DIpil Das

What’s the Story?

After registering losses every year since its IPO (initial public offering) in 2014, online furniture retailer Wayfair has turned in profits in its last four quarters, including the first quarter of fiscal 2021, ended March 31. The pandemic-driven shift to online shopping benefited Wayfair, and now its challenge is to sustain its newfound profitability. In this report, we analyze the sector-wide trends that Wayfair is profiting from, as well as its own revenue-growth drivers, such as its investments in its supply chain and its growing number of repeat customers.Why It Matters

Wayfair’s development will be important to follow for two reasons:- According to Wayfair’s estimates, the addressable market for home goods is worth $840 billion globally, and within this category, the online channel is growing by 15% annually. Within the US, the company estimates that the addressable market is around $450 billion, and e-commerce comprises approximately 20% of total sales. With the tremendous potential to scale revenue growth, Wayfair has the opportunity not just to maintain but to amplify its profitability.

- The Covid-19 pandemic was a significant boost for Wayfair in 2020. As the impact of the crisis fades in 2021, Wayfair’s underlying capacity to remain profitable will be revealed.

Can Wayfair Sustain Profitability?: In Detail

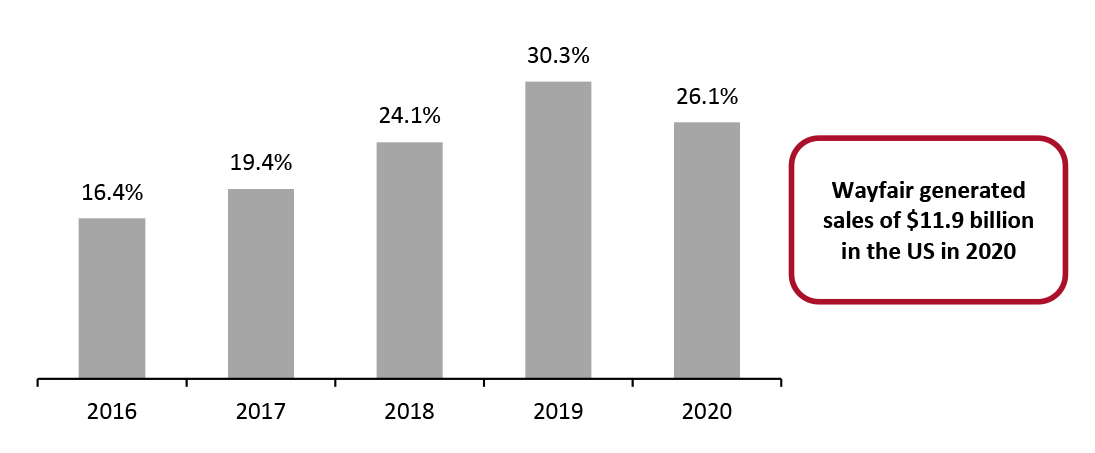

Recent Performance Wayfair’s growth has been impressive within the US furniture retail sector. Founded in 2002 and going public in 2014, the retailer has grown its revenues quickly—from an annual net revenue of $2.3 billion in 2015 to $14.1 billion in 2020. Some $11.9 billion of that 2020 revenue was generated in the US, yielding a share of online furniture and furnishings sales of 26.1% in that year, we estimate. That was down by around four percentage points year over year, as Euromonitor International estimates that online category sales (our base for the market share) jumped by around three-quarters in 2020, which Wayfair’s 53% increase in US revenues failed to match. From other sources, we estimate Amazon to be in a strong second place in the US online furniture and furnishings market.Figure 1. Wayfair’s Estimated Share of US Online Furniture, Furnishings and Housewares Sales (%) [caption id="attachment_129519" align="aligncenter" width="725"]

