DIpil Das

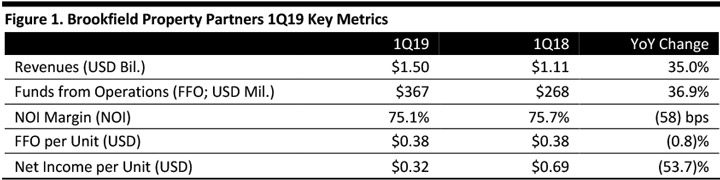

[caption id="attachment_86501" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Brookfield reported 1Q19 revenues of $1.50 billion, up 35.0% year over year.

Net operating income (NOI) was $1.1 billion, up 34.0% year over year.

Company FFO was $367 million ($0.38 per unit), compared with $268 million ($0.38 per unit) in the year-ago quarter. FFO increased due to realizations in the company’s LP investment strategy, benefits from investment in Core Retail over the prior year and continued same-property growth in core office, offset by the impact of higher interest rates and a stronger US dollar.

Management highlighted same-property growth in the core operating businesses while maintaining high occupancy and capturing mark-to-market rent increases.

Details from the Quarter

Core retail generated FFO of $184 million, compared to $116 million in the year-ago quarter. The increase in FFO was primarily attributable to the acquisition of GGP in August 2018. The business generated 2.2% net operating income growth, which was partially offset by higher operating expenses, lower lease-termination income and higher US interest rates.

As of the end of the quarter, the company had executed 6.6 million square feet of leases to commence in 2019 plus 9 million square feet of additional leases, reaching 90% of the company’s goal for the year.

At the end of the quarter, same-property occupancy was 95.3%, down 10 bps year over year, and average suite-to-suite spreads were 7% on a NOI-weighted basis. NOI-weighted sales per square foot were $765, up 4% year over year and up 3% sequentially.

Core office generated company FFO of $140 million, compared to $153 million in the year-ago quarter. The business generated 4.2% higher same-property net operating income than a year ago plus $24 million of fee income, up $5 million. The decrease in FFO was due to higher interest rates and a stronger US dollar.

Occupancy in the portfolio was 93.3% on 1.4 million square feet of total leasing at the end of the quarter, an increase of 70 bps year over year and a decrease of 10 bps quarter over quarter. Leases signed during the quarter carried an average of 16% higher rents compared to leases expiring during the quarter.

LP Investments generated FFO of $146 million, compared to $96 million in the year-ago quarter. This figure includes $60 million of realized gains from the sale of mature assets. Offsetting factors include the loss of recurring income from the sold assets and time required to redeploy the proceeds. A stronger US dollar and higher interest rates also hurt results.

Dispositions:

During the quarter, the company completed $490 million of gross asset dispositions, at prices 3.6% higher than their IFRS value. The sales generated $296 million in net proceeds plus $60 million in realized gains. Dispositions completed during the quarter include:

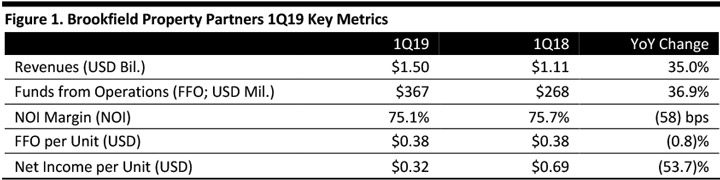

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Brookfield reported 1Q19 revenues of $1.50 billion, up 35.0% year over year.

Net operating income (NOI) was $1.1 billion, up 34.0% year over year.

Company FFO was $367 million ($0.38 per unit), compared with $268 million ($0.38 per unit) in the year-ago quarter. FFO increased due to realizations in the company’s LP investment strategy, benefits from investment in Core Retail over the prior year and continued same-property growth in core office, offset by the impact of higher interest rates and a stronger US dollar.

Management highlighted same-property growth in the core operating businesses while maintaining high occupancy and capturing mark-to-market rent increases.

