Saumya Sharma

Introduction

The global payment environment is facing rapid change as innovative new companies and technologies change the way consumers purchase goods. The last couple of years have seen an explosion of innovations in the financial services landscape. New, alternative digital payment platforms are shaking up the online payments industry, and playing an increasingly dominant role in the sector. One of those innovations gaining traction is buy now, pay later services – which enable shoppers to split purchase payments into several zero-interest payment installments. This up-and-coming segment of the payment industry is in its early stage, yet represents a large and growing opportunity. In this report, we present an analysis of key trends and growth drivers in this alternative payment space. We begin with five insights from the report.Five Key Insights

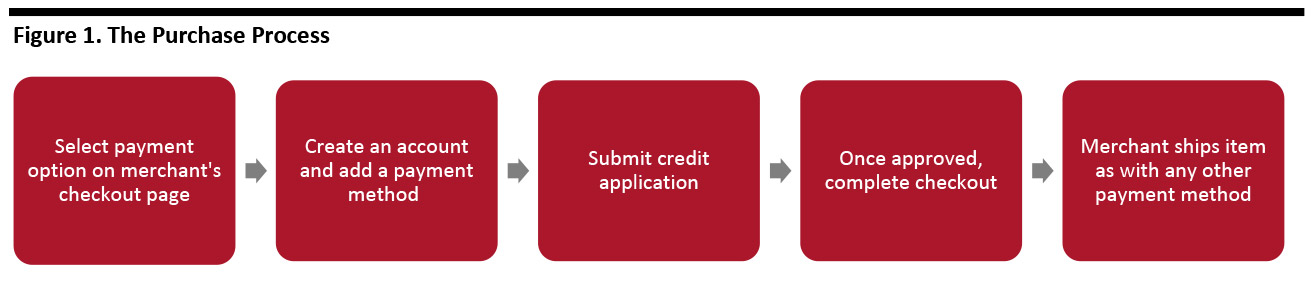

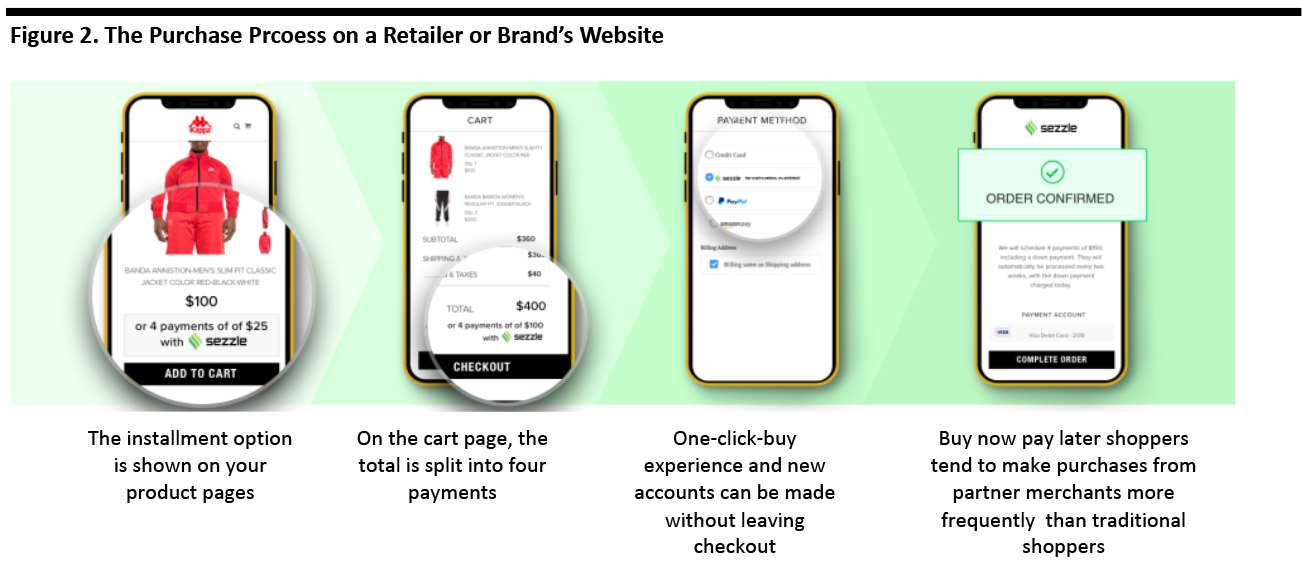

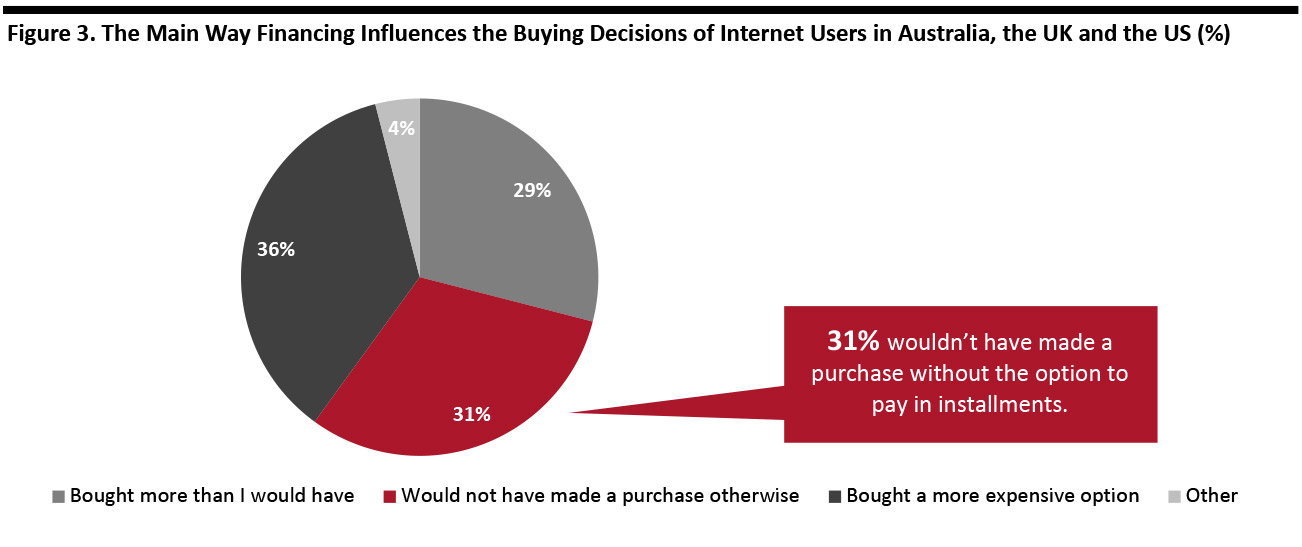

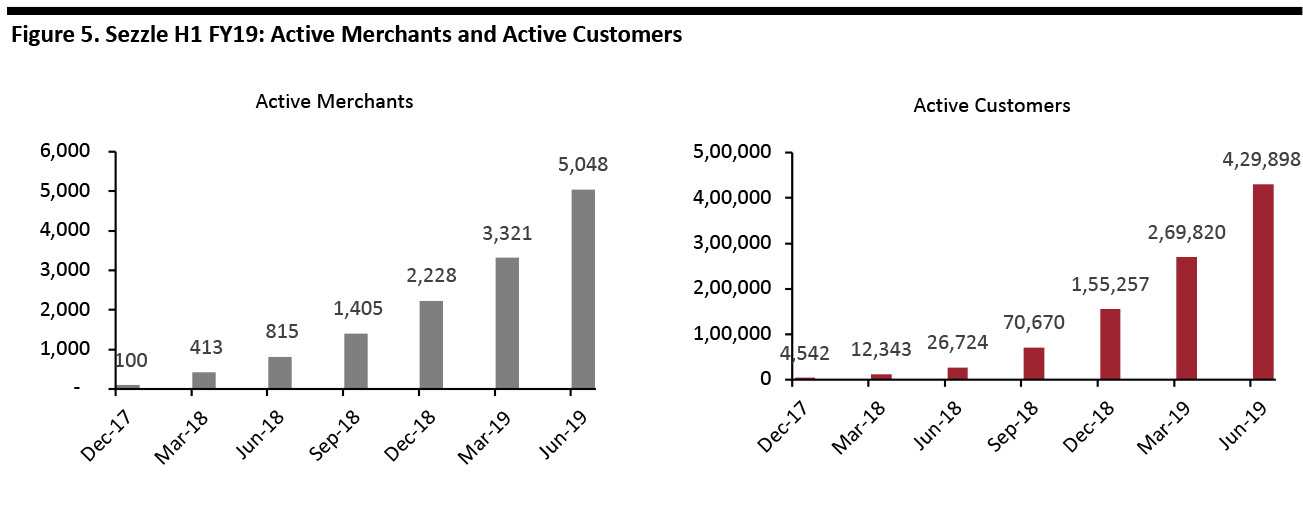

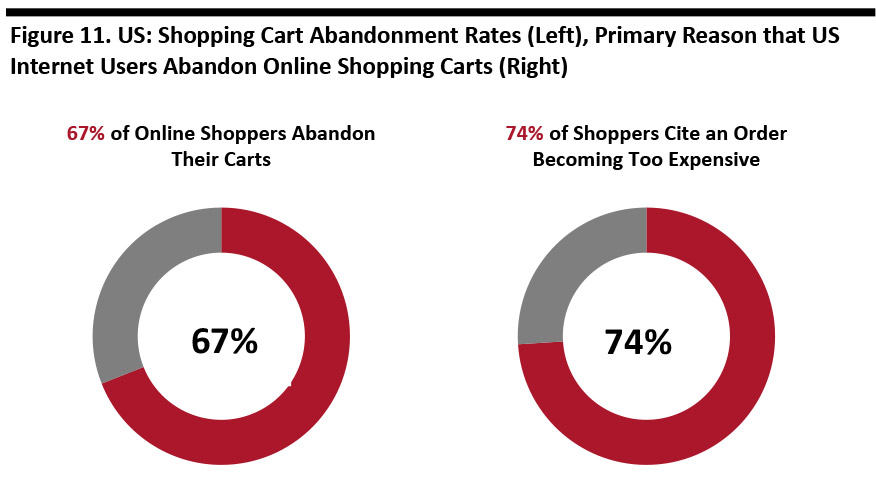

1. Alternative Payment Platforms Are Experiencing Rapid Growth Layaway programs are well established in the retail industry, but now new financing models are gaining popularity. Alternative payment platforms — particularly those that focus on zero-interest payments — are popping up at checkout across the internet. A number of factors are driving this growth: added flexibility that shoppers have become accustomed to; convenience; fast and easy approval process; fee-free; often interest-free; falling credit card adoption rates among younger consumers. 2. Growth is Led by Zero-Interest Buy Now, Pay Later Platforms Leading companies such as Sezzle, Affirm, Klarna, Afterpay and Splitit have seen robust growth: Afterpay reported 4.6 million active customers at end of FY19, up 110% year over year, with 6,500 US merchants currently using the platform. Sezzle reported active merchants of 5,048 in June 2019, up 52% from the prior quarter while adding 16,000 new customers a week. 3. Millennials and Young Shoppers Lead Adoption The timing for these new services may be a product of another major trend in payments: the gradual decline of the credit card. Adoption rates for credit cards are falling off among younger Americans: Just one out of three millennials own a credit card, according to a Bankrate survey. As a