DIpil Das

Introduction: Can CBD Save the Mall?

Despite a relatively positive macroeconomic backdrop, retail has seen the number of store closures rise in recent years: Year to date in 2019, US retailers have announced they will close 8,201 stores, which is 40% higher than total closures in 2018. Coresight Research estimates that US store closures could reach 12,000 by the end of 2019. Retailers, brands and especially mall owners are looking for ways to drive foot traffic to brick and mortar stores, leveraging tactics such as innovative formats and experiential events to better engage the consumer and bring them into the store. Can CBD be the secret sauce to lure customers back to stores and most especially to malls? Cannabidiol (CBD) has seen surging popularity in what is a very new product category. (See later in the report for a more detailed briefing on what CBD is and its legal status.)Growing Demand for CBD

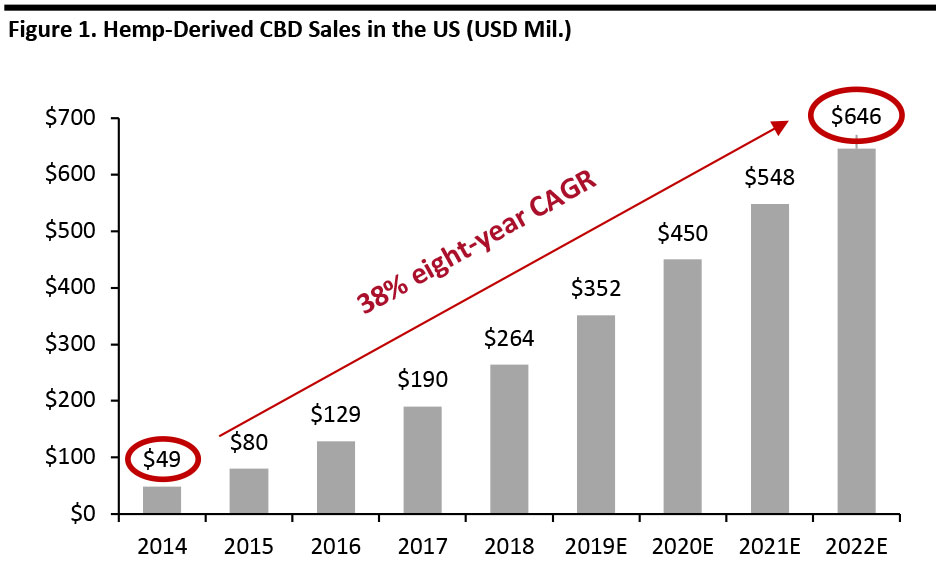

The sudden surge in CBD, hemp and CBD-containing products in the US is due to a change in its legal status: In December 2018, the federal government clarified what had been a murky legal question around CBD, enacting legislation that made it legal in all states. Production is surging, and brands and companies are jumping on the opportunity by launching new products containing CBD — selling extracts, capsules and even raw plant. According to Hemp Business Journal, a division of New Frontier Data, total retail sales of hemp-derived CBD products in the US will exceed $646 million by 2022. Hemp Business Journal estimates that $184.3 million of those consumer sales will be in natural products and specialty markets. Hemp-derived CBD product sales in the US have grown nearly 440% since 2014, according to the same organization, with $57.5 million of the $264 million in sales in 2018 coming from transactions in retail stores. [caption id="attachment_97072" align="aligncenter" width="700"] Source: New Frontier Data[/caption]

Behind the growing market is consumers’ increased interest in CBD products. At Cosmoprof North America 2019, The Benchmarking Company presented results from surveys that reached over 7,000 women globally. Responses revealed that US Gen Xers are the most willing to try beauty and personal care products made with hemp or containing CBD at 77%, followed by millennials at 74%, Gen Zers at 68% and baby boomers at 67%.

