DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

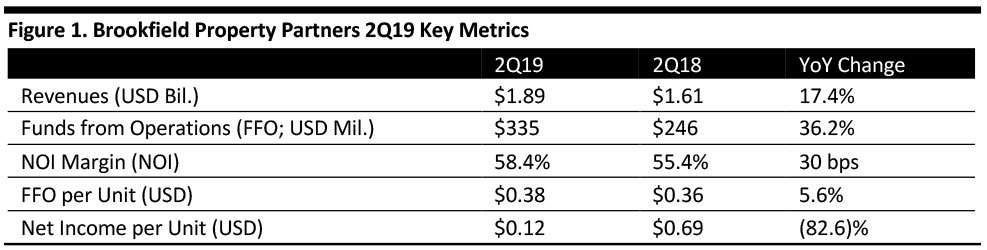

Brookfield reported 2Q19 revenues of $1.89 billion, up 17.4% year over year.

Net operating income (NOI) was $1.1 billion, up 24.0% year over year. NOI margin increased 30 basis points (bps) to 58.4% in 2Q19.

Company FFO was $335 million, compared with $246 million, excluding realized gains, in the year-ago quarter. FFO per unit was $0.38, compared to $0.36 in the year-ago quarter and beating the consensus estimate of $0.36. Excluding realized gains, FFO per unit was $0.35, consistent with the prior-year period.Management highlighted the mark-to-market on rents at core businesses helped drive same-store NOI growth.

Details from the Quarter

Core retail generated FFO of $170 million, compared to $119 million in the year-ago quarter. The increase in FFO was primarily attributable to the acquisition of GGP in the late August of 2018. The business generated 0.4% net operating income growth for the quarter and 1.7% year-to-date.

Over the past 12months, the company has leased over 9.8 million square feet, with suite-to-suite rent spreads up 7.2%. At the end of the quarter, same-property occupancy was 95%. In-place rents were up 2.2% and NOI-weighted sales grew at 5.2% to $777 per square foot.

Core office generated company FFO of $187 million, compared to $149 million in the year-ago quarter. The business generated 3.2% higher same-property NOI growth than a year ago plus $64 million of fee income, up $44 million. The raise in FFO was due to same-property growth and a performance-based fee at Five Manhattan West, partially offset by asset sales, higher interest rates and a stronger US dollar.

Occupancy in the portfolio was 92.4% on 1.2 million square feet of total leasing at the end of the quarter, a decrease of 30 bps year over year and 90 bps quarter over quarter. Leases signed during the quarter saw 25% higher rents compared to leases expiring during the quarter.

LP Investments generated FFO and realized gains of $106 million, compared to $87 million in the year-ago quarter. Offsetting factors included the loss of income from the sale of stable and mature investments and higher average interest rates.

Dispositions

In 2Q19, the company completed $326 million of gross asset dispositions, at prices 9% higher than their IFRS value. The sales generated $173 million in net proceeds plus $60 million in realized gains.

Dispositions completed during the quarter included:

- 2001 M Street in Washington, D.C. (43% interest; net proceeds of $45 million).

- Office building at 240 Queen Street in Brisbane (50% interest; net proceeds of $36 million).

- Marina Village office park in Alameda, California (net proceeds of $27 million).

Other projects to sell:

- 75 State Street in Boston (remaining 26% interest; net proceeds of $79 million).

- Darling Park Complex in Sydney (30% stake; net proceeds of A$432 million).

- Manhattan multifamily portfolio (net proceeds of $135 million).

- Net lease automotive dealership assets (CARS) (a portion; net proceeds of $24 million).

Outlook

The company has not provided guidance for 2019. Current consensus estimates for revenues is $6.11 billion. Looking forward, management focus in the core office and retail businesses will be leasing vacant space, stabilizing occupancy and recycling capital into other investment opportunities.