Burberry Beats Expectations

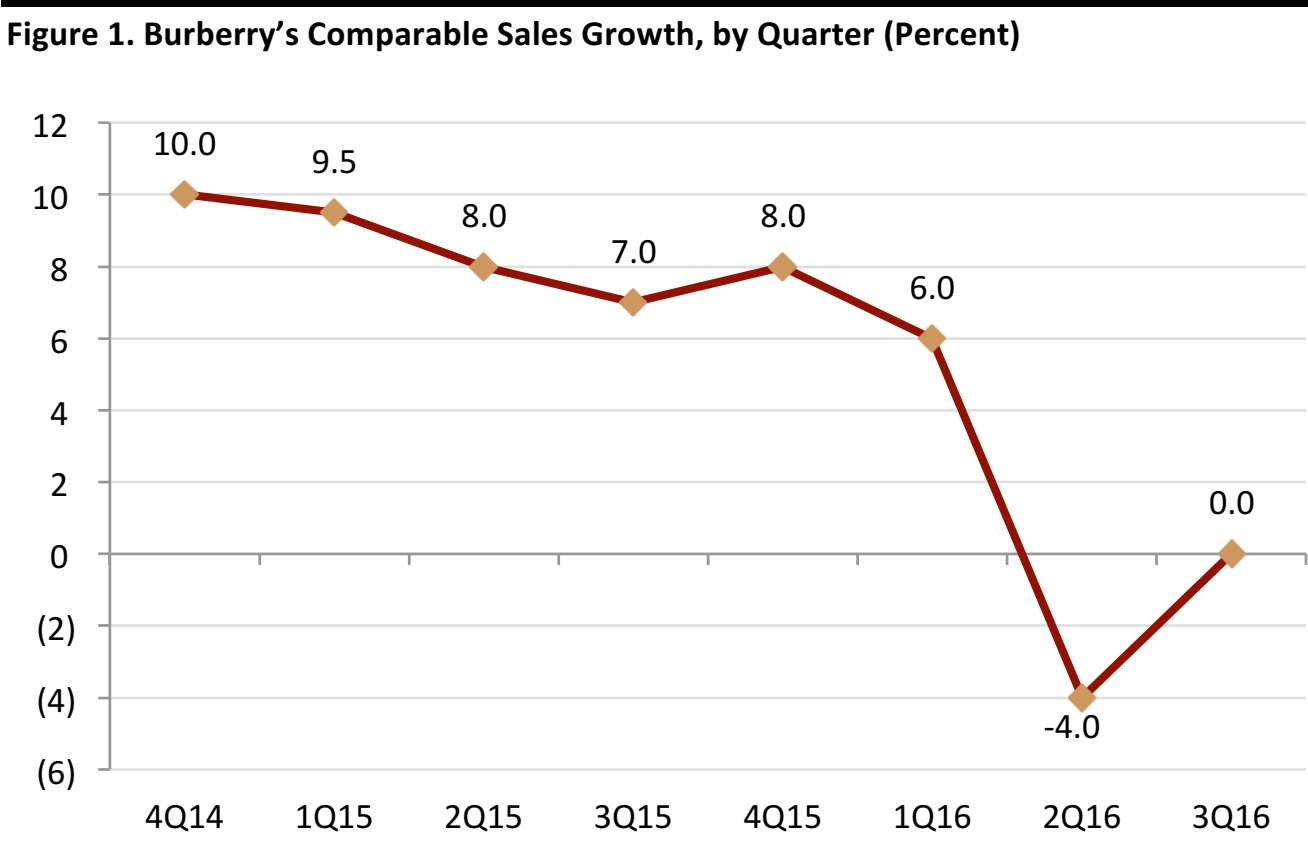

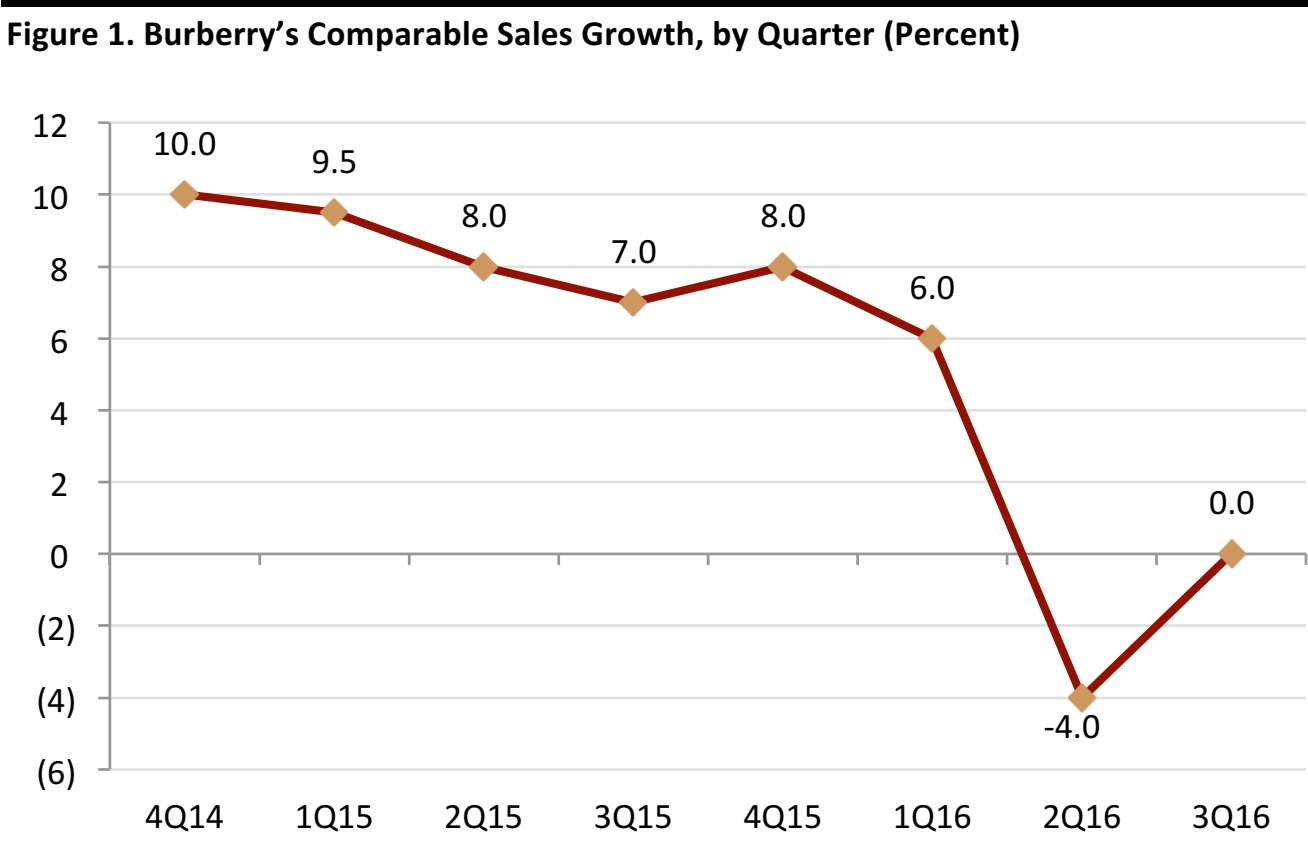

Burberry, the British manufacturer, wholesaler and retailer of luxury goods, reported flat

comps for its third fiscal quarter ending December 31, 2015. The result was better than the consensus estimate of (2.0)%, according to S&P Capital IQ, and an improvement over the previous quarter’s (4.0)% comps. Burberry’s underlying retail revenue rose by 1% in the period.

Source: Company reports/S&P Capital IQ

Burberry’s results have been achieved in a challenging environment for luxury retailers, with the economies of market leaders such as China showing a slowdown in growth. Christopher Bailey, Burberry’s CEO and Chief Creative Officer, said that the company’s focus on growth and cost control was instrumental in delivering the quarterly results, which would have been positive—with comps up 3%—were it not for the negative impact of the results in Hong Kong.

Hong Kong Dragged Down Results, but China Returned to Growth

In the Asia-Pacific region, comps saw a mid-single digit decline, dragged down by the negative performance in Hong Kong, where comps declined by 20%. However, excluding Hong Kong and Macau, the region showed mid-single-digit comparable sales growth. Most significantly, the crucial markets of China and South Korea returned to growth, while Japan remained strong, with comps up 50%. Traveling luxury customers, particularly from Mainland China, started to travel to Japan for their shopping trips. They avoided Hong Kong because the devaluation of the renminbi against the US dollar made it less affordable for Mainland Chinese customers to shop there, as the Hong Kong dollar is pegged to the US dollar.

The EMEA region also saw mid-single-digit increases in comps. Within the region, the best-performing markets were Spain and Italy, which both delivered comps in excess of 20%. France and the UK remained challenging, and the UK accounts for more than a third of the company’s revenue in the region. In the UK, a decline in traveling luxury customers from China and the Middle East negatively impacted results.

