Nitheesh NH

[caption id="attachment_71958" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

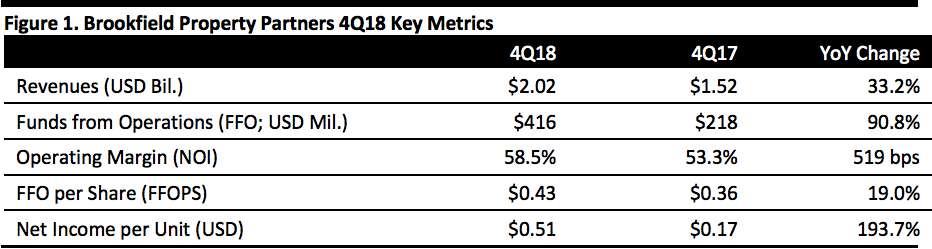

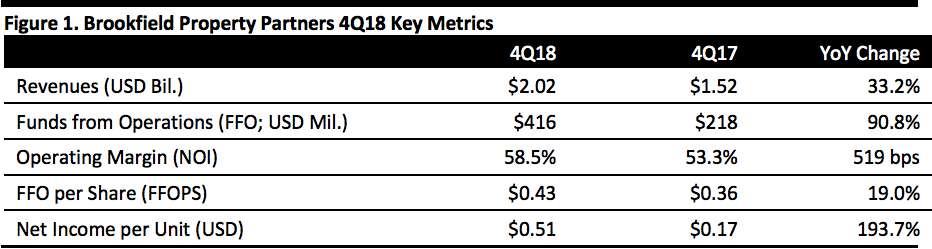

4Q18 Results

Brookfield reported net income of $858 million ($0.51 per unit) versus $958 million ($0.17 per unit) in the year-ago quarter.

FFO was $416 million ($0.43 per unit), compared with $286 million ($0.41 per unit) in the year-ago quarter.

The increases in FFO in the quarter and year were due to the following factors: Higher investment in core retail and seasonally strong performance in the quarter, along with same-property income growth in the core office business. This strong operating performance more than offset the impact of a higher interest rate environment and negative currency effects.

FY18 Results

Net income for the year ended December 31, 2018 was $3.65 billion ($2.28 per unit) compared with $2.47 billion ($0.48 per unit) in 2017.

FFO was $1.18 billion ($1.48 per unit) for the year, compared with $1.02 billion ($1.44 per unit) in the prior year, breaking down as follows:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Brookfield reported net income of $858 million ($0.51 per unit) versus $958 million ($0.17 per unit) in the year-ago quarter.

FFO was $416 million ($0.43 per unit), compared with $286 million ($0.41 per unit) in the year-ago quarter.

The increases in FFO in the quarter and year were due to the following factors: Higher investment in core retail and seasonally strong performance in the quarter, along with same-property income growth in the core office business. This strong operating performance more than offset the impact of a higher interest rate environment and negative currency effects.

FY18 Results

Net income for the year ended December 31, 2018 was $3.65 billion ($2.28 per unit) compared with $2.47 billion ($0.48 per unit) in 2017.

FFO was $1.18 billion ($1.48 per unit) for the year, compared with $1.02 billion ($1.44 per unit) in the prior year, breaking down as follows:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Brookfield reported net income of $858 million ($0.51 per unit) versus $958 million ($0.17 per unit) in the year-ago quarter.

FFO was $416 million ($0.43 per unit), compared with $286 million ($0.41 per unit) in the year-ago quarter.

The increases in FFO in the quarter and year were due to the following factors: Higher investment in core retail and seasonally strong performance in the quarter, along with same-property income growth in the core office business. This strong operating performance more than offset the impact of a higher interest rate environment and negative currency effects.

FY18 Results

Net income for the year ended December 31, 2018 was $3.65 billion ($2.28 per unit) compared with $2.47 billion ($0.48 per unit) in 2017.

FFO was $1.18 billion ($1.48 per unit) for the year, compared with $1.02 billion ($1.44 per unit) in the prior year, breaking down as follows:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Brookfield reported net income of $858 million ($0.51 per unit) versus $958 million ($0.17 per unit) in the year-ago quarter.

FFO was $416 million ($0.43 per unit), compared with $286 million ($0.41 per unit) in the year-ago quarter.

The increases in FFO in the quarter and year were due to the following factors: Higher investment in core retail and seasonally strong performance in the quarter, along with same-property income growth in the core office business. This strong operating performance more than offset the impact of a higher interest rate environment and negative currency effects.

FY18 Results

Net income for the year ended December 31, 2018 was $3.65 billion ($2.28 per unit) compared with $2.47 billion ($0.48 per unit) in 2017.

FFO was $1.18 billion ($1.48 per unit) for the year, compared with $1.02 billion ($1.44 per unit) in the prior year, breaking down as follows:

- Core office FFO was $608 million, compared to $532 million on a comparable basis in the prior year. Total leasing was 7.8 million square feet, and occupancy increased 90 basis points.

- Core retail FFO was $651 million, compared to $515 million in in the prior year. NOI-weighted tenant sales per square foot increased 6% to $746 in 2018.

- LP investments generated FFO of $330 million, compared to $335 million in the prior year.

- Brookfield’s strategy during the past five years has been to consolidate its ownership in various operating businesses and complete the privatization of five publicly listed companies, which, having done that, gives the company operating flexibility and access to free cash flow, which has enabled the $500 repurchase program announced today.

- Moreover, during the past 12 months, the company has disposed of more than $8 billion of real estate assets, generating $3.6 billion of net proceeds at prices that were 5% above carrying value.

- Management expects that the use of $500 million of the $3.6 billion proceeds to repurchase units and shares at a 30% discount will create almost $250 million in value for unitholders. If the company’s units continue to trade at a significant discount following the completion of the offer, management will continue to devote more capital to repurchasing units.

- Revenues of $6.41 billion, up 17.6%.

- FFOPS of $1.59, up 12.0%.