albert Chan

Burlington Stores, Inc.

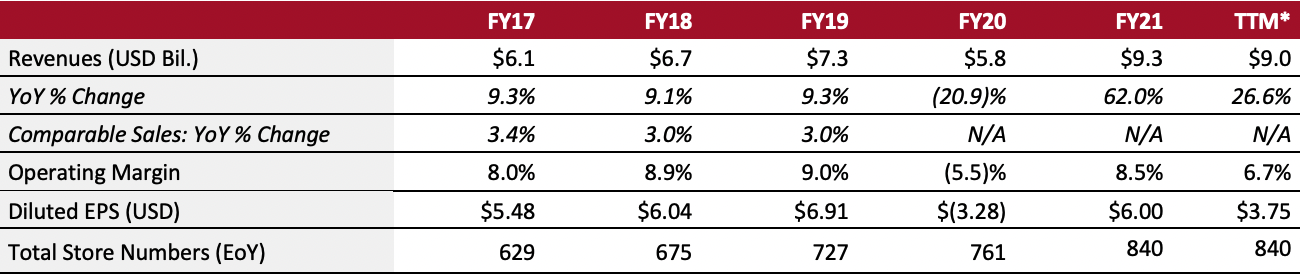

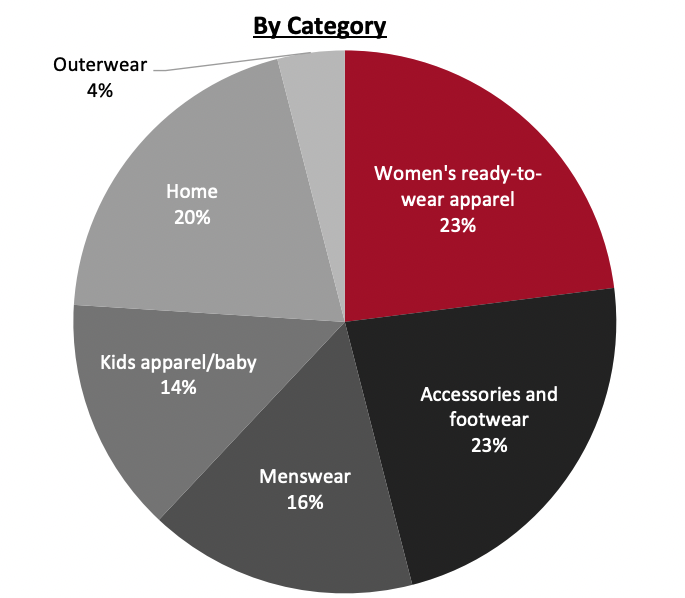

Sector: Off-price Country of operation: US Key product categories: Accessories, beauty, baby and youth, footwear, home, toys, and men’s and women’s ready-to-wear Annual Metrics [caption id="attachment_151933" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

