DIpil Das

Meet BORIS

Returns are a key part of any retailer’s service offering – especially for online sales. Nearly 30% of all items ordered online are returned, compared to only 9% of items purchased in physical stores, according to a study from brand consulting firm Invesp. High return rates for online sales and the reverse logistics required to process them are creating challenges for retailers. However, returns also offer an untapped opportunity for retailers to build loyalty. Increasing numbers of US retailers are investing in omnichannel retail strategies, which include buy online, return in store (BORIS), to keep up with consumer demand for convenience and flexibility. With BORIS, customers can return items to a physical store rather than having to pack and ship. The challenge is consumers love shopping online, but often change their minds once they see the product. And when it comes to returning online purchases, most consumers prefer dropping it off at a store over shipping it back. According to a 2018 survey by IT service provider CGS, about 75% of US Internet users prefer to return items in-store versus shipping them back. For retailers, BORIS creates a number of inventory management headaches – but also an opportunity to engage the customer once in the store to exchange the product instead of returning for refund, and while in the store they are likely to buy additional items. In the following sections, we will cover the BORIS retail strategies of key leading US retailers and highlight the challenges they face implementing and managing the offering.How BORIS Works

The BORIS model requires a reverse logistics pipeline, and retailers have to create parameters for what happens to online purchases returned in-store. Retailers can add returned online purchases to store inventory, ship to another store or return to a distribution center (DC). 1. Adding returned online purchases to store inventory. Returned products are sold in the store or used to fulfill buy online, pick up in store (BOPIS) orders. Macy’s says most of its stores quickly re-shelve returned items. Incorporating returned items into the store inventory is the least expensive and speediest option. This approach can also enhance in-store customer experience if store associates discover any items that are in-demand but unavailable at stores temporarily. The challenge is that stores often end up holding incongruent inventory shaped by what shoppers return, not by what shoppers are buying. Retailers may end up marking down products or having to incur costs to ship them to another store or DC. This approach also requires store associates to handle the products and return them to the shop floor, diverting them from more productive tasks such as engaging with customers. Some retailers deploy ship-from-store (SFS), which can speed the resale process. Best Buy uses an SFS delivery system with more than 1,000 stores to ensure it can fulfil orders for open-box products listed on its website. Open-box products are returned items that are inspected by the retailer, found to be in working order and resold at a discount. By leveraging its SFS capabilities, Best Buy has cut its average online delivery times by two days. 2. Ship to another store or DC. By shipping the returned items to another store or DC, retailers can reduce markdowns and manage store inventory more efficiently, while also ensuring store associates are not diverted from more productive tasks such as engaging with customers. This approach is particularly useful for specialist formats, which may have smaller backrooms and fewer store associates to handle and re-shelve returned items. As the assortment available online is much broader than the in-store, retailers may end up with inventory they do not need, requiring them to send returned items to another store or DC. The downside is the approach is not as cost-effective as incorporating returned items to in-store assortments due to shipping expenses, and resale may be delayed by the time it takes for the product to reach another store and be put back on the shelf or to a DC for online sale. There is also always the risk of items being damaged or lost in transit. Many retailers are not clear about the path returned products should follow through the reverse logistics pipeline. According to a JDA Software Group August 2017 survey of 252 US-based retail store managers, nearly 30% of store managers are unsure of what to do with the additional inventory received through BORIS — i.e., there is no clarity on whether to keep the extra inventory at the store, move it to other stores or return it to a DC.Key Things to Consider When Implementing BORIS

