On September 26, the Coresight Research team attended Brookfield’s 2019 investor day. The event featured many management presentations, including those by: Brian William Kingston, Senior Managing Partner and CEO; Beatrice Hsu, Senior Vice President of Development and Forward Planning; and Bryan Kenneth Davis, Managing Partner of Rest Estate and CFO.

This report covers the day’s highlights.

Brookfield Continues To Grow

Over the course of 2019, Brookfield completed over 19 million square feet of leasing and delivered over 5 million square feet in development. The company realized $2 billion of net proceeds from asset sales and invested over $1 billion in new developments and $300 million in acquisition.

Brookfield projected a total of $2.5 billion capital spending on near-term projects.

Redevelopment Is Planned in the Short Term

- Brookfield plans to redevelop Ala Moana Center in Honolulu, Hawaii, with a total of 205 affordable housing and ultra-luxury condo/hotel rental units.

- The company plans to redevelop the Macy’s space at Stonestown Galleria in San Francisco, California, into Wholefoods, Sports Basement and Regal Cinema, and expand Target into the previous Nordstrom store.

- The company plans to redevelop the Sears box at Cumberland Mall in Atlanta, Georgia, and work on re-zoning is under way.

Success in the Student Housing Sector

Brookfield owns Student Roost, a UK-based student accommodation management and development company, and due to growing national interest in the student housing sector, it has built a portfolio of 55 assets and over 20,000 beds in the past five years—from an initial base of 13 assets. Brookfield management commented that local knowledge has been key to this success.

Piloting Airbnb’s Friendly Buildings Program

Brookfield is piloting Airbnb’s Friendly Buildings Program through apartments in Orlando and Nashville. The apartments encourage and facilitate hosting through Airbnb by incorporating certain operational terms—such as hosting rules and updated lease agreements—as an attempt to boost both tenant’s and landlord’s income.

Mixed-Use Development Capabilities

Brookfield’s mixed-use development capabilities are a reflection of the company’s core investment principle: enhancing asset value through operations. The management commented that the pace of change is faster than ever today, and that Brookfield is committed to innovation.

Creating Value Through Placemaking

Within the same metro area, rent premiums for office, retail and multifamily spaces in walkable mixed-use/urban locations are on average 75% higher compared with suburban “drive-only” locations. Consumers are shifting away from the traditional aspiration of a “suburb life,” and Hsu commented that 74% of Americans prioritize experiences over products. Brookfield is thus aiming to amplify asset value through “placemaking”, creating places where consumers can have good experiences and memories.

Digital Native Brands Are Replacing Traditional Retailers

Although the company had approximately 2.5 million square feet of leasing returned due to retailers’ bankruptcies, all of this space has now been released. Digital native brands are among the new tenants. Kingston commented that on average, the rents for newcomers were 7% higher than previous rates, and properties are 96% occupied.