Source: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

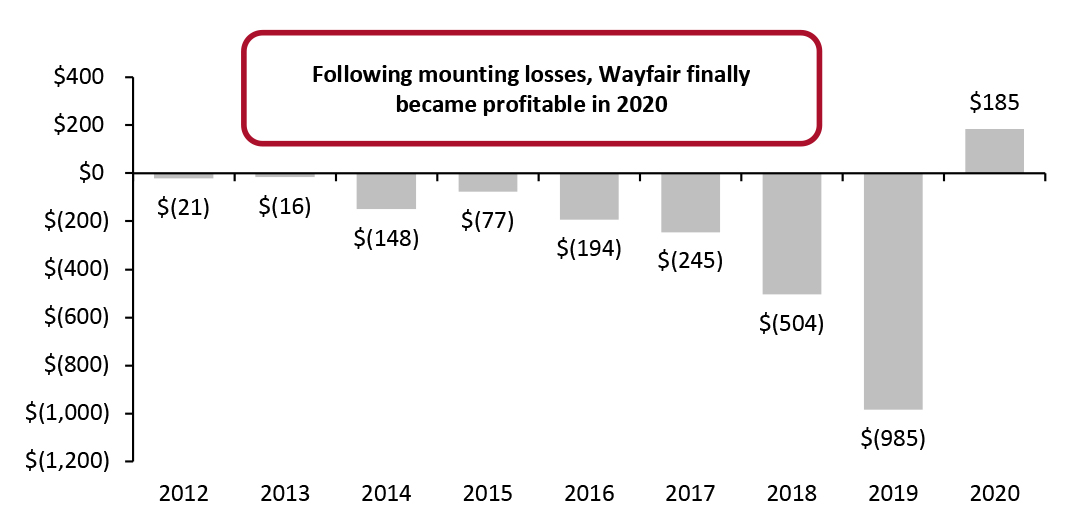

Despite these successes, Wayfair posted losses every year from its 2014 IPO to 2019. However, pandemic-hit 2020 brought change for the retailer, which reported its first profit in the second quarter of 2020, ended June 30, 2020. The company followed this with profits in its third and fourth quarters, and generated a statutory net income of $185 million for the full-year 2020, ended December 31, 2020 (see Figure 2). In 2021, Wayfair posted net income of $18.2 million in the first quarter, compared to a net loss of $285.9 million one year earlier.

Source: Company reports/Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Despite these successes, Wayfair posted losses every year from its 2014 IPO to 2019. However, pandemic-hit 2020 brought change for the retailer, which reported its first profit in the second quarter of 2020, ended June 30, 2020. The company followed this with profits in its third and fourth quarters, and generated a statutory net income of $185 million for the full-year 2020, ended December 31, 2020 (see Figure 2). In 2021, Wayfair posted net income of $18.2 million in the first quarter, compared to a net loss of $285.9 million one year earlier.

Figure 2. Wayfair’s Annual Net Loss/Income (USD Mil.) [caption id="attachment_129520" align="aligncenter" width="725"]

Source: Company reports [/caption]

Four Market Tailwinds for Wayfair in 2021

1. Heightened Spending in the Home Category

So far in 2021, US shoppers have continued to spend on their homes, supported by spending still more time at home and a strong housing market. In May 2021 (latest reported), US consumer spending on furniture and furnishings was up 29.8% year over year, according to data from the US Bureau of Economic Analysis.

Wayfair’s sales grew by 45% in the fourth quarter of 2020 and by 49% in the first quarter of 2021. The company did not offer a financial outlook for 2021 but stated that growth is likely to slow as we annualize the Covid-19 outbreak.

The company has plans to expand its professional business (i.e., B2B sales) in North America and become a bigger player in appliances by introducing more brands to its site.

2. Positive E-Commerce Prospects for the Home and Home-Improvement Categories

Online sales as a percentage of US furniture, home furnishings and housewares retail sales have shown steady growth, rising from 12.4% in 2016 to 15.2% in 2019, according to Euromonitor International. Euromonitor International estimates that e-commerce penetration jumped by 10 percentage points to account for one-quarter of category sales in 2020 (an increase from the company’s prior estimates for 2020).

In Wayfair’s earnings call on February 25, 2021, CEO Niraj Shah said, “Online shopping behavior is becoming increasingly entrenched, and consumer demand for the home category remains elevated.” Although we expect in-store sales to recover as a higher proportion of consumers receive Covid-19 vaccinations, we expect that online shopping habits will persist in the home category.

3. Consumer Migration from Cities to Suburbs and Rural Areas

US consumers’ exodus to suburbs has prompted a surge in the housing market, leading to record home sales and housing starts (see Coresight Research’s Leading Indicators of US Retail Sales series). Working from home has also left consumers with more discretionary income available to purchase furniture for their new homes. Suburban shifts also imply more space in houses for furniture and fixtures. With limited competition from physical stores, Wayfair has benefited from this trend.

