Nitheesh NH

What’s the Story?

Visuals impact shoppers’ buying decisions. Retailers realize this and have continued to invest in technologies such as space and floor planning software, category management tools for localization of assortment and planogram generators. Today’s omnichannel shoppers expect a seamless shopping experience, and retailers must leverage the opportunity to create an unforgettable experience for their in-store shoppers and, in turn, build loyalty and retain customers. This is easier said than done—creating a seamless experience for shoppers requires retailers to understand shopper needs across stores and create localized promotions and events. In addition, retailers must optimize store staff, communicate instructions clearly and ensure the timely resolution of issues across stores, having identified them in real time. The aforementioned criteria are not necessarily about merchandising technology, but they emphasize the importance of seamless merchandising execution. Retail merchandising technologies, coupled with an in-store execution platform or software, can help retailers bridge the gap between intent in merchandising and actual execution. The only way for retailers to know that all their instructions are executed is by seeing it in real time and closing the loop by telling a similar story across stores and building their brand, while cutting costs. [caption id="attachment_118008" align="aligncenter" width="700"] Source: Coresight Research[/caption]

In this report, we analyze the findings of an August 2020 survey of 180 global retail respondents in China, Germany, the UK and the US involved in strategic retail merchandising decision-making. We asked respondents about key retail merchandising execution challenges, benefits and best practices, as well as the importance of merchandising software, among other things.

This report is sponsored by One Door, a leading retail merchandising execution platform that helps retailers plan, execute and analyze their in-store merchandising efforts.

Source: Coresight Research[/caption]

In this report, we analyze the findings of an August 2020 survey of 180 global retail respondents in China, Germany, the UK and the US involved in strategic retail merchandising decision-making. We asked respondents about key retail merchandising execution challenges, benefits and best practices, as well as the importance of merchandising software, among other things.

This report is sponsored by One Door, a leading retail merchandising execution platform that helps retailers plan, execute and analyze their in-store merchandising efforts.

Why It Matters

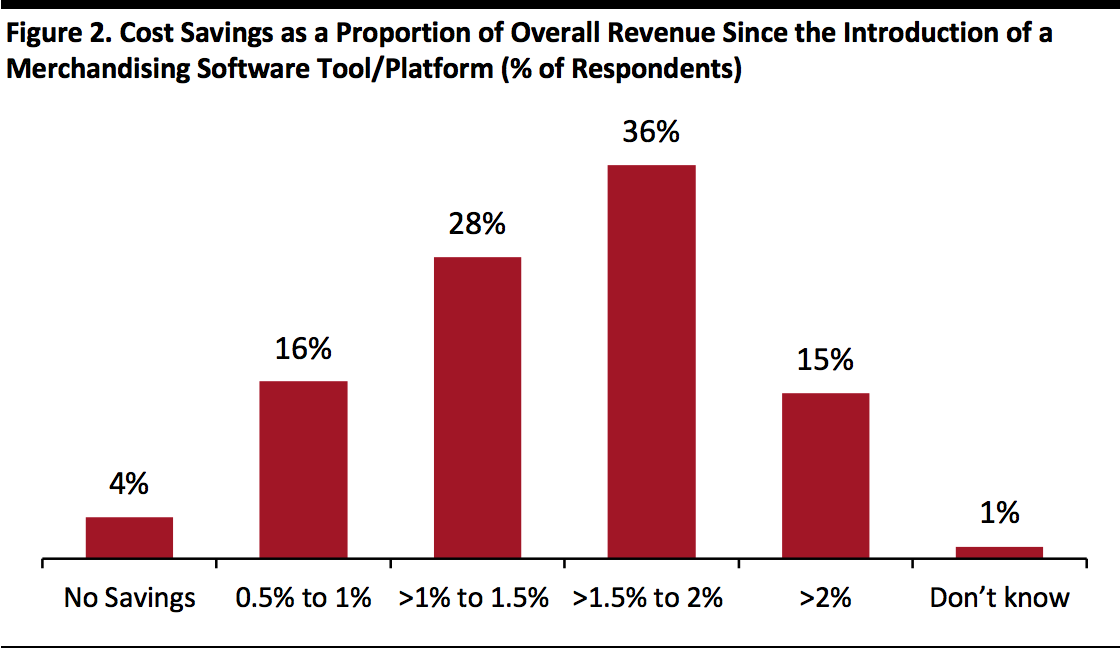

In today’s complex retail environment, in-store merchandising execution can often be challenging for store associates to carry out efficiently. Some common day-to-day challenges for store associates include issues with multiple communication streams, lack of clarity in instructions from headquarters and incorrect or damaged promotional material. Challenges for retailers include lack of transparency and an inability to understand work completion across stores. Poor merchandising execution costs retailers sales. In fact, over 50% of retailers lose 5–10% of their sales to poor in-store execution, and more than one-quarter (26%) lose 10–15% of their sales, according to Coresight Research’s October 2019 survey of 200 global retail decision-makers. Effective retail merchandising execution not only translates to increases in sales and basket size but also has a substantial impact on retailers’ revenues. An end-to-end merchandising platform can help retailers save costs through the following:- Better merchandising compliance across stores

