DIpil Das

Introduction

What’s the Story? Coresight Research has identified the expanding metaverse as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of this report for more details). Our new Building Blocks of the Metaverse series presents insights into the core technological components of the retail metaverse, including important details for retailers to know in establishing a presence and operating in the virtual space. In this report, we explore the development of non-fungible tokens (NFTs), analyze their technological structure and relationship with the metaverse, and provide examples of creative NFT strategies by notable retailers. Why It Matters NFTs are non-exchangeable units of data stored on an indelible record of transactions (the blockchain). NFTs have skyrocketed in popularity along with pandemic-fueled interest in blockchain and cryptocurrencies, allowing for authenticity, security, verification and protection of digital assets. As these features provide blockchain games and virtual worlds with the opportunity to establish functioning in-game economies, brands and retailers are beginning to mint and sell NFTs as individual pieces and collections as they look to expand their businesses, strengthen brand names and increase their customer base and loyalty. As technologies improve and metaverse users become more invested in their digital lives, NFTs will enable them to protect virtual and (in some cases) physical assets of all types, fostering uniqueness for digital avatars and lives. Due to their complexity and digital nature, however, critics say that prices are overinflated, and NFTs are fraudulent. In fact, in January 2022, the largest NFT marketplace, OpenSea, stated that 80% of NFT sales were “plagiarized, fake and spam.” Despite the risks of conducting transactions in a market fraught with fake products, we believe that NFTs are important for retailers to build a virtual presence. Over the next few decades, if the metaverse does evolve to become an extension of the real world, NFTs will comprise the basis of in-world economics and could represent every unique digital asset in virtual worlds and on blockchains. NFTs have recently made headlines for impressive transaction sizes (see Figure 1), with many brands, customers and collectors joining the craze. The NFT market is set to grow from $35 billion in 2022 to $80 billion by 2025, representing a CAGR of 31.7%, according to financial services firm Jefferies Group.Figure 1: Top Five NFT Collections by All-Time Sales* (Primary and Secondary) [wpdatatable id=1833 table_view=regular]

*As of March 15, 2022 Source: CryptoSlam

Building Blocks of the Metaverse—NFTs: Coresight Research Analysis

Advantages of NFTs in the Metaverse NFTs benefit from the strengths on the blockchain, upon which they are based. In-game payments for blockchain-based virtual worlds and transactions of digital assets are not subject to third-party delays; they are instant, verified and secure; and they provide the purchaser with verified record of products’ transaction history, improving authenticity. Because of these features, NFTs can represent all types of digital assets, and economies within worlds are free to thrive without interference or delay experienced in today’s world of centralized finance with fiat currencies. As users spend more hours in the metaverse, they will likely become more invested in their digital personas, customizing their avatars with unique accessories, attire and cosmetics—represented by NFTs. As each digital asset is unique, users prescribe them with value and can sell them in an NFT marketplace or virtual world as they would in the real world. Transacting on the blockchain secures and verifies ownership of digital possessions and increases authenticity by providing parties with records of products’ transaction history. NFTs allow for interoperability, with users free to bring their assets and avatars between virtual worlds. [caption id="attachment_143766" align="aligncenter" width="720"] Genies Avatar accessory NFTs, available on Flow (left); RTFKT CloneX NFT Avatars (right)

Genies Avatar accessory NFTs, available on Flow (left); RTFKT CloneX NFT Avatars (right) Sources: Flow/RTFKT [/caption] Protecting Ownership, Distinctiveness and Documenting Authenticity The metaverse will likely become a fully functioning economy and fully formed universe. Because virtual and augmented renderings of practically any real-world object can be created or copied very easily in a virtual setting, it is crucial for users to protect the originality of virtual avatars, establish ownership of digital assets of all types and values, and ensure authenticity of virtual products. Without the scarcity that drives NFT demand, it is difficult, if not impossible, to lay the groundwork for active in-world economies that function much like markets in the real world. By tying assets to NFTs through digital certificates, NFT meta data and transaction history, and social media announcements, platforms are able to protect ownership as users build inventories of digital assets (from avatar makeup, accessories and clothing to land parcels, to essentially anything). Every node in a blockchain maintains a record of transactions, so ownership can only be disrupted if all the nodes are disrupted.