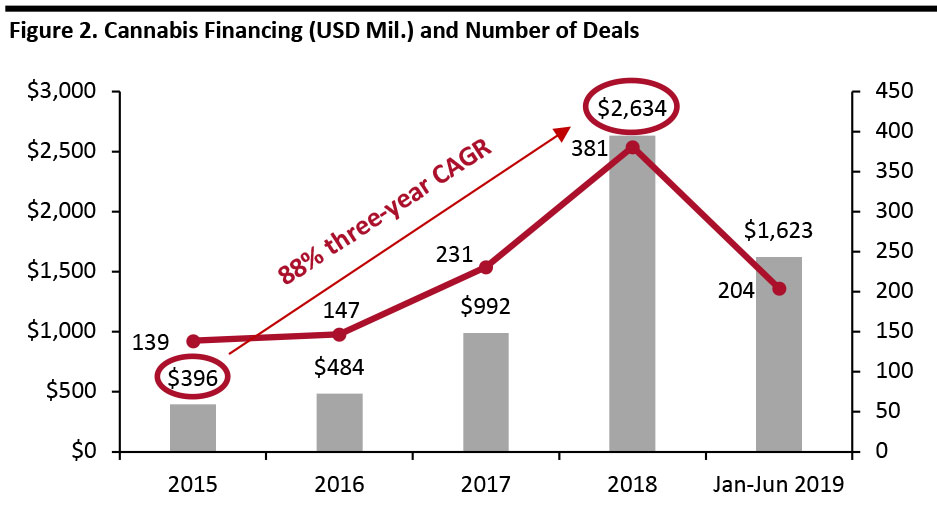

In recent years, a number of startups focusing on CBD products have emerged, and venture capital has been flowing into hemp startups in nearly every category — beauty, medicine, food and packaging.Total funding almost tripled from $992 million in 2017 to $2.63 billion in 2018, and the number of deals increased 65%, from 231 in 2017 to 381 in 2018, according to CB Insights.

With venture capital support, CBD startups are expanding and actively looking for channels to generate revenue.

[caption id="attachment_97073" align="aligncenter" width="700"]

Source: New Frontier Data[/caption]

Behind the growing market is consumers’ increased interest in CBD products. At Cosmoprof North America 2019, The Benchmarking Company presented results from surveys that reached over 7,000 women globally. Responses revealed that US Gen Xers are the most willing to try beauty and personal care products made with hemp or containing CBD at 77%, followed by millennials at 74%, Gen Zers at 68% and baby boomers at 67%.

In recent years, a number of startups focusing on CBD products have emerged, and venture capital has been flowing into hemp startups in nearly every category — beauty, medicine, food and packaging.Total funding almost tripled from $992 million in 2017 to $2.63 billion in 2018, and the number of deals increased 65%, from 231 in 2017 to 381 in 2018, according to CB Insights.

With venture capital support, CBD startups are expanding and actively looking for channels to generate revenue.

[caption id="attachment_97073" align="aligncenter" width="700"] Source: CB Insights[/caption]

Source: CB Insights[/caption]

Can CBD and CBD Products Drive Foot Traffic to Stores and Malls?

