DIpil Das

Introduction

What’s the Story? Substantial shifts in consumer preferences, the e-commerce surge and rising inflation amid the Covid-19 pandemic have added to the ever-growing complexity of planning and forecasting for brands and retailers. While internal and historical data are indispensable to planning and forecasting processes, it may not be enough in the current environment of ever-growing volatility across demand and supply. Advanced technologies such as artificial intelligence (AI) endow retailers with the tools to streamline planning and forecasting processes—but these tools must be used effectively to achieve desired outcomes. We analyze the findings of a February 2022 Coresight Research survey of 126 respondents—involved in planning and forecasting—from brands, retailers and manufacturers in the US. Through the medium of this proprietary survey, we aim to understand how Covid-19 impacted planning and forecasting processes and whether businesses are incorporating external macroeconomic data into their planning and forecasting processes. This report is sponsored by Prevedere, an intelligent forecasting and predictive analytics solutions provider. Why It Matters Recent macroeconomic volatility has added to planning and forecasting complexities. The core US CPI (consumer price index) increased by 7.5%, year over year, in January 2022, with the CPI for food rising by 7%, according to the US Bureau of Labor Statistics (latest data available). In addition, the Covid-19 pandemic has dented brand loyalty, altered spending/saving patterns and increased e-commerce spending. Brands, retailers and manufacturers must be able to adapt to such changes, with planning and forecasting processes having a substantial impact on almost all business functions. For example, an incorrect forecast can inform an incorrect promotional calendar, understocked store shelves and frequent out-of-stocks. Furthermore, traditional forecasting and planning is a lengthy process, and it may be difficult to leverage real-time external or macroeconomic data into forecasts. By the time forecasts are prepared, there may be newer market shifts that impact the forecast, so an organization’s ability to respond to real-time market changes are substantially limited. Brands and retailers can overcome the challenges associated with planning and forecasting processes by incorporating real-time economic data and making frequent changes to the forecast outlook when necessary. We have identified three key benefits leveraging economic data in planning and forecasting processes, which we detail below and summarize in Figure 1.- Adaptability to market changes: Harnessing real-time macroeconomic data allows businesses to be build more responsive supply chains. For example, it becomes easier to identify how much of a certain stock-keeping unit (SKU) should go into manufacturing and how much of any given product a store should stock. The ability to oversee the confluence of demand and supply ensures retailers’ responsiveness to supply chain.

- Localization of assortment: By identifying relevant macroeconomic indicators such as discretionary spending and personal disposable income, retailers, brands and manufacturers can better meet local demand—which translates to higher sales and reduced churn to competitors.

- Improved margins: With greater control of the supply chain and better localization efforts, retailers can carry and sell the right set of products across their stores, based on shopper demand. This ensures reduced markdowns, as there will be increased full-price selling and improved inventory management, positively impacting the bottom line and improving overall margins.

Figure 1. Key Benefits of Using Economic Data in Planning and Forecasting Processes [caption id="attachment_144070" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Business Planning and Forecasting: Coresight Research x Prevedere Analysis

Based on analysis of our survey findings, we have identified six key trends in planning and forecasting among brands, retailers and manufacturers in the US, which we believe reveal three missing pieces of the planning and forecasting puzzle. We present our insights and recommendations for businesses to complete the puzzle in Figure 2 and explore each in detail below.Figure 2. Business Planning and Forecasting Using Economic Data: Survey-Based Insights and Recommendations [caption id="attachment_144071" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

1. The Covid-19 Pandemic Has Impacted Planning Processes

Forecasting models that are based on historical data can only do so much in identifying future demand due to the increased volatility in the global supply chain brought about by Covid-19 and rising inflation, which have impacted consumption patterns and exacerbated the planning uncertainties facing businesses.

Our survey results reflect this uncertainty: Brands, retailers and manufacturers all reported that Covid-19 has impacted their planning processes.

Source: Coresight Research [/caption]

1. The Covid-19 Pandemic Has Impacted Planning Processes

Forecasting models that are based on historical data can only do so much in identifying future demand due to the increased volatility in the global supply chain brought about by Covid-19 and rising inflation, which have impacted consumption patterns and exacerbated the planning uncertainties facing businesses.