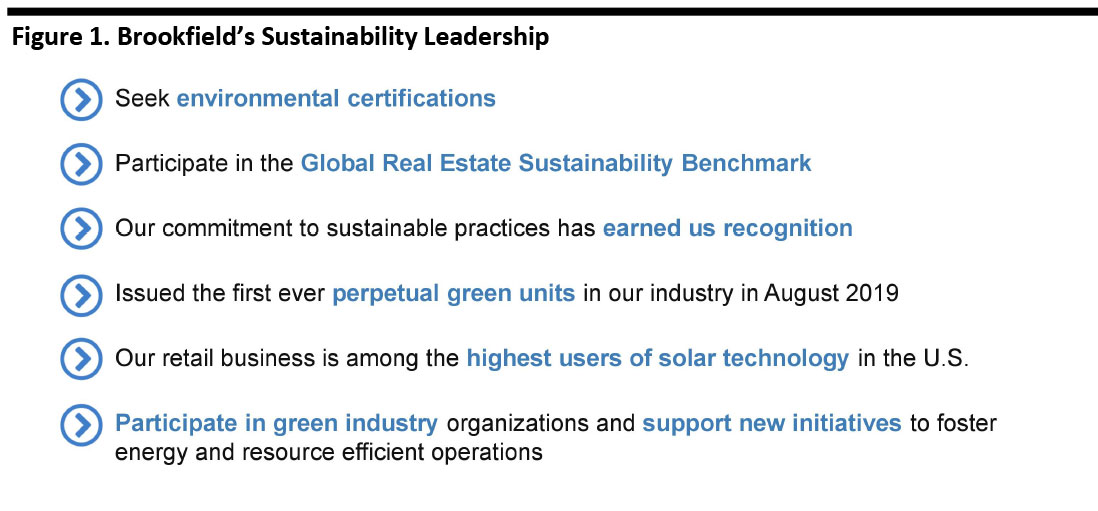

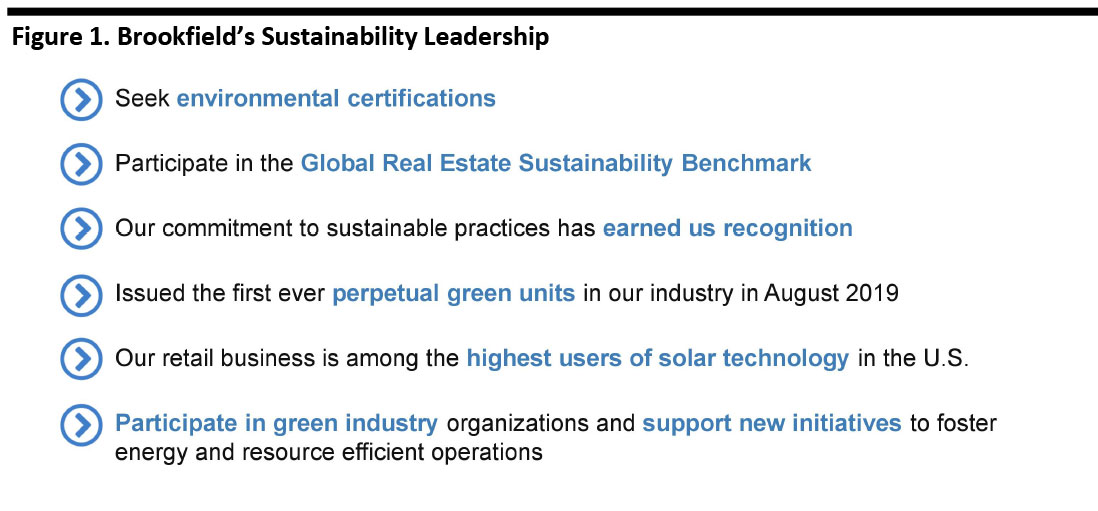

Sustainability, a Vital Component of Brookfield’s Corporate Culture

Brookfield is committed to minimizing the environmental impact of its operations, fostering energy efficiency, conserving natural resources and reducing waste. Solar power now supplies more than 25% of the electricity needs of common areas within the Brookfield’s portfolio. In total, the company has spent more than $300 million to improve energy efficiency in retail properties.

Notably, management conducted a survey at investor day, which found that 30% of attendees did not consider an organization’s ESG (environmental, social and corporate governance) practices important when making investment decisions.

However, sustainability is a key focus for Brookfield, and the company is thus pursuing the following objectives across its portfolio:

- Energy reduction

- Water conservation

- Recycling

- Enhanced indoor air quality

- Alternative transportation parking

- Use of green cleaning materials

[caption id="attachment_97592" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports [/caption]