- On February 8, 2022, cross-world avatar platform Ready Player Me, developed by Wolf3D, released avatars featuring various CryptoPunks NFTs. Owners of the original CryptoPunks NFTs will have the exclusive opportunity to use these avatars in various virtual world platforms, but no other users will. The distinctiveness of these 10,000 avatars, tied to the original collection, is protected.

CryptoPunks NFT avatars

CryptoPunks NFT avatars Source: Ready Player Me[/caption] Interoperability Although many virtual worlds currently exist separately from one another, NFT technology is crucial for bridging the gap between these worlds and creating a truly uniform metaverse, where users are able to bring their digital assets (other than land) and avatars from environment to environment—a prerequisite for introducing customers to digital lifestyles. This concept is known as interoperability and is extremely important to the metaverse’s success, because users will want to take their virtual assets and explore different immersive environments and virtual worlds that each have their own unique offerings. Without an interoperable ecosystem, users are confined to one metaverse and are unable to interact with acquaintances in other universes without setting up an entirely new digital identity and so losing digital assets. Without NFT technology protecting and verifying ownership on the blockchain, a digital asset only has value in its native game. Currently, interoperability main applies to virtual worlds based on the same blockchain—for example, Decentraland and The Sandbox are, in theory, interoperable because they are both built on Ethereum. In the future, advances in technology will make cross-chain communication possible, where separate blockchains send and receive information and data—enabling NFTs constructed on different blockchains to be interoperable. Games not based on a blockchain, such as Fortnite and Roblox, have created large and thriving ecosystems with their own protections of digital assets, but they run on different technology. Without significant technological development, assets from these non-blockchain worlds would lose value in other environments. Background: The Development of NFTs One of the main reasons for the recent growing popularity of NFTs, other than their scarcity, is that many notable brands, celebrities and retailers began generating staggering NFT sales during the Covid-19 pandemic. Even before the pandemic accelerated a shift to virtual life, however, NFT technology had been developing steadily. Blockchain technology was first introduced in 2009, when Bitcoin’s creator, Satoshi Nakamoto, mined the “Genesis Block.” Bitcoin, the first major blockchain, did not directly support unique tokens with non-fungible hashes until 2014, when the Counterparty platform introduced XCP (its own currency built on Bitcoin) as well as standards (known as token standards) for smart contracts in the blockchain, which is crucial for smoothly transferring and verifying NFT transactions and ownership. Smart contracts are lines of code written into the blockchain that automatically execute contracts when pre-existing conditions are met. Newly minted NFTs will be native to a specific blockchain, with different smart contract features establishing their rules for transfer. In Figure 2, we present a brief timeline of important events in recent NFT history leading up their explosion in popularity and establishment as the backbone of commerce in virtual worlds.

Figure 2: Notable NFT Developments: A Timeline [wpdatatable id=1834 table_view=regular]

