Nitheesh NH

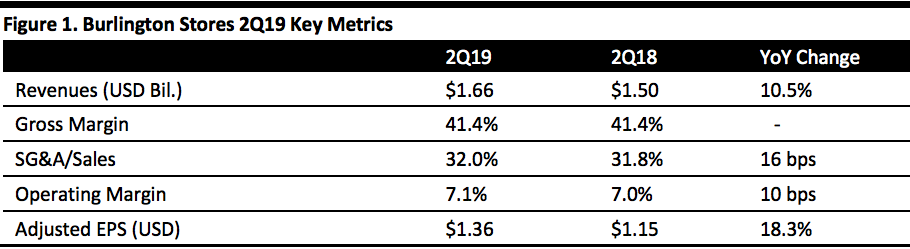

[caption id="attachment_95508" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Burlington Stores reported fiscal 2Q19 revenues of $1.66 billion, up 10.5% year over year and beating the consensus estimate of $1.63 billion. The company’s adjusted EPS increased 18.3% year over year to $1.36, ahead of the consensus estimate of $1.14.

The company saw comparable store sales growth of 3.8%, ahead of both the consensus estimate of 1.9% and the company’s guidance of 1.0-2.0%.

CEO Thomas A. Kingsbury said the company reduced its overall inventory level, from up 27% at the beginning of the fiscal year to down 2% at the end of the second quarter. The company’s comparable sales inventory was down 7% at the end of 2Q.

Management commented the company made some progress in its ladies’ apparel business during the second quarter, with accelerated growth in missy sportswear and substantial in-season open-to-buy in ladies’ apparel. However, the company reported that its penetration in ladies’ apparel is likely to decline in 2019, owing to the first half performance and rise of other businesses.

The top performing businesses were home, beauty, ladies' better and active missy sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported its beauty category was one of the strongest businesses during the second quarter, and the company expects penetration in the beauty and fragrance businesses to expand over time.

Geographically, the northeast and southwest performed above average, while comps in the west were below average.

During the second quarter, Burlington rolled out a private-label credit card and loyalty program to all of its stores, except those in Puerto Rico, which is scheduled for the third quarter. The program was piloted in the first quarter and launched in approximately 140 stores. Management said the rollout has been smooth, and expects the program to drive loyalty and purchase decisions among its customers.

Burlington opened seven net new stores in 2Q. The company is remodeling 28 stores in 2019 as part of its initiative to remodel and expand its store fleet. Management reiterated that it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the second quarter with 691 stores.

Outlook

For 3Q19, Burlington forecasts adjusted EPS of $1.37-1.41, higher than the consensus estimate of $1.33. The company expects to report comparable sales growth of 2-3%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8.5-9.5%.

For fiscal 2019 (ending February 1, 2020), Burlington raised EPS guidance to $7.14-7.22 versus prior guidance of $6.93-7.01 and compared to the consensus estimate of $6.99. The company also raised its comparable sales growth estimate to 2.0-2.5% from 1.3-2.1% earlier and compared to the consensus estimate of 1.9%.

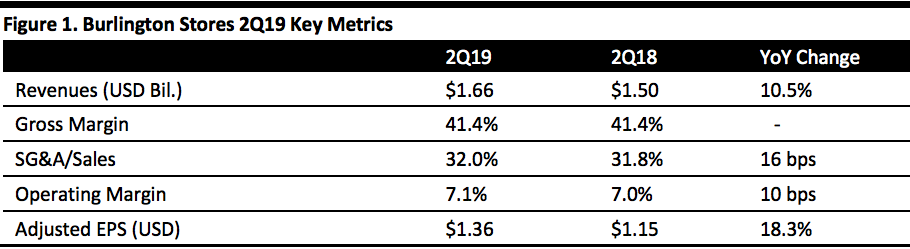

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Burlington Stores reported fiscal 2Q19 revenues of $1.66 billion, up 10.5% year over year and beating the consensus estimate of $1.63 billion. The company’s adjusted EPS increased 18.3% year over year to $1.36, ahead of the consensus estimate of $1.14.

The company saw comparable store sales growth of 3.8%, ahead of both the consensus estimate of 1.9% and the company’s guidance of 1.0-2.0%.

CEO Thomas A. Kingsbury said the company reduced its overall inventory level, from up 27% at the beginning of the fiscal year to down 2% at the end of the second quarter. The company’s comparable sales inventory was down 7% at the end of 2Q.

Management commented the company made some progress in its ladies’ apparel business during the second quarter, with accelerated growth in missy sportswear and substantial in-season open-to-buy in ladies’ apparel. However, the company reported that its penetration in ladies’ apparel is likely to decline in 2019, owing to the first half performance and rise of other businesses.

The top performing businesses were home, beauty, ladies' better and active missy sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported its beauty category was one of the strongest businesses during the second quarter, and the company expects penetration in the beauty and fragrance businesses to expand over time.

Geographically, the northeast and southwest performed above average, while comps in the west were below average.

During the second quarter, Burlington rolled out a private-label credit card and loyalty program to all of its stores, except those in Puerto Rico, which is scheduled for the third quarter. The program was piloted in the first quarter and launched in approximately 140 stores. Management said the rollout has been smooth, and expects the program to drive loyalty and purchase decisions among its customers.

