manufacturer and retailer of performance luxury apparel goods, primarily outerwear. The company is based in Toronto, Canada, and comprises two segments: wholesale and direct-to-consumer (DTC). Canada Goose wholesales to functional and fashion retailers, including in luxury, through international distributors. The company’s DTC segment sells via in stores and online.

Company Analysis

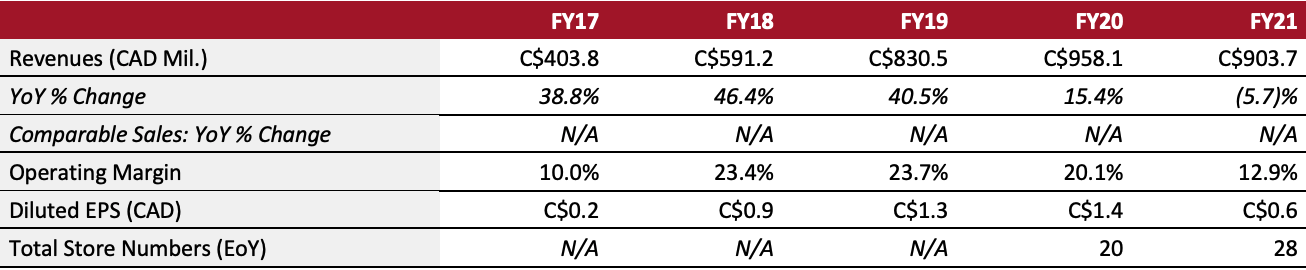

Coresight Research insight: Canada Goose saw its full-year revenues decline by 5.7% for its fiscal 2021 (ended March 28, 2021), as it was heavily impacted by the pandemic. While the company’s wholesale revenues decreased by 24.2%, its DTC revenues increased by 0.6%, driven by 54.0% e-commerce growth. However, this does not paint the full picture: In its final quarter, the company returned to growth, with revenues up 48.2%—driven by sales in Asia and the US—after moderate growth of 4.8% over the preceding holiday quarter.

Canada Goose has been strategically expanding its retail presence and plans to open six to 10 stores in fiscal 2022. Its assortment has typically focused on simplicity in terms of outerwear apparel, and it plans to introduce footwear to its product mix during fiscal 2022. We think Canada Goose is poised for strong growth over during fiscal 2022, with its slow and steady brick-and-mortar expansion approach, largely vertically integrated supply chain, and focus on a high-quality assortment in major growth markets.

| Tailwinds |

Headwinds |

- Pent-up demand for luxury

- Enhanced digital channels, enabling better customer experience

- Easing of travel restrictions and pent-up demand for travel

|

- Economic uncertainty across global markets

- Competition from larger luxury brands

- Rise of ethical and sustainable shopping causing a decline in discretionary purchases

- Varying lockdown restrictions resulting in store closures

- Supply-side disruptions and input cost inflation

|

Strategy

As of March 2021, Canada Goose is focused on the following areas for strategic growth:

1. Pursue global growth

- Expand its store footprint gradually, with around 10 openings per year across international markets including Europe, Mainland China and the US.

- Drive further expansion across its DTC channel.

2. Develop as a lifestyle brand

- Expand its offerings, with plans to launch a footwear range. In 2018, the company acquired Baffin, a brand that makes extreme cold weather boots. Canada Goose will leverage this acquisition for its entry into footwear.

3. Drive higher margins

- Drive higher margins by running its own manufacturing facilities and is growing its DTC channel—through this initiative, Canada Goose can control costs that could have been lost to third-party suppliers and agents.

Revenue Breakdown (FY21)

| Date |

Development |

| April 15, 2021 |

Canada Goose introduces its fur buyback program, as part of its goal to end the purchasing of new fur for creating new products by 2022. |

| March 2, 2021 |

Canada Goose announces a partnership with the National Basketball Association (NBA). As part of the deal, Canada Goose will develop an exclusive design collaboration each year: this year with Los Angeles-based brand RHUDE, which is renowned for creatively mixing luxury with streetwear features. |

| January 15, 2021 |

Canada Goose launches a capsule collection in collaboration with guest designer Angel Chen, featuring a range of accessories, down-jackets, knitwear, rainwear and windwear for men and women. |

| November 8, 2020 |

Canada Goose launches HUMANATURE, a platform that brings together its philanthropic and sustainability initiatives, in line with its motto, “keeping the planet cold and the people on it warm.” |

