DIpil Das

What’s the Story?

“Buy now, pay later” (BNPL) has become a popular payment option for younger generations, such as millennials and Gen Zers. It allows consumers to pay in installments, often interest-free, for purchases. The time period in which the installments are due varies case by case, sometimes up to 36 months. A number of BNPL startups have recently surfaced in Australia, Sweden and New Zealand, followed by established financial institutions joining the race. There are two sides of the market: the borrower (the consumer) and the lender (BNPL service providers). BNPL has piggybacked on the growth of e-commerce. Service providers typically partner with brands and retailers to offer BNPL as a payment option for consumers to choose on the online checkout page. Some companies offer a 30-day payment grace period, so consumers can receive their order even before payment is made for the purchase. In addition, there are platforms that serve as the marketplace to connect shoppers with lenders—examples include Divido and Vyze. Brands and retailers from various sectors have adopted BNPL as a payment method, including Adidas, Bose, Brookstone, Home Depot and Sephora.Why It Matters

The global pandemic has put pressure on some consumers’ pockets. Consumers are more cautious about their spending, and flexible payment options help them to preserve cash and defer payments without incurring interest. The BNPL market is growing:- The share of BNPL represented 1.6% of the global e-commerce payment methods market in 2019 and is estimated to grow to 2.8% by 2023, according to payment-processing company Worldpay, a subsidiary of Fidelity National Information Services.

- A Coresight Research proprietary survey, conducted in early September 2020, suggests that 20.2% of US consumers aged 18+ have used BNPL services in the past 12 months.

- BNPL provider Sezzle said that it attracted 325,000 new users in the second quarter this year, up 326% from the same period last year.

Buy Now, Pay Later: In Detail

Competitive Landscape There are many companies that now offer BNPL services. A number of startups emerged under the first model of splitting the purchase at the point of sale, and some have been expanding quickly. Klarna, which received investment from Visa, reached 10.4 million monthly active users this year. The fast-growing industry has also attracted attention from established companies. Recently, major financial institutions joined the space, which we discuss later in this report.Figure 1. The BNPL Landscape [wpdatatable id=491]