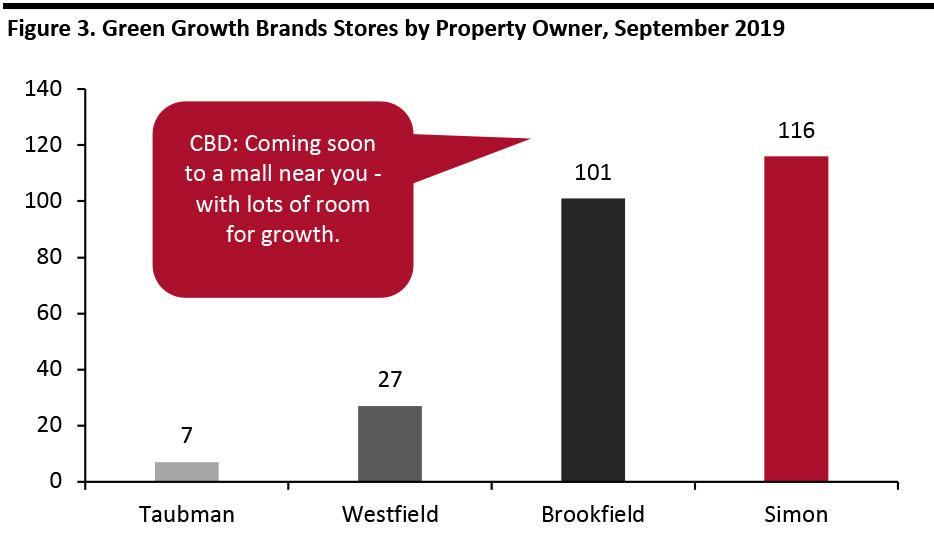

Growing demand for CBD products offers the potential for malls to drive traffic and sales. A survey conducted by The Benchmarking Company in February 2019 found that 39% of respondents purchase CBD-infused or CBD-derived beauty and personal care products directly from the brand, but 31% go to specialty retailers. With the full legalization of hemp, standalone stores have been popping up that sell hemp in a wide variety of formulations. Simon Property Group announced in February that it would partner with Green Growth Brands to open 108 shops selling CBD products at Simon malls in the US. Two have already opened: one in Castle Square in Indiana and the other in the Oxmoor Center in Kentucky. Green Growth Brands has a number of brands in its portfolio, including CAMP and Seventh Sense. As of September 2019, the company had 116 stores in Simon properties, 101 in Brookfield properties, 27 in Westfield locations and seven in Taubman malls. Abercrombie & Fitch tested the water with Green Growth Brands’ products in 10 stores in May 2019. The trial was so successful that the retailer decided to expand the number of stores selling items from Green Growth Brands to more than 160. Meanwhile, American Eagle Outfitters has announced it will partner with Green Growth Brands-owned Seventh Sense to launch CBD beauty products for this holiday season. Seventh Sense products are already available on American Eagle Outfitters’ online stores. [caption id="attachment_97074" align="aligncenter" width="700"] Source: Green Growth Brands/Coresight Research[/caption]

Charlotte’s Web, which makes hemp-derived CBD products, reported US$70 million revenue in 2018, up 74% year on year. The company’s products are available in over 8,000 retail locations; it produced 675,000 pounds of hemp in 2018 and planted 862 acres in 2019.

CBDMEDIC, a CBD-infused topical pain relief and skincare brand, has products available via 15 retail and pharmacy chains and around 2,200 locations in 11 states throughout the US, and is working with CVS to make its products available in over 600 of its stores. CBDMEDIC products are already available at Harmon, Bed Bath & Beyond, Giant Eagle, URM Stores, Road Runner Sports, Fruth Pharmacy, Hartig and Dierbergs.

On September 10, 2019, Social CBD launched a line of new CBD products online and in more than 10,000 retail locations nationwide, including Walgreens, CVS and the Vitamin Shoppe. The company sells wellness-related CBD solutions and expects to reach over 20,000 retail locations by the end of this year.

Non-CBD natives are also getting in on the action.Sephora sells a number of CBD-infused beauty products. Urban Outfitters and Free People have added CBD products to their shelves as well.

Barneys New York also opened a shop-in-shop called The High End on the fifth floor of its Beverly Hills store in March 2019. The shop offers a variety of CBD-infused products, including accessories and beauty. (Unrelated, the company filed for Chapter 11 bankruptcy protection in August 2019.)

In addition to being one of the most recognized CBD brands, Charlotte’s Web has another claim to fame: It holds the first US patent for a cultivar of hemp. Patent documents describe CW2A as a hardy plant, resistant to cold and capable of producing up to 6.24% CBD and only 0.27% tetrahydrocannabinol (THC). Patent filings list Charlette’s Web Holdings CEO Joel Stanley as inventor. The patent for “a new and distinct hemp cultivar designated as ‘CW2A’” was granted on July 2, 2019, according to filings.

Source: Green Growth Brands/Coresight Research[/caption]

Charlotte’s Web, which makes hemp-derived CBD products, reported US$70 million revenue in 2018, up 74% year on year. The company’s products are available in over 8,000 retail locations; it produced 675,000 pounds of hemp in 2018 and planted 862 acres in 2019.