Management Team

- Dani Reiss—President and CEO

- Jonathan Sinclair—CFO and EVP

- Ana Mihaljevic—Chief Commercial Officer

- Penny Brook—Chief Marketing Officer

Source: Company reports/S&P Capital IQ

Latest fiscal year end: March 28, 2021[/caption]

Summary

Canada Goose Holdings Inc. is a manufacturer and retailer of performance luxury apparel goods, primarily outerwear. The company is based in Toronto, Canada, and comprises two segments: wholesale and direct-to-consumer (DTC). Canada Goose wholesales to functional and fashion retailers, including in luxury, through international distributors. The company’s DTC segment sells via in stores and online.

Company Analysis

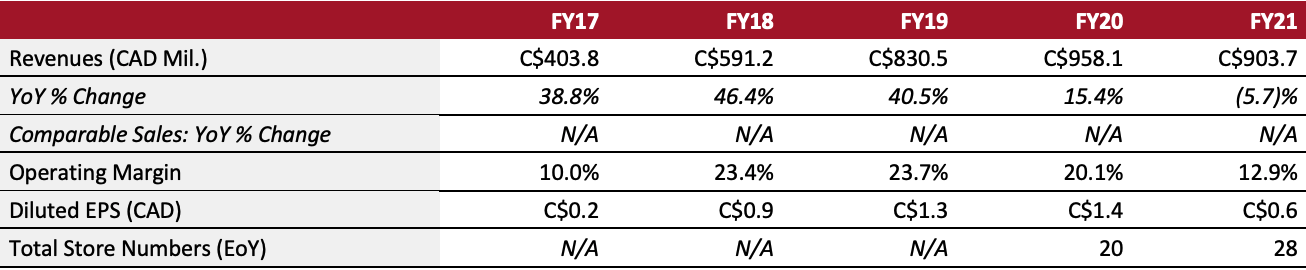

Coresight Research insight: Canada Goose saw its full-year revenues decline by 5.7% for its fiscal 2021 (ended March 28, 2021), as it was heavily impacted by the pandemic. While the company’s wholesale revenues decreased by 24.2%, its DTC revenues increased by 0.6%, driven by 54.0% e-commerce growth. However, this does not paint the full picture: In its final quarter, the company returned to growth, with revenues up 48.2%—driven by sales in Asia and the US—after moderate growth of 4.8% over the preceding holiday quarter.

Canada Goose has been strategically expanding its retail presence and plans to open six to 10 stores in fiscal 2022. Its assortment has typically focused on simplicity in terms of outerwear apparel, and it plans to introduce footwear to its product mix during fiscal 2022. We think Canada Goose is poised for strong growth over during fiscal 2022, with its slow and steady brick-and-mortar expansion approach, largely vertically integrated supply chain, and focus on a high-quality assortment in major growth markets.

Latest fiscal year end: March 28, 2021[/caption]

Summary

Canada Goose Holdings Inc. is a manufacturer and retailer of performance luxury apparel goods, primarily outerwear. The company is based in Toronto, Canada, and comprises two segments: wholesale and direct-to-consumer (DTC). Canada Goose wholesales to functional and fashion retailers, including in luxury, through international distributors. The company’s DTC segment sells via in stores and online.

Company Analysis

Coresight Research insight: Canada Goose saw its full-year revenues decline by 5.7% for its fiscal 2021 (ended March 28, 2021), as it was heavily impacted by the pandemic. While the company’s wholesale revenues decreased by 24.2%, its DTC revenues increased by 0.6%, driven by 54.0% e-commerce growth. However, this does not paint the full picture: In its final quarter, the company returned to growth, with revenues up 48.2%—driven by sales in Asia and the US—after moderate growth of 4.8% over the preceding holiday quarter.

Canada Goose has been strategically expanding its retail presence and plans to open six to 10 stores in fiscal 2022. Its assortment has typically focused on simplicity in terms of outerwear apparel, and it plans to introduce footwear to its product mix during fiscal 2022. We think Canada Goose is poised for strong growth over during fiscal 2022, with its slow and steady brick-and-mortar expansion approach, largely vertically integrated supply chain, and focus on a high-quality assortment in major growth markets.