DIpil Das

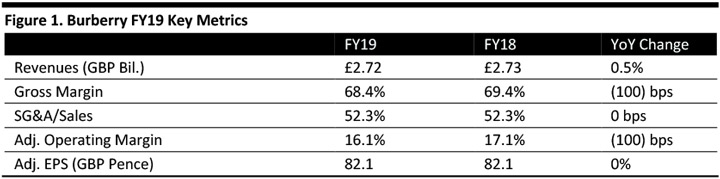

[caption id="attachment_88529" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

FY19 Results

Burberry reported FY19 sales of £2.72 billion, down 1% at constant foreign exchange rates, missing the consensus estimate of flat currency neutral. Revenues excluding beauty wholesale grew 2% as reported and up 2% currency neutral. Adjusted EPS was flat at 82.1 pence, beating the consensus estimate of 81.3 pence.

The company recorded flat retail sales, both as reported and currency neutral. Retail comparable store sales grew 2%. The company also saw a decrease of 1% from the net impact of space on revenue.

Comps saw low single digit percentage growth in Asia Pacific, EMEA and the Americas:

In Asia, the company saw Chinese spending shift away from other Asian tourists’ locations. Comps in the second half were stronger in mainland China but softer in Hong Kong. Comps in Korea benefited from both local consumption and Chinese outbound tourists in the first half. In EMEIA, the UK delivered mid-single digit percentage growth, driven by improved tourist spending in the second half. Comps declined in the Middle East due to the macroeconomic environment. US comps saw low single digit percentage growth, negatively impacted by softer local footfall trends in the second half.

By product, the company saw a positive response from seasonal products and innovation but softness in older among mainline and digital customers. Products from Burberry’s new Chief Creative Officer Riccardo Tisci had a strong initial response with double digit percentage growth. Although customers responded positively to new bags, the overall category performance was negatively impacted by previous collections.

Wholesale revenue, excluding beauty, increased 8% (up 7% currency neutral), driven by strong spending in travel retail from Chinese tourists.

Licensing revenue increased 54% (up 53% currency neutral) to £46 million, driven by beauty. The business transitioned from wholesale to a licensed partnership with Coty in October 2017. However, excluding beauty, revenue was down £3 million because of the non-renewal of the watch licensing agreement with Fossil.

Gross margin declined 100 bps to 68.4%, the result of negative foreign exchange rates and increasing investment in new products. Adjusted operating margin was down 100 bps (up 10 bps currency neutral) to 16.1%.

During FY19, the company refreshed Burberry’s logo and monogram and created a new product aesthetic. With the growing importance of digital, the company sold monthly drops of limited-edition products called B- on social platforms. The company also partnered with Instagram to allow customers to make purchases directly via Burberry’s Instagram account.

In FY19, the company started to close 38 smaller, non-strategic retail stores in secondary locations, relocated and expanded its Dubai flagship and opened a new store at Xi’an Shin Kong Place in Xi’an, China. The company is also remodeling flagship stores, with more than 80 to be completed by the end of FY20.

Outlook

The company confirmed its guidance for FY20:

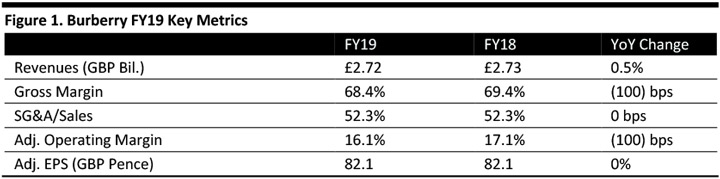

Source: Company reports/Coresight Research[/caption]

FY19 Results

Burberry reported FY19 sales of £2.72 billion, down 1% at constant foreign exchange rates, missing the consensus estimate of flat currency neutral. Revenues excluding beauty wholesale grew 2% as reported and up 2% currency neutral. Adjusted EPS was flat at 82.1 pence, beating the consensus estimate of 81.3 pence.

The company recorded flat retail sales, both as reported and currency neutral. Retail comparable store sales grew 2%. The company also saw a decrease of 1% from the net impact of space on revenue.

Comps saw low single digit percentage growth in Asia Pacific, EMEA and the Americas:

In Asia, the company saw Chinese spending shift away from other Asian tourists’ locations. Comps in the second half were stronger in mainland China but softer in Hong Kong. Comps in Korea benefited from both local consumption and Chinese outbound tourists in the first half. In EMEIA, the UK delivered mid-single digit percentage growth, driven by improved tourist spending in the second half. Comps declined in the Middle East due to the macroeconomic environment. US comps saw low single digit percentage growth, negatively impacted by softer local footfall trends in the second half.

By product, the company saw a positive response from seasonal products and innovation but softness in older among mainline and digital customers. Products from Burberry’s new Chief Creative Officer Riccardo Tisci had a strong initial response with double digit percentage growth. Although customers responded positively to new bags, the overall category performance was negatively impacted by previous collections.

Wholesale revenue, excluding beauty, increased 8% (up 7% currency neutral), driven by strong spending in travel retail from Chinese tourists.

Licensing revenue increased 54% (up 53% currency neutral) to £46 million, driven by beauty. The business transitioned from wholesale to a licensed partnership with Coty in October 2017. However, excluding beauty, revenue was down £3 million because of the non-renewal of the watch licensing agreement with Fossil.

Gross margin declined 100 bps to 68.4%, the result of negative foreign exchange rates and increasing investment in new products. Adjusted operating margin was down 100 bps (up 10 bps currency neutral) to 16.1%.