Details from the Quarter

Core retail generated FFO of $184 million, compared to $116 million in the year-ago quarter. The increase in FFO was primarily attributable to the acquisition of GGP in August 2018. The business generated 2.2% net operating income growth, which was partially offset by higher operating expenses, lower lease-termination income and higher US interest rates.

As of the end of the quarter, the company had executed 6.6 million square feet of leases to commence in 2019 plus 9 million square feet of additional leases, reaching 90% of the company’s goal for the year.

At the end of the quarter, same-property occupancy was 95.3%, down 10 bps year over year, and average suite-to-suite spreads were 7% on a NOI-weighted basis. NOI-weighted sales per square foot were $765, up 4% year over year and up 3% sequentially.

Core office generated company FFO of $140 million, compared to $153 million in the year-ago quarter. The business generated 4.2% higher same-property net operating income than a year ago plus $24 million of fee income, up $5 million. The decrease in FFO was due to higher interest rates and a stronger US dollar.

Occupancy in the portfolio was 93.3% on 1.4 million square feet of total leasing at the end of the quarter, an increase of 70 bps year over year and a decrease of 10 bps quarter over quarter. Leases signed during the quarter carried an average of 16% higher rents compared to leases expiring during the quarter.

LP Investments generated FFO of $146 million, compared to $96 million in the year-ago quarter. This figure includes $60 million of realized gains from the sale of mature assets. Offsetting factors include the loss of recurring income from the sold assets and time required to redeploy the proceeds. A stronger US dollar and higher interest rates also hurt results.

Dispositions:

During the quarter, the company completed $490 million of gross asset dispositions, at prices 3.6% higher than their IFRS value. The sales generated $296 million in net proceeds plus $60 million in realized gains. Dispositions completed during the quarter include:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Brookfield reported 1Q19 revenues of $1.50 billion, up 35.0% year over year.

Net operating income (NOI) was $1.1 billion, up 34.0% year over year.

Company FFO was $367 million ($0.38 per unit), compared with $268 million ($0.38 per unit) in the year-ago quarter. FFO increased due to realizations in the company’s LP investment strategy, benefits from investment in Core Retail over the prior year and continued same-property growth in core office, offset by the impact of higher interest rates and a stronger US dollar.

Management highlighted same-property growth in the core operating businesses while maintaining high occupancy and capturing mark-to-market rent increases.

Details from the Quarter

Core retail generated FFO of $184 million, compared to $116 million in the year-ago quarter. The increase in FFO was primarily attributable to the acquisition of GGP in August 2018. The business generated 2.2% net operating income growth, which was partially offset by higher operating expenses, lower lease-termination income and higher US interest rates.

As of the end of the quarter, the company had executed 6.6 million square feet of leases to commence in 2019 plus 9 million square feet of additional leases, reaching 90% of the company’s goal for the year.

At the end of the quarter, same-property occupancy was 95.3%, down 10 bps year over year, and average suite-to-suite spreads were 7% on a NOI-weighted basis. NOI-weighted sales per square foot were $765, up 4% year over year and up 3% sequentially.

Core office generated company FFO of $140 million, compared to $153 million in the year-ago quarter. The business generated 4.2% higher same-property net operating income than a year ago plus $24 million of fee income, up $5 million. The decrease in FFO was due to higher interest rates and a stronger US dollar.

Occupancy in the portfolio was 93.3% on 1.4 million square feet of total leasing at the end of the quarter, an increase of 70 bps year over year and a decrease of 10 bps quarter over quarter. Leases signed during the quarter carried an average of 16% higher rents compared to leases expiring during the quarter.

LP Investments generated FFO of $146 million, compared to $96 million in the year-ago quarter. This figure includes $60 million of realized gains from the sale of mature assets. Offsetting factors include the loss of recurring income from the sold assets and time required to redeploy the proceeds. A stronger US dollar and higher interest rates also hurt results.