When integrating BORIS into omnichannel strategies, retailers should consider the following factors: 1. Integrate and ensure the accuracy of inventory systems. With BORIS, retailers need to track total inventory to find out how in-store and warehouse inventory is impacted by returned items. An integrated inventory system can help retailers determine the best path for returned products through the reverse logistics pipeline. Radio frequency identification (RFID) is one technology that has the potential to transform the way retailers track the location and movement of returned items. RFID can ensure quick inventory allocation, fast picking from the returns area and cross-docking. Many retailers, including Target and Macy’s, use RFID tags to track items during the return process, both in-store and in DC. RFID can provide in-store inventory accuracy (as measured by gross unit variance) up to 98%, according to SML-RFID, an RFID technology provider. Macy’s RFID tagging helped the company maintain its gross unit variance in a 2% to 4.5% range and to count items 30 times faster than using barcodes and scanners, according to a Platt Retail Institute analysis of Macy’s data in 2017. 2. Invest in technologies, such as order management systems. Managing reverse logistics is trickier than outbound shipments and retailers need fulfillment flexibility and network visibility to manage it properly. Order management systems (OMS) integrate point of sale (POS) terminals, online platforms, warehouse management systems and other systems to provide enterprise-wide visibility. By providing a full view of products, customers and sales order information across both online and offline channels, OMS can handle returns more effectively, especially high volumes. OMS also supports in-store organization and receipt-free returns. Through the OMS, returned items can be immediately re-inventoried in real-time and replaced on the shelf, ready for resale. Home Depot is one retailer that has been upgrading its order management system. In 2014, the company launched its first in-store implementation of a new customer OMS, designed for greater visibility of orders. In 2017, Home Depot replaced its legacy systems, including 10 different systems for servicing and managing orders, with the new Order Up system. Order Up consolidates these different systems into one user interface that requires minimal training and reduces associate time to sell and edit orders. In its 2018 annual report, Home Depot’s CEO Craig Menear said that Order Up had increased the overall productivity of associates. 3. Get the in-store operations right. The challenges associated with integrating online and physical stores are not just technological: Retailers need to define the customer experience before jumping into the functional requirements of BORIS. With a BORIS strategy, retailers must have clear policies, appropriate technology, dedicated in-store space and well-trained staff. An easy return process not only improves the shopper experience, it also creates opportunities to exchange instead of return or to make additional purchases. Conversely, poorly managed BORIS can frustrate customers and leave retailers with untracked inventory across the country. Getting it right from the start is key. The role of the store associate is key. With BORIS, stores will see a rise in customers, parcels and deliveries. Store associates will have to receive, track and store returned items for in-store restocking or transfer to a warehouse. Retailers must ensure that store associates are trained to handle in-store returns of online orders.Key Challenges Retailers Face in Managing BORIS

Supply chain management, increasing returns and extra costs are the most significant issues for retailers in implementing and managing BORIS: 1. Inventory/Logistics management. When managing BORIS, inventory visibility and logistics management become dramatically more complex, as are the systems that support it due to the way inventory is managed. Retailers cannot predict where customers will return, what they return, or how they will return. For example, a customer may buy furniture online but return it to a store that does not sell furniture; the retailer would have to be able to quickly move that furniture to a DC or another store that does sell furniture. Some retailers improvise their reverse supply chains, while others place conditions on in-store returns. For example, Macy’s lets customers return online Apple purchases only at stores that sell Apple products. Similarly, Macy’s Backstage items can be returned only at a Backstage store. 2. Additional Costs. The BORIS model requires an investment in IT development, support and maintenance. Retailers also have to find space to process and hold returns in the store. Then there is the opportunity cost of having staff working on returns rather than engaging with customers to drive in-store sales. Returned goods that cannot be put on store shelves incur cost being send to another store or DC. 3. Increasing product returns. According to an NRF survey in 2018, many retailers saw a jump in returns after implementing BORIS. The NRF study found about 38% of retailers reported an increase in BORIS returns in 2018, while nearly 93% of retailers said returns were the same or higher after BORIS. We believe some retailers may find it difficult to integrate and develop the underlying IT system quickly enough to manage rising in-store returns.In BORIS Deployment, US Retailers Marginally Trail Global Counterparts