Fiscal year ends on January 30 of the following calendar year* TTM is calculated based on the month ending April 30, 2022[/caption] Summary Burlington Stores, Inc. sells branded apparel products in the US, operating under the following categories: accessories, baby and youth, footwear, home, and men’s and women’s ready-to-wear. Beyond apparel, the company also sells beauty products, home goods and toys. It offers merchandise at up to 60% off other retailers’ prices. The company was founded in 1972, when it operated as Burlington Coat Factory, and is headquartered in Burlington, New Jersey. As of January 29, 2022, Burlington operates 840 physical stores in the US in 45 states, including Puerto Rico, and employs 62,395 associates, including 47,592 part-time and seasonal associates. Of those associates, 86% work in stores, 10% in distribution centers and 4% in its corporate organization. Over 99% of the company’s net sales are derived from its physical stores. The company made its full shift away from e-commerce in 2020, with the decision to transition its e-commerce website to a marketing and content-based site designed to inspire customers to shop in stores, which was announced on its fourth-quarter earnings call in March. Management reported that its decision was based on challenges of e-commerce profitability regarding shipping at its low price points, as well as a desire to focus on the “treasure hunt” experience in off-price, which is difficult to recreate online. The company’s e-commerce sales were immaterial to its overall sales as merchandise sold directly from the company’s website represented approximately 0.5% of its total sales in fiscal 2019. In its annual 10-K report, dated January 29, 2022, the company described its core customer as “25–49-years-old with an average annual household income of $25,000–$100,000” who is “more ethnically diverse than the general population. The core customer is educated, resides in mid- to large-sized metropolitan areas and shops for themselves, their family and their home. We appeal to value-seeking and brand-conscious customers who understand the off-price model and love the thrill of the hunt.” Company Analysis Coresight Research insight: Burlington’s strategy sets out a path that is heavily focused on physical store expansion and is reliant on consumer revenue from physical stores. On its third-quarter earnings call in November 2020, the retailer stated that its average unit retail price is between $11 and $11—price points that e-commerce retailers would struggle to compete with. The company highlighted on its fourth-quarter fiscal 2022 earnings call in March 2022 that it expects value-oriented shoppers to migrate to its off-price stores, particularly in an inflationary economy and as consumers increasingly seek offerings at affordable prices across categories. While this physical retail-focused growth strategy has worked in the past, we still note this as a risk for the company going forward, given the fixed costs of a physical real estate portfolio particularly as more consumers are shopping online. The retailer’s move to a smaller format store is a positive move given this concern.

| Tailwinds | Headwinds |

|

|

- Chase the sales trend more effectively. Plan more conservative comparable stores sales growth, hold and control liquidity, closely analyze the sales trend by business and be ready to chase that trend.

- Make a greater investment in merchandising capabilities. Invest in incremental headcount, especially in growing or under-developed businesses, training and coaching, improved tools and reporting, and other forms of merchant support.

- Operate with leaner inventories. Carry less inventory, which should drive faster turns and lower markdowns, while simultaneously improving customers’ shopping experience. Expand the depth and bread of categories, including beauty, home and women’s apparel.

- Adhere to a market-focused and financially disciplined real estate strategy. Expand the retail store base in the US to at least 2,000 stores over the long term.

- Maintain focus on unit economics and returns. Adopt a market-focused approach to new store openings, emphasize maximizing sales and achieve attractive unit economics and returns.

- Reduce its comparable store inventory and reduce the square footage of its stores—but continue to maintain a broad assortment.

- Enhance the store experience through store remodels and relocations. Invest in store remodels on a store-by-store basis where appropriate, taking into consideration the age, sales and profitability of a store, as well as the potential impact on the customer shopping experience.

- On its third-quarter 2020 earnings call on November 24, 2020, management stated that the company has the opportunity to significantly improve store-level productivity and economics by further reducing the size of its stores—its real estate and store operations teams have developed a smaller, 25,000-square-foot store prototype for future store openings.

- A year later, on its third-quarter 2021 earnings call on November 23, 2021, management provided an update on its store strategy, with an acceleration of its new store opening program. In 2022, Burlington plans to open 120 new stores, which should yield approximately 90 net new stores after closures and relocations. From 2023 onward, Burlington expects to open 130–150 new stores each year. About 30 of these will be relocations of older stores to newer, smaller prototype locations. Over the next five years, more than 75% of the new stores will be less than 30,000 square feet.

- Enhance existing categories and introduce new categories. The store and supply chain teams must continue to respond to the challenge of becoming more responsive to the sales chase, enhancing their ability to flex up and down based on trends.

- Optimize markdowns. Maximize sales and gross margin dollars based on forward-looking sales forecasts, sell-through targets and exit dates.

- Enhance purchasing power. Increasing the store footprint and expanding east and west coast buying offices provides the opportunity to capture incremental buying opportunities and realize economies of scale in merchandising and non-merchandising purchasing activities.

- Challenge expenses to drive operating leverage. Leverage sales over the fixed costs of the business and conservatively plan comparable store sales growth to force tighter expense control throughout all areas of the business to drive operating leverage on any sales ahead of the plan.