- Real-time identification of corrective actions

- Reduction in time and effort to achieve merchandising compliance

- Reduction in printing and shipping instructions to stores

- Reduction in production of promotional signage

Base: 123 global merchandising decision-makers who use merchandising software

Base: 123 global merchandising decision-makers who use merchandising softwareSource: Coresight Research[/caption]

Lack of Transparency and Clear Communication: The Achilles Heel of Retail Merchandisers

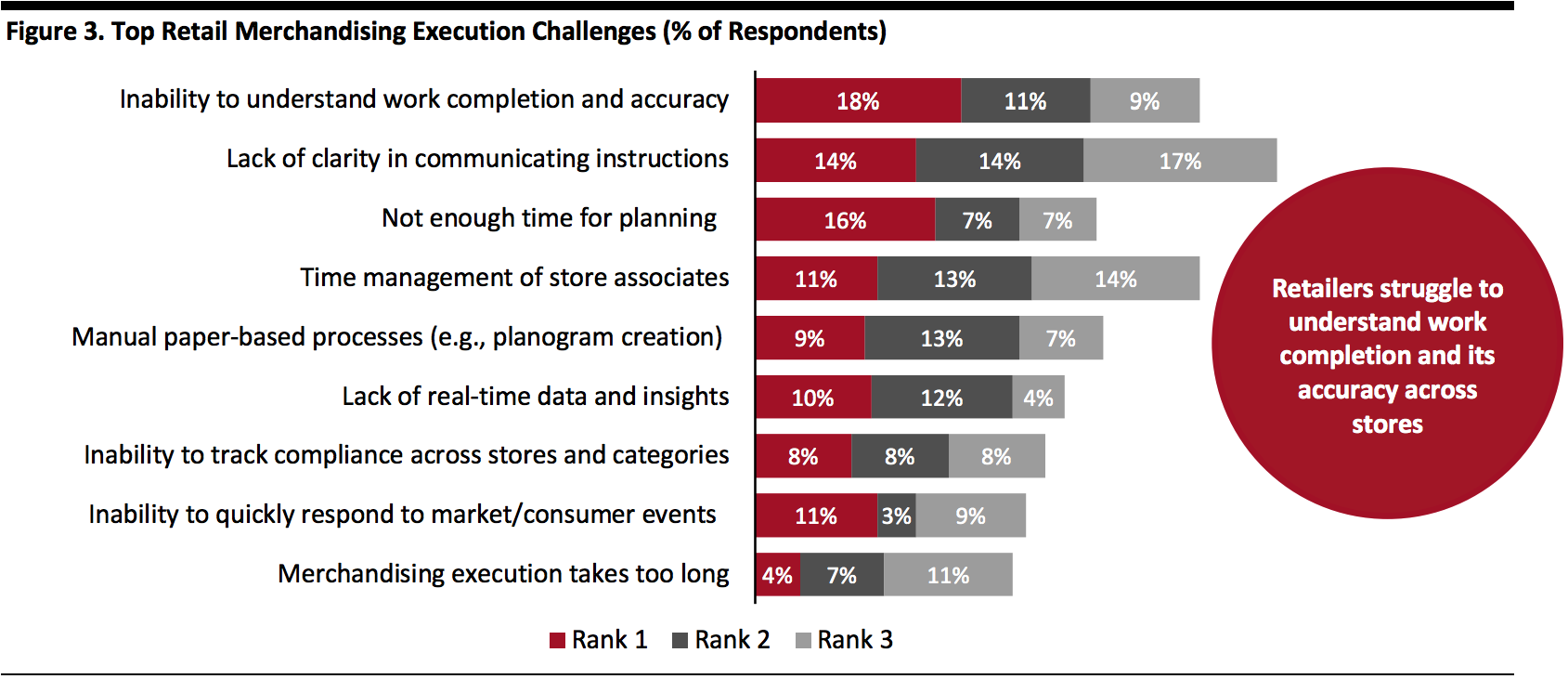

Retail merchandising has evolved leaps and bounds over the past few years and is no longer confined to simply placing products in stores based on guesswork. Brands and retailers are increasingly using technologies such as artificial intelligence (AI), virtual reality tools to plan store layout, and planograms and advanced analytics to curate their in-store assortment. An increase in multichannel shoppers along with the rising importance of localization has been fueling this trend and has left retailers with no choice but to innovate their retail merchandising strategy to stay ahead of the competition. For example, sportswear brand NIKE opened its first concept store, “Nike by Melrose,” on Melrose Avenue, Los Angeles in July 2018. At Nike by Melrose, store merchandise is informed by analysis of omnichannel sales and NikePlus data to meet the needs of the local community. In its fourth-quarter 2020 earnings call in June 2020, NIKE’s EVP and CFO Matthew Friend cited testing a similar concept in Tokyo, where store inventory is routinely changed based on digital demand. Similarly, Tractor Supply is working on a space-productivity technology for SKU (stock keeping unit) localization and assortment to help grow its specific product categories across its stores. In the company’s fourth-quarter earnings call in January 2020, Tractor Supply’s CEO Harry Lawton said, “Leading retailers need to excel at not only merchandising, customer service and execution but also at data, technology, flexible supply chains and productivity. The key for successful retailers, however, will continue to be the same: a differentiated customer experience.” Retailers must communicate instructions clearly from headquarters to store associates to ensure that changes to the store layout and planograms are implemented in real time. In addition, it is important for retailers to validate work completion and determine its