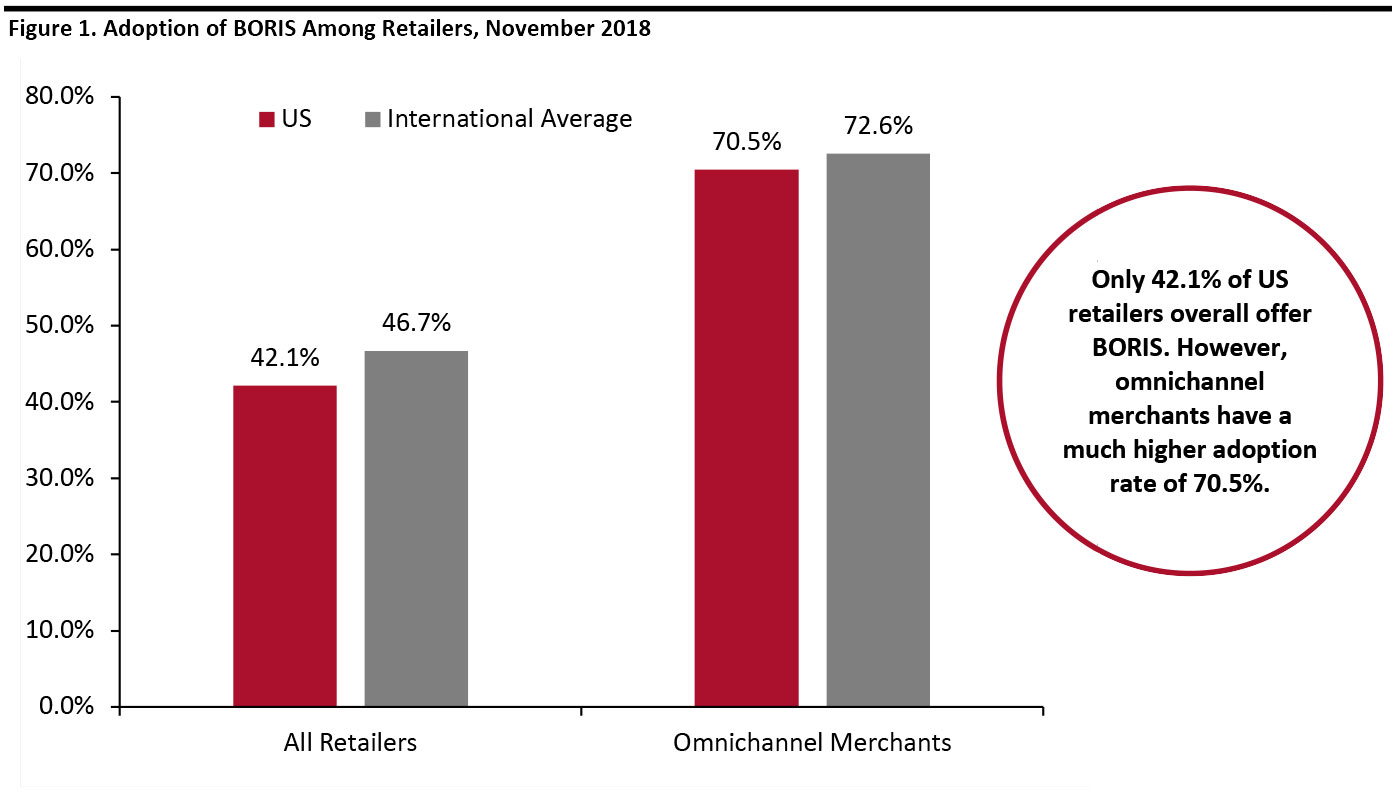

BORIS is gaining traction across the globe, and US retailers are behind their international counterparts – but not by much. Across all retail categories, 42.1% of US retailers offer BORIS versus the international average of 46.7%, according to a 2018 OrderDynamics survey of retailers in seven countries. The adoption rate is particularly high for omnichannel vendors, who outpaced other retailers. The OrderDynamics study found that 70.5% of US omnichannel retailers offer BORIS, compared to the international average of 72.6%. By retail sector, department stores are the largest BORIS providers in the US, with an adoption rate of 65.9%, followed by fashion retailers (at 52.3%) and footwear merchants (52.0%). The survey found electronics goods vendors were least likely to allow shoppers to return online purchased products in store, with only 23.8% of them offering a BORIS service in 2018. [caption id="attachment_96624" align="aligncenter" width="700"] Base: 2,000 international retailers, including a subset of 753 US retailers