In its earnings call for the fourth quarter of fiscal 2020, held on February 8, 2021, real estate investment trust Simon Property Group predicted that the consumer shift to suburban areas will continue, although the intensity and longevity of the trend is unclear. A continuation of this trend would be a tailwind for Wayfair.

4. Expanding Customer Base: The Rise of Millennials

Wayfair is seeing increasing demand from millennials, and with each passing year, more consumers are moving into this demographic. Around 45% of Wayfair’s sales come from customers aged 31–50, according to an investor presentation by the company in early 2020.

According to population estimates from the US Census Bureau, there were approximately 72.1 million millennials (defined as individuals between the ages of 23 and 38) in the US as of July 1, 2019 (the latest date for which data are available), and this number is continuing to grow. Moreover, young immigrants are adding more numbers to this age group than any other. As per a demographic segmentation prepared by the Census Bureau on June 25, 2020, millennials are the biggest cohort among all age groups.

The growing number of millennials will lead to a rise in purchases of household goods and furniture among this age group, who have strong online shopping habits. Concordantly, online sales of home goods will increase as millennials age, start new families and move into new homes, which will enable Wayfair to capture a sizeable share of the market.

Three Revenue-Growth Drivers

1. Supply Chain Investments

In 2019, Wayfair expanded its CastleGate warehouse network with three more facilities—one each in California, Florida and Georgia.

In the same year, it also opened a 1.1 million-square-foot facility in Lutterworth, UK. It had been operating a 250,000-square-foot warehouse in Lutterworth since November 2016, but according to the company, rapid sales growth necessitated a larger facility.

In its earnings call for the third quarter of 2020, held on November 3, 2020, Wayfair announced plans to upgrade from its current facility in Germany (opened in 2018) to a larger 1 million-square-foot fulfillment center in Leist, Germany, in 2021 to support continued growth.

In February 2021, Wayfair stated that the number of participating suppliers in its CastleGate warehouse network grew by 60% year over year in 2020, and the company expects significant growth to continue going forward. Wayfair also highlighted that it gained 100 basis points of leverage in 2020 from fulfillment efficiencies.

Also in February 2021, the retailer announced that it will open a 1.2 million-square-foot fulfillment center in Romeoville, a suburb to the north of Joliet, Illinois. Construction of the warehouse will begin in spring this year and Wayfair expects the center to open in mid-2022.

Wayfair has mitigated the effects of supply chain disruption—which is causing ongoing problems for many retailers—by using over 16,00 suppliers, none of which represents more than 2% of its revenue, as of the fourth quarter of 2020, according to the company.

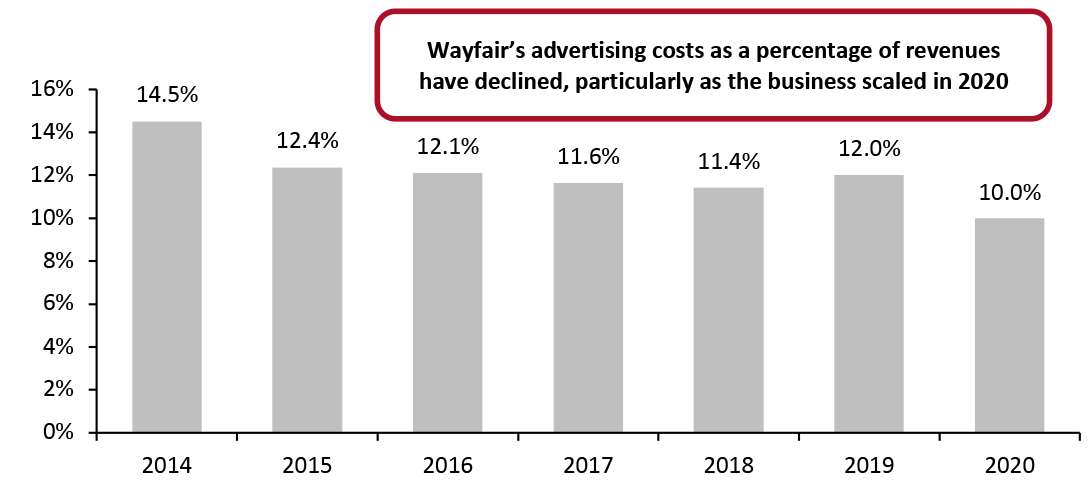

2. Reduced Advertising Spend

Wayfair’s advertising costs have been declining as a percentage of revenues on an annual basis since 2014. The only exception was in 2019, which saw higher advertising costs, reflecting increased investment by the company in generating future customer growth.