result, these services have found appeal among 18-35 year-old shoppers (millennials and Gen Zers), as they provide an alternative financing option to credit cards. This is compelling, particularly as credit is a rising issue for those under the age of 35 and younger consumers have become accustomed to getting what they want when they want. 4. Buy Now, Pay Later Financing is Influencing Shoppers’ Willingness to Purchase Buy now, pay later services are influencing shoppers’ willingness to make a purchase: 35% of shoppers would be more likely to make a purchase online if offered the ability to pay in interest-free monthly installments and 47% say interest-free credit is the most important factor when choosing an installment plan, according to a July 2018 survey by alternative payment provider Splitit. 5. Merchants Benefit from Increasing Average Order Value and Transaction Volume One of the major reasons merchants are adopting buy now, pay later services is to reduce shopping cart abandonment and increase conversion. According to research firm Baymard Institute, the average online shopping cart abandonment rate in the US was 69% in 2018 — mobile rates are even higher, with some estimates at 80%. Nearly three-quarters of US Internet shoppers cited an order becoming too expensive as a top reason for abandoning a cart. Offering shoppers a convenient option to split payments at checkout can reduce or discourage customers from abandoning their carts before checking. Sezzle says its partners have seen checkout conversations increase 38.7% for first time visitors and customer basket increasing by up to 50%. How Does Buy Now, Pay Later Work? Buy now, pay later services offer shoppers the ability to split a purchase into several interest-free installments over a pre-determined period. There’s typically no additional fee charged to the shopper and they only have to pay a portion of the transaction (typically 25% of total transaction value) at the time of the purchase. The provider pays the merchant upfront, typically around 95% of the purchase price. The retailer pays a 4-6% processing fee for each transaction. The provider then collects the payments from the shoppers – and assumes the risk. Failure to repay on time can incurs late fees – sometimes as much as 25% of the total order value. [caption id="attachment_97323" align="aligncenter" width="700"] Source: Coresight Research[/caption]

