DIpil Das

Introduction

What’s the Story? Coresight Research has identified the expanding metaverse as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer centricity, in 2022 and beyond (see the end of this report for more details). In this report, we discuss the development of immersive technologies, analyze their structures and relationships with the metaverse, and provide examples of creative extended reality strategies among notable brands and retailers. This report forms part of our new Building Blocks of the Metaverse series, which presents insights into the core technological components of the retail metaverse, including important details for retailers to know in establishing a presence and operating in the virtual space. Why It Matters With the metaverse currently in its infancy, there are two separate visions of how it relates to immersive technologies, which will likely be interoperable in the future. The first vision is more popular, positioning the metaverse as a virtual world and gaming space for users to interact and trade with one another, as well as brands and retailers, as avatars. The second vision is an emerging concept based on the metaverse’s capacity to provide instant global access to virtual versions of real-world locations by linking virtual and physical places with real-time data. Immersive technologies will help brands and retailers to realize both of these visions and engage in innovative strategies to improve customer experiences and enable instant universal access to unlock a larger customer base.Building the Metaverse: Immersive Technologies: Coresight Research Analysis

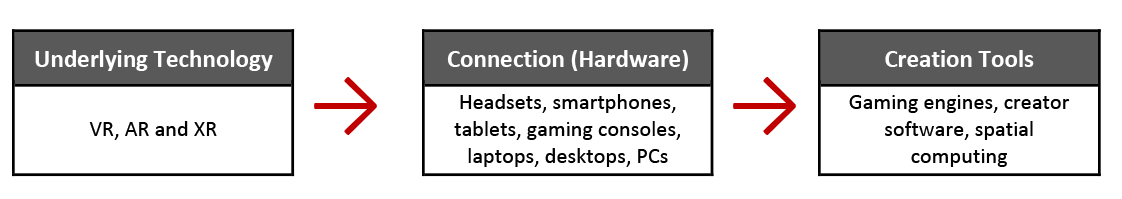

Connection to the metaverse is facilitated through hardware and creation tools, which leverage underlying immersive technology: virtual reality (VR), augmented reality (AR) and extended reality (XR).Figure 1. Immersive Technologies Building the Metaverse [caption id="attachment_146102" align="aligncenter" width="699"]

Source: Coresight Research [/caption]

1. Underlying Technology

VR enables the creation of fully immersive, computer-generated, three-dimensional (3D) environments and objects while AR refers to the overlay of real-world images with those that are computer-generated. Extended reality (XR) is a combination of the two, enabling augmented and virtual elements in combined environments.

Although XR technology has been under development for decades, businesses and retailers have been relatively slow to incorporate it into their strategies and offerings. However, in 2020 and 2021, the pandemic heightened interest in virtual shopping and gaming experiences, which has led many developers to accelerate investment in hardware and software that can support the metaverse, striving to improve graphics, speed and general immersion. AR, VR and XR technologies are set to boost global gross domestic product (GDP) by $855 billion by 2025 and $1.5 trillion by 2030, according to PwC.

While these immersive technologies are complicated and can be overwhelming for brands and retailers to incorporate, having a strong understanding of how they power the metaverse will be crucial for retailers to seamlessly improve customer experience within virtual environments.

By 2025, 60% of virtual reality market revenues will be virtual gaming (selling digital products to avatars and creating immersive experiences) and broadcasting mass events (virtual event advertising, merchandise and branding), according to Goldman Sachs—all of which are areas highly relevant to retail players.

We discuss the hardware that enables connection to the metaverse, how it powers interactive virtual experiences, and what brands and retailers should know as they look to enter the metaverse.

2. Connection to the Metaverse: Hardware

Although many users are able to access the metaverse from desktops, tablets and smartphones, we expect headsets, haptic bodysuits and gaming consoles to become more mainstream as developers, brands and businesses look to deliver immersive 3D experiences.

Developers are endeavoring to improve user-friendliness for AR/VR/XR headsets and bodysuits, releasing frequent product updates and investing heavily in spatial computing and graphic design. Without an easily accessible virtual world that immerses users with high-quality visuals, the concept of living within virtual worlds, and enabling instant global access to physical spaces, loses much of its power and appeal.