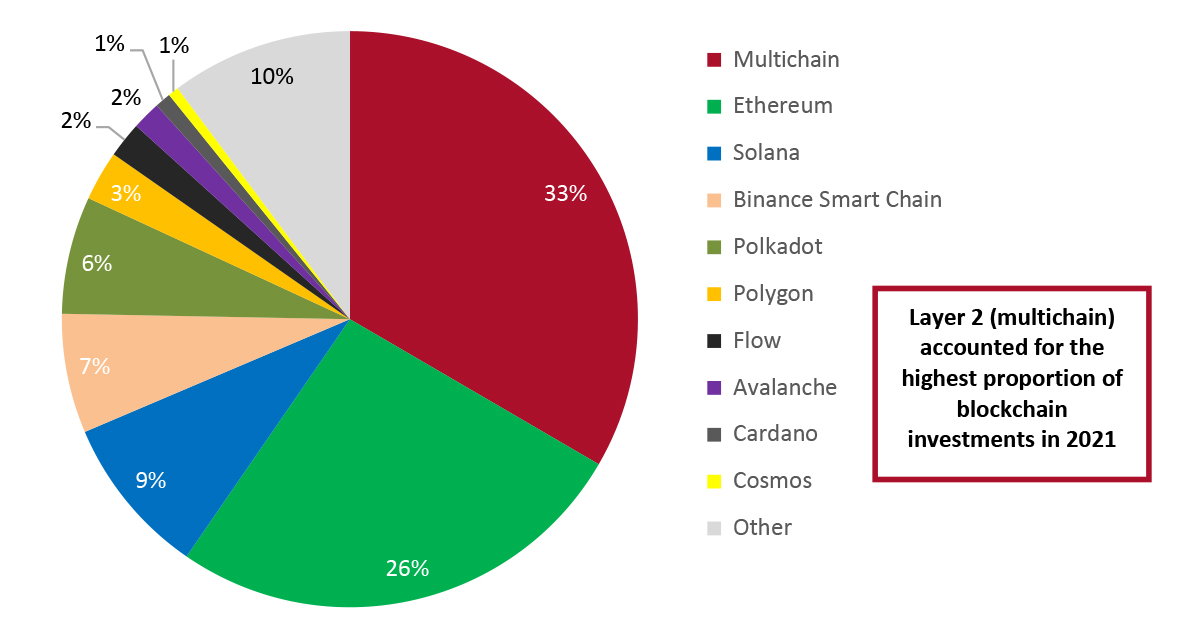

Source: Coresight Research Underlying Technologies Blockchain The blockchain comprises three layers. Layer 3 covers blockchain-based applications and games (virtual worlds) that feature cross-chain implementation for different Mainnet blockchains (primary public blockchain) to send and receive data. Layers 1 and 2 are key infrastructure for NFTs, as we discuss below. (Look out for our upcoming report for more on blockchain in the metaverse.)

- NFTs in Layer 1

- NFTs in Layer 2

Figure 3: Blockchain Funding Deals in 2021, Breakdown by Blockchain Platform (% of Total Count) [caption id="attachment_143778" align="aligncenter" width="700"]

Source: The Block Research[/caption]

Cryptographic Hashes

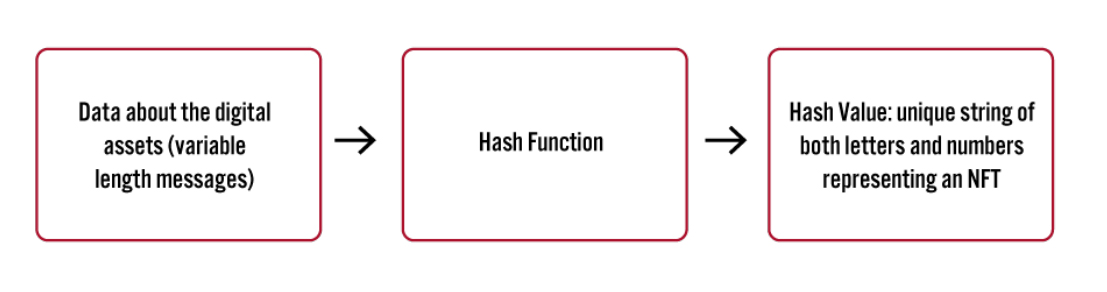

Cryptographic hash functions, which are important for all NFTs, are algorithms or mathematical formulas that take arbitrary amounts of data about the digital asset and convert them into a string of enciphered text called the hash value, or encryption. This hash value represents the NFT, and it can be used to verify the owner, serving in place of a password and making the NFT non-exchangeable.

Strong hash functions should be “collision-free” to ensure security, meaning that no two inputs (string of characters) produce the same output so it is near-impossible to guess the input value. Using cryptocurrencies as payment increases security even further, with transactions being recorded across every block in the distributed ledger.

Source: The Block Research[/caption]

Cryptographic Hashes

Cryptographic hash functions, which are important for all NFTs, are algorithms or mathematical formulas that take arbitrary amounts of data about the digital asset and convert them into a string of enciphered text called the hash value, or encryption. This hash value represents the NFT, and it can be used to verify the owner, serving in place of a password and making the NFT non-exchangeable.

Strong hash functions should be “collision-free” to ensure security, meaning that no two inputs (string of characters) produce the same output so it is near-impossible to guess the input value. Using cryptocurrencies as payment increases security even further, with transactions being recorded across every block in the distributed ledger.

Figure 4: Fundamentals of Cryptographic Hash Functions [caption id="attachment_143769" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Token Standards for Smart Contracts

In Ethereum and many other blockchains, smart contracts are lines of code, or computer programs, written directly into the blockchain that automate the execution of contracts once pre-existing conditions are met; they enable parties to be certain that a transaction has taken place immediately, rather than experiencing third-party delays and transaction costs. In other words, smart contracts are responsible for handling and securing transfers of NFTs, and verifying ownership on the blockchain.