To purchase an item, shoppers go through an approval process. The shopper selects the payment option on the merchant’s checkout page, links the preferred payment method then is prompted to create an account and apply. Many solutions rely on traditional credit checks, while some models also leverage a myriad of data, such as the product’s repayment history, demographic data and the shoppers’ history using the platform. These credit risk assessments are often completed within minutes.

Unlike traditional credit issuers, many alternative payment providers do not charge interest and instead make the bulk of their income from service fees paid by participating merchants. These payment solutions are offered across online, mobile and in-store channels. Today, the majority of buy now, pay later transactions are via e-commerce.

[caption id="attachment_97324" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

To purchase an item, shoppers go through an approval process. The shopper selects the payment option on the merchant’s checkout page, links the preferred payment method then is prompted to create an account and apply. Many solutions rely on traditional credit checks, while some models also leverage a myriad of data, such as the product’s repayment history, demographic data and the shoppers’ history using the platform. These credit risk assessments are often completed within minutes.

Unlike traditional credit issuers, many alternative payment providers do not charge interest and instead make the bulk of their income from service fees paid by participating merchants. These payment solutions are offered across online, mobile and in-store channels. Today, the majority of buy now, pay later transactions are via e-commerce.

[caption id="attachment_97324" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Does Buy Now, Pay Later Affect Consumer Credit?

Some merchants that offer buy now, pay later financing perform a “soft” credit check. In that case, there will not be a credit check or an inquiry on the consumer’s credit report. If the service reports to a credit bureau (Equifax, Experian or TransUnion), on-time payments may help the shoppers’ credit score while late payments may cause the score to drop.

The Difference From Traditional Layaway Programs

Under a traditional layaway program, a customer makes a deposit on a product and completes payment over a fixed period. The retailer sets aside the product and the customer must wait until payments are completed to own the item. With buy now, pay later, shoppers receive the product as if it was a traditional purchase. Merchants also benefit from being able to move products out of inventory more quickly.

Source: Coresight Research[/caption]

Does Buy Now, Pay Later Affect Consumer Credit?

Some merchants that offer buy now, pay later financing perform a “soft” credit check. In that case, there will not be a credit check or an inquiry on the consumer’s credit report. If the service reports to a credit bureau (Equifax, Experian or TransUnion), on-time payments may help the shoppers’ credit score while late payments may cause the score to drop.

The Difference From Traditional Layaway Programs

Under a traditional layaway program, a customer makes a deposit on a product and completes payment over a fixed period. The retailer sets aside the product and the customer must wait until payments are completed to own the item. With buy now, pay later, shoppers receive the product as if it was a traditional purchase. Merchants also benefit from being able to move products out of inventory more quickly.

Buy Now, Pay Later Financing Influences Purchase Decisions

Buy now, pay later services are influencing shoppers’ willingness to make a purchase. This payment option tends to encourage higher-ticket purchases, such as electronics, furniture and luxury fashion products. In July 2018, alternative payment provider Splitit surveyed 1,000 US respondents aged 18 and above. This is what the survey found:- 35% of consumers would be more likely to make a purchase online if offered the ability to pay in interest-free monthly installments.

- 47% of respondents said interest-free credit would be the most important factor when choosing to use an installment plan.

- 83% of online shoppers say the fear of overspending or losing control of their cash flow would deter them from making an expensive online purchase.

Note: ages 18+.

Note: ages 18+. Source: BigCommerce, “2018 Omnichannel Buying Report” conducted by SurveyMonkey, Oct 24, 2018 [/caption]

The Landscape: Leading Global Players

Across Europe, US and Australia, some of the leading alternative payment providers include Swedish firm Klarna, US firm Sezzle and Australian firm Afterpay. These firms are partnering with hundreds of merchants and have made the new payment option available to millions of customers. Below, we outline some of the leading alternative payment service companies serving the retail space: [caption id="attachment_100453" align="aligncenter" width="700"] Source: Coresight Research/Company Websites[/caption]

Source: Coresight Research/Company Websites[/caption]

Sezzle

Sezzle is leading the payment trend in the US. The company reported 496,307 active customers, up 15% from the previous month, and over 5,800 active merchants (as of July 2019). According to company reports:

Sezzle

Sezzle is leading the payment trend in the US. The company reported 496,307 active customers, up 15% from the previous month, and over 5,800 active merchants (as of July 2019). According to company reports:

- Underlying merchant sales rose to $41.9 million by the end of the June quarter, up 48% from $28.3 million from the prior quarter.

- Merchant fees (as a proxy for revenue) were $2.1 million, up from $1.4 million from the prior quarter.

- Its service accounts for over 10% of sales for most of its merchant partners and has had success with small and medium-sized companies to date.

- Target recently announced that Sezzle would be among the nine retail-focused startups to participate in the METRO Target Retail Accelerator.

- Sezzle made its debut on the Australian Stock Exchange (ASX) in July 2019.

- Sezzle announced expansion into Canada in a partnership with retailing giant Kappa Sportswear.

- Sezzle announced an integration with Visa’s CyberSource platform.

Source: Sezzle ASX Release[/caption]

Source: Sezzle ASX Release[/caption]

- Existing multi-channel retail partnering adopting the in-store payment option. The company reported sales through its platform in Australia and New Zealand of $4.3 billion, with in-store sales exceeding $1 billion, or 21% of the regions sales in the second half of FY19.

- A combination of new customers, growing at an average of 12,500 per day, repeat customer activity and new merchant adoption.

- Active merchants participation doubled during the FY19 period, reflecting more partnerships with larger enterprise retailers and small and medium-sized companies.