Source: Company reports

Revenue Breakdown (FY21) [caption id="attachment_151934" align="aligncenter" width="480"] Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments

| Date | Development |

| May 26, 2022 | Announces that Kristin Wolfe has been appointed Chief Financial Officer effective on or about August 1, 2022. |

| April 4, 2022 | Announces the retirement of Chief Financial Officer, John Crimmins, effective August 3, 2022, or on the date his successor takes employment. |

| November 2021 | Updates its store opening program, focusing on small-format stores. In 2022, Burlington plans to open about 120 new stores, yielding approximately 90 net new stores. From 2023 onward, Burlington expects to open 130–150 new stores each year, about 30 of which will be relocations of older stores to newer, smaller prototype locations. Over the next five years, more than 75% of the new stores will be less than 30,000 square feet. |

| August 2021 | Releases its third annual Corporate Social Responsibility Report. This report highlights progress the company has made across its Environmental, Social and Governance initiatives during its fiscal year 2020. |

| March 2021 | Announces that it has expanded its new store target to 2,000 stores—up from the company’s initial target of 1,000 stores, which was established in connection with the company’s IPO in 2013. |

| Appoints Michael Goodwin, Senior Vice President and Chief Information Technology Officer of PetSmart, Inc., to the Board of Directors and Audit Committee, effective December 1, 2020. | |

| April 2020 | Announces two weeks of financial support to employees impacted by store closures, and temporarily furloughs most store and distribution center associates. Burlington continues to provide benefits to furloughed associates, including paying 100% of their current health-benefit premiums. |

| March 2020 | Announces that all of its stores will close from March 22, due to the Covid-19 pandemic. |

| March 2020 | Closes 100 stores across the US on March 19, due to the Covid-19 pandemic. |

| October 2019 | Appoints John Crimmins as Chief Financial Officer on October 15. Crimmins served as Interim Chief Financial Officer since September 16, in addition to his role as Executive Vice President, Finance and Chief Accounting Officer. |

| September 2019 | Announces a nationwide initiative encouraging its customers to donate $1 or more at checkout to tThe company partnered with CFDA designer Christian Siriano to help young cancer survivors find fashions that suit their personal style with looks from Burlington. |

| September 2019 | Appoints John Crimmins as Interim Chief Financial Officer on September 16. Marc Katz resigns as the company’s Chief Financial Officer/Principal, effective immediately. |

| September 2019 | Donates $2 million to AdoptAClassroom.org to support teachers and students as they head back to school. |

| April 2019 | Announces a leadership succession plan: Thomas Kingsbury, Chairman, President and Chief Executive Officer, will step down as CEO on September 16, 2019; Michael O’Sullivan, formerly President and Chief Operating Officer of Ross Stores, Inc., will join Burlington on September 16, 2019, as CEO. O’Sullivan will also be appointed to the company’s Board. Jennifer Vecchio, Chief Merchandising Officer, Principal, has been appointed to the newly created role of President, Chief Merchandising Officer, effective immediately. |

| November 2018 | Kicks off the 12th year of the Warm Coats and Warm Hearts Coat Drive with ABC’s Good Morning America and Delivering Good, Inc. The company encourages customers to visit a Burlington location to donate “gently worn” coats. |

| October 2018 | Makes changes to its business model to adapt to the ongoing transformation in the sector, including increasing vendor counts, technological advancements and a better marketing approach. These will help in registering top- and bottom-line growth. |

| October 2018 | Announces that Jessica Rodriguez will join its board of directors and corporate governance committee. Rodriguez served as President and Chief Operating Officer of UCI Networks since January 2018 and, since 2014, as Chief Marketing Officer for Univision Communications Inc. (UCI), a Spanish-language media company. |

- Michael O’Sullivan—CEO and Director

- John D. Crimmins—Executive VP and CFO

- Jennifer Vecchio—Chief Merchandising Officer and President

- Travis Marquette—President and COO

- David Glick—Senior VP of Investor Relations and Treasurer

Source: Company reports