Burlington opened seven net new stores in 2Q. The company is remodeling 28 stores in 2019 as part of its initiative to remodel and expand its store fleet. Management reiterated that it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the second quarter with 691 stores.

Outlook

For 3Q19, Burlington forecasts adjusted EPS of $1.37-1.41, higher than the consensus estimate of $1.33. The company expects to report comparable sales growth of 2-3%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8.5-9.5%.

For fiscal 2019 (ending February 1, 2020), Burlington raised EPS guidance to $7.14-7.22 versus prior guidance of $6.93-7.01 and compared to the consensus estimate of $6.99. The company also raised its comparable sales growth estimate to 2.0-2.5% from 1.3-2.1% earlier and compared to the consensus estimate of 1.9%.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Burlington Stores reported fiscal 2Q19 revenues of $1.66 billion, up 10.5% year over year and beating the consensus estimate of $1.63 billion. The company’s adjusted EPS increased 18.3% year over year to $1.36, ahead of the consensus estimate of $1.14.

The company saw comparable store sales growth of 3.8%, ahead of both the consensus estimate of 1.9% and the company’s guidance of 1.0-2.0%.

CEO Thomas A. Kingsbury said the company reduced its overall inventory level, from up 27% at the beginning of the fiscal year to down 2% at the end of the second quarter. The company’s comparable sales inventory was down 7% at the end of 2Q.

Management commented the company made some progress in its ladies’ apparel business during the second quarter, with accelerated growth in missy sportswear and substantial in-season open-to-buy in ladies’ apparel. However, the company reported that its penetration in ladies’ apparel is likely to decline in 2019, owing to the first half performance and rise of other businesses.

The top performing businesses were home, beauty, ladies' better and active missy sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported its beauty category was one of the strongest businesses during the second quarter, and the company expects penetration in the beauty and fragrance businesses to expand over time.

Geographically, the northeast and southwest performed above average, while comps in the west were below average.

During the second quarter, Burlington rolled out a private-label credit card and loyalty program to all of its stores, except those in Puerto Rico, which is scheduled for the third quarter. The program was piloted in the first quarter and launched in approximately 140 stores. Management said the rollout has been smooth, and expects the program to drive loyalty and purchase decisions among its customers.

Burlington opened seven net new stores in 2Q. The company is remodeling 28 stores in 2019 as part of its initiative to remodel and expand its store fleet. Management reiterated that it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the second quarter with 691 stores.

Outlook

For 3Q19, Burlington forecasts adjusted EPS of $1.37-1.41, higher than the consensus estimate of $1.33. The company expects to report comparable sales growth of 2-3%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8.5-9.5%.

For fiscal 2019 (ending February 1, 2020), Burlington raised EPS guidance to $7.14-7.22 versus prior guidance of $6.93-7.01 and compared to the consensus estimate of $6.99. The company also raised its comparable sales growth estimate to 2.0-2.5% from 1.3-2.1% earlier and compared to the consensus estimate of 1.9%.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Burlington Stores reported fiscal 2Q19 revenues of $1.66 billion, up 10.5% year over year and beating the consensus estimate of $1.63 billion. The company’s adjusted EPS increased 18.3% year over year to $1.36, ahead of the consensus estimate of $1.14.

The company saw comparable store sales growth of 3.8%, ahead of both the consensus estimate of 1.9% and the company’s guidance of 1.0-2.0%.

CEO Thomas A. Kingsbury said the company reduced its overall inventory level, from up 27% at the beginning of the fiscal year to down 2% at the end of the second quarter. The company’s comparable sales inventory was down 7% at the end of 2Q.

Management commented the company made some progress in its ladies’ apparel business during the second quarter, with accelerated growth in missy sportswear and substantial in-season open-to-buy in ladies’ apparel. However, the company reported that its penetration in ladies’ apparel is likely to decline in 2019, owing to the first half performance and rise of other businesses.

The top performing businesses were home, beauty, ladies' better and active missy sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported its beauty category was one of the strongest businesses during the second quarter, and the company expects penetration in the beauty and fragrance businesses to expand over time.

Geographically, the northeast and southwest performed above average, while comps in the west were below average.

During the second quarter, Burlington rolled out a private-label credit card and loyalty program to all of its stores, except those in Puerto Rico, which is scheduled for the third quarter. The program was piloted in the first quarter and launched in approximately 140 stores. Management said the rollout has been smooth, and expects the program to drive loyalty and purchase decisions among its customers.

Burlington opened seven net new stores in 2Q. The company is remodeling 28 stores in 2019 as part of its initiative to remodel and expand its store fleet. Management reiterated that it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the second quarter with 691 stores.

Outlook

For 3Q19, Burlington forecasts adjusted EPS of $1.37-1.41, higher than the consensus estimate of $1.33. The company expects to report comparable sales growth of 2-3%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8.5-9.5%.

For fiscal 2019 (ending February 1, 2020), Burlington raised EPS guidance to $7.14-7.22 versus prior guidance of $6.93-7.01 and compared to the consensus estimate of $6.99. The company also raised its comparable sales growth estimate to 2.0-2.5% from 1.3-2.1% earlier and compared to the consensus estimate of 1.9%.