- Strong growth in new markets including US and UK. US sales reached almost $1 billion in first year of operation with over 6,500 merchants.

- On-time payments: 80% of its community has never incurred a late fee and 93% of purchases are paid on time.

- Strategic partnership with VISA to support future expansion and platform innovation in the US.

- Has 60 million consumers across 130,000 merchants in 13 countries.

- Is working with top retail brands such as Adidas, H&M, IKEA, Zara, Wish.com and Sephora.

- Is offering businesses a “try before you buy” option, allowing shoppers up to 30 days to decide on an item after its delivered.

Affirm

San Francisco-based Affirm was one of the early entrants in the industry. Shoppers can use Affirm for purchases ranging from $200 to $2,000, primarily focused on larger ticket items over $1,000, such as mattresses and furniture. The payment option is available both in-store and online, and the loan occurs through the retailers.

Affirm

San Francisco-based Affirm was one of the early entrants in the industry. Shoppers can use Affirm for purchases ranging from $200 to $2,000, primarily focused on larger ticket items over $1,000, such as mattresses and furniture. The payment option is available both in-store and online, and the loan occurs through the retailers.

- Flexible loan scheduling for 3, 6, 9 or 12 months.

- Interest on purchases ranges from 10% to 30%.

- Allows only debit and check payment for loans and allows customers to pay early with no fees or penalties.

- Shoppers who do not pay on time with Affirm can have their credit score negatively impact.

Splitit

Splitit offers customers the option to split payments into interest-free, monthly installments when shopping online, via mobile phone or in store.

Splitit

Splitit offers customers the option to split payments into interest-free, monthly installments when shopping online, via mobile phone or in store.

- Splitit doesn’t require the customer to set up an account or download an app. Everything is handled between the retailer and Splitit, no separate intermediate step is required by the customer.

- Splitit offers flexible payment schedules with the option to divide a purchase into even smaller payments, from 12 to 36 months.

Millennials and Young Shoppers Lead Adoption

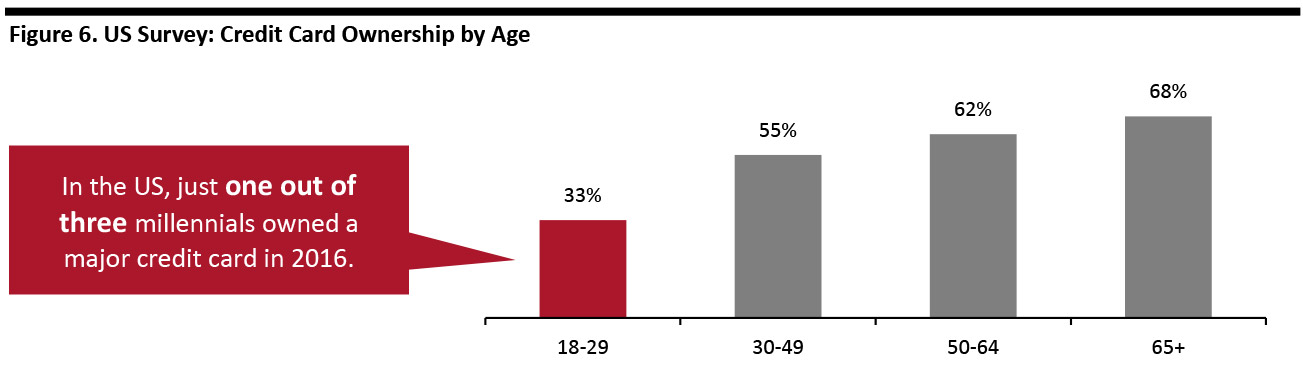

Younger shoppers – specifically Gen Zers and millennials – have gravitated towards new financing options more than older generations. There are many underlying factors driving this, such as the credit crisis of 2008, mounting student loan debt and regulatory changes that made it more difficult for credit card companies to extend offers to those under the age of 21. In the US, just one out of three millennials owned a major credit card in 2016, according to Bankrate’s survey. [caption id="attachment_97330" align="aligncenter" width="700"] The survey was conducted May 19-22, 2016, by Princeton Survey Research Associates International and included responses from 1,002 adults living in the continental US

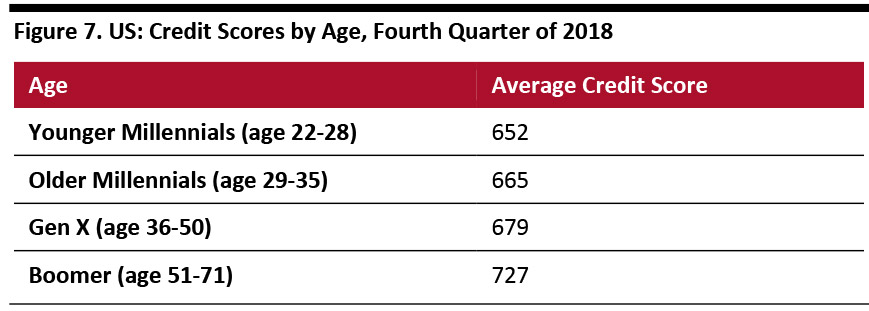

The survey was conducted May 19-22, 2016, by Princeton Survey Research Associates International and included responses from 1,002 adults living in the continental US Source: Bankrate Money Pulse Survey [/caption] According to the aforementioned Splitit survey, one in four millennials are most concerned with the possibility of damaging credit scores when shopping online. Consumers with lower credit scores are more likely to search for alternative financing options. US millennials had an average FICO score of 665 in the fourth quarter of 2018, compared with a national average of 701, according to credit rating agency Experian. Credit scores between 660-719 are average and scores between 620-659 are considered poor. [caption id="attachment_97331" align="aligncenter" width="700"]

Source: Experian[/caption]