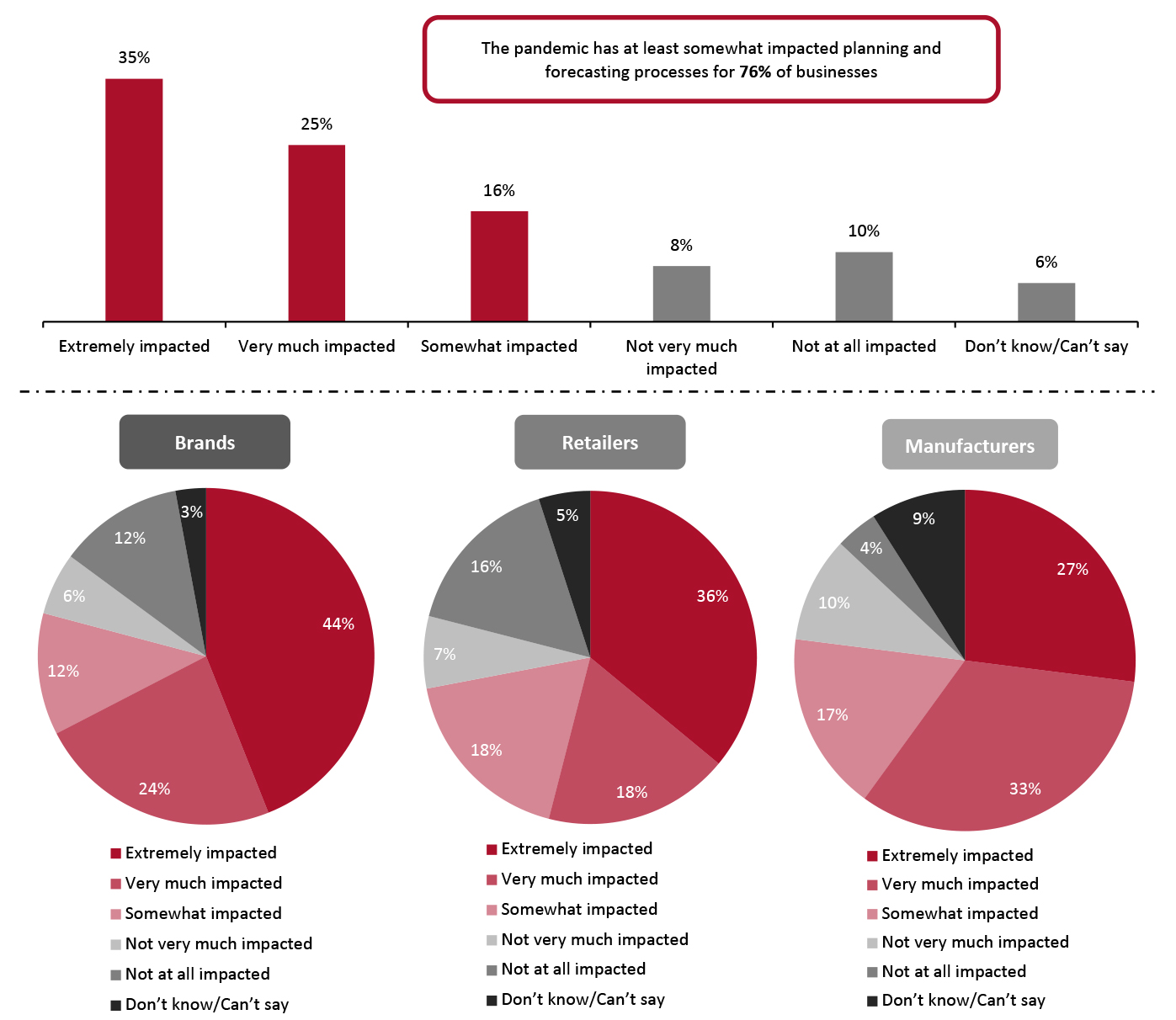

Our survey results reflect this uncertainty: Brands, retailers and manufacturers all reported that Covid-19 has impacted their planning processes.

- Almost eight in 10 (76%) respondents said that Covid-19 has at least “somewhat” impacted their planning and forecasting processes.

- Only 10% of respondents cited that Covid-19 has not impacted business and planning processes at all.

- Breaking down our findings by type of respondent, we can see that Covid-19 has impacted business across industries to a similar degree: Around three-quarters of brands (79%), manufacturers (77%) and retailers (73%) reported that the pandemic has at least somewhat impacted planning and forecasting processes.

Figure 3. Impact of Covid-19 on Planning and Forecasting Processes (% of Respondents) [caption id="attachment_144072" align="aligncenter" width="700"]

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US Source: Coresight Research [/caption] 2. The Time for Change Is Now To fully reap the benefits of planning and forecasting tools, businesses must act fast. A couple of years ago, with the onset of the pandemic, many economies went into lockdown and demand plunged across most sectors, with the exception of fast-moving goods such as groceries. Reopenings and recovery have not been steady or symmetrical across sectors and markets, leading to manufacturing shortfalls—exacerbated by labor shortages and unprecedented uncertainty around consumer behavior. In what continues to be a volatile environment, retailers must focus on scenario planning to be prepared for the future. In such uncertain times, businesses can suffer when they would have otherwise flourished, but those that are able to utilize advanced forecasting methods can thrive. In response to the shifting landscape, many businesses have made changes to their planning and forecasting systems since the Covid-19 outbreak:

