albert Chan

Brookfield Property Partners L.P.

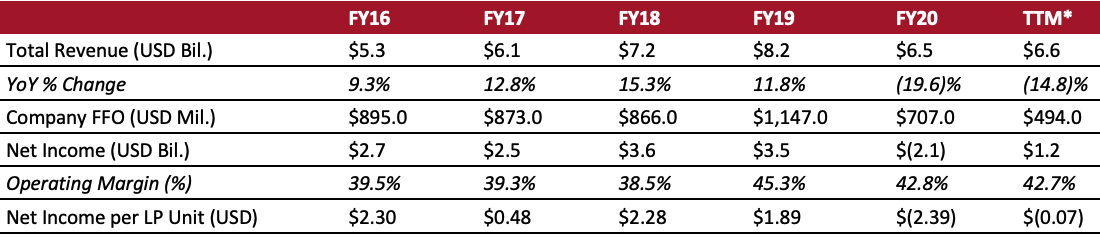

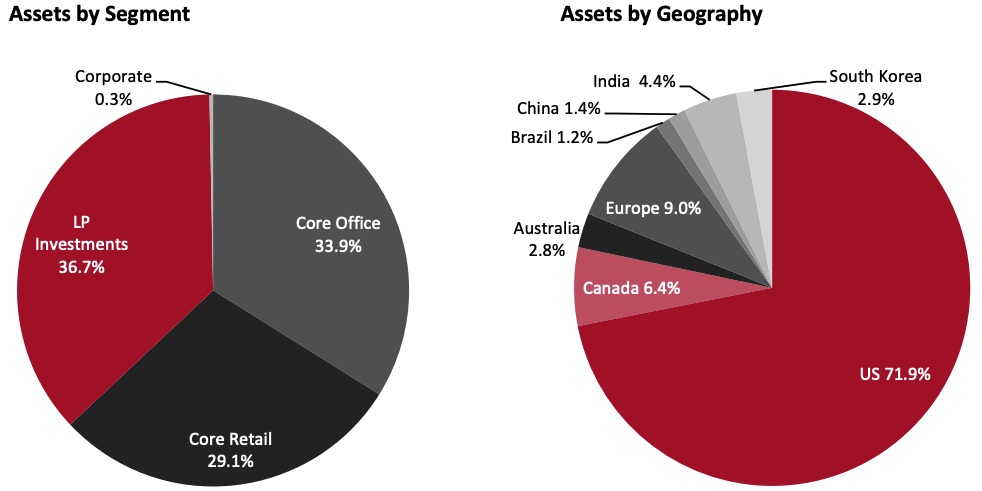

Sector: Real estate investment trusts (REITs) Countries of operation: The US and 29 other countries Key categories: Core office space, core retail space and limited partnership (LP) investments Annual Metrics [caption id="attachment_136329" align="aligncenter" width="700"] Fiscal year ends December 31

Fiscal year ends December 31*Trailing 12 months ended June 30, 2021[/caption] Summary Brookfield Property Partners L.P. is one of the world’s leading owners and operators of commercial real estate, with over $111 billion in total assets. It was created from a spin-off from Brookfield Asset Management (BAM) in 2013 and is BAM’s primary vehicle for investing in the real estate sector. Headquartered in Hamilton, Bermuda, it has a diversified real estate portfolio and operates on a global scale with a presence in 30 countries. Brookfield Property Partners operates in four segments: Core Office, Core Retail, Corporate and LP Investments. As of June 30, 2021, the company’s Core Office portfolio has 143 premier properties, covering 98 million square feet, and its Core Retail portfolio includes 119 best-in-class malls and urban retail properties, spanning 117 million square feet in total. Its LP Investments portfolio comprises equity invested in Brookfield-sponsored real estate opportunity funds, targeting high-quality assets with operational upsides across various real estate sectors—including hospitality, logistics, multifamily, manufactured housing, office, retail, student housing and triple net lease. On July 26, 2021, BAM completed the privatization of Brookfield Property Partners, through the acquisition of all its LP units and Brookfield Office Properties Exchange’s exchangeable LP units. Company Analysis Coresight Research insight: Since 2020, pandemic-driven disruptions have adversely affected Brookfield Property Partners’ finances and consolidated performance. While we expect that the company’s high-quality stabilized properties and associated cash flows will remain in demand from investors, in the short term, the company may face setbacks in recycling its capital. Nevertheless, its self-funding business model, caused by its stabilized portfolio and flexible balance sheet, allows for financial independence—the company does not have to access capital markets to fund its growth. The company’s Core Office portfolio generated $131 million in funds from operations (FFO) in its latest quarter, ended June 30, 2021, rising by almost 14% from $115 million in the comparable period 2020. Growth was driven by the impact of foreign currency exchange, an increase in net operating income (NOI) and condominium sales in a London residential tower. In its Core Retail sector, FFO decreased to $103 million during its second quarter, dropping below the $147 million recorded in the comparable period last year. The decrease was caused by tenant vacancies and rent abatements amid the pandemic. FFO in the company’s LP investment rose by $51 million for the same quarter, driven by the rise in Brookfield’s hospitality portfolio earnings. In its Corporate segment, FFO was at a loss of $130 million in its latest quarter, compared to a loss of $81 million in the same quarter of the last fiscal year.

