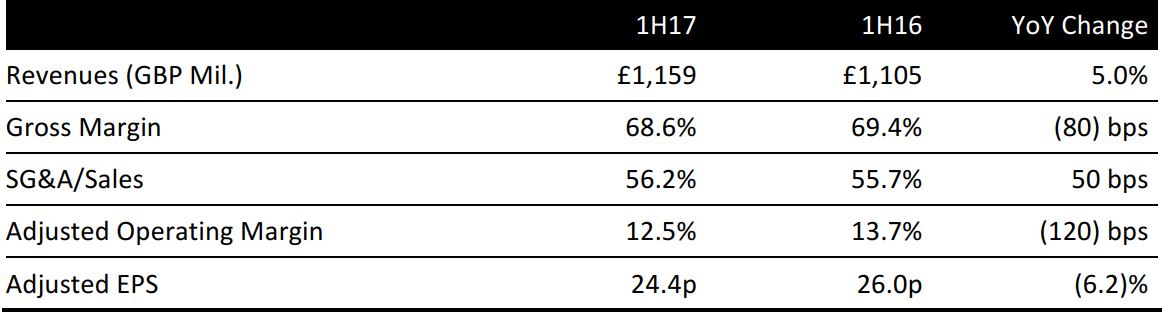

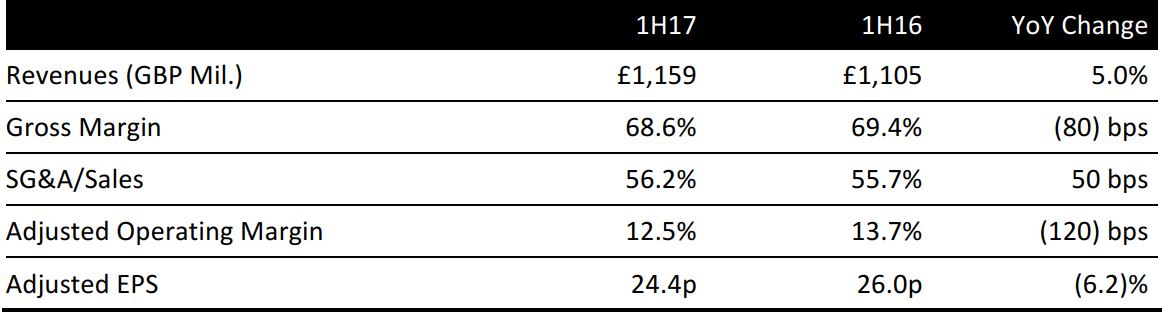

1H17 is 26-week period ended September 30, 2016

Source: Company reports/Fung Global Retail & Technology

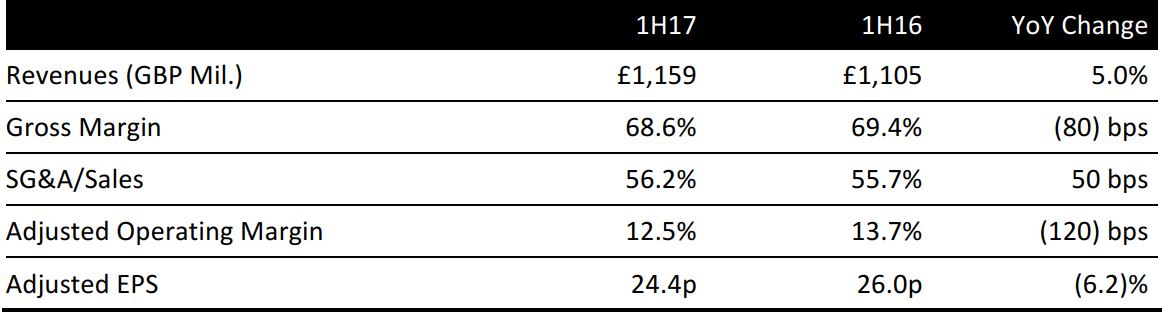

Burberry reported a constant-currency decline of 4% in 1H17 total group revenue to £1,159 million (up 5% in reported currency), below the consensus estimate of £1,165 million. Total results were negatively impacted by weakness in the wholesale and licensing businesses.

Total retail sales increased 2% year over year at constant currency (down 11% in reported currency) to £859 million. The retail business was driven by strength in the UK, and company-wide retail comparable sales increased 2% year over year in 2Q17, marking a sequential improvement from the 3% decline in 1Q17.

Wholesale sales declined by 14% year over year at constant currency (down 6% in reported currency) to £287 million in FY17.

1H17 licensing revenue declined 54% year over year on a constant-currency basis to £12.8 million, primarily reflecting the planned expiry of Japanese Burberry licenses.

1H17 sales in Asia Pacific declined by 1% year over year at constant currency. Hong Kong continued to experience negative footfall in 1H17, with comparable retail sales down in the double-digit percentage. Excluding Hong Kong and Macau, comparable retail sales in the region were positive in 1H17. Revenues were down 12% at constant currency in the Americas and up 1% year over year at constant currency in Europe, the Middle East, India and Africa. Revenues in 2Q17 in the UK increased by 30% on a comparable basis, driven by strong tourist spend due to the weakness of sterling.

1H17 gross margin contracted by 80bps and the SG&A margin increased by 50bps, resulting in operating margin contraction of 120bps. 1H17 adjusted EPS declined by 6.2% year over year, in line with consensus.

OUTLOOK

FY17 net new space additions are expected to contribute low single-digit percentage sales growth in the retail division. Around 15 store openings are planned, with a similar number of closures.

Burberry expects total wholesale revenues to decline in the mid-teens percentage year over year at constant currency for 2H17, reflecting similar revenue trends to those reported in 1H17.

Total licensing revenue in FY17 is expected to decline about £20 million at constant currency, down from £42 million in FY16, primarily reflecting the expiry of the Japanese Burberry licenses.

Burberry expects FY17 constant-currency adjusted profit before tax to remain stable.

The company plans to deliver at least £100 million of annualized cost savings by FY19, of which around £20 million will be delivered in FY17.

The consensus estimate for FY17 revenue stands at £2,755.9 million, implying annual year-over-year growth of 9.6%. Consensus expects operating profit of £434.0 million, implying a year-over-year increase of 7.7%. The FY17 consensus EPS estimate is 76 pence, implying a year-over-year increase of 8.6%.