Dispositions:

During the quarter, the company completed $490 million of gross asset dispositions, at prices 3.6% higher than their IFRS value. The sales generated $296 million in net proceeds plus $60 million in realized gains. Dispositions completed during the quarter include:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Brookfield reported 1Q19 revenues of $1.50 billion, up 35.0% year over year.

Net operating income (NOI) was $1.1 billion, up 34.0% year over year.

Company FFO was $367 million ($0.38 per unit), compared with $268 million ($0.38 per unit) in the year-ago quarter. FFO increased due to realizations in the company’s LP investment strategy, benefits from investment in Core Retail over the prior year and continued same-property growth in core office, offset by the impact of higher interest rates and a stronger US dollar.

Management highlighted same-property growth in the core operating businesses while maintaining high occupancy and capturing mark-to-market rent increases.

Details from the Quarter

Core retail generated FFO of $184 million, compared to $116 million in the year-ago quarter. The increase in FFO was primarily attributable to the acquisition of GGP in August 2018. The business generated 2.2% net operating income growth, which was partially offset by higher operating expenses, lower lease-termination income and higher US interest rates.

As of the end of the quarter, the company had executed 6.6 million square feet of leases to commence in 2019 plus 9 million square feet of additional leases, reaching 90% of the company’s goal for the year.

At the end of the quarter, same-property occupancy was 95.3%, down 10 bps year over year, and average suite-to-suite spreads were 7% on a NOI-weighted basis. NOI-weighted sales per square foot were $765, up 4% year over year and up 3% sequentially.

Core office generated company FFO of $140 million, compared to $153 million in the year-ago quarter. The business generated 4.2% higher same-property net operating income than a year ago plus $24 million of fee income, up $5 million. The decrease in FFO was due to higher interest rates and a stronger US dollar.

Occupancy in the portfolio was 93.3% on 1.4 million square feet of total leasing at the end of the quarter, an increase of 70 bps year over year and a decrease of 10 bps quarter over quarter. Leases signed during the quarter carried an average of 16% higher rents compared to leases expiring during the quarter.

LP Investments generated FFO of $146 million, compared to $96 million in the year-ago quarter. This figure includes $60 million of realized gains from the sale of mature assets. Offsetting factors include the loss of recurring income from the sold assets and time required to redeploy the proceeds. A stronger US dollar and higher interest rates also hurt results.

Dispositions:

During the quarter, the company completed $490 million of gross asset dispositions, at prices 3.6% higher than their IFRS value. The sales generated $296 million in net proceeds plus $60 million in realized gains. Dispositions completed during the quarter include:

- A portfolio of retail properties in China (net proceeds of $159 million).

- Three office buildings in Brazil (net proceeds of $59 million).

- Five multifamily buildings in the US (net proceeds of $42 million).

- An office park in southern California (net proceeds of $22 million).

- In March 2019, the company repurchased 18.7 million BPY units and BPR shares at an average price of $20.83 per unit or share, under an announced Substantial Issuer Bid.

- The company subsequently repurchased nearly 600,000 BPY LP units at an average price of $20.90 per unit under its Normal Course Issuer Bid.

- The SoNo Collection in Norwalk, Connecticut (a ground-up development).

- Paramus Park in Paramus, New Jersey (a Sears redevelopment for Stew Leonard’s).

- Stonestown Galleria in San Francisco (redevelopment for retail and entertainment).

- Ala Moana in Honolulu (a residential tower).

- Jordan Creek in West Des Moines, Iowa (Younkers redevelopment).

- North Point in Alpharetta, Georgia (a residential Sears redevelopment).

- Two Northbrook Court projects in Northbrook, Illinois (Macy’s redevelopment for retail and residential).

- Oxmoor Center in Louisville, Kentucky (Sears redevelopment).

- Streets at Southpoint in Durham, North Carolina (mixed-use densification).

- Tysons Galleria in McLean, Virginia (Macy’s redevelopment).

- Valley Plaza Mall in Bakersfield, California (Sears backfill for multi-tenant).