In 2020, Wayfair’s advertising costs as a percentage of revenues declined to 10.0%—down from 12.0% in 2019, mainly owing to efficiencies in its advertising spend. However, the company pointed out that advertising as a percentage of net revenue will vary depending on the opportunities that it sees in the market in any given period. Wayfair expects this percentage to remain around 10%–11% range in the near term as it continues to see a strong return on investment. In the first quarter of 2021, advertising costs accounted for 10.5% of Wayfair revenues, versus 11.8% one year earlier and roughly level with the 10.2% reported for the fourth quarter of 2020.

Source: Company reports [/caption]

Four Market Tailwinds for Wayfair in 2021

1. Heightened Spending in the Home Category

So far in 2021, US shoppers have continued to spend on their homes, supported by spending still more time at home and a strong housing market. In May 2021 (latest reported), US consumer spending on furniture and furnishings was up 29.8% year over year, according to data from the US Bureau of Economic Analysis.

Wayfair’s sales grew by 45% in the fourth quarter of 2020 and by 49% in the first quarter of 2021. The company did not offer a financial outlook for 2021 but stated that growth is likely to slow as we annualize the Covid-19 outbreak.

The company has plans to expand its professional business (i.e., B2B sales) in North America and become a bigger player in appliances by introducing more brands to its site.

2. Positive E-Commerce Prospects for the Home and Home-Improvement Categories

Online sales as a percentage of US furniture, home furnishings and housewares retail sales have shown steady growth, rising from 12.4% in 2016 to 15.2% in 2019, according to Euromonitor International. Euromonitor International estimates that e-commerce penetration jumped by 10 percentage points to account for one-quarter of category sales in 2020 (an increase from the company’s prior estimates for 2020).

In Wayfair’s earnings call on February 25, 2021, CEO Niraj Shah said, “Online shopping behavior is becoming increasingly entrenched, and consumer demand for the home category remains elevated.” Although we expect in-store sales to recover as a higher proportion of consumers receive Covid-19 vaccinations, we expect that online shopping habits will persist in the home category.

3. Consumer Migration from Cities to Suburbs and Rural Areas

US consumers’ exodus to suburbs has prompted a surge in the housing market, leading to record home sales and housing starts (see Coresight Research’s Leading Indicators of US Retail Sales series). Working from home has also left consumers with more discretionary income available to purchase furniture for their new homes. Suburban shifts also imply more space in houses for furniture and fixtures. With limited competition from physical stores, Wayfair has benefited from this trend.

In its earnings call for the fourth quarter of fiscal 2020, held on February 8, 2021, real estate investment trust Simon Property Group predicted that the consumer shift to suburban areas will continue, although the intensity and longevity of the trend is unclear. A continuation of this trend would be a tailwind for Wayfair.

4. Expanding Customer Base: The Rise of Millennials

Wayfair is seeing increasing demand from millennials, and with each passing year, more consumers are moving into this demographic. Around 45% of Wayfair’s sales come from customers aged 31–50, according to an investor presentation by the company in early 2020.

According to population estimates from the US Census Bureau, there were approximately 72.1 million millennials (defined as individuals between the ages of 23 and 38) in the US as of July 1, 2019 (the latest date for which data are available), and this number is continuing to grow. Moreover, young immigrants are adding more numbers to this age group than any other. As per a demographic segmentation prepared by the Census Bureau on June 25, 2020, millennials are the biggest cohort among all age groups.

The growing number of millennials will lead to a rise in purchases of household goods and furniture among this age group, who have strong online shopping habits. Concordantly, online sales of home goods will increase as millennials age, start new families and move into new homes, which will enable Wayfair to capture a sizeable share of the market.

Three Revenue-Growth Drivers

1. Supply Chain Investments

In 2019, Wayfair expanded its CastleGate warehouse network with three more facilities—one each in California, Florida and Georgia.

In the same year, it also opened a 1.1 million-square-foot facility in Lutterworth, UK. It had been operating a 250,000-square-foot warehouse in Lutterworth since November 2016, but according to the company, rapid sales growth necessitated a larger facility.

In its earnings call for the third quarter of 2020, held on November 3, 2020, Wayfair announced plans to upgrade from its current facility in Germany (opened in 2018) to a larger 1 million-square-foot fulfillment center in Leist, Germany, in 2021 to support continued growth.