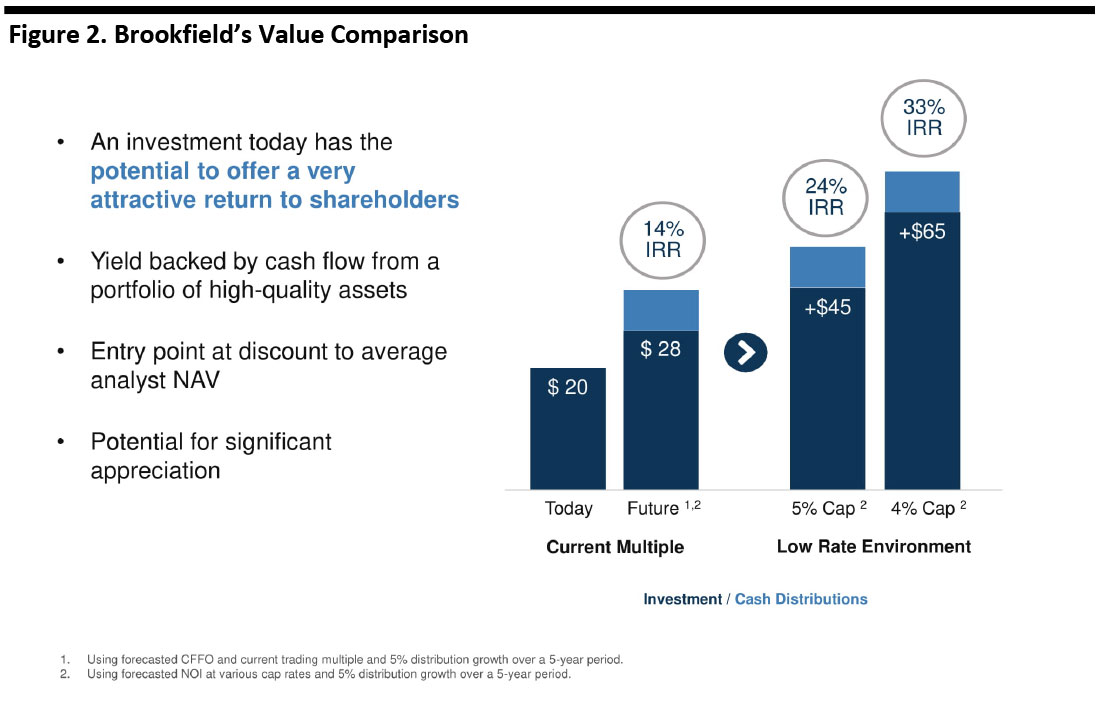

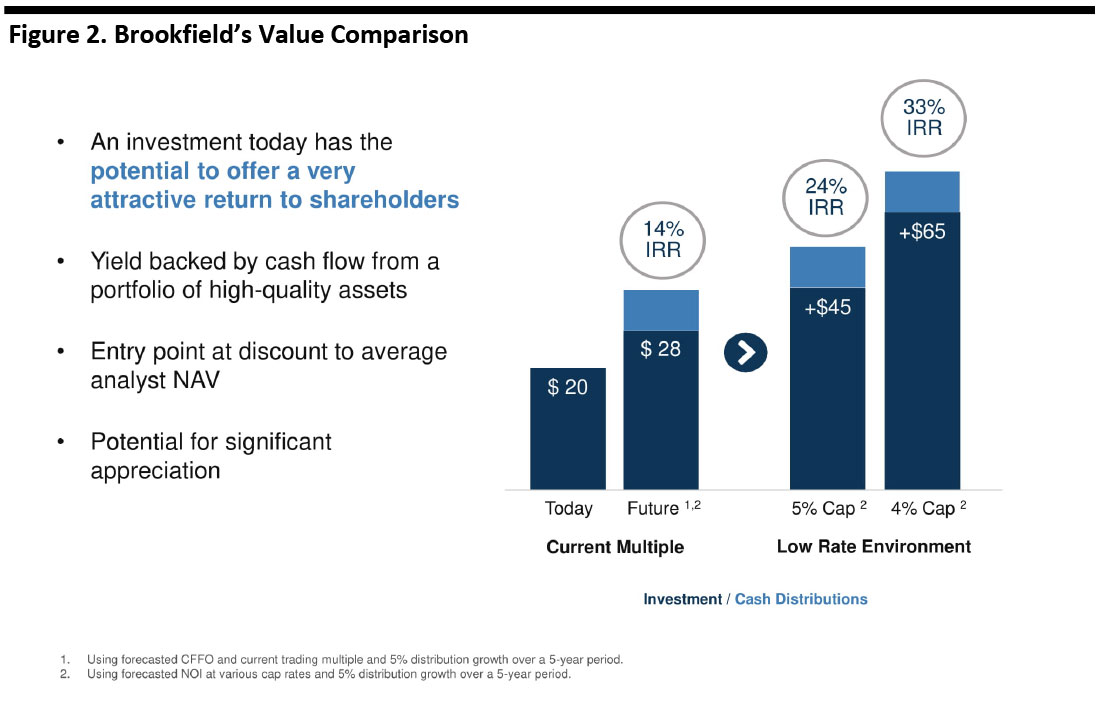

Lower Interest Rate Benefits Brookfield

Management commented that the company’s assets will become more valuable in a low-interest-rate environment.

[caption id="attachment_97593" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports [/caption]

Source: Company reports [/caption]

Lower Interest Rate Benefits Brookfield

Management commented that the company’s assets will become more valuable in a low-interest-rate environment.

[caption id="attachment_97593" align="aligncenter" width="700"]

Source: Company reports [/caption]

Lower Interest Rate Benefits Brookfield

Management commented that the company’s assets will become more valuable in a low-interest-rate environment.

[caption id="attachment_97593" align="aligncenter" width="700"] Source: Company reports [/caption]

Source: Company reports [/caption]