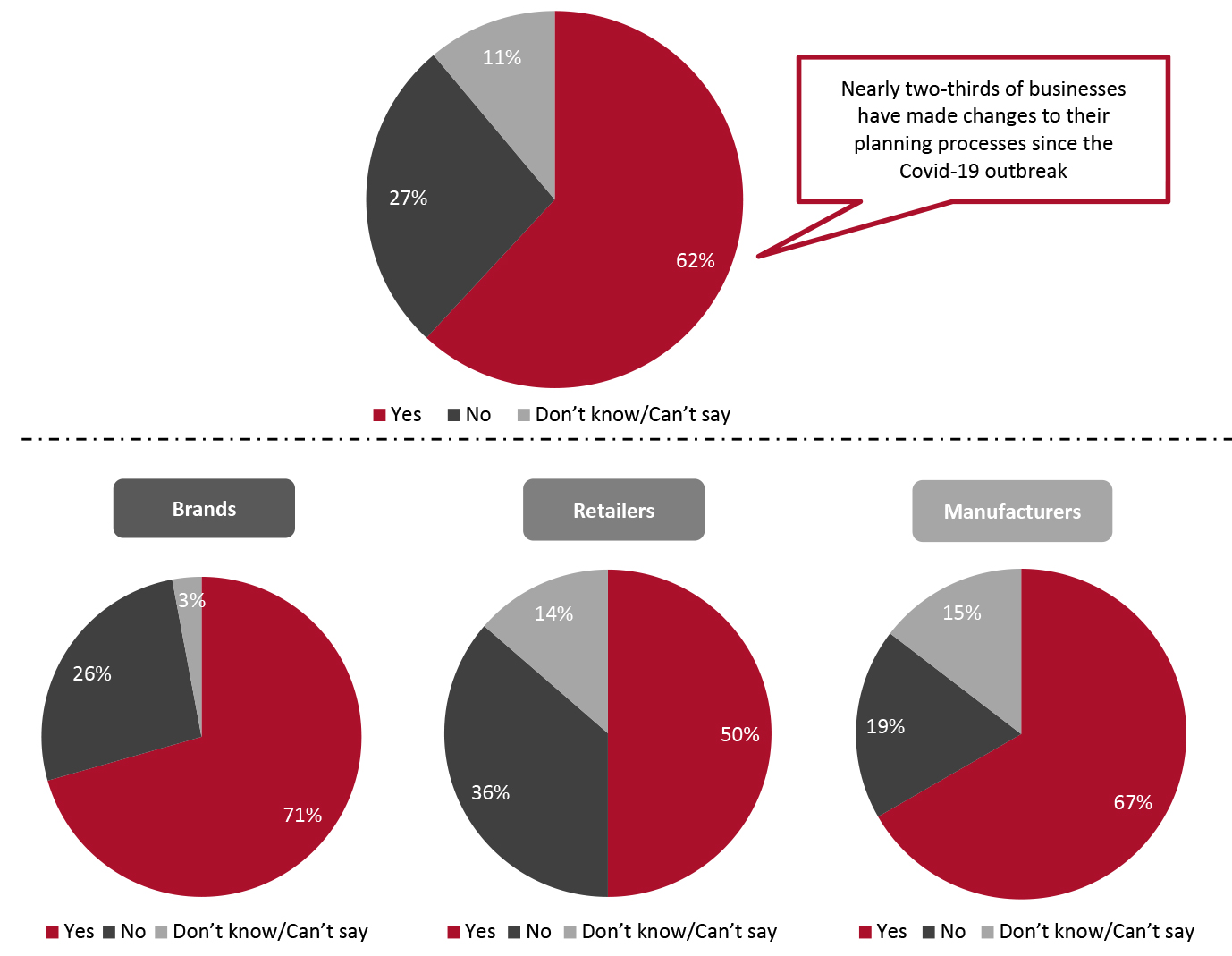

- Nearly two-thirds (62%) of respondents cited making changes to their planning and forecasting processes.

- By industry, the highest proportion of businesses that reported making changes to their planning and forecasting process was brands (71%), followed by manufacturers (67%) and retailers (50%).

Figure 4. Whether Any Changes Made to Planning and Forecasting Processes Since the Covid-19 Outbreak (% of Respondents) [caption id="attachment_144073" align="aligncenter" width="700"]

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US Source: Coresight Research [/caption] Exploring the specific changes that businesses have made to planning and forecasting processes since the outbreak of the Covid-19 pandemic, we found the following:

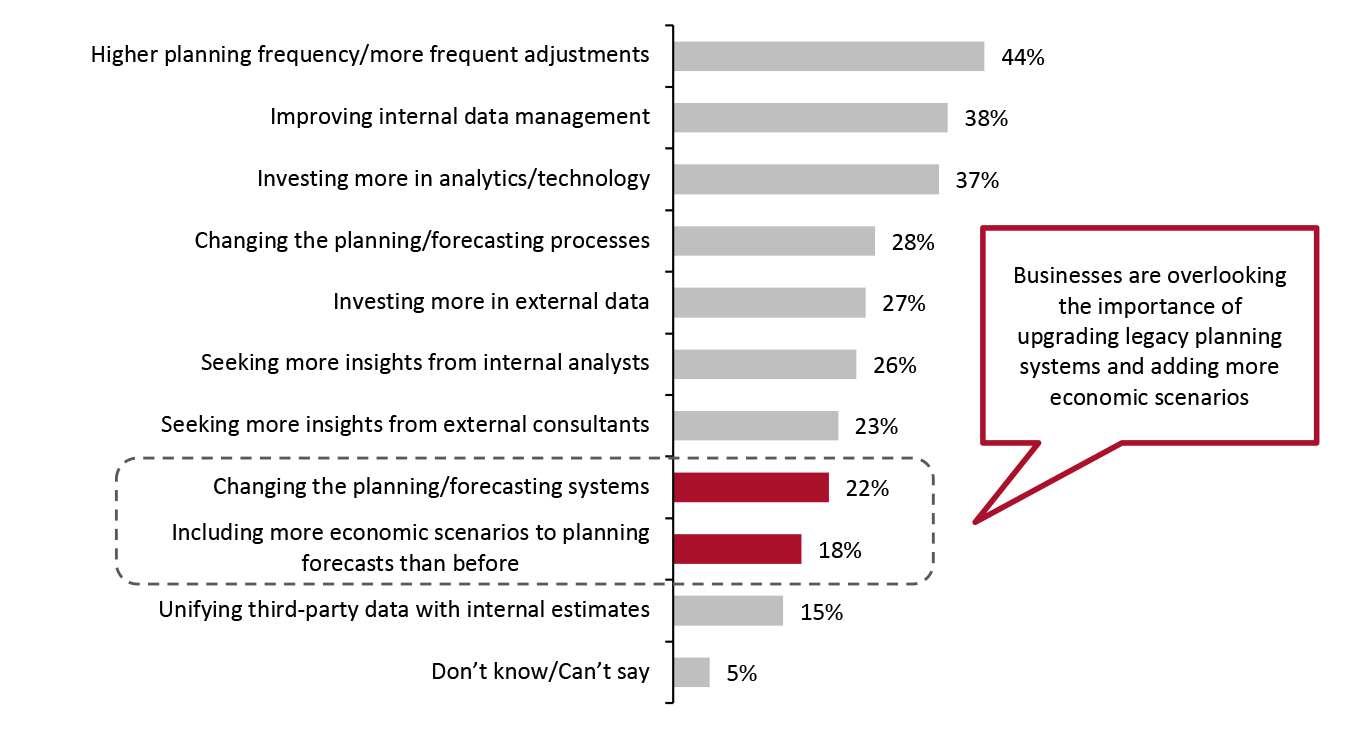

- Higher planning frequency or more frequent adjustments to forecasts emerged as the most common change—made by 44% of businesses that reported making changes.

- Organizations are overlooking the importance of revamping their existing legacy systems, such as spreadsheets and standalone software. Only 22% of businesses that made changes to planning and forecasting reported that those changes were related to systems, while just 18% said that they are now including more economic scenarios to plan forecasts.

Figure 5. Changes Made to Planning Processes Since the Covid-19 Outbreak (% of Respondents) [caption id="attachment_144074" align="aligncenter" width="701"]

Respondents could select more than one option Base: 78 brands, retailers and manufacturers in the US that have made changes to planning and forecasting processes since the Covid-19 outbreak

Respondents could select more than one option Base: 78 brands, retailers and manufacturers in the US that have made changes to planning and forecasting processes since the Covid-19 outbreak Source: Coresight Research [/caption] 3. Macroeconomic Challenges Outweigh Organizational Challenges US consumers are facing a surge in the prices they are paying for goods and services. The core CPI increase of 7.5% year over year, cited earlier in the report, is the highest since February 1982. Furthermore, in a recent US Consumer Tracker survey, Coresight Research asked respondents about how they have changed, or expect to change, their non-grocery shopping behavior in response to raised inflation. Nearly half of US consumers (48.4%) reported that they are purchasing fewer items, and seeking out coupons, discounts or promotions followed closely behind that top response (reported by 46.1% of respondents). Reflecting the high inflationary pressure and changing consumer behavior, brands, retailers and manufacturers in our planning and forecasting survey said they are facing macroeconomic challenges, which are outweighing some of the internal organizational challenges.

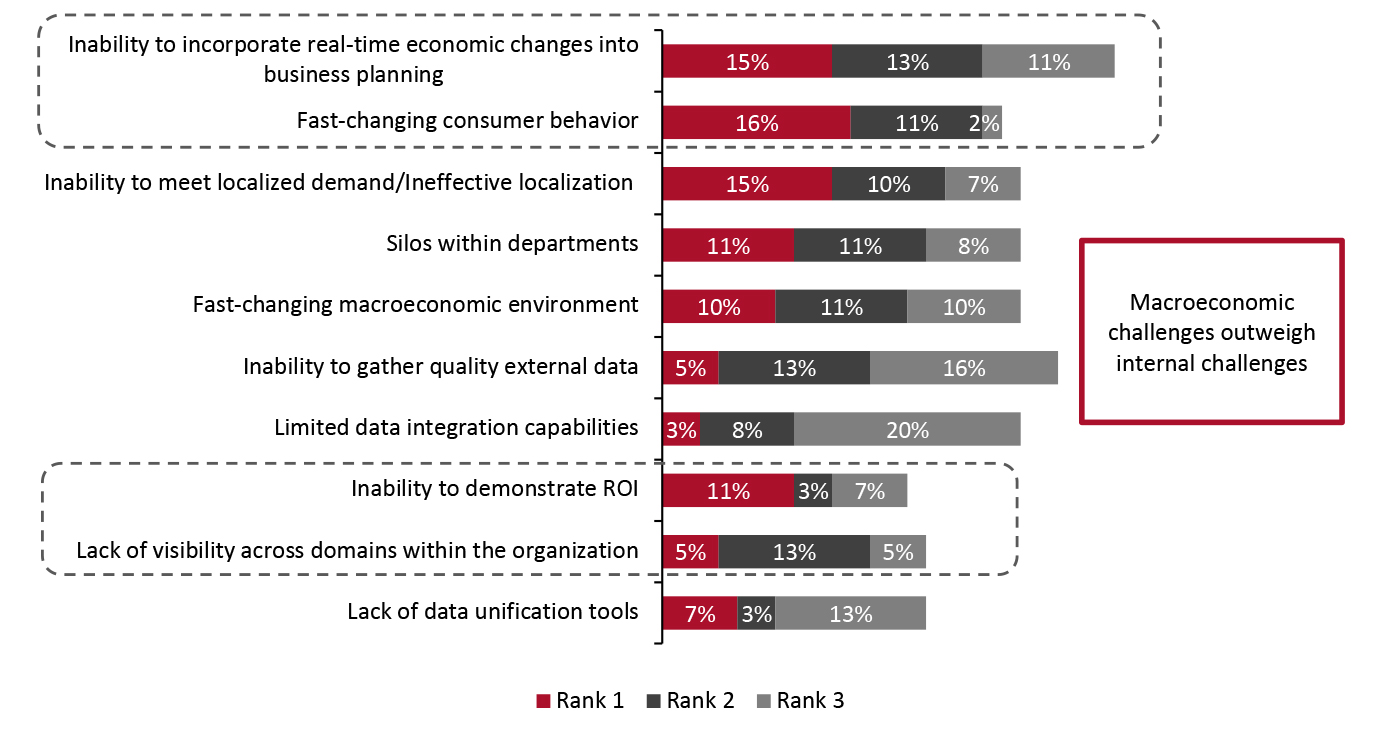

- Some 39% of respondents cited an inability to incorporate real-time economic changes into business planning, and 28% cited fast-changing consumer behavior, as among the top three challenges related to planning and forecasting processes that they have faced since the start of the pandemic.