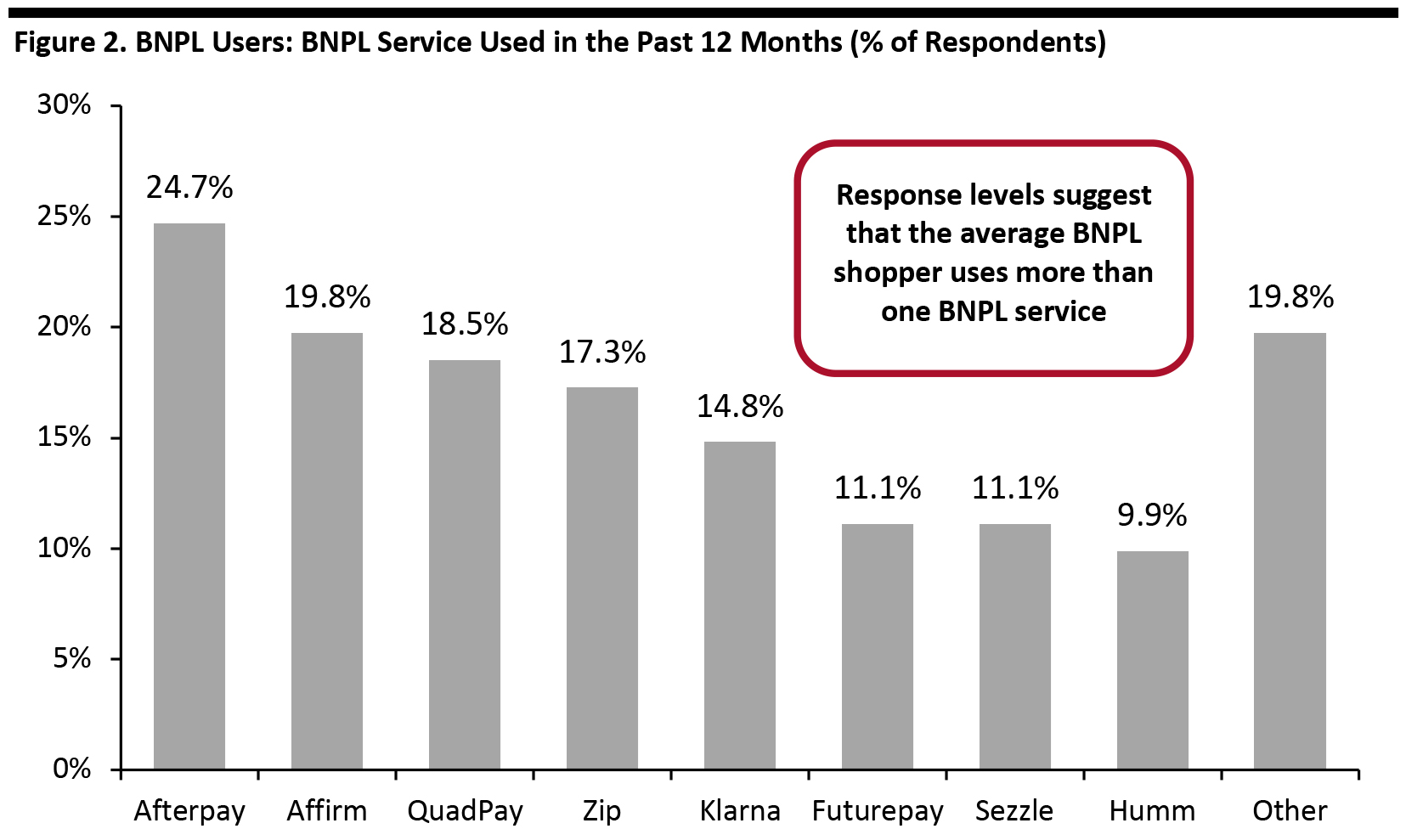

Source: Company reports/Crunchbase/Coresight Research Who Uses BNPL and Which Providers Do They Use? As we mentioned above, around one in five respondents reported to have used BNPL services in the past 12 months. Our US survey revealed that the service is most popular among consumers aged 30–44, with 27% of this demographic having used BNPL in the past year, compared to 22% of 18–29-year-olds, 21% of 45–60-year-olds and just 10% of respondents aged over 60. We asked those consumers that had used BNPL which provider they used in the past 12 months: Afterpay was the most popular (24.7% of BNPL users), followed by Affirm (19.8%)—see Figure 2. Several of the named services saw relatively high, and roughly similar, usage levels—seemingly reflecting that this emerging market has not yet established dominant players. The total response levels imply that each BNPL shopper in our survey used on average 1.5 BNPL services in the past year—which suggests that users are willing to try new services and are not tied to any one provider. In turn, this suggests that there may not be any single provider that is a “must have” from the consumer perspective when retailers are considering BNPL implementation. [caption id="attachment_117187" align="aligncenter" width="700"]

Base: 81 US Internet users aged 18+ who had used BNPL services in the past 12 months

Base: 81 US Internet users aged 18+ who had used BNPL services in the past 12 months Source: Coresight Research [/caption] Benefits of BNPL Services With BNPL, consumers can worry less about their cash position and the interest generated from taking on debt through more traditional credit channels. In return, merchants are likely to observe better sales results, such as improvement in conversion rates.

- Affirm noted that retailers that use its service saw an 85% increase in average order value and a 20% expansion in repeat purchase rate.

- According to Klarna, retailers that offer its BNPL services saw a 30% increase in conversion rate.

- Sezzle has reported that fashion brand Jared Lang saw a 20% boost in sales upon adding its BNPL service.