Base: 2,000 international retailers, including a subset of 753 US retailers Source: OrderDynamics [/caption]

Factors Driving Adoption of BORIS Among Consumers and Retailers

For Consumers

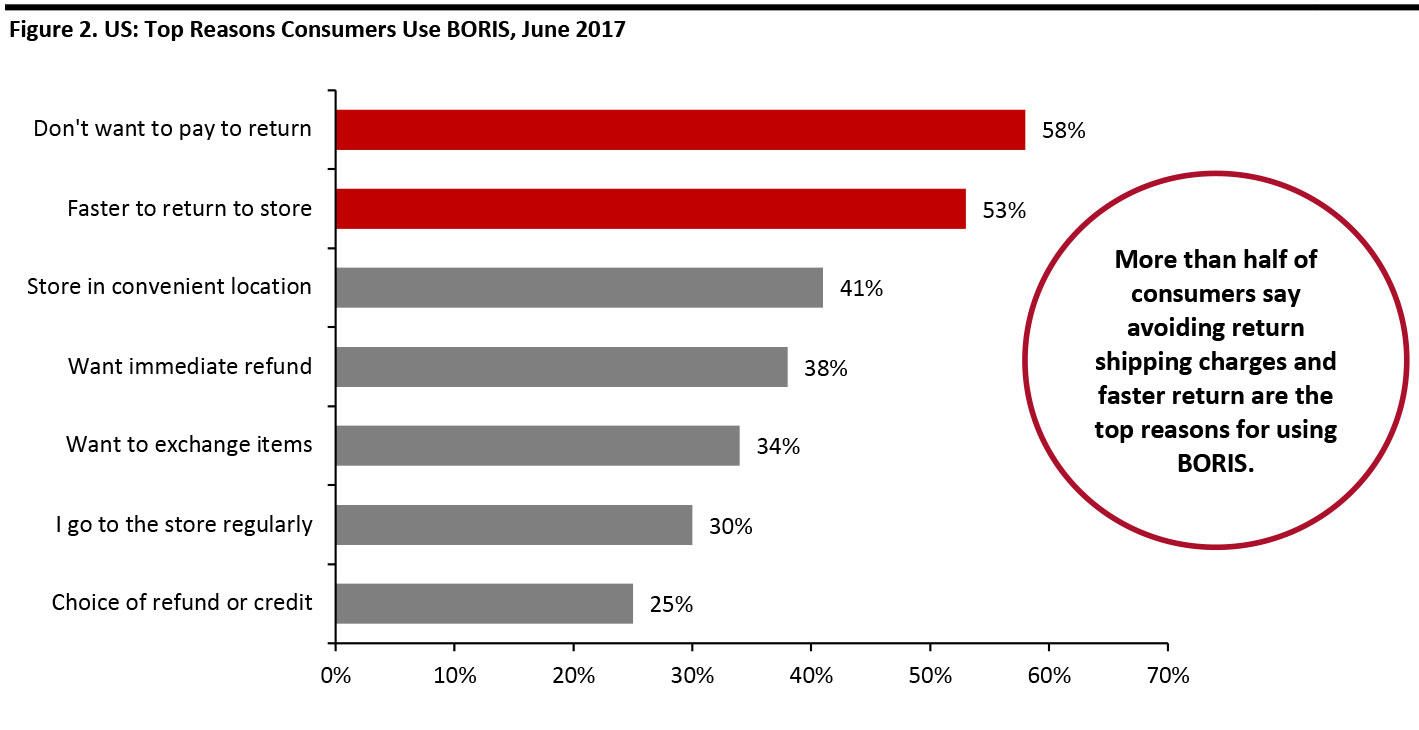

The main reasons shoppers use BORIS is to avoid paying to return something and greater speed, according to a 2017 UPS survey. That survey found 58% of consumers said they don’t want to pay to return an item bought online, and so prefer to return items to stores. Of those surveyed, 53% of buyers choose BORIS so they can return the items to the stores more quickly, while 41% say they use it as stores are more convenient. The study also revealed that 38% of shoppers return online orders in store to get an immediate refund, while 34% would return in-store to exchange items. Other reasons shoppers choose BORIS: They visit the store regularly anyway and in-store returns offer choices on refunds or credits. [caption id="attachment_96626" align="aligncenter" width="700"] Source: UPS [/caption]

Source: UPS [/caption]

For Retailers

BORIS is gaining traction as it offers the following key benefits: 1. Faster return and resale. In-store returns offer the fastest resale opportunity if the products can be placed on store shelves or packed for online order fulfillment. Faster resale supports fatter margins on returned goods. At the UBS Global Consumer and Retail Conference in March 2019, Nordstrom CFO Anne Bramman said BORIS led to faster returns to Nordstrom stores and it is helping the company improve average margins on the resale of returned products. 2. Higher store traffic and upselling opportunities. BORIS returns drive foot traffic, which in-turn drives incremental purchases. Instead of shipping an item back for refunds, shoppers returning in-store may exchange items for others or buy additional products. According to a 2018 Bell and Howell study, nearly 53% of shoppers make additional purchases when they return online ordered items in-store. With BORIS, omnichannel retailers can use their store estates to engage customers in a way online-only rivals cannot. To leverage the upselling opportunity created by BORIS, some retailers use mobile apps, coupons and push notifications. For example, Home Depot uses an enterprise mobile app that sends a push notification that highlights a new product line in a similar category, or offering discounts; this can create an additional path in the shopping journey, boosting shopper retention and increase revenues. 