Figure 6. Key Challenges Businesses Have Faced in Planning and Forecasting Since the Start of the Covid-19 Pandemic (% of Respondents) [caption id="attachment_144075" align="aligncenter" width="700"]

Respondents were asked to select and rank up to three options, with “Rank 1” being the topmost challenge

Respondents were asked to select and rank up to three options, with “Rank 1” being the topmost challenge The challenges in the chart above are shown in descending order of weighted averages of the proportion of respondents who ranked these criteria, where “Rank 1” carries the highest weight

Base: 61 brands, retailers and manufacturers in the US that have faced significant challenges in planning and forecasting processes since the Covid-19 outbreak

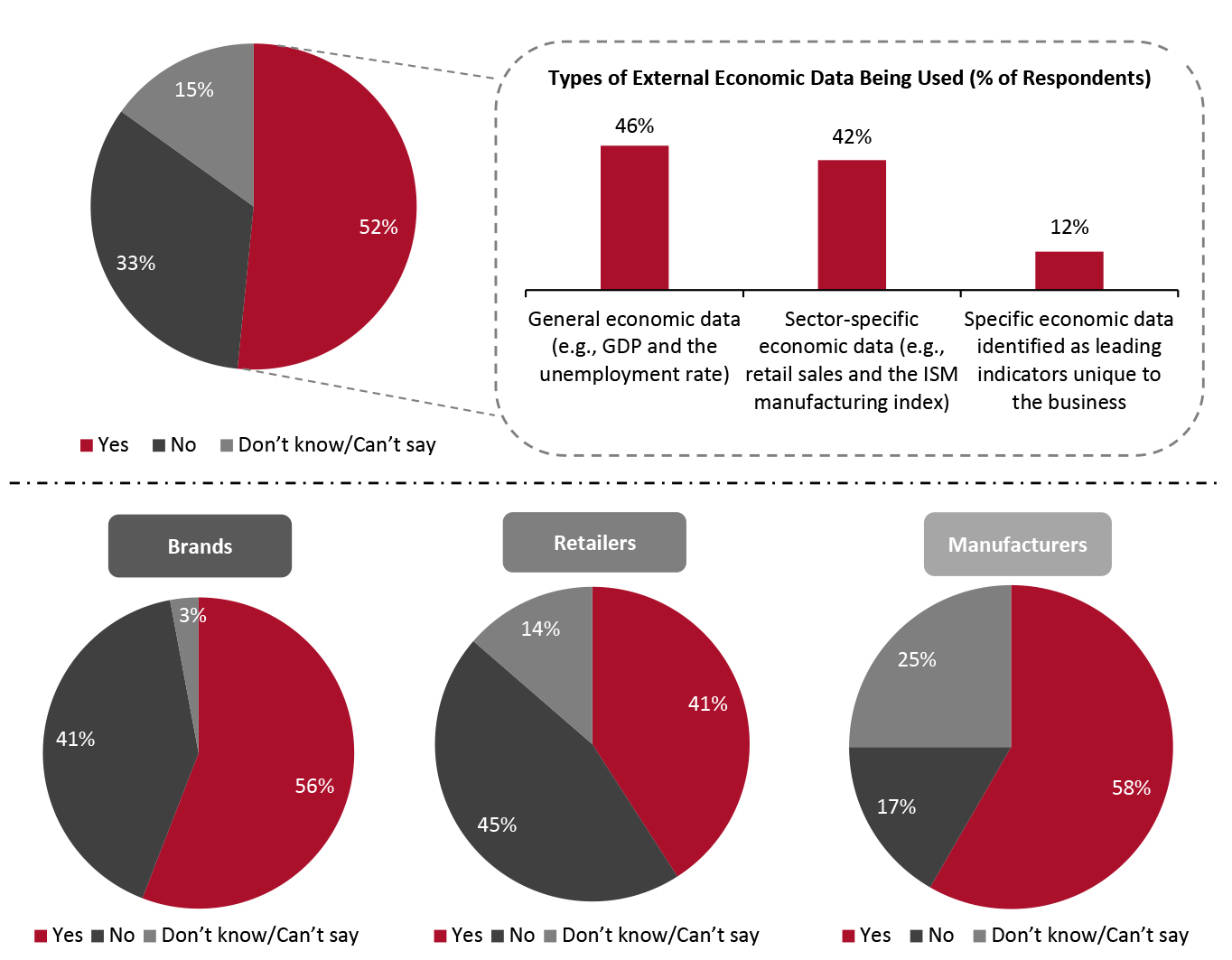

Source: Coresight Research [/caption] 4. Businesses Can Benefit from Improving Their Use of External Economic Data Identifying shopper demand at the store level is the holy grail of effective forecasting. Placing products for the right consumer, at the right time and at the right price point can substantially improve profitability. Economic data plays an important role in identifying shopper demand in any specific geographic area. For effective localization, brands and retailers must be able to identify the economic health of shoppers using indicators such as personal income, spending rate and unemployment rate. It is pivotal for companies to understand the impact of these variables on the business and overall demand. Focusing on external economic data and using such data in econometric models (such as linear regression models) can help retailers do this. Simulating these models in real time based on external events can strongly position retailers to be more responsive to market shifts or any disruptions caused by “black swan” events such as Covid-19. We asked our survey respondents whether they use external economic data for their planning and forecasting processes and found the following:

- Just over half (52%) of respondents cited using external economic data for planning and forecasting processes.