The Americas showed marginally positive comps, with Canada, Brazil and Mexico delivering double-digit increases. The US delivered mixed results, having experienced some recovery of sales from domestic customers but a decline in sales from traveling luxury customers.

Investment in Mobile and Digital Innovation

Investment in mobile was instrumental to delivering growth in digital, which outperformed in all regions during the quarter. Mobile now accounts for the majority of traffic on Burberry.com. During the quarter, Burberry continued to invest in digital innovation, including through collaborations with Apple, WeChat, Google and DreamWorks. The expansion of the single inventory model in the UK and the US, the largest digital markets for the company, also contributed to growth.

Burberry Prepares for the Challenges Ahead

Burberry expects that fiscal year 2016 retail/wholesale profit will be about £10 million (US$15.2 million) higher than it was in fiscal year 2015, assuming that exchange rates remain at their current levels.

Bailey said that the outlook for the luxury industry continues to be challenging, as the operating environment remains uncertain, but that the company is responding to the changes through continuous investments in new growth opportunities and efficiency.

comps for its third fiscal quarter ending December 31, 2015. The result was better than the consensus estimate of (2.0)%, according to S&P Capital IQ, and an improvement over the previous quarter’s (4.0)% comps. Burberry’s underlying retail revenue rose by 1% in the period.

comps for its third fiscal quarter ending December 31, 2015. The result was better than the consensus estimate of (2.0)%, according to S&P Capital IQ, and an improvement over the previous quarter’s (4.0)% comps. Burberry’s underlying retail revenue rose by 1% in the period.