Headsets

In their development phase, headsets have presented various usability challenges, with many finding them cumbersome and difficult to wear given the numerous fragile and moving parts. Users have also faced major cost barriers and issues such as overheating.

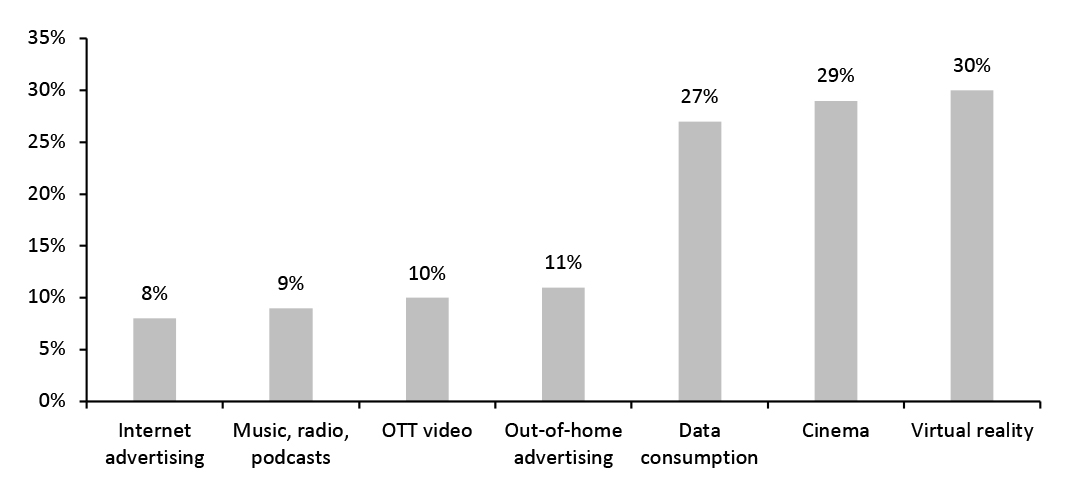

Nevertheless, of all sectors that interact with digital consumers, VR headset sales are set to see the highest CAGR rate through 2025, with interest in virtual gaming likely to drive even higher growth in the future, according to data from professional services firm PwC.

Source: Coresight Research [/caption]

1. Underlying Technology

VR enables the creation of fully immersive, computer-generated, three-dimensional (3D) environments and objects while AR refers to the overlay of real-world images with those that are computer-generated. Extended reality (XR) is a combination of the two, enabling augmented and virtual elements in combined environments.

Although XR technology has been under development for decades, businesses and retailers have been relatively slow to incorporate it into their strategies and offerings. However, in 2020 and 2021, the pandemic heightened interest in virtual shopping and gaming experiences, which has led many developers to accelerate investment in hardware and software that can support the metaverse, striving to improve graphics, speed and general immersion. AR, VR and XR technologies are set to boost global gross domestic product (GDP) by $855 billion by 2025 and $1.5 trillion by 2030, according to PwC.

While these immersive technologies are complicated and can be overwhelming for brands and retailers to incorporate, having a strong understanding of how they power the metaverse will be crucial for retailers to seamlessly improve customer experience within virtual environments.

By 2025, 60% of virtual reality market revenues will be virtual gaming (selling digital products to avatars and creating immersive experiences) and broadcasting mass events (virtual event advertising, merchandise and branding), according to Goldman Sachs—all of which are areas highly relevant to retail players.

We discuss the hardware that enables connection to the metaverse, how it powers interactive virtual experiences, and what brands and retailers should know as they look to enter the metaverse.

2. Connection to the Metaverse: Hardware

Although many users are able to access the metaverse from desktops, tablets and smartphones, we expect headsets, haptic bodysuits and gaming consoles to become more mainstream as developers, brands and businesses look to deliver immersive 3D experiences.

