DIpil Das

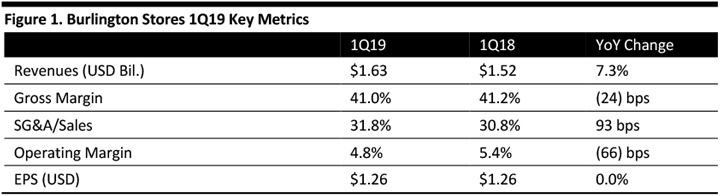

[caption id="attachment_89555" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Burlington Stores reported fiscal 1Q19 revenues of $1.63 billion, up 7.3% year over year and beating the consensus estimate of $1.62 billion. The company’s EPS was $1.26, even with the year ago period and above the consensus estimate of $1.25.

The company saw comparable store sales growth of 0.1%, lower than the consensus estimate of 0.6%, but within the company’s guidance of flat to up 2.0%.

Management commented that its ladies’ apparel business continued to be a challenge for the company during the first quarter, as women are not purchasing “career dressing” apparel, which includes dresses and suits. The company reported that it does not plan to increase its penetration in ladies’ apparel in 2019.

The top performing businesses were home, beauty and beds, ladies' better and active sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot. Management said its missy sportswear business is outperforming, particularly in the casual and athletic categories.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported that its beauty category outperformed during the first quarter, beauty being another growth area for Burlington.

Geographically, the Northeast and Southwest performed above the company’s average, while comps in the Midwest, Southeast and West were slightly below company average.

Burlington piloted a private-label credit card and loyalty program during the first quarter, and the program is now live in approximately 140 stores. The company is preparing to roll out the program to its full chain of stores this fiscal year.

Burlington is remodeling 28 stores in 2019 as part of the company’s growth initiative to remodel and expand its store fleet. Management reported it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the first quarter with 684 stores.

Outlook

For 2Q19, Burlington forecasts EPS of $1.11-1.15, in line with the consensus estimate of $1.13. The company expects to report comparable sales growth of 1-2%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8-9%, in line with the consensus estimate of 8.8% growth.

For fiscal 2020, Burlington lowered its EPS guidance to $6.93-7.01 versus prior guidance of $6.93-7.06 and compared to the consensus estimate of $6.97. The company lowered its comparable sales estimate to 1.3-2.1% from 1.5-2.8% and compared to the consensus estimate of 2.2%.

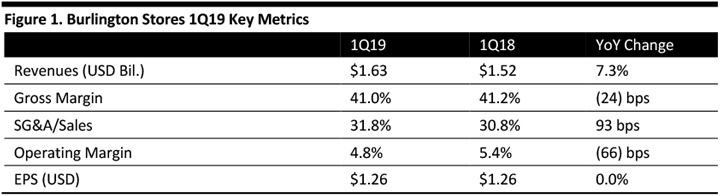

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Burlington Stores reported fiscal 1Q19 revenues of $1.63 billion, up 7.3% year over year and beating the consensus estimate of $1.62 billion. The company’s EPS was $1.26, even with the year ago period and above the consensus estimate of $1.25.

The company saw comparable store sales growth of 0.1%, lower than the consensus estimate of 0.6%, but within the company’s guidance of flat to up 2.0%.

Management commented that its ladies’ apparel business continued to be a challenge for the company during the first quarter, as women are not purchasing “career dressing” apparel, which includes dresses and suits. The company reported that it does not plan to increase its penetration in ladies’ apparel in 2019.

The top performing businesses were home, beauty and beds, ladies' better and active sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot. Management said its missy sportswear business is outperforming, particularly in the casual and athletic categories.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported that its beauty category outperformed during the first quarter, beauty being another growth area for Burlington.

Geographically, the Northeast and Southwest performed above the company’s average, while comps in the Midwest, Southeast and West were slightly below company average.

Burlington piloted a private-label credit card and loyalty program during the first quarter, and the program is now live in approximately 140 stores. The company is preparing to roll out the program to its full chain of stores this fiscal year.

Burlington is remodeling 28 stores in 2019 as part of the company’s growth initiative to remodel and expand its store fleet. Management reported it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the first quarter with 684 stores.

Outlook

For 2Q19, Burlington forecasts EPS of $1.11-1.15, in line with the consensus estimate of $1.13. The company expects to report comparable sales growth of 1-2%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8-9%, in line with the consensus estimate of 8.8% growth.