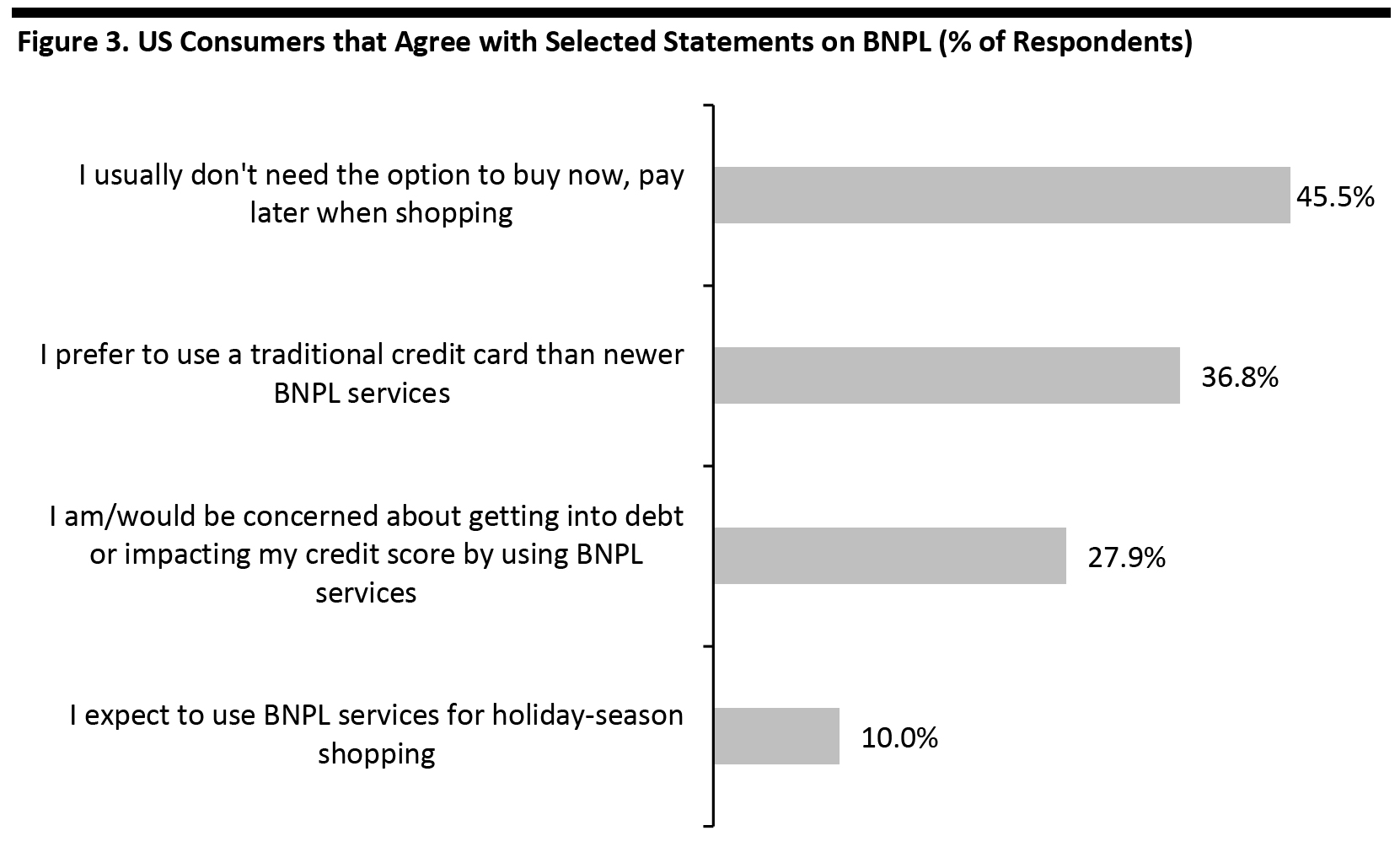

Base: 402 US Internet users aged 18+

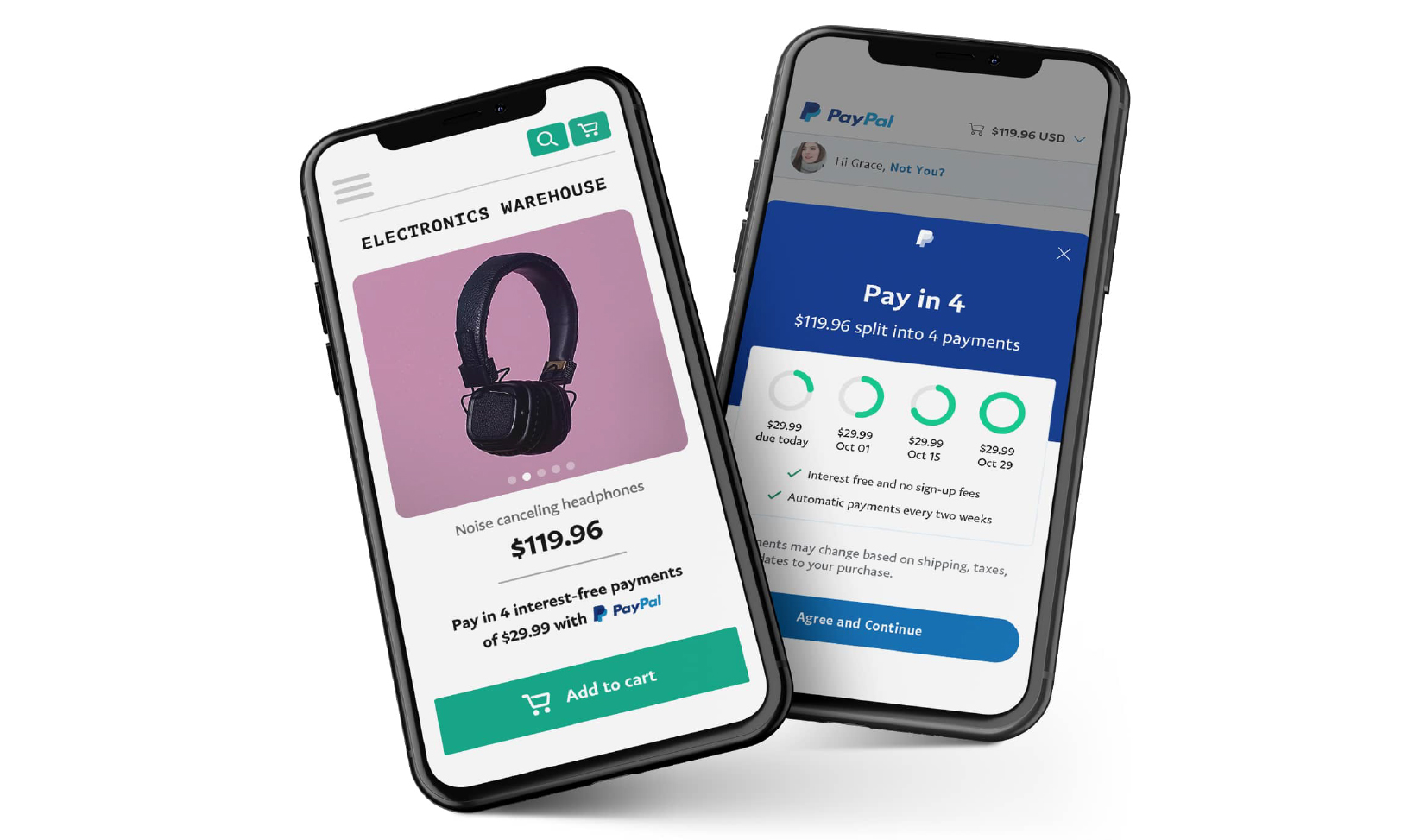

Base: 402 US Internet users aged 18+ Source: Coresight Research [/caption] Three Recent Developments in the BNPL Market 1. PayPal Launches “Pay in 4” In August 2020, PayPal introduced “Pay in 4,” a new installment credit option for PayPal users. This new service allows consumers to pay for purchases through interest-free, four-installment payments. Customers can use Pay in 4 for purchases between $30 and $600 over a six-week period. PayPal had been testing “Easy Payments” since 2014. The service was first available on Apple.com and then expanded globally to more merchants. Easy Payments was based on PayPal Credit’s revolving line of credit and is an installment-like payment plan with a fixed monthly payment schedule. Unlike a typical BNPL, consumers who use Easy Payments will pay interest on their purchases. [caption id="attachment_117189" align="aligncenter" width="700"]