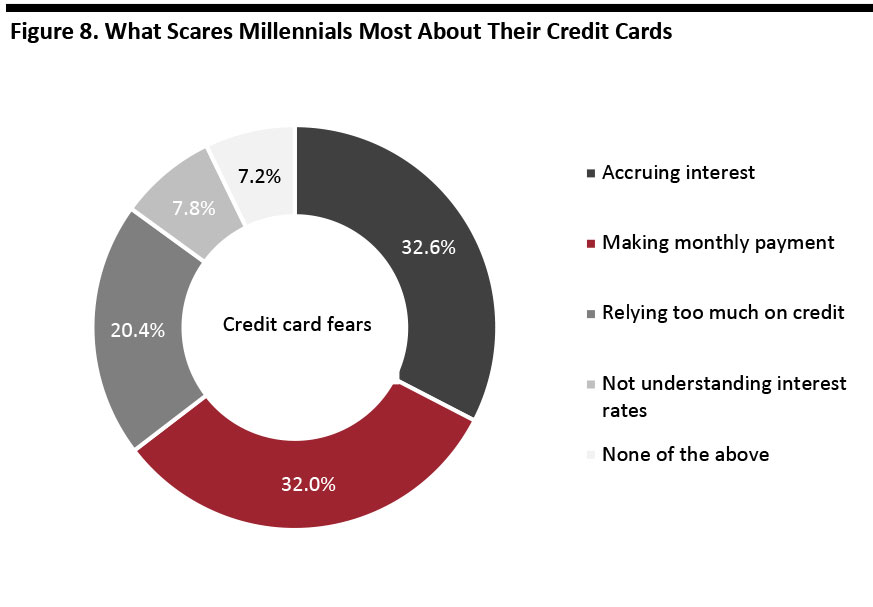

According to a survey by Credible of 500 consumers aged 18-34 who carry credit card debt, the average credit card balance among respondents was $5,290, with nearly one in five saying they needed to rely on their credit card(s) to supplement their monthly income. The survey found millennials with credit card debt find their debt to be scarier than climate change, the threat of war – and even dying.

Millennials found the disconcerting aspects of their credit card debt to be the fear of accruing interest (32.6%) and making their monthly payments (32%). Credible.com lets users compare student loans from vetted lenders.

[caption id="attachment_97358" align="aligncenter" width="700"]

Source: Experian[/caption]

According to a survey by Credible of 500 consumers aged 18-34 who carry credit card debt, the average credit card balance among respondents was $5,290, with nearly one in five saying they needed to rely on their credit card(s) to supplement their monthly income. The survey found millennials with credit card debt find their debt to be scarier than climate change, the threat of war – and even dying.

Millennials found the disconcerting aspects of their credit card debt to be the fear of accruing interest (32.6%) and making their monthly payments (32%). Credible.com lets users compare student loans from vetted lenders.

[caption id="attachment_97358" align="aligncenter" width="700"] Base: 500 adults aged 18-34 who have credit card debt

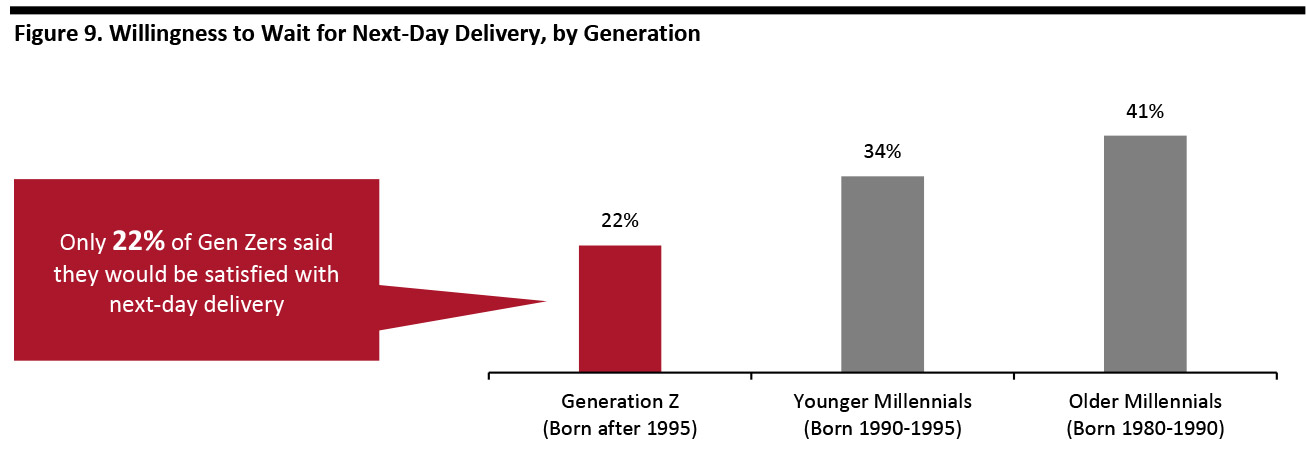

Base: 500 adults aged 18-34 who have credit card debt Source: Credible.com [/caption] The buy now, pay later customer tends to be under 35 – and therefore far less likely to make purchases using credit cards, so it shouldn’t be a surprise that these shoppers look for non-credit card options. Afterpay says 85% of its customers use debit cards to pay, and the average age of an Afterpay customer is 33. Sezzle targets a similar cohort of 18-35-year-old shoppers, those without credit cards and those with low credit limits. Younger Shoppers Demand Immediacy Modern young consumers increasingly demand immediacy in many areas of their lives. As they have become accustomed to getting what they want when they want it, they’re turning to new layaway programs to buy items immediately. This trend is evident in younger shoppers’ expectations for fast delivery of online orders. Same-day delivery is high on the priority list for Gen Zers, with 34% saying they prefer same-day delivery, according to a 2017 Accenture survey of 10,000 consumers in 13 markets. Only 22% of Gen Zers said they would be satisfied with next-day delivery, compared to 41% of older millennial customers born 1980-1990 who are willing to wait for next-day delivery. [caption id="attachment_97333" align="aligncenter" width="700"]

Source: Accenture<>/em[/caption]