In February 2021, Wayfair stated that the number of participating suppliers in its CastleGate warehouse network grew by 60% year over year in 2020, and the company expects significant growth to continue going forward. Wayfair also highlighted that it gained 100 basis points of leverage in 2020 from fulfillment efficiencies.

Also in February 2021, the retailer announced that it will open a 1.2 million-square-foot fulfillment center in Romeoville, a suburb to the north of Joliet, Illinois. Construction of the warehouse will begin in spring this year and Wayfair expects the center to open in mid-2022.

Wayfair has mitigated the effects of supply chain disruption—which is causing ongoing problems for many retailers—by using over 16,00 suppliers, none of which represents more than 2% of its revenue, as of the fourth quarter of 2020, according to the company.

2. Reduced Advertising Spend

Wayfair’s advertising costs have been declining as a percentage of revenues on an annual basis since 2014. The only exception was in 2019, which saw higher advertising costs, reflecting increased investment by the company in generating future customer growth.

In 2020, Wayfair’s advertising costs as a percentage of revenues declined to 10.0%—down from 12.0% in 2019, mainly owing to efficiencies in its advertising spend. However, the company pointed out that advertising as a percentage of net revenue will vary depending on the opportunities that it sees in the market in any given period. Wayfair expects this percentage to remain around 10%–11% range in the near term as it continues to see a strong return on investment. In the first quarter of 2021, advertising costs accounted for 10.5% of Wayfair revenues, versus 11.8% one year earlier and roughly level with the 10.2% reported for the fourth quarter of 2020.

Figure 3. Wayfair’s Advertising Spend as a Proportion of Total Revenues (%) [caption id="attachment_129521" align="aligncenter" width="725"]

Source: Company reports[/caption]

3. Improved Customer Loyalty

One of the significant metrics that indicates the strength of Wayfair’s operations is repeat orders. Repeat customers accounted for 74.5% of total orders in the first quarter of 2021, up from 69.8% in the year-ago period and showing sequential growth (Figure 4). Repeat customers also increased the number of orders they placed by 58.9% year over year to 10.9 million in the first quarter of 2021. The company also highlighted in its fourth-quarter 2020 earnings call that its repeat customers are highly engaged on its platform even between orders.

Moreover, almost 60% of Wayfair’s orders in 2020 came via customers who had made at least three lifetime purchases from the platform, according to the company. This loyalty metric stood at 30% just five years ago.

Source: Company reports[/caption]

3. Improved Customer Loyalty

One of the significant metrics that indicates the strength of Wayfair’s operations is repeat orders. Repeat customers accounted for 74.5% of total orders in the first quarter of 2021, up from 69.8% in the year-ago period and showing sequential growth (Figure 4). Repeat customers also increased the number of orders they placed by 58.9% year over year to 10.9 million in the first quarter of 2021. The company also highlighted in its fourth-quarter 2020 earnings call that its repeat customers are highly engaged on its platform even between orders.

Moreover, almost 60% of Wayfair’s orders in 2020 came via customers who had made at least three lifetime purchases from the platform, according to the company. This loyalty metric stood at 30% just five years ago.

Figure 4. Wayfair’s Repeat Orders [wpdatatable id=1073]

Source: Company reports Challenges Remain Ahead Although Wayfair is enjoying some tailwinds, there are significant challenges to its growth and profitability. Transportation of large and heavy items at cost-effective rates and without damage remains an ongoing challenge, and since the closure of its Natick, Massachusetts store in December 2020, the retailer currently has a physical presence only at one location—an outlet center in Florence, Kentucky. This means that compared to some of its rivals in the category such as Macy’s, Target and Walmart, Wayfair cannot leverage omnichannel advantages to address logistical challenges. In its earnings call for the fourth quarter of 2020, Wayfair management said that port congestion is disrupting the company’s supply chain, with delays causing inventory challenges and keeping some stock-keeping units (SKUs) out of stock. Wayfair anticipates that it will not be able to meet its usual target stock levels for some months. Ocean carriers are increasing their capacity but not yet enough to clear the company’s current backlog. However, Wayfair’s control over its end-to-end supply chain as well as its 20-foot equivalent unit (TEU) volume gives it a strong negotiating position when dealing with shipping companies, according to Shah.