3. Save shipping costs. Instead of offering free returns by mail, which heaps shipping fees onto the retailer, BORIS saves on shipping costs. In-store return costs the retailers half compared to shipping back the returns, according to AlixPartners. When customers return products to stores, it costs retailers an average of $3 per package, compared to a $6 per return when shipped to a DC and $8 per return when returned to a third-party processor, according to AlixPartners. Savings are particularly high for expensive or bulky items, such as furniture or electronics. BORIS also reduces the risk of an expensive item return getting delayed or lost. 4. Build loyalty. BORIS offers retailers an opportunity to turn a customer’s negative experience — an unwanted purchase — into a positive one by satisfying the customer.Leading US Retailers’ BORIS Strategies

Below, we assess the BORIS offerings of key US retailers:

Walmart Number of return locations: 4,700. Category serviced: Grocery, general merchandise and others. Walmart offers an in-store return option for online orders at all its 4,700 stores. In addition to Walmart-sourced returns, the company also supports third-party returns. Walmart ships marketplace items back to sellers on the customer’s behalf and customers receive a refund from the seller. Walmart reinvented its in-store return process with the launch of the Mobile Express Returns app in December 2017. In the company’s press release, Daniel Eckert, SVP, Walmart Services and Digital Acceleration, said this was not the first time Walmart accepted online returns in-store but this new system promises a faster return experience. With the Mobile Express Returns app, shoppers can simply visit a nearby store, open the app at the Mobile Express Lane, select the items to be returned, scan a QR code and then hand over the items to the associate. The Mobile Express Returns app refunds the amount instantly so customers can use the refund in-store or for future purchases. As of February, mobile express returns have been used about 740,000 times for online purchases and cut transaction time 70%, from an average of five minutes to 92 seconds. Recently, Walmart announced a plan to allow customers to return items and get a refund at the front door of its stores to make the process even more convenient: Shoppers don’t have to walk to a customer desk inside the store. [caption id="attachment_96628" align="aligncenter" width="700"] Walmart’s Mobile Express Returns Lanes