Category Usage: Millennials Favor Fashion and Electronic Categories

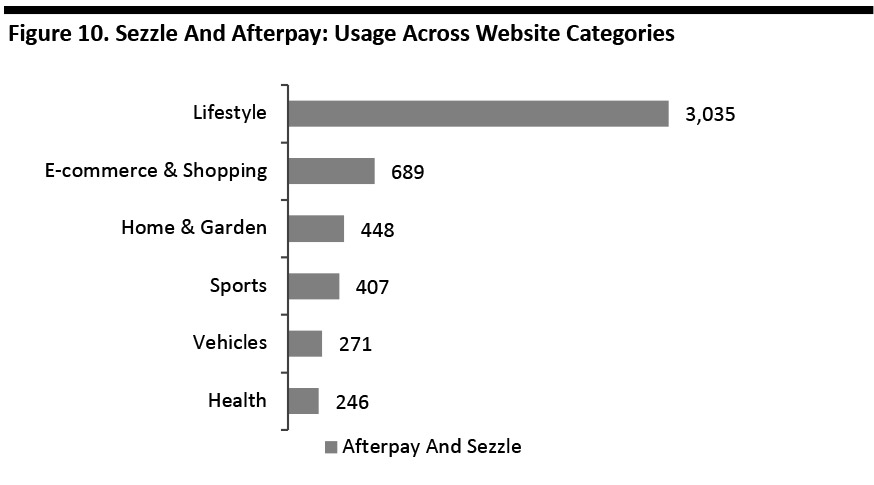

Sezzle and Afterpay have penetrated several website categories. Below, we look at the website categories offering these services, according to sales insights platform SimilarTech:

[caption id="attachment_97334" align="aligncenter" width="700"]

Source: Accenture<>/em[/caption]

Category Usage: Millennials Favor Fashion and Electronic Categories

Sezzle and Afterpay have penetrated several website categories. Below, we look at the website categories offering these services, according to sales insights platform SimilarTech:

[caption id="attachment_97334" align="aligncenter" width="700"] Source: SimilarTech[/caption]

Source: SimilarTech[/caption]

Factors Driving Buy Now, Pay Later Merchant Adoption

The momentum in merchant adoption of buy now, pay later services has been supported by several benefits it offers. Reduces Cart Abandonment and Increases Conversion One of the major reasons merchants are adopting buy now, pay later services is to cut shopping cart abandonment — which represents a major gap in potential conversions. According to research firm Baymard Institute, the average online shopping cart abandonment rate in the US was 69% in 2018. Mobile rates are even higher, with some estimates at 80%. This is a pain point for e-commerce retailers, adding up to more than $4 trillion a year in lost sales. [caption id="attachment_97335" align="aligncenter" width="700"] (Left): Value is calculated based on 41 different studies containing statistics on e-commerce shopping cart abandonment

(Left): Value is calculated based on 41 different studies containing statistics on e-commerce shopping cart abandonment Source: Baymard Institute/Content Square [/caption] Nearly three-quarters of US Internet shoppers cited an order becoming too expensive as a top reason for abandoning a cart. Offering shoppers a convenient option to split payments at checkout can reduce or discourage customers from abandoning their carts before checking out and increase conversion:

- Sezzle says its partners have seen checkout conversations increase 38.7% for first time visitors. Reducing “sticker shock” of a one-time purchase reduces cart abandonment.

- Afterpay says it can increase sales and conversion rates from 20-30% for its brand partners.

- 67% of shoppers said they would be more likely to make bigger purchases, such as large electronics or furniture, if they were able to pay in monthly installments.

- Nearly 25% of online shoppers stated the option of interest-free monthly installment payments would encourage them to increase the size of their purchase – but only 4% would do so for standard consumer financing options.

- Pay one lump sum up to 30 days after purchase.

- Pay in three equal monthly installments.

- Pay across a six-to-26-month payment plan, for higher-cost items.

Countries Leading Buy-Now-Pay-Later Adoption

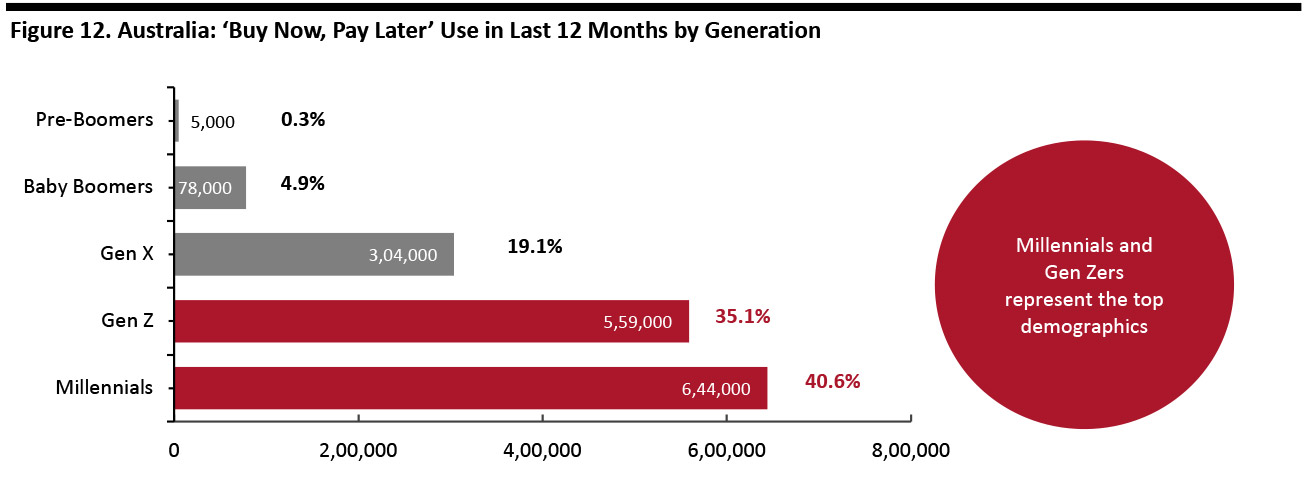

Australia: Buy Now, Pay Later is Booming: Millennials and Gen Zers Dominate Buy now, pay later services are gaining significant momentum among Australian consumers, in part thanks to more shopping taking place online and in part due to the growing availability of these services. Total Australian online retail sales reached $21.3 billion in 2018, up 18.7% from 2017, according to Australia Post’s 2018 Inside Australian Online Shopping report. The national postal service provider’s report estimates that buy now, pay later services accounted for 7.7% ($1.6 billion) of total online goods spend. According to a 2018 survey of over 50,000 Australian consumers by research firm Roy Morgan, in the 12 months to January 2019, 1.59 million Australians used one of the latest buy now, pay later digital payment methods, with millennials making up the largest share. The following chart shows millennials account for 40.6% of buy now, pay later users, followed by Gen Zers with 35.1%. These two generations combined account for over three quarters (75.7%) of the market or 1.2 million consumers. [caption id="attachment_97336" align="aligncenter" width="700"] Base: 51,036 Australian consumers 14 and above, surveyed in February 2018 – January 2018 Gen Z (1991-2005); Millennials (1976-1990); Gen X (1961-1975); Baby Boomers (1946-1960); Pre-Boomers (<1946)