- Manufacturers led the way, with 58% of these respondents using external economic data for planning and forecasting processes, followed by brands (56%) and retailers (41%).

Figure 7. Whether Companies Are Using External Economic Data for Planning and Forecasting Processes (% of Respondents) [caption id="attachment_144076" align="aligncenter" width="700"]

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US

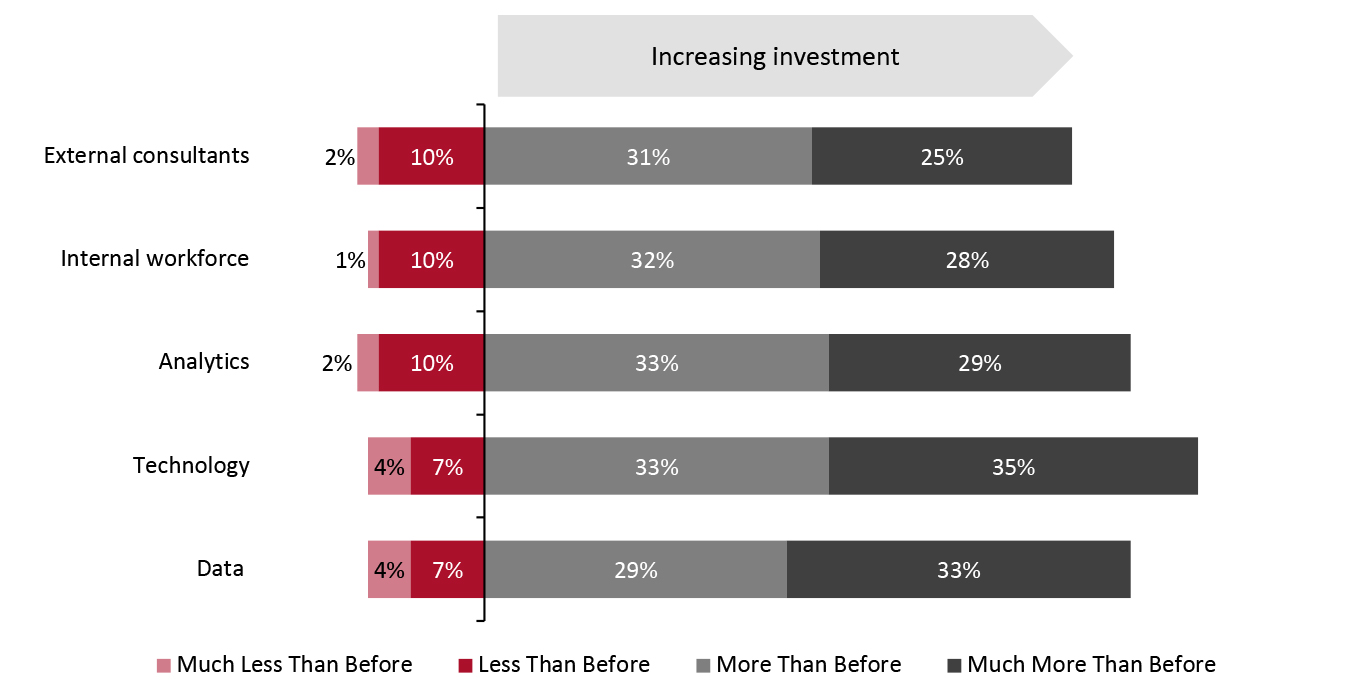

Base: 126 respondents across brands (34), retailers (44) and manufacturers (48) in the US Source: Coresight Research [/caption] 5. Organizations Are Stepping Up Investments Across Major Business Verticals Although the past two years have been underlined by the Covid-19 pandemic and shifts in consumer behavior—which may be permanent in some cases—many retailers have posted robust financials. For example, Target recorded $106 billion in total revenue in fiscal 2021—having grown by nearly $28 billion, around 35%, over the past two years. The overall US retail sector is seeing robust growth: Total retail sales increased by 14% year over year, amounting to $4.5 trillion, in 2021, according to Coresight Research analysis of Census Bureau data. We expect retail sales to increase by around 4% year over year in 2022 to reach $4.6 trillion. To capitalize on the fast-growing opportunity, retailers must focus on redefining the consumer journey to provide a seamless experience to shoppers—but this requires improved localization efforts through responsive supply chains. We asked our survey respondents about their investments across selected functions since pre-pandemic levels. We found the following:

- Investments are broadly on the rise versus pre-pandemic levels, with 68% of respondents cited that they are now investing “more” or “much more” in technology—the highest proportion among all functions.

- Investments in data closely followed with 62% of the respondents citing investing “more” or “much more” than before.