Walmart’s Mobile Express Returns Lanes Source: Walmart [/caption] Kohl’s Number of return locations: 1,150. Category serviced: Grocery, apparel and others. Like Walmart, Kohl’s offers BORIS at all its stores. In 2017, the company took a bold step by partnering with Amazon to accept returns of Amazon merchandise at 100 Kohl’s stores. Under the terms of the partnership, if the customers come to Kohl’s to return Amazon items but do not have a receipt, they get credit at Kohl’s, not Amazon. Most people returning products also get a coupon offering a 25% discount on any product bought at Kohl’s. Amazon customers may not have shopped at Kohl’s before or may not be planning to buy anything after returning their Amazon package, but the coupon from Kohl’s may entice them to browse. The pilot program was successful: Foot traffic at the Kohl’s stores participating in the Amazon returns program averaged 13.5% higher than others, according to CNN. Earnest Research analysis of payment data show the partnership led to a 9% rise in new Kohl’s customers and an 8% increase in revenues. On July 9, Kohl’s rolled out the Amazon returns program to all its 1,150 stores nationwide and said the partnership would start benefiting the company from the second half of 2019. Kohl’s management believes this is a highly complementary – and breakthrough – program. Kohl’s will invest in logistics and additional staffing to support the end-to-end returns process. [caption id="attachment_96629" align="aligncenter" width="700"]

Source: Kohl's[/caption]

Home Depot

Number of in-store return locations: 2,200.

Category serviced: Home appliances, furniture and others.

Home Depot launched its BORIS offering in 2011 and now offers the service at all its 2,200 locations. Nearly 85% of items ordered online are now returned in-store – which enabled the company to cut shipping and postage costs associated with its online operations.

Home Depot is one retailer that has successfully integrated its inventory systems. At SMC3’s Jump Start conference in March 2018, Home Depot senior director of reverse logistics Sarah Galica said the company has three returns centers and that it optimizes labor and reduces transportation costs by combining shipments.

In December 2017, the company announced the “One Home Depot” plan, which aims to sharpen its omnichannel retail strategy by overhauling stores, improving e-commerce capabilities and revamping distribution, among others. Home Depot announced that it plans to spend $5.4 billion in the next three fiscal years on its “One Home Depot” plan. We believe these investments will boost its overall omnichannel capabilities, including BORIS.

Nordstrom

Number of return locations: 115 full-line stores and three Nordstrom Locals.

Category serviced: Apparel, toys and cosmetics, among others.

Nordstrom allows customers to return online purchases at all its locations. The company has also installed express return kiosks at select stores to make returns even easier. Though the company provides free shipping, about 60% of its full-price customers return online orders at a Nordstrom store. At the Goldman Sachs Global Retailing Conference in September 2018, the company’s CFO Anne Bramman said in-store returns enable quicker sell-through on that inventory and reduce markdowns of some of the items, especially perishable products.

In April, Nordstrom joined the Narvar Concierge platform for Nordstrom Local stores and four Nordstrom stores in California. With this partnership, in addition to Nordstrom’s existing in-store return options, shoppers can return online orders at a Narvar Concierge location. The partnership will help Nordstrom better meet customer demand for more choice and convenience without investing in Nordstrom’s physical footprint.

Recently, Nordstrom entered into a partnership with Rent the Runway, the apparel rental subscription service provider, so Rent the Runway customers can return rented clothes at four Nordstrom locations in Los Angeles, including three Nordstrom Locals and one full-size location – a move likely to further boost foot traffic.

Source: Kohl's[/caption]

Home Depot

Number of in-store return locations: 2,200.

Category serviced: Home appliances, furniture and others.

Home Depot launched its BORIS offering in 2011 and now offers the service at all its 2,200 locations. Nearly 85% of items ordered online are now returned in-store – which enabled the company to cut shipping and postage costs associated with its online operations.

Home Depot is one retailer that has successfully integrated its inventory systems. At SMC3’s Jump Start conference in March 2018, Home Depot senior director of reverse logistics Sarah Galica said the company has three returns centers and that it optimizes labor and reduces transportation costs by combining shipments.