Developers are endeavoring to improve user-friendliness for AR/VR/XR headsets and bodysuits, releasing frequent product updates and investing heavily in spatial computing and graphic design. Without an easily accessible virtual world that immerses users with high-quality visuals, the concept of living within virtual worlds, and enabling instant global access to physical spaces, loses much of its power and appeal.

Headsets

In their development phase, headsets have presented various usability challenges, with many finding them cumbersome and difficult to wear given the numerous fragile and moving parts. Users have also faced major cost barriers and issues such as overheating.

Nevertheless, of all sectors that interact with digital consumers, VR headset sales are set to see the highest CAGR rate through 2025, with interest in virtual gaming likely to drive even higher growth in the future, according to data from professional services firm PwC.

Figure 2. Global: Sales in Sectors that Interact with Digital Consumers (CAGR, 2021–2025) [caption id="attachment_146103" align="aligncenter" width="701"]

Source: PwC’s Global Entertainment and Media Outlook 2021–2025, in partnership with Omidia [/caption]

Developers are also driving innovation to overcome headset adoption hurdles. For instance, China-based augmented reality company Nreal, which raised $60 million in funding from Alibaba in March 2022, and Taiwan-based virtual reality solution provider HTC Vive are creating lightweight, user-friendly headset versions. These new headset products resemble sunglasses for improved wearability and are sold at lower price points and are compatible with most mobile phones and tablets. This reduces the entry barriers for customers looking for full metaverse immersion, thus increasing opportunity for brand interaction and digital commerce.

Other major developers are competing and investing to improve headset technology and general immersion, including Meta, Microsoft, Snap, Varjo, SonyPlayStation, Logitech and Magic Leap.

[caption id="attachment_146104" align="aligncenter" width="701"]

Source: PwC’s Global Entertainment and Media Outlook 2021–2025, in partnership with Omidia [/caption]

Developers are also driving innovation to overcome headset adoption hurdles. For instance, China-based augmented reality company Nreal, which raised $60 million in funding from Alibaba in March 2022, and Taiwan-based virtual reality solution provider HTC Vive are creating lightweight, user-friendly headset versions. These new headset products resemble sunglasses for improved wearability and are sold at lower price points and are compatible with most mobile phones and tablets. This reduces the entry barriers for customers looking for full metaverse immersion, thus increasing opportunity for brand interaction and digital commerce.

Other major developers are competing and investing to improve headset technology and general immersion, including Meta, Microsoft, Snap, Varjo, SonyPlayStation, Logitech and Magic Leap.

[caption id="attachment_146104" align="aligncenter" width="701"] The Nreal Light headset device, which is priced at $599 (left); The HTC Vive Flow headset device, which is priced at $499 (right)

The Nreal Light headset device, which is priced at $599 (left); The HTC Vive Flow headset device, which is priced at $499 (right) Source: Nreal/HTC Vive [/caption] Meta’s Oculus Quest 2 headset and Sony PlayStation’s PSVR 2 are currently market leaders for headset devices. The Oculus Quest 2 device is a standalone headset, meaning it does not require a PC or another system to function, while the PSVR 2 requires another device, such as a PC or PlayStation, to connect. Despite the obvious immersive advantages of operating a standalone headset, headsets that require external devices are currently more commonplace. Speed and immersion of PC headsets are determined by the underlying technology of both the headset and the console or computer that it pairs with (if required). Developers are continually working on updates to improve immersion, including display resolution, haptic feedback, hand and eye tracking, and 3D audio. [caption id="attachment_146105" align="aligncenter" width="700"]

