Nitheesh NH

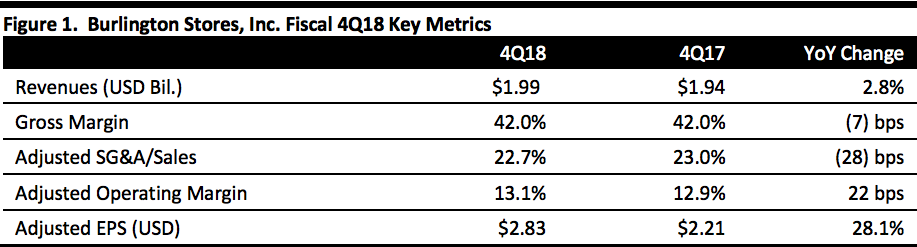

[caption id="attachment_79612" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Burlington Stores, Inc. reported fiscal 4Q18 revenues of $1.99 billion, lower than the consensus estimate of $2.05 billion, and up 2.8% year over year. The company reported adjusted 4Q18 EPS of $2.83, higher than the consensus estimate of $2.77 and 28.1% higher than the year ago period which excludes the impact of the third week and the revaluation of the 2017 deferred tax liabilities. The GAAP earnings per share (prior to the adjustments of the 53rd week and tax valuation) was $2.70 for the quarter, down 22.2% from the year ago period.

For the year, the company reported total revenue of $6.64 billion, up 9.2% from the year ago period of $6.08 billion.

Fourth quarter comparable store sales increased 1.3%, on top of 2017’s comp growth increase of 5.9%, but lower than the consensus estimate of 3.2%. The company reported the fourth quarter was its 24th consecutive quarter of positive comp sales growth. For the fiscal year, comparable store sales increased 3.2% on top of a 3.4% increase in 2017, marking the eighth consecutive year of positive comparable store sales growth.

By geography, the Southwest, Southeast and West performed above the Burlington Store’s national comp average, while the Northeast and Midwest comped below the national average.

In terms of category highlights, the company identified its top performing business lines for the fourth quarter: home; guest, toys; duty; athletic shoes; men's and ladies sportswear (driven by athletic apparel), baby apparel and Baby Depot.

The company reported that its cold weather businesses underperformed in the fourth quarter, with comps down 3.8% in the category. Management reported that sales in its heritage ladies apparel business fell short of expectations in the fourth quarter, with merchandise content a challenge.

Burlington opened three new stores in the fourth quarter in former Toys “R” Us locations. The company opened a total of 46 net new stores in 2018. The company reported it expects to open approximately 75 new stores in 2019 and close or relocate approximately 25 stores, with a net new store count for 2019 of 50 stores. The company operated 675 stores as of the end of the fourth quarter of 2018. Management stated that 34 Toys “R” US sites are part of its 2019 and 2020 new-store pipeline and commented that Toys "R" Us is a real estate opportunity as significant as the Sports Authority liquidation, which yielded 32 (former) locations to Burlington.

The company stated it is focusing on long-term strategic priorities by expanding underpenetrated categories, home and beauty, and continuing to grow its gifting category. The company ended 2018 with the home category penetration at approximately 15% of sales, which represented a 100-basis-point increase over 2017. The company stated it aims to achieve a home penetration level of at least 20%, over time. In the fourth quarter, management said that beauty and fragrance businesses were key elements of its holiday gift strategy and were sales drivers. Management commented it expects the beauty category to increase in penetration. Last, the company commented that it is continuing to develop its gift business as part of its strategic priorities, which includes toys. Gifts contributed to positive sales growth in the fourth quarter.

Outlook

1Q19 earnings per share guidance is $1.21-1.31, lower than the consensus estimate of $1.36. The company projects total sales to increase 7-9%, compared to the consensus estimate of 8.9%, and comps are expected to be 0-2% compared to the consensus estimate of 2.6%. For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06.

For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06. Total sales are expected to be in the range of 9% to 10% compared to the consensus estimate of 8.8%; this assumes comparable store sales will increase in the range of 2% to 3% for the second, third and fourth quarters of the fiscal year. Burlington expects comparable store sales in the range of 1.5% to 2.8% for the year, compared to the consensus estimate of 2.8%.

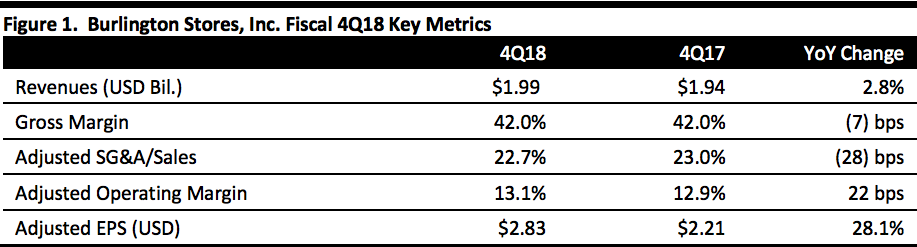

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Burlington Stores, Inc. reported fiscal 4Q18 revenues of $1.99 billion, lower than the consensus estimate of $2.05 billion, and up 2.8% year over year. The company reported adjusted 4Q18 EPS of $2.83, higher than the consensus estimate of $2.77 and 28.1% higher than the year ago period which excludes the impact of the third week and the revaluation of the 2017 deferred tax liabilities. The GAAP earnings per share (prior to the adjustments of the 53rd week and tax valuation) was $2.70 for the quarter, down 22.2% from the year ago period.