When a new token is created, whether fungible or not, it is issued with a token standard, which defines the rules that smart contracts must follow for how that token (or later tokens minted in the same denomination if it is a currency/coin) is transferred and how records of transfers are stored on the blockchain. These standards also ensure that tokens of new projects remain compatible with existing blockchains. ERC-20 is one of the most popular token standards on the Ethereum blockchain, defining rules for fungible tokens such as virtual currencies. ERC-721 is the most popular standard for NFTs such as digital artwork or music.

Although NFTs and cryptocurrencies are based on the same technology, NFTs operate on specific standards, whereas tokens in any denomination of a cryptocurrency are issued on standards for fungible tokens.

Most blockchains will have technology similar to token standards. Newer Layer 1 protocols such as Solana, released in 2020, feature slightly different systems. Each account created in the Solana chain has a unique address and is owned by a program, which enables minting, transferring and burning. The mint address for a particular token determines fungibility.

What Retailers Should Know

Businesses looking to sell digital products as NFTs and tie real-world products to NFTs have several options for blockchains and marketplaces to use, each with slightly different features to consider. The table below shows the top five NFT marketplaces not confined to a specific gaming environment or brand (for NFTs of all types), where transaction fees are charged and vary by marketplace (the marketplace’s income), and gas fees are variable based on time of transaction and blockchain used.

Source: Coresight Research[/caption]

Token Standards for Smart Contracts

In Ethereum and many other blockchains, smart contracts are lines of code, or computer programs, written directly into the blockchain that automate the execution of contracts once pre-existing conditions are met; they enable parties to be certain that a transaction has taken place immediately, rather than experiencing third-party delays and transaction costs. In other words, smart contracts are responsible for handling and securing transfers of NFTs, and verifying ownership on the blockchain.

When a new token is created, whether fungible or not, it is issued with a token standard, which defines the rules that smart contracts must follow for how that token (or later tokens minted in the same denomination if it is a currency/coin) is transferred and how records of transfers are stored on the blockchain. These standards also ensure that tokens of new projects remain compatible with existing blockchains. ERC-20 is one of the most popular token standards on the Ethereum blockchain, defining rules for fungible tokens such as virtual currencies. ERC-721 is the most popular standard for NFTs such as digital artwork or music.

Although NFTs and cryptocurrencies are based on the same technology, NFTs operate on specific standards, whereas tokens in any denomination of a cryptocurrency are issued on standards for fungible tokens.

Most blockchains will have technology similar to token standards. Newer Layer 1 protocols such as Solana, released in 2020, feature slightly different systems. Each account created in the Solana chain has a unique address and is owned by a program, which enables minting, transferring and burning. The mint address for a particular token determines fungibility.

What Retailers Should Know

Businesses looking to sell digital products as NFTs and tie real-world products to NFTs have several options for blockchains and marketplaces to use, each with slightly different features to consider. The table below shows the top five NFT marketplaces not confined to a specific gaming environment or brand (for NFTs of all types), where transaction fees are charged and vary by marketplace (the marketplace’s income), and gas fees are variable based on time of transaction and blockchain used.

- As Solana was released in 2020, its gas fees (per transaction) are almost nonexistent at $0.00025—a fraction of a penny.

- Ethereum gas fees can vary widely, but have been diminishing as Layer 2 solutions are quickly being added to support NFT trade.

- Solanart and AtomicMarket charge variable creator’s fees, improving monetization opportunities for designers and developers.

Figure 5: Top Five NFT Marketplaces Not Confined to a Particular Game or Brand by All-Time Volume* [wpdatatable id=1835 table_view=regular]