Meta’s Oculus Quest 2 headset device

Meta’s Oculus Quest 2 headset device Source: Synth Riders [/caption] Haptic Bodysuits Startups are beginning to develop haptic sensor technology to deepen immersive experiences by enabling users to “feel” virtual objects. This technology facilitates devices including bodysuits, gloves and brain-computer interface (BCI) headsets for users to control. This technology is gaining popularity in metaverse spaces. For example, celebrity singer Justin Bieber example used a bodysuit to control his avatar during a concert he performed on XR entertainment platform Wave in November 2021. Nevertheless, this technology is more in its infancy than other immersive technologies and will likely face many hurdles to widespread adoption as people around the world acclimate to the idea of fully living within virtual worlds. 5G With 5G technology improving data rates, we expect virtual reality games and experiences to be increasingly accessible on smartphones and tablets, many of which can link up to headsets. This will significantly increase accessibility to the metaverse. One of the largest current blockchain games, Axie Infinity, is already available on Android and IOS, for example, and Meta Platforms is currently developing a mobile version of Horizon Worlds. Moreover, wireless technology Qualcomm has developed an XR platform that functions using 5G. The Snapdragon XR2 can able to connect to immersive and shared experiences from anywhere, without requiring a Wifi connection. 3. Creation Tools Gaming engines, creator tools and spatial computing can help businesses, brands and retailers to unlock innovative new strategies to engage and interact with customers in virtual environments. Gaming Engines Developers of virtual games and worlds are building powerful gaming engines to construct assets and objects. This allows brands and retailers to design virtual product collections, build avatars and mint visually appealing non-fungible tokens (NFTs) with low production costs. As graphic capabilities improve, creators will be able to use these engines to build all types of digital assets, limited only by imagination. As engines vary significantly, brands and retailers should consider features such as efficiency, availability of 3D models to build on and cost to game developers, when looking to establish permanent metaverse residences. Gaming engines are responsible for the quality of immersive and interactive virtual world experiences.

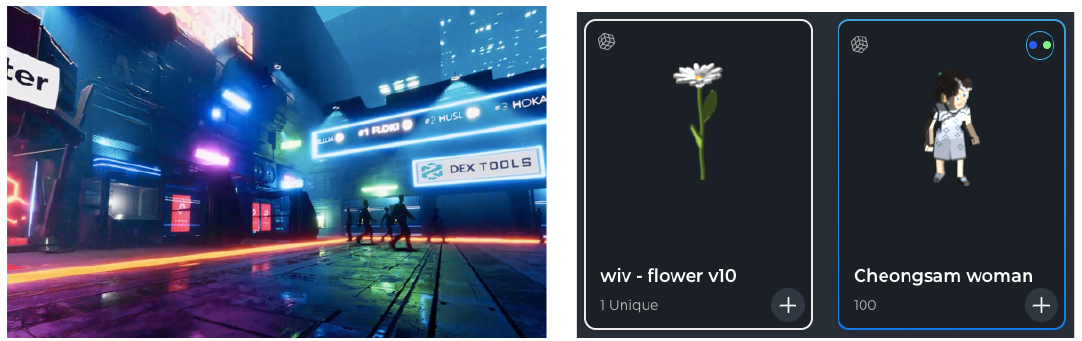

- Bloktopia, a virtual world built using the Polygon blockchain, is an example of a metaverse striving to provide users with superior graphics via a powerful gaming engine. At the release of its alpha version in March 2022, it described the development tool it used as the world’s most powerful and advanced 3D creation engine. The advertisements and visuals it features are highly developed and its operation speed makes living within the world a seamless experience, according to the company.

- One of the more established metaverse worlds, The Sandbox, has created VoxEdit, an in-game creation engine for creators, brands and retailers, which has been used by Gucci, among others. Creators can use the tool to design visual objects, including avatars, avatar wearables and accessories, to sell as NFTs in the platform’s marketplace. Established virtual world platforms, including Decentraland, Fortnite, Roblox and Horizon Worlds also offer creator engine tools.

Bloktopia’s virtual world environment (left); NFTs created using The Sandbox’s VoxEdit engine (right)