CBDMEDIC, a CBD-infused topical pain relief and skincare brand, has products available via 15 retail and pharmacy chains and around 2,200 locations in 11 states throughout the US, and is working with CVS to make its products available in over 600 of its stores. CBDMEDIC products are already available at Harmon, Bed Bath & Beyond, Giant Eagle, URM Stores, Road Runner Sports, Fruth Pharmacy, Hartig and Dierbergs.

On September 10, 2019, Social CBD launched a line of new CBD products online and in more than 10,000 retail locations nationwide, including Walgreens, CVS and the Vitamin Shoppe. The company sells wellness-related CBD solutions and expects to reach over 20,000 retail locations by the end of this year.

Non-CBD natives are also getting in on the action.Sephora sells a number of CBD-infused beauty products. Urban Outfitters and Free People have added CBD products to their shelves as well.

Barneys New York also opened a shop-in-shop called The High End on the fifth floor of its Beverly Hills store in March 2019. The shop offers a variety of CBD-infused products, including accessories and beauty. (Unrelated, the company filed for Chapter 11 bankruptcy protection in August 2019.)

In addition to being one of the most recognized CBD brands, Charlotte’s Web has another claim to fame: It holds the first US patent for a cultivar of hemp. Patent documents describe CW2A as a hardy plant, resistant to cold and capable of producing up to 6.24% CBD and only 0.27% tetrahydrocannabinol (THC). Patent filings list Charlette’s Web Holdings CEO Joel Stanley as inventor. The patent for “a new and distinct hemp cultivar designated as ‘CW2A’” was granted on July 2, 2019, according to filings.

Shoppers Still Turn to Stores for Product Discovery

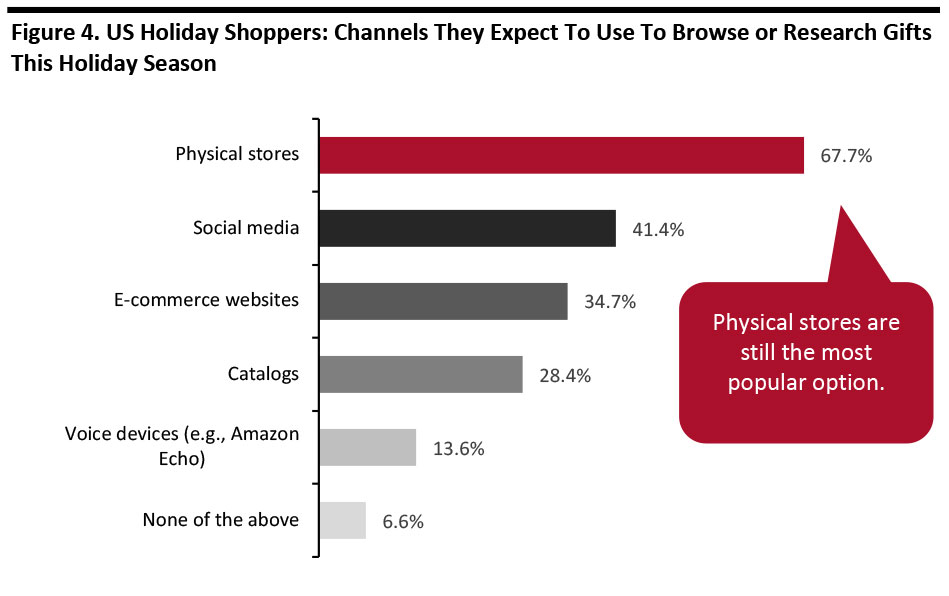

Although retail is seeing a wave of store closures, consumers are still interested in physical stores, particularly for browsing and researching products. Coresight Research’s recent survey of US consumers who expect to buy gifts for the holidays in 2019 found that 83.0% of respondents plan to buy gifts in store, while 67.7% expect to browse or research gifts in physical stores. [caption id="attachment_97075" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options Base: 1,784 US Internet users aged 18 and above who expect to buy gifts for the holidays in 2019

Source: Coresight Research [/caption] Physical stores are a point of discovery for emerging brands: New stores generate an average 45% lift in web traffic, according to an International Council of Shopping Center survey. For beauty products, even though the research and discovery process often begins online, some 80.7% of global beauty and personal care sales are made in store.