For the year, the company reported total revenue of $6.64 billion, up 9.2% from the year ago period of $6.08 billion.

Fourth quarter comparable store sales increased 1.3%, on top of 2017’s comp growth increase of 5.9%, but lower than the consensus estimate of 3.2%. The company reported the fourth quarter was its 24th consecutive quarter of positive comp sales growth. For the fiscal year, comparable store sales increased 3.2% on top of a 3.4% increase in 2017, marking the eighth consecutive year of positive comparable store sales growth.

By geography, the Southwest, Southeast and West performed above the Burlington Store’s national comp average, while the Northeast and Midwest comped below the national average.

In terms of category highlights, the company identified its top performing business lines for the fourth quarter: home; guest, toys; duty; athletic shoes; men's and ladies sportswear (driven by athletic apparel), baby apparel and Baby Depot.

The company reported that its cold weather businesses underperformed in the fourth quarter, with comps down 3.8% in the category. Management reported that sales in its heritage ladies apparel business fell short of expectations in the fourth quarter, with merchandise content a challenge.

Burlington opened three new stores in the fourth quarter in former Toys “R” Us locations. The company opened a total of 46 net new stores in 2018. The company reported it expects to open approximately 75 new stores in 2019 and close or relocate approximately 25 stores, with a net new store count for 2019 of 50 stores. The company operated 675 stores as of the end of the fourth quarter of 2018. Management stated that 34 Toys “R” US sites are part of its 2019 and 2020 new-store pipeline and commented that Toys "R" Us is a real estate opportunity as significant as the Sports Authority liquidation, which yielded 32 (former) locations to Burlington.

The company stated it is focusing on long-term strategic priorities by expanding underpenetrated categories, home and beauty, and continuing to grow its gifting category. The company ended 2018 with the home category penetration at approximately 15% of sales, which represented a 100-basis-point increase over 2017. The company stated it aims to achieve a home penetration level of at least 20%, over time. In the fourth quarter, management said that beauty and fragrance businesses were key elements of its holiday gift strategy and were sales drivers. Management commented it expects the beauty category to increase in penetration. Last, the company commented that it is continuing to develop its gift business as part of its strategic priorities, which includes toys. Gifts contributed to positive sales growth in the fourth quarter.

Outlook

1Q19 earnings per share guidance is $1.21-1.31, lower than the consensus estimate of $1.36. The company projects total sales to increase 7-9%, compared to the consensus estimate of 8.9%, and comps are expected to be 0-2% compared to the consensus estimate of 2.6%. For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06.

For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06. Total sales are expected to be in the range of 9% to 10% compared to the consensus estimate of 8.8%; this assumes comparable store sales will increase in the range of 2% to 3% for the second, third and fourth quarters of the fiscal year. Burlington expects comparable store sales in the range of 1.5% to 2.8% for the year, compared to the consensus estimate of 2.8%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Burlington Stores, Inc. reported fiscal 4Q18 revenues of $1.99 billion, lower than the consensus estimate of $2.05 billion, and up 2.8% year over year. The company reported adjusted 4Q18 EPS of $2.83, higher than the consensus estimate of $2.77 and 28.1% higher than the year ago period which excludes the impact of the third week and the revaluation of the 2017 deferred tax liabilities. The GAAP earnings per share (prior to the adjustments of the 53rd week and tax valuation) was $2.70 for the quarter, down 22.2% from the year ago period.

For the year, the company reported total revenue of $6.64 billion, up 9.2% from the year ago period of $6.08 billion.

Fourth quarter comparable store sales increased 1.3%, on top of 2017’s comp growth increase of 5.9%, but lower than the consensus estimate of 3.2%. The company reported the fourth quarter was its 24th consecutive quarter of positive comp sales growth. For the fiscal year, comparable store sales increased 3.2% on top of a 3.4% increase in 2017, marking the eighth consecutive year of positive comparable store sales growth.

By geography, the Southwest, Southeast and West performed above the Burlington Store’s national comp average, while the Northeast and Midwest comped below the national average.

In terms of category highlights, the company identified its top performing business lines for the fourth quarter: home; guest, toys; duty; athletic shoes; men's and ladies sportswear (driven by athletic apparel), baby apparel and Baby Depot.

The company reported that its cold weather businesses underperformed in the fourth quarter, with comps down 3.8% in the category. Management reported that sales in its heritage ladies apparel business fell short of expectations in the fourth quarter, with merchandise content a challenge.