| Tailwinds | Headwinds |

|

|

- Invest globally through various operating entities based around the world

- Build strong local relationships and partnerships across regions

- Make use of its 24,400 operating employees around the globe

- Capitalize on unique access to BAM funds and other Brookfield entities

- Recycle capital for re-investment in new opportunities

- Stabilize cash flows on Core Office and Core Retail portfolios

- Use strong relationships with investment houses and banks for better rates on raising new capital

- Develop best-in-class properties at a discount to asset valuations

- Optimize tenant relationships through higher occupancy, longer lease terms and premium rents, resulting in improved revenues in each market

- Acquire add-on assets and entities that can be integrated into existing assets to improve overall asset value and returns

- Revalue investment properties to reflect initiatives that increase property level cash flows, change the asset’s risk profile and reflect changes in market conditions or the portfolio premiums realized upon an asset’s sale

Source: 2020 Annual Report[/caption]

Company Developments

Source: 2020 Annual Report[/caption]

Company Developments

| Date | Development |

| 6, 2021 | Brookfield Property Partners sells four retail assets in the US to an unknown buyer for approximately $73 million. |

| August 5, 2021 | Brookfield Property Partners files Form 15 with the Securities and Exchange Commission (SEC) to complete its delisting. |

| July 26, 2021 | Brookfield Asset Management completes the privatization of Brookfield Property Partners, acquiring its LP units and Brookfield Office Properties Exchange L.P.’s exchangeable LP units. |

| May 7, 2021 | Brookfield Property Partners sells Forever 21, Inc., to an unknown buyer acquires for $63 million. |

| May 7, 2021 | Brookfield Property Partners sells a 50% stake in Bay Adelaide Centre North Office Development to an unknown buyer for approximately $580 million. |

| April 15, 2021 | Brookfield India Real Estate Trust appoints Saurabh Jain as Company Secretary. |

| January 4, 2021 | Brookfield Asset Management and Institutional Partners propose the acquisition of 100% of Brookfield Property Partners’ units. |

| December 7, 2021 | Brookfield Property Partners and Simon Property Group complete the acquisition of all retail and operating assets of JCPenney. |

| November 6, 2020 | Brookfield Property Partners announces the appointment of Michael Warren to the Board. |

| September 29, 2020 | Brookfield India Real Estate Trust files for an initial public offering (IPO). |

| September 11, 2020 | Brookfield Property Partners announces a share repurchase program for 31,602,923 limited partnership units, representing 7.35% of issued share capital. |

| September 2, 2020 | Brookfield Property Partners completes the repurchase of 35,500,000 shares, representing 8.1% for $426 million under the buyback announced on July 2, 2020. |

| August 10, 2020 | Brookfield Property Partners and Brookfield Premier Real Estate Partners Pooling LLC sell a 50% stake in One Blue Slip and an unknown stake in Andorra, respectively, to an unknown buyer. |

| June 10, 2020 | Brookfield Property Partners files a shelf registration, which enables it to can register to issue new shares up to two years before filing an IPO. The registration will speed up its IPO process should it decide to file in the future. |

| March 6, 2020 | Brookfield Property Partners completes the acquisition of InterContinental Buckhead Atlanta Hotel and Sofitel Washington DC Lafayette Square from Pebblebrook Hotel Trust for $260 million. |

Source: S&P Capital IQ

Management Team- Brian William Kingston—CEO and Senior Managing Partner

- Bryan Kenneth Davis—CFO and Managing Partner of Rest Estate

- William Mitchell Powell—COO and Senior Managing Partner of Real Estate

- Lowell G. Baron—Chief Investment Officer and Managing Partner of Real Estate

- Matthew P. Cherry—Senior Vice President, Investor Relations

Source: Company reports/S&P Capital IQ