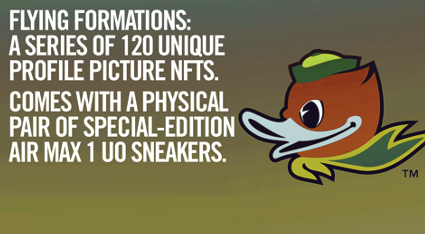

*As of March 15, 2022 Sources: DappRadar Notable Examples Many retailers from different industries have partnered with NFT platforms, marketplaces and blockchains to mint and sell NFT collections. As NFTs can come to represent any type of digital asset that trades on a blockchain, brands have engaged in innovative strategies to capitalize of benefits of NFT scarcity and security. Below, we present examples of unique NFT-related offerings from notable brands operating in various sectors. NIKE (Apparel) NIKE is heavily involved in building a metaverse presence, filing patents to pair physical goods and NFTs and for the sale of downloadable goods, and creating a virtual headquarters, Nikeland, in the Roblox metaverse. In December 2021, NIKE acquired RTFKT, a digital apparel company that mints virtual sneakers, clothing, accessories and avatars as NFTs for users to customize their virtual and digital lives. RTFKT has released its CloneX collection of unique avatars for users to take across the metaverse as identities. The collection is one of the top 10 highest-selling NFT collections (total sales), and its mysterious NIKE-branded MNLTH collection, a levitating box that “seems to be sentient,” is also in the top 30, according to NFT data aggregator CryptoSlam. In collaboration with University of Oregon alum and designer Tinker Hatfield, NIKE also released Oregon Duck-branded limited-edition Nike Air Max 1 sneakers, paired with “Ducks of a Feather” NFTs, worth about $2,800 at time of auction. With these moves, NIKE has positioned itself well to be a big player in avatar accessorizing and augmented-reality fashion. [caption id="attachment_143779" align="aligncenter" width="425"]

NFT of a duck, also the logo featured on the Nike Air Max 1 Sneaker

NFT of a duck, also the logo featured on the Nike Air Max 1 Sneaker Source: Ducks of a Feather [/caption] Clinique (Cosmetics) Estée Lauder’s first set of NFTs was minted in 2021 for Clinique, its venerable beauty brand. Clinique held a competition for its Smart Rewards loyalty members, who would each share stories of optimism and hopes for the future. Judges selected three winners who were awarded an NFT each, named “MetaOptimist,” and were digital representations of their flagship products, Moisture Surge 100H and Almost Lipstick Black Honey. The goal of the campaign was not to generate millions in additional sales from NFTs but to increase interaction and loyalty, giving customers a platform to tell a story. Clinique partnered with Layer 2 Ethereum protocol Polygon and promises to deliver customers authentic and interconnected real-time experiences by continuing to leverage its NFT marketplace for unique and immersive offerings. Hot Wheels (Toy Manufacturing) Leading up to Christmas 2021, Mattel, the manufacturer of iconic toy car brand, Hot Wheels, released toy car NFTs as part of a unique strategy to increase exclusivity and market certain hot wheels paired with NFTs as valuable collectibles that appreciate over time. Mattel released 40 limited-edition Hot Wheels designs along with animated cars depicted driving, starting at $15 each. Each product came with either four or 10 NFTs, with various levels of exclusivity. Over 5,000 (5% chance for any customer) of these NFTs were also redeemable for physical versions, blurring the lines between real and virtual and increasing the company’s customer base. [caption id="attachment_143771" align="aligncenter" width="700"]

Source: Hot Wheels[/caption]

Partnering with Wax Blockchain, Mattel is also giving customers the opportunity to buy, sell and propose trades of the collectible Hot Wheels in the Wax NFT marketplace while also showcasing their inventories on social media. The global marketplace allows users to track rarity with comprehensive ownership records.

Source: Hot Wheels[/caption]

Partnering with Wax Blockchain, Mattel is also giving customers the opportunity to buy, sell and propose trades of the collectible Hot Wheels in the Wax NFT marketplace while also showcasing their inventories on social media. The global marketplace allows users to track rarity with comprehensive ownership records.

What We Think

Although NFTs are complex technologies—which, in their early days, have experienced issues with fraud—they have huge long-term potential as they may eventually come to represent every type of asset. By tying both real and virtual assets to NFTs, the blockchain is able to provide superior verification of ownership and authenticity than assets have in the real world, as there is a record of every transaction being stored in each block. Smart contracts, which are essential for NFTs, allow both parties in transactions to be immediately certain the transaction has occurred, without incurring costs or delays through third parties. Because NFTs are non-exchangeable, protect ownership and execute transactions automatically, they enable decentralized in-world economies to thrive. Many organizations are building solutions to support high-volume NFT trading in these virtual world economies. Each NFT minted, per its token standard, will come to represent a specific digital asset, whether it be an avatar or digital clothing, accessories, cosmetics, etc. This means they will be important in enabling users to protect the distinctiveness of their digital personas. Many NFTs are also constructed on the same blockchain, making the interoperability of assets between different virtual worlds theoretically possible. Many retailers have partnered with blockchains, NFT platforms and blockchain projects to mint NFT collections that have generated hundreds of millions of dollars in sales. However, we believe that retailers with stronger brands, as opposed to multi-brand retailers, will have larger opportunities to leverage NFT-related technologies, as single brands can be more recognizable and provide higher levels of product interaction and experience for customers.Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]