During FY19, the company refreshed Burberry’s logo and monogram and created a new product aesthetic. With the growing importance of digital, the company sold monthly drops of limited-edition products called B- on social platforms. The company also partnered with Instagram to allow customers to make purchases directly via Burberry’s Instagram account.

In FY19, the company started to close 38 smaller, non-strategic retail stores in secondary locations, relocated and expanded its Dubai flagship and opened a new store at Xi’an Shin Kong Place in Xi’an, China. The company is also remodeling flagship stores, with more than 80 to be completed by the end of FY20.

Outlook

The company confirmed its guidance for FY20:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Burberry reported FY19 sales of £2.72 billion, down 1% at constant foreign exchange rates, missing the consensus estimate of flat currency neutral. Revenues excluding beauty wholesale grew 2% as reported and up 2% currency neutral. Adjusted EPS was flat at 82.1 pence, beating the consensus estimate of 81.3 pence.

The company recorded flat retail sales, both as reported and currency neutral. Retail comparable store sales grew 2%. The company also saw a decrease of 1% from the net impact of space on revenue.

Comps saw low single digit percentage growth in Asia Pacific, EMEA and the Americas:

In Asia, the company saw Chinese spending shift away from other Asian tourists’ locations. Comps in the second half were stronger in mainland China but softer in Hong Kong. Comps in Korea benefited from both local consumption and Chinese outbound tourists in the first half. In EMEIA, the UK delivered mid-single digit percentage growth, driven by improved tourist spending in the second half. Comps declined in the Middle East due to the macroeconomic environment. US comps saw low single digit percentage growth, negatively impacted by softer local footfall trends in the second half.

By product, the company saw a positive response from seasonal products and innovation but softness in older among mainline and digital customers. Products from Burberry’s new Chief Creative Officer Riccardo Tisci had a strong initial response with double digit percentage growth. Although customers responded positively to new bags, the overall category performance was negatively impacted by previous collections.

Wholesale revenue, excluding beauty, increased 8% (up 7% currency neutral), driven by strong spending in travel retail from Chinese tourists.

Licensing revenue increased 54% (up 53% currency neutral) to £46 million, driven by beauty. The business transitioned from wholesale to a licensed partnership with Coty in October 2017. However, excluding beauty, revenue was down £3 million because of the non-renewal of the watch licensing agreement with Fossil.

Gross margin declined 100 bps to 68.4%, the result of negative foreign exchange rates and increasing investment in new products. Adjusted operating margin was down 100 bps (up 10 bps currency neutral) to 16.1%.

During FY19, the company refreshed Burberry’s logo and monogram and created a new product aesthetic. With the growing importance of digital, the company sold monthly drops of limited-edition products called B- on social platforms. The company also partnered with Instagram to allow customers to make purchases directly via Burberry’s Instagram account.

In FY19, the company started to close 38 smaller, non-strategic retail stores in secondary locations, relocated and expanded its Dubai flagship and opened a new store at Xi’an Shin Kong Place in Xi’an, China. The company is also remodeling flagship stores, with more than 80 to be completed by the end of FY20.

Outlook

The company confirmed its guidance for FY20:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Burberry reported FY19 sales of £2.72 billion, down 1% at constant foreign exchange rates, missing the consensus estimate of flat currency neutral. Revenues excluding beauty wholesale grew 2% as reported and up 2% currency neutral. Adjusted EPS was flat at 82.1 pence, beating the consensus estimate of 81.3 pence.

The company recorded flat retail sales, both as reported and currency neutral. Retail comparable store sales grew 2%. The company also saw a decrease of 1% from the net impact of space on revenue.

Comps saw low single digit percentage growth in Asia Pacific, EMEA and the Americas:

In Asia, the company saw Chinese spending shift away from other Asian tourists’ locations. Comps in the second half were stronger in mainland China but softer in Hong Kong. Comps in Korea benefited from both local consumption and Chinese outbound tourists in the first half. In EMEIA, the UK delivered mid-single digit percentage growth, driven by improved tourist spending in the second half. Comps declined in the Middle East due to the macroeconomic environment. US comps saw low single digit percentage growth, negatively impacted by softer local footfall trends in the second half.

By product, the company saw a positive response from seasonal products and innovation but softness in older among mainline and digital customers. Products from Burberry’s new Chief Creative Officer Riccardo Tisci had a strong initial response with double digit percentage growth. Although customers responded positively to new bags, the overall category performance was negatively impacted by previous collections.

Wholesale revenue, excluding beauty, increased 8% (up 7% currency neutral), driven by strong spending in travel retail from Chinese tourists.

Licensing revenue increased 54% (up 53% currency neutral) to £46 million, driven by beauty. The business transitioned from wholesale to a licensed partnership with Coty in October 2017. However, excluding beauty, revenue was down £3 million because of the non-renewal of the watch licensing agreement with Fossil.

Gross margin declined 100 bps to 68.4%, the result of negative foreign exchange rates and increasing investment in new products. Adjusted operating margin was down 100 bps (up 10 bps currency neutral) to 16.1%.

During FY19, the company refreshed Burberry’s logo and monogram and created a new product aesthetic. With the growing importance of digital, the company sold monthly drops of limited-edition products called B- on social platforms. The company also partnered with Instagram to allow customers to make purchases directly via Burberry’s Instagram account.

In FY19, the company started to close 38 smaller, non-strategic retail stores in secondary locations, relocated and expanded its Dubai flagship and opened a new store at Xi’an Shin Kong Place in Xi’an, China. The company is also remodeling flagship stores, with more than 80 to be completed by the end of FY20.

Outlook

The company confirmed its guidance for FY20:

- Broadly stable revenue and adjusted operating margins at constant exchange rates.

- Higher weight of operating profit in H2 relative to H1 than the prior year.