Bloktopia’s virtual world environment (left); NFTs created using The Sandbox’s VoxEdit engine (right) Source: Bloktopia/The Sandbox [/caption] Spatial Computing Spatial computing was coined to describe “human interaction with a machine in which the machine retains and manipulates referents to real objects and spaces,” by Massachusetts Institute of Technology (MIT) researcher, Simon Greenwold. Spatial computing is broadly synonymous with XR, but more specifically refers to storing a data-intensive and detailed version of a physical space as a virtual space. It will help brands and retailers and brands construct replicas of physical stores that receive real-time meta data so that customers from every corner of the globe can enjoy the same offering. This concept has recently been made possible following advances in emerging technologies, including Internet of Things (IoT), live augmented reality and sensor/camera technology. IoT will allow for links between virtual and physical spaces by fitting objects and devices with smart sensors for real-time data analytics. Live augmented reality will rely on camera and sensor technology to build virtual assets based on real-world objects to digital spaces with extreme precision. Augmented reality applications will enable users to scan real-world locations and create virtual spaces based on these scans. We expect this development to help businesses in creating highly detailed virtual storefronts and immersive metaverse experiences based on “real” places. In essence, spatial computing technology can help retail players to transform their established storefronts into a virtual experience that can be part of the metaverse, or available as a standalone experience. Within virtual experiences, experiential tools can also be added to enhance offerings, which we present examples of in Figure 4 below. 4. What Retailers Should Know Improving immersive technologies will significantly increase brand interaction, enabling customers are able to interact with 3D versions of products within engaging immersive environments. This also facilitates global customer base expansion, with users from all over the world drawn into experiences from the comfort of their own homes. Even before the pandemic accelerated a shift to digital life, an estimated 66% of consumers were interested in using AR while shopping, according to 2019 survey data from Google. Immersive technologies are rising in popularity for all types of users, from creators and hobbyists to businesses and professionals. We are increasingly seeing customers taking the time to teach themselves how to use these immersive tools—the number of global AR users is steadily rising and is set to equate to more than half the global population by 2025, according to 2021 data from social media company Snap.

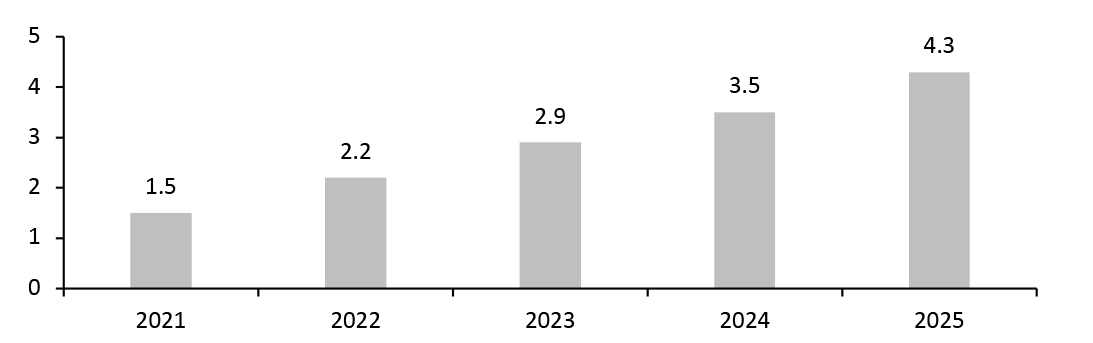

Figure 3. Global: Number of Frequent AR Users 2025 (Bil.) [caption id="attachment_146107" align="aligncenter" width="701"]

Source: Snap Consumer AR Global Report 2021[/caption]

Brands and retailers have already started to access this growing base of consumers using AR by leveraging immersive technologies in innovative ways, as we present in Figure 4.

Source: Snap Consumer AR Global Report 2021[/caption]

Brands and retailers have already started to access this growing base of consumers using AR by leveraging immersive technologies in innovative ways, as we present in Figure 4.

Figure 4. Selected Notable Brands Using Immersive Technologies [wpdatatable id=1924 table_view=regular]

Source: Company reports/Coresight Research Decentraland’s Metaverse Fashion Week featured over 70 brands, both metaverse-native and real-world, utilizing the platform’s game engine and creator tools to mint NFTs and debut collections of physical products in immersive settings. Though few retailers require customers to use headsets for an experience. If the metaverse does evolve to become an extension of reality, we expect the use of headsets to soar, becoming the most common metaverse access device. Until headset technology improves to the point of widespread adoption, brands and retailers should continue to look toward other technologies, including gaming engines and creator tools, as they determine how to offer augmented and virtual experiences to customers.