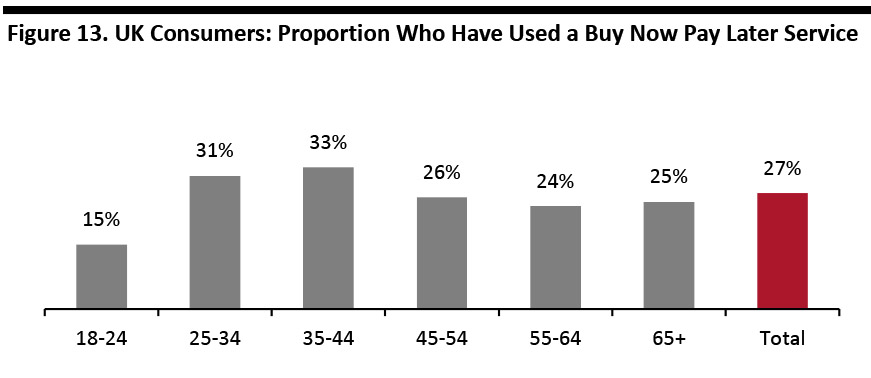

Base: 51,036 Australian consumers 14 and above, surveyed in February 2018 – January 2018 Gen Z (1991-2005); Millennials (1976-1990); Gen X (1961-1975); Baby Boomers (1946-1960); Pre-Boomers (<1946) Source: Roy Morgan [/caption] The study found fashionshoppers were among those most keen to use buy now, pay later services, with 57% of buy now, pay later purchases being fashion-related, while 10% of beauty transactions were made using buy now, pay later platforms. Afterpay says its buy now, pay later services account for about 25% of total transactions of the retailers it works with in Australia. UK and US Markets In the UK, companies such as Very.co.uk, Argos and PayPal credit are proving very popular with consumers and offering variations on the buy now, pay later theme. Some grant six months to pay before interest kicks in and others offer installment payment terms. A recent survey of consumers in the UK by RFi Group shows that more than one in four consumers has used a buy now, payer later service, making it one of the most developed markets globally. [caption id="attachment_97337" align="aligncenter" width="700"]

Base: 2,000 consumers and 200 small-to-medium sized businsses (SMEs), surveyed in 2018

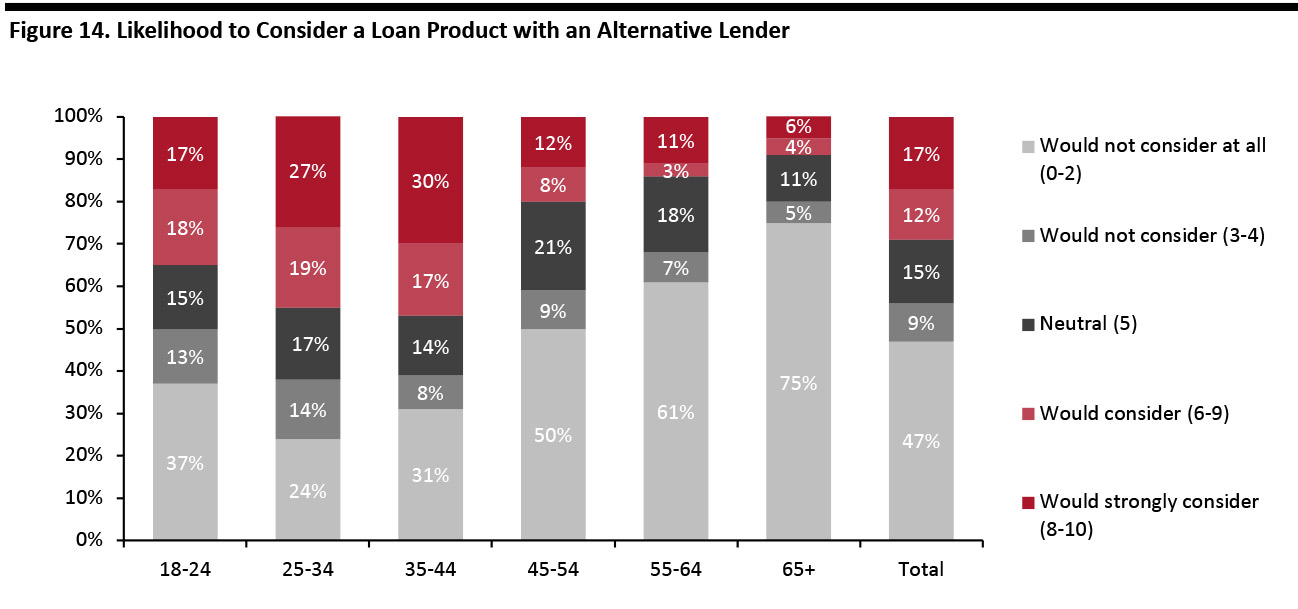

Base: 2,000 consumers and 200 small-to-medium sized businsses (SMEs), surveyed in 2018 Source: RFi Group PSD2 Customer Study [/caption] The US retail market for buy now, pay later services is increasingly gaining traction. RFi Group research shows that almost one in three US consumers under the age of 44 years old would strongly consider using an alternative lender. US millennials and Gen Z shoppers are leading the adoption of digital payment tools. Since entering the US, Afterpay has signed over 3,300 US retailers and brands with 1.5 million US customers. Anthropologie, Bandier, Forever 21, Reformation, Revolve, Steve Madden, True Religion and Urban Outfitters are among the millennial-centric brands that joined. Afterpay recently announced new partnerships with Levi’s, Ray-Ban, O’Neill and Tarte Cosmetics. [caption id="attachment_97338" align="aligncenter" width="700"]

Source: RFi Group PSD2 Customer Study[/caption]

Source: RFi Group PSD2 Customer Study[/caption]

Questions of Regulation

Global markets are benefitting from low barriers to entry driven by a lack of regulatory requirements – but that may be changing. In Australia, buy now, pay later companies recently faced regulatory challenges from the Australian senate committee. The senate looked into requiring companies to conduct costly credit checks before signing up customers and to do more to ensure users can afford to repay the debts. In June 2019, Australia’s government agency AUSTRAC — responsible for monitoring financial transactions — ordered an audit of Afterpay, citing suspected non-compliance with anti-money-laundering and counter-terrorism financing laws (the AML/CTF Act). The external auditor will examine Afterpay’s:- Governance and oversight of decisions related to its AML/CTF framework.