PayPal’s Pay in 4

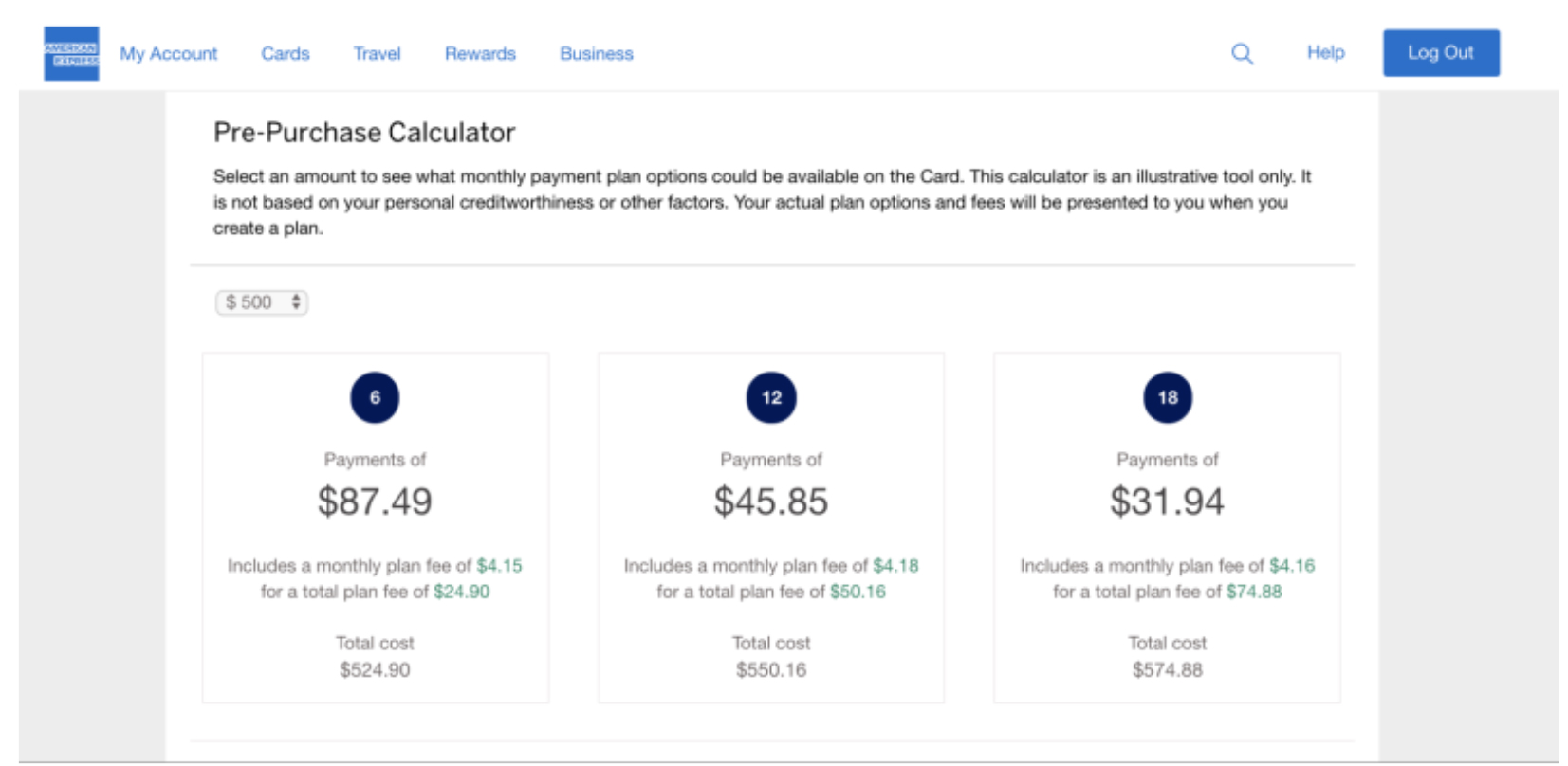

PayPal’s Pay in 4 Source: PayPal [/caption] 2. American Express Expands BNPL Offerings to Business Owners Established financial institutions such as American Express (Amex) offer similar services to BNPL startups. Amex offers two options for personal card users who want to split payments:

- Pay Over Time allows users to pay eligible charges of $100 or more over time with interest. The Amex Platinum, Gold and Green cards come auto-enrolled with this service.

- Pay It Plan It allows personal cardholders to pay off individual purchases before the statement closure to keep the balance down. Users can pay for eligible purchases of over $100 over several months. While Amex does not charge interest for this service, it does charge a fixed monthly fee.

Amex Pay Over Time demonstration

Amex Pay Over Time demonstration Source: Amex/Credit Card Insider/Coresight Research [/caption] 3. Mastercard Partnered with TSYS To Add BNPL Features On September 2, 2020, Mastercard announced its partnership with global payment company TSYS to offer configurable, issuer-driven installment payment options. Through the partnership, TSYS has become the first processor to deliver installment capabilities to issuers. Unlike other BNPL options, where consumers need to choose before ordering, this services allows them to use their Mastercard to split transactions into installments before, during and after a purchase, offering a more seamless payment experience to North American cardholders. This is not Mastercard’s first move into the space. In April 2019, Mastercard acquired alternative financing platform Vyze, which connects businesses and lenders to deliver more financing options to consumers at the point of sale. In other words, Vyze does not directly lend to consumers. Merchants on the Vyze platform include retailers in the home improvement, electronics and home fitness spaces. In August 2020, Quadpay partnered with Vyze to provide business and consumers an installment-based payment option both online and offline. QuadPay offers a four-installment plan without interest.

What We Think

The sector is seeing a growing number of companies competing with each other for market share. As adoption of BNPL in retail increases, more consumers are likely to try this service. Implications for Brands/Retailers- Our survey data imply that BNPL usage is spread across several different providers and that many BNPL shoppers are using more than one such service. For retailers, this suggests that there may not be any single provider that is a “must have” from the consumer perspective when considering BNPL implementation. Longer term, however, we expect some consolidation in the market and for one or a few clear leaders to emerge.

- Brands and retailers should leverage these BNPL platforms to promote themselves and offer flexible payment options. One in 10 of all respondents plan to use BNPL for holiday shopping—a substantial niche and one that suggests retailers could gain from rolling out BNPL for the holiday peak.

- Bundling hero products with less popular items for BNPL is likely to increase the average sales ticket.

- BNPL service providers can collaborate with brands and retailers to increase adoption rates and usage. The recent surge in e-commerce and likely sustained very strong demand through the rest of the year suggest opportunities to help retailers serve peak holiday demand with BNPL services.

- Given the multiplicity of BNPL providers in the market, these firms should be looking to gain any competitive advantage over rivals including locking in shopper loyalty. BNPL providers should develop new features to attract customers and increase conversion rates. They could build a community and loyalty programs for BNPL users.