In December 2017, the company announced the “One Home Depot” plan, which aims to sharpen its omnichannel retail strategy by overhauling stores, improving e-commerce capabilities and revamping distribution, among others. Home Depot announced that it plans to spend $5.4 billion in the next three fiscal years on its “One Home Depot” plan. We believe these investments will boost its overall omnichannel capabilities, including BORIS.

Nordstrom

Number of return locations: 115 full-line stores and three Nordstrom Locals.

Category serviced: Apparel, toys and cosmetics, among others.

Nordstrom allows customers to return online purchases at all its locations. The company has also installed express return kiosks at select stores to make returns even easier. Though the company provides free shipping, about 60% of its full-price customers return online orders at a Nordstrom store. At the Goldman Sachs Global Retailing Conference in September 2018, the company’s CFO Anne Bramman said in-store returns enable quicker sell-through on that inventory and reduce markdowns of some of the items, especially perishable products.

In April, Nordstrom joined the Narvar Concierge platform for Nordstrom Local stores and four Nordstrom stores in California. With this partnership, in addition to Nordstrom’s existing in-store return options, shoppers can return online orders at a Narvar Concierge location. The partnership will help Nordstrom better meet customer demand for more choice and convenience without investing in Nordstrom’s physical footprint.

Recently, Nordstrom entered into a partnership with Rent the Runway, the apparel rental subscription service provider, so Rent the Runway customers can return rented clothes at four Nordstrom locations in Los Angeles, including three Nordstrom Locals and one full-size location – a move likely to further boost foot traffic.

The “Try Before You Buy” Model is Also Gaining Traction

Try before you buy (TBYB) programs let customers order and try multiple items before committing to purchase. The TBYB model is gaining popularity among online apparel retailers, such as Stitch Fix and Trunk Club. Amazon launched Prime Wardrobe in 2017, which allows its Prime members to order a few clothing items and try them on before deciding which to keep and which to return. Amazon offers free shipping both ways and customers have seven days to decide. Most TBYB programs focus on apparel, but retailers from other verticals are also leveraging this model. For instance, Warby Parker sends five frames of eyeglasses to customers to try, with five days to decide to purchase or return. TBYB has the potential to lift sales for retailers, but it also creates a surge in return rates (as that is part of the model) and shipping costs. A 2018 study from omnichannel retail software provider Brightpearl revealed that US shoppers return an average of 3.95 more items each month with TBYB.In Addition to BORIS, US Retailers are Taking Measures to Curb Product Returns