- Identification and verification of customers.

- AML/CTF program, including the development of its money laundering and terrorism financing risk assessment.

Notable Partnerships and Acquisitions in the Past 12 Months

Walmart: In 2019, Walmart announced a partnership with financial company Affirm, offering shoppers flexible financing when purchasing large items ($200 to $2,000) both in-store and online. Eligible shoppers can opt for a repayment term of three, six or 12-month installments with interest-rate charged based on the customer’s credit score. “We are focused on providing customers transparent, easy and convenient ways to pay, and offering Affirm both in stores and online is one way to do that,” said Daniel Eckert, Senior Vice Present of Walmart Services & Digital Acceleration. Mastercard: In April 2019, Mastercard announced the acquisition of Vyze, a technology platform that offer shoppers point-of-sale payment options. Vyze connects merchants with multiple lenders, allowing them to offer their customers a wide range of credit options online and in-store. Through this acquisition, Mastercard became a more strategic partner to both lenders and merchants.Conclusions

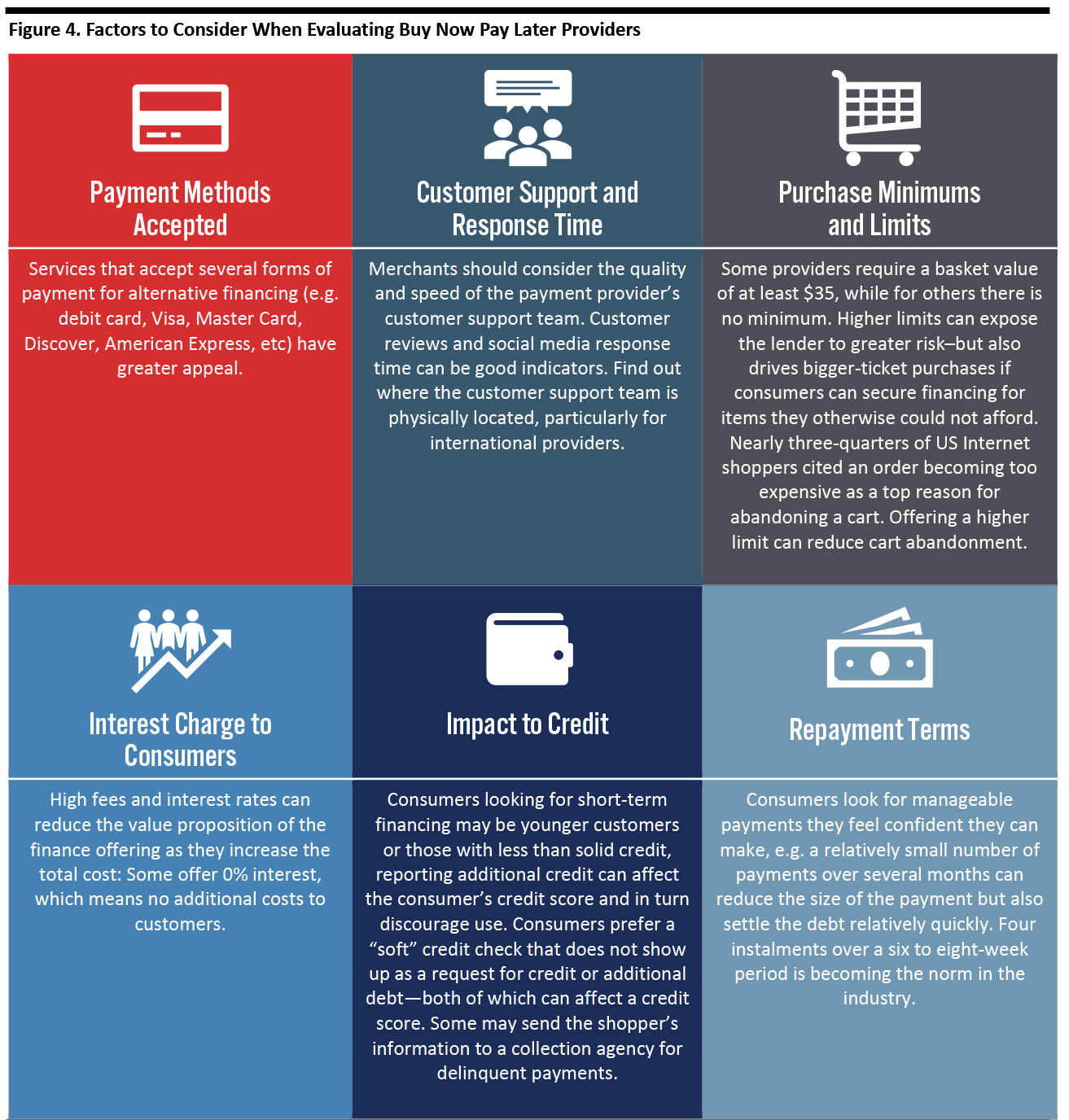

In e-commerce, sometimes it seems everything old is new again: Layaway programs are not a new payment innovation in retail, but these services (in a form that gives customers the product before they’re paid) have seen a revival in recent years and we expect this trend to continue, primarily driven by younger consumers. Merchants should consider several factors when selecting a partner to provide alternative payment options:- How does the solution align with consumer preferences in your local market?

- Look for solutions withmore merchant-friendly terms. Sezzle, for example, is working proactively with merchant partners to reduce chargeback and return rates, allowing merchants to earn interest on their account balance and providing prompt merchant support.

- Sezzle Mobile, for example, is being developed to allow customers to combine mobile payments with pay-by-installment plans, eliminating traditional in-store lay-bys. Sezzle said it has identified a potential card issuer and is working to identify suitable retail merchant clients to participate in a trial this year with a view to moving towards commercial and contractual arrangements.

- Retailers and brands may include multiple payment options at checkout to maximize conversions and provide more options for customers. Merchants may offer these options similar to the way they offer both Mastercard and Visa in order to match customer’s preferences.

- Uplift offers flexible payment options to customers purchasing vacation packages. The company has partnered with United Airlines, American Airlines, JetBlue Airways and several others.

- PayRight targets buyers of home improvement, education, health and beauty products and services. Currently the company has over 1,000 merchants.