For fiscal 2020, Burlington lowered its EPS guidance to $6.93-7.01 versus prior guidance of $6.93-7.06 and compared to the consensus estimate of $6.97. The company lowered its comparable sales estimate to 1.3-2.1% from 1.5-2.8% and compared to the consensus estimate of 2.2%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Burlington Stores reported fiscal 1Q19 revenues of $1.63 billion, up 7.3% year over year and beating the consensus estimate of $1.62 billion. The company’s EPS was $1.26, even with the year ago period and above the consensus estimate of $1.25.

The company saw comparable store sales growth of 0.1%, lower than the consensus estimate of 0.6%, but within the company’s guidance of flat to up 2.0%.

Management commented that its ladies’ apparel business continued to be a challenge for the company during the first quarter, as women are not purchasing “career dressing” apparel, which includes dresses and suits. The company reported that it does not plan to increase its penetration in ladies’ apparel in 2019.

The top performing businesses were home, beauty and beds, ladies' better and active sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot. Management said its missy sportswear business is outperforming, particularly in the casual and athletic categories.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported that its beauty category outperformed during the first quarter, beauty being another growth area for Burlington.

Geographically, the Northeast and Southwest performed above the company’s average, while comps in the Midwest, Southeast and West were slightly below company average.

Burlington piloted a private-label credit card and loyalty program during the first quarter, and the program is now live in approximately 140 stores. The company is preparing to roll out the program to its full chain of stores this fiscal year.

Burlington is remodeling 28 stores in 2019 as part of the company’s growth initiative to remodel and expand its store fleet. Management reported it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the first quarter with 684 stores.

Outlook

For 2Q19, Burlington forecasts EPS of $1.11-1.15, in line with the consensus estimate of $1.13. The company expects to report comparable sales growth of 1-2%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8-9%, in line with the consensus estimate of 8.8% growth.

For fiscal 2020, Burlington lowered its EPS guidance to $6.93-7.01 versus prior guidance of $6.93-7.06 and compared to the consensus estimate of $6.97. The company lowered its comparable sales estimate to 1.3-2.1% from 1.5-2.8% and compared to the consensus estimate of 2.2%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Burlington Stores reported fiscal 1Q19 revenues of $1.63 billion, up 7.3% year over year and beating the consensus estimate of $1.62 billion. The company’s EPS was $1.26, even with the year ago period and above the consensus estimate of $1.25.

The company saw comparable store sales growth of 0.1%, lower than the consensus estimate of 0.6%, but within the company’s guidance of flat to up 2.0%.

Management commented that its ladies’ apparel business continued to be a challenge for the company during the first quarter, as women are not purchasing “career dressing” apparel, which includes dresses and suits. The company reported that it does not plan to increase its penetration in ladies’ apparel in 2019.

The top performing businesses were home, beauty and beds, ladies' better and active sportswear, men's sportswear and active wear, children's and baby apparel and accessories and baby depot. Management said its missy sportswear business is outperforming, particularly in the casual and athletic categories.

Management highlighted that its home category represents the largest growth opportunity for the company. Burlington ended fiscal year 2018 with its home category penetration at approximately 15% of sales, and management projects the company can hit 20% over time. Management also reported that its beauty category outperformed during the first quarter, beauty being another growth area for Burlington.

Geographically, the Northeast and Southwest performed above the company’s average, while comps in the Midwest, Southeast and West were slightly below company average.

Burlington piloted a private-label credit card and loyalty program during the first quarter, and the program is now live in approximately 140 stores. The company is preparing to roll out the program to its full chain of stores this fiscal year.

Burlington is remodeling 28 stores in 2019 as part of the company’s growth initiative to remodel and expand its store fleet. Management reported it expects to open approximately 75 gross and 50 net new stores in 2019. Burlington ended the first quarter with 684 stores.

Outlook

For 2Q19, Burlington forecasts EPS of $1.11-1.15, in line with the consensus estimate of $1.13. The company expects to report comparable sales growth of 1-2%, compared to the consensus estimate of 2.5%. The company expects revenue growth of 8-9%, in line with the consensus estimate of 8.8% growth.

For fiscal 2020, Burlington lowered its EPS guidance to $6.93-7.01 versus prior guidance of $6.93-7.06 and compared to the consensus estimate of $6.97. The company lowered its comparable sales estimate to 1.3-2.1% from 1.5-2.8% and compared to the consensus estimate of 2.2%.