Source: Company reports

4Q15 RESULTS

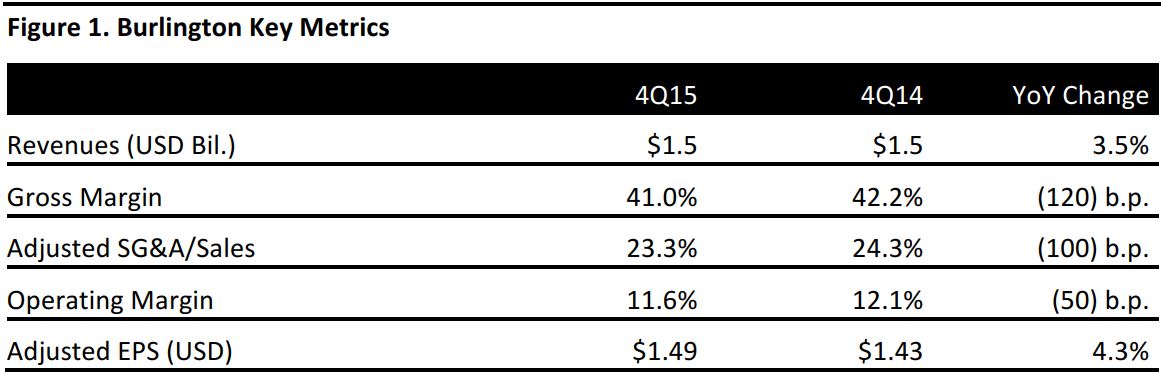

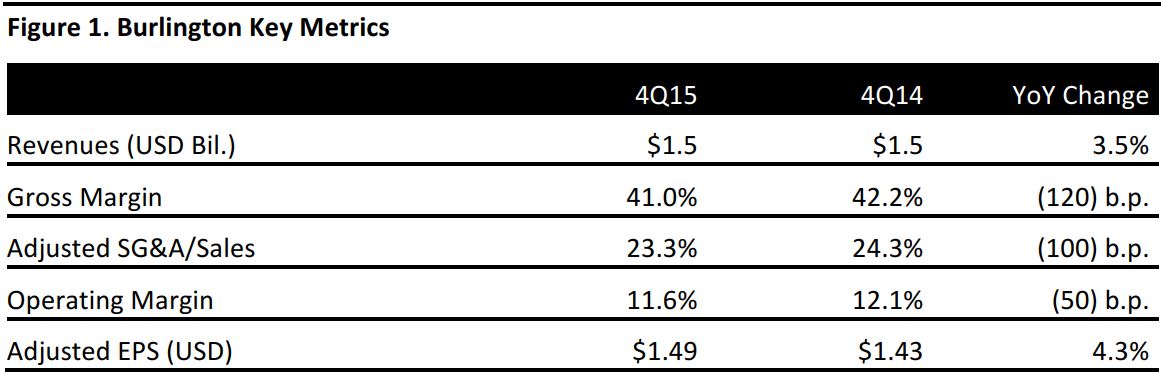

Discount retailer Burlington recorded 4Q15 comps of 0.1%, compared with an increase of 6.7% in the year-ago quarter. The company previously expected that unseasonably warm weather would dampen results during the period. Comps excluding cold weather categories—which represent 22% of total sales and generated a (11.0)% comp in the quarter—increased by 4.0% year over year.

Gross margin declined by 120 basis points, to 41.0%, in the quarter, driven by increased markdown expenses.

Adjusted SG&A improved by 100 basis points due to lower costs for incentives, store payroll and advertising, which were partially offset by an increase in stock-based compensation.

2015 RESULTS

The company’s revenues in 2015 were $5.1 billion, up 5.8% from 2014.

Comps were up 2.1%, compared to a 4.9% increase in the prior year.

Burlington recorded adjusted EPS of $2.31, up 26.0% from $1.83 in 2014.

Total merchandise inventory during the year decreased by 0.7%, to $783.5 million, compared to $788.7 million in 2014, primarily driven by a comp store inventory decrease of 6.0%. The decrease was partially offset by new store inventory at the 25 new stores opened during the year.

GUIDANCE

For 1Q16, Burlington expects comps to increase by 2.5%–3.5%, versus consensus of 3.0%. Adjusted EPS guidance is for $0.44–$0.48, below the consensus of $0.49. Net sales are expected to increase by 6.2%–7.2%, to about $1.6 billion.

For the year, comps are expected to increase by 2.5%–3.5%, in line with consensus of 2.8%. Burlington expects adjusted EPS of $2.62–$2.72, versus consensus of $2.72. The company expects revenue to increase by 6.5%–7.5%, implying $5.4–$5.5 billion in sales, versus the consensus of $5.4 billion.

The company expects to open 25 new stores in 2016.