Figure 8. Selected Functions: Changes to Investments Versus Pre-Pandemic Levels (% of Respondents) [caption id="attachment_144077" align="aligncenter" width="700"]

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not included

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not included Base: 126 respondents across brands, retailers and manufacturers in the US

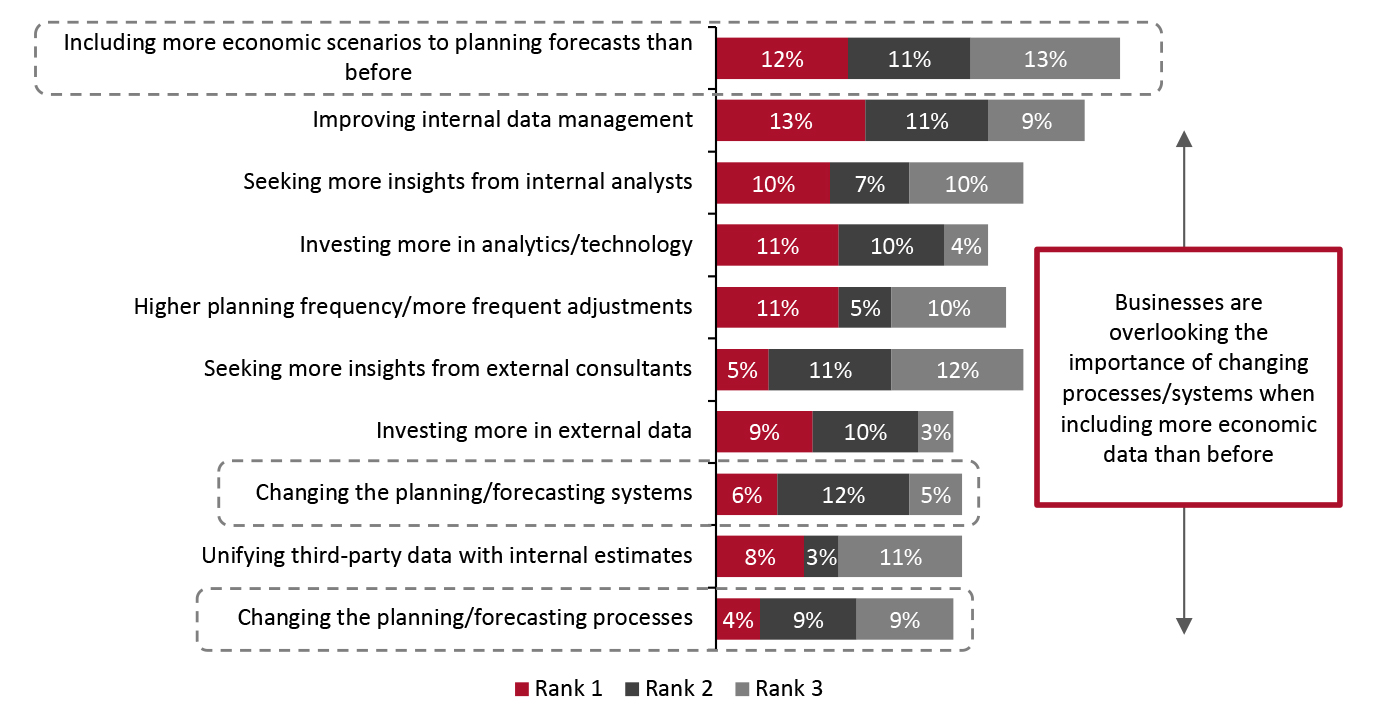

Source: Coresight Research [/caption] We asked respondents about the key areas within planning and forecasting that they will prioritize for investments in 2022. The top response was “including more economic scenarios in planning forecasts than before,” cited by 36% as among their top three investment priorities this year. However, the mismatch between the desired outcome of economic responsiveness and the pathway—revamping legacy systems and processes—also surfaced in our analysis.

- Only 23% of respondents cited changing planning or forecasting systems as among their top three investment priorities for 2022.

- Some 22% of respondents cited changing processes involved in planning and forecasting as among their top three investment priorities for 2022.

Figure 9. Key Focus Areas for Investment in 2022 (% of Respondents) [caption id="attachment_144078" align="aligncenter" width="701"]

Respondents were asked to select and rank up to three options, with “Rank 1” being the most important focus area

Respondents were asked to select and rank up to three options, with “Rank 1” being the most important focus area The focus areas in the chart above are shown in descending order of weighted averages of the proportion of respondents who ranked these criteria, where “Rank 1” carries the highest weight