Burlington opened three new stores in the fourth quarter in former Toys “R” Us locations. The company opened a total of 46 net new stores in 2018. The company reported it expects to open approximately 75 new stores in 2019 and close or relocate approximately 25 stores, with a net new store count for 2019 of 50 stores. The company operated 675 stores as of the end of the fourth quarter of 2018. Management stated that 34 Toys “R” US sites are part of its 2019 and 2020 new-store pipeline and commented that Toys "R" Us is a real estate opportunity as significant as the Sports Authority liquidation, which yielded 32 (former) locations to Burlington.

The company stated it is focusing on long-term strategic priorities by expanding underpenetrated categories, home and beauty, and continuing to grow its gifting category. The company ended 2018 with the home category penetration at approximately 15% of sales, which represented a 100-basis-point increase over 2017. The company stated it aims to achieve a home penetration level of at least 20%, over time. In the fourth quarter, management said that beauty and fragrance businesses were key elements of its holiday gift strategy and were sales drivers. Management commented it expects the beauty category to increase in penetration. Last, the company commented that it is continuing to develop its gift business as part of its strategic priorities, which includes toys. Gifts contributed to positive sales growth in the fourth quarter.

Outlook

1Q19 earnings per share guidance is $1.21-1.31, lower than the consensus estimate of $1.36. The company projects total sales to increase 7-9%, compared to the consensus estimate of 8.9%, and comps are expected to be 0-2% compared to the consensus estimate of 2.6%. For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06.

For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06. Total sales are expected to be in the range of 9% to 10% compared to the consensus estimate of 8.8%; this assumes comparable store sales will increase in the range of 2% to 3% for the second, third and fourth quarters of the fiscal year. Burlington expects comparable store sales in the range of 1.5% to 2.8% for the year, compared to the consensus estimate of 2.8%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Burlington Stores, Inc. reported fiscal 4Q18 revenues of $1.99 billion, lower than the consensus estimate of $2.05 billion, and up 2.8% year over year. The company reported adjusted 4Q18 EPS of $2.83, higher than the consensus estimate of $2.77 and 28.1% higher than the year ago period which excludes the impact of the third week and the revaluation of the 2017 deferred tax liabilities. The GAAP earnings per share (prior to the adjustments of the 53rd week and tax valuation) was $2.70 for the quarter, down 22.2% from the year ago period.

For the year, the company reported total revenue of $6.64 billion, up 9.2% from the year ago period of $6.08 billion.

Fourth quarter comparable store sales increased 1.3%, on top of 2017’s comp growth increase of 5.9%, but lower than the consensus estimate of 3.2%. The company reported the fourth quarter was its 24th consecutive quarter of positive comp sales growth. For the fiscal year, comparable store sales increased 3.2% on top of a 3.4% increase in 2017, marking the eighth consecutive year of positive comparable store sales growth.

By geography, the Southwest, Southeast and West performed above the Burlington Store’s national comp average, while the Northeast and Midwest comped below the national average.

In terms of category highlights, the company identified its top performing business lines for the fourth quarter: home; guest, toys; duty; athletic shoes; men's and ladies sportswear (driven by athletic apparel), baby apparel and Baby Depot.

The company reported that its cold weather businesses underperformed in the fourth quarter, with comps down 3.8% in the category. Management reported that sales in its heritage ladies apparel business fell short of expectations in the fourth quarter, with merchandise content a challenge.

Burlington opened three new stores in the fourth quarter in former Toys “R” Us locations. The company opened a total of 46 net new stores in 2018. The company reported it expects to open approximately 75 new stores in 2019 and close or relocate approximately 25 stores, with a net new store count for 2019 of 50 stores. The company operated 675 stores as of the end of the fourth quarter of 2018. Management stated that 34 Toys “R” US sites are part of its 2019 and 2020 new-store pipeline and commented that Toys "R" Us is a real estate opportunity as significant as the Sports Authority liquidation, which yielded 32 (former) locations to Burlington.

The company stated it is focusing on long-term strategic priorities by expanding underpenetrated categories, home and beauty, and continuing to grow its gifting category. The company ended 2018 with the home category penetration at approximately 15% of sales, which represented a 100-basis-point increase over 2017. The company stated it aims to achieve a home penetration level of at least 20%, over time. In the fourth quarter, management said that beauty and fragrance businesses were key elements of its holiday gift strategy and were sales drivers. Management commented it expects the beauty category to increase in penetration. Last, the company commented that it is continuing to develop its gift business as part of its strategic priorities, which includes toys. Gifts contributed to positive sales growth in the fourth quarter.

Outlook

1Q19 earnings per share guidance is $1.21-1.31, lower than the consensus estimate of $1.36. The company projects total sales to increase 7-9%, compared to the consensus estimate of 8.9%, and comps are expected to be 0-2% compared to the consensus estimate of 2.6%. For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06.

For FY19, the company projects earnings per share of $6.93-7.06, compared to the consensus estimate of $7.06. Total sales are expected to be in the range of 9% to 10% compared to the consensus estimate of 8.8%; this assumes comparable store sales will increase in the range of 2% to 3% for the second, third and fourth quarters of the fiscal year. Burlington expects comparable store sales in the range of 1.5% to 2.8% for the year, compared to the consensus estimate of 2.8%.