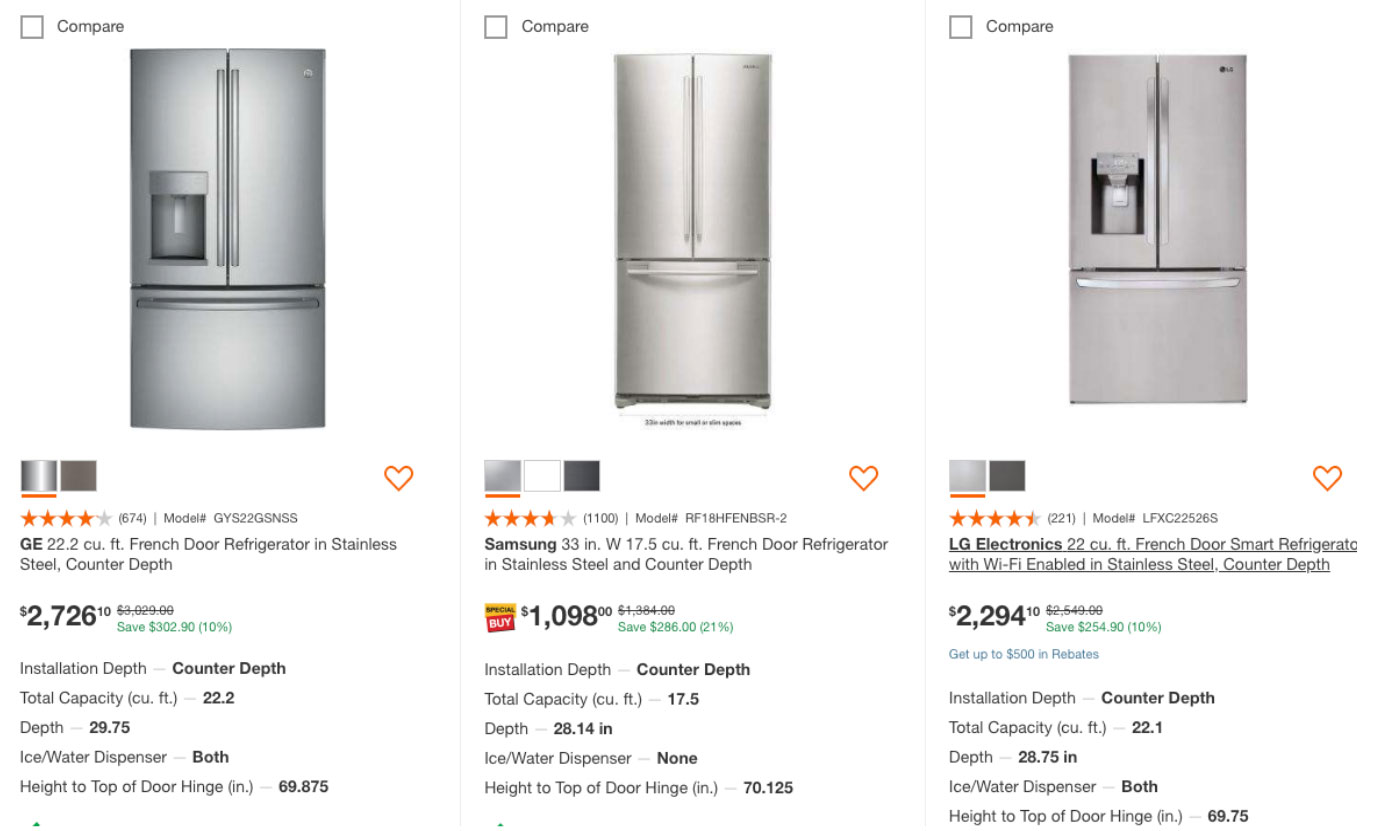

According to the NRF 2018 organized Retail Crime survey, total product returns accounted for about $369 billion in lost sales for US retailers in 2018. Of the total returns, $24 billion were attributed to fraud and abuse. The survey found that 86% of the BORIS retailers saw the same or more fraud in 2018 versus prior year. The cost of reverse logistics is about 1.5 times that of outbound shipments, according to e-commerce logistics provider iThink Logistics, and returns negatively impact margins. Many retailers recover only 15 to 30 cents on the dollar for returns, given the challenges of processing and returning them to the best market economically, according to Tobin Moore, CEO of returns technology provider Optoro. To drive down online purchase returns, retailers are taking various measures, such as ensuring product listings are thorough and accurate, improve product display, incorporating fitting technology, making customer reviews more visible and being more diligent on quality control. Home Depot has worked to enhance its online offering to better manage returns, for example by offering detailed technical information on each product, key data, selling points and even a comparison table. The company also allows shoppers to ask questions about products, which are displayed on product pages. Retailers are also leveraging AR and VR technology to enhance sales and reduce return rates. In late 2018, Macy’s partnered with Marxent, a 3D product visualization company, to roll out VR installations in 70 Macy’s stores nationwide. VR-influenced furniture sales grew more than 60% in the pilot stores compared to their non-VR counterparts. Returns fell to less than 2%. Some online retailers offer financial incentives to discourage returns. For instance, Jet.com offers a lower price if the shopper opts out of the free return policy. [caption id="attachment_96630" align="aligncenter" width="700"] Home Depot product page displays key data in the comparison table

Home Depot product page displays key data in the comparison table Source: Home Depot [/caption]