Base: 126 respondents across brands, retailers and manufacturers in the US

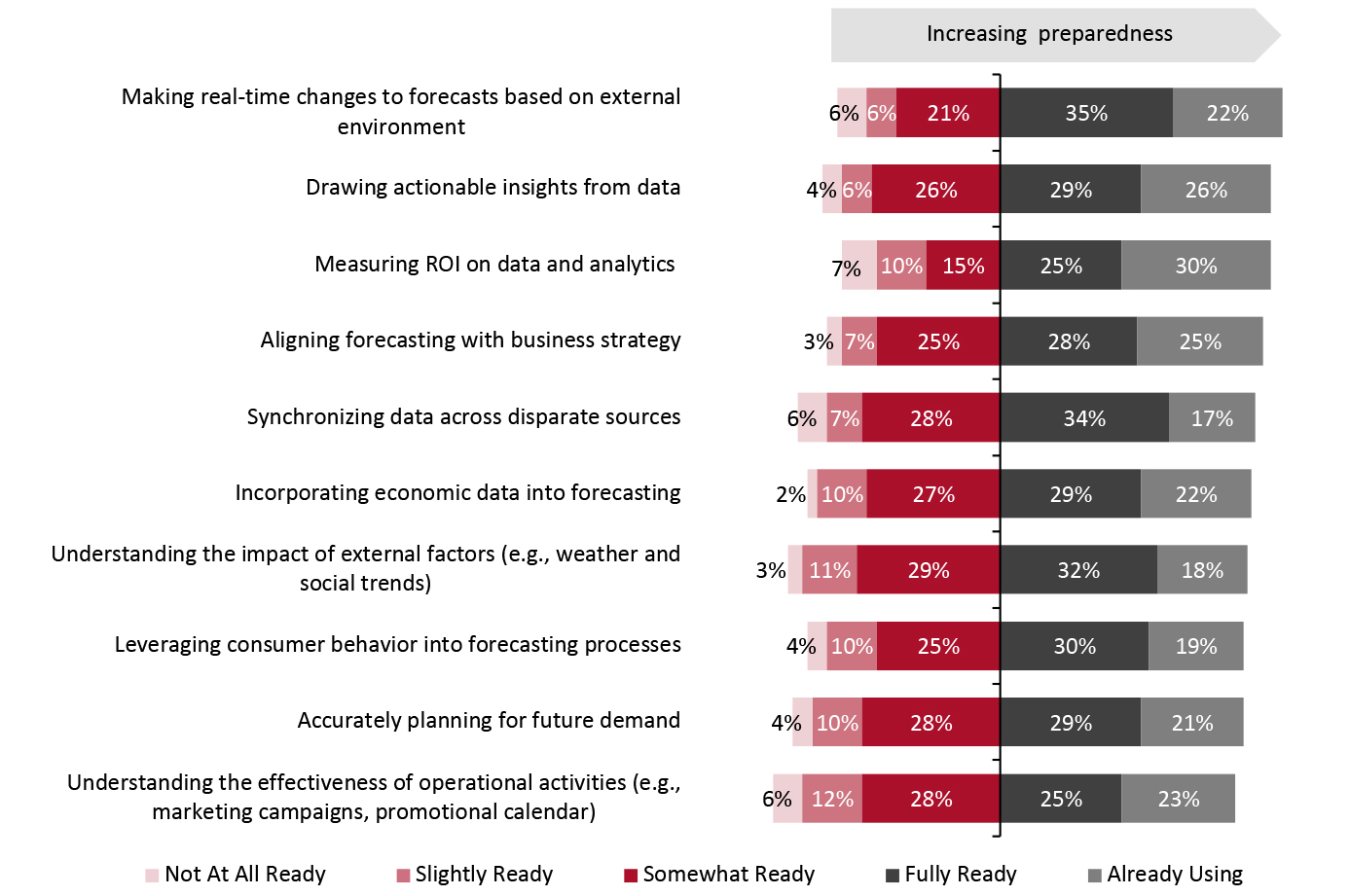

Source: Coresight Research [/caption] 6. Businesses Are Not Fully Prepared To Effectively Use AI Businesses—brands, retailers and manufacturers—across the supply chain need advanced technologies and platforms to identify demand patterns in advance. Maintaining a more frequent cadence of updating forecasts can help businesses navigate rapidly evolving consumer behavior and the macroeconomic environment. We believe that leveraging AI effectively requires taking a holistic approach toward all business functions and increasing integration or information exchange among individual departments. To succeed in planning and forecasting, businesses must leverage AI effectively while incorporating granular and real-time data into their forecasts. However, based on our survey findings, we can infer that while many businesses are working toward incorporating more economic and consumer data into their forecasts, they are overlooking upgrading their systems and processes to take full advantage of new data.

- Only around half of respondents are either currently using AI or are fully ready to use it across different business processes.

- Around one-third of respondents reported that their businesses are “somewhat ready” to use AI for understanding the impact of external factors such as weather and social trends on their business. We found a similar trend for business processes such as demand planning and incorporating economic data into forecasting processes.

Figure 10. Selected Business Processes: Level of Preparedness To Effectively Use AI (% of Respondents) [caption id="attachment_144079" align="aligncenter" width="700"]

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not included

Totals do not sum to 100% because “Don’t know/Can’t say” responses are not included Base: 126 respondents across brands, retailers and manufacturers in the US

Source: Coresight Research [/caption]

The Path Ahead—Three Key Recommendations

Our survey findings inform our three recommendations for businesses to succeed in planning and forecasting in today’s volatile environment, which we present below.- Incorporate more external economic data/scenarios that are known to impact the business at a category levelto achieve an edge over competitors. This allows for improved decision-making and acts as an invisible hedge to any business’ bottom line against market volatility by ensuring operational efficiency across the entire supply chain. We believe that data will continue to play a crucial role in the coming years—and external economic data coupled with internal data can substantially improve forecasting processes and their efficacy.

- Take a milestone-based approach to investing.With businesses not holding back on spending to improve their processes—especially on technology and data—it is essential to focus on targeted and objective-oriented investments. For example, our survey data reveal that businesses are overlooking investing in planning and forecasting systems and processes (see Figure 9). In addition, very few respondents cited that they have made changes to forecasting systems and the way they use economic data since the start of the pandemic (see Figure 5). Having a milestone-based approach to these investments will allow businesses to make changes in real time as the economic situation evolves.

- Improve planning and forecasting systems using a centralized and connected platform, which can help unleash the true potential of AI. It may not be possible to include real-time economic data while understanding its impact on the business using legacy tools such as spreadsheets or standalone applications. Businesses should focus on switching to a centralized platform with integration capabilities for forecasting. This can help address specific problems and incorporate business-specific macroeconomic data into scenario-based simulations.

Methodology

This study is based on the analysis of data from an online survey of 126 respondents across brands, retailers and manufacturers in the US. The survey was conducted by Coresight Research on February 9–16, 2022. Respondents satisfied the following criteria:- Organizations based in the US

- Position focus on brick-and-mortar, e-commerce and omnichannel retail

- Associated with either apparel, beauty, grocery or hardware/home-improvement verticals

- Holding roles with significant strategic decision-making responsibilities within the planning and forecasting departments