accuracy to maximize returns from their merchandising strategy. However, retailers face challenges in doing so. We asked respondents about the challenges involved in retail merchandising execution, and found that:- An inability to understand work completion and its accuracy emerged as the topmost challenge for retailers, with 38% of respondents citing it as a “top challenge” (ranked first, second or third) and 18% citing it as the biggest challenge.

- A lack of clarity in communicating instructions was cited as a top challenge by 45% of respondents in total, with 14% reporting it to be the biggest retail merchandising challenge.

- Some 30% of respondents cited not having enough time for planning as a top retail merchandising challenge.

Note: The ordering of responses is based on the weighted average of all responses, where “Rank 1” carries the highest weight.

Note: The ordering of responses is based on the weighted average of all responses, where “Rank 1” carries the highest weight.Base: 180 global retail merchandising decision-makers

Source: Coresight Research[/caption]

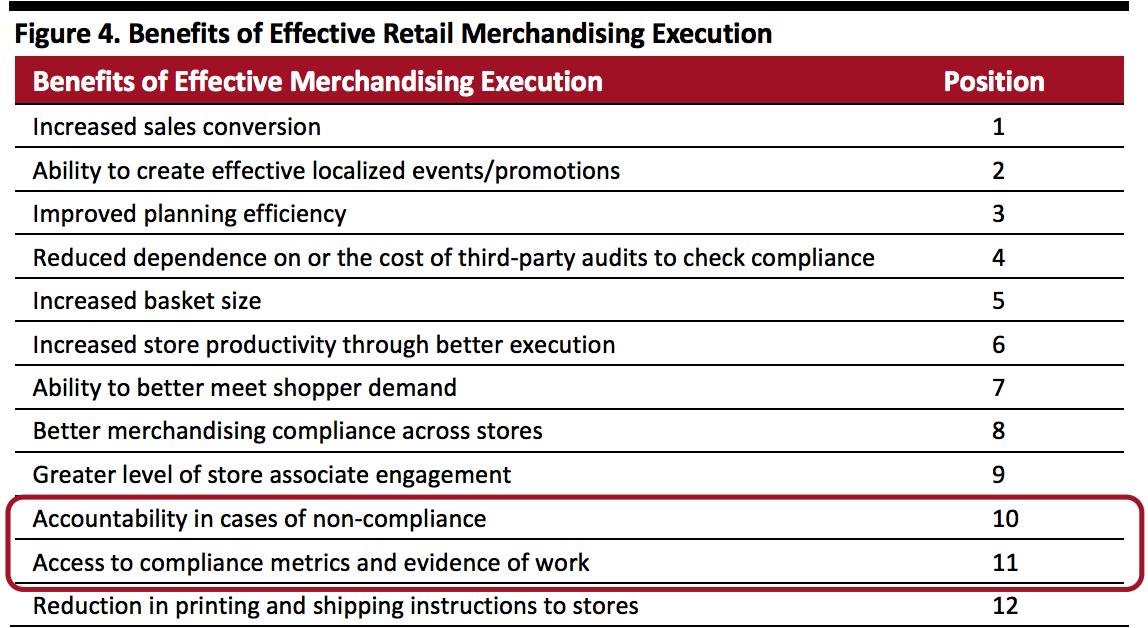

Effective Merchandising Execution Translates to Higher Sales and Improved Localization

Effective merchandising execution—including ensuring adequate stock levels, planogram compliance and offering the relevant promotions to targeted consumers—can help retailers to increase sales and average basket size. Consumers expect their shopping experience to be convenient. In fact, nine in 10 shoppers back out of a purchase if it is inconvenient to them, according to a survey of 2,949 US adults conducted by the NRF in October 2019. Furthermore, seven in 10 shoppers cited leaving a store empty-handed because they could not find what they wanted, according to iVend’s 2018 survey of 2,250 global consumers. Effective merchandising execution can help retailers to satisfy the needs of their shoppers. By properly maintaining shelves and accurately executing data-driven instructions from headquarters, retailers can best meet the expectations of today’s busy omnichannel shoppers, which in turn lifts sales. In fact, we asked respondents about the benefits of effective retail merchandising execution and found that:- Increased sales conversion emerged as the topmost benefit of effective retail merchandising, with over half of respondents (51%) citing it at as a benefit. In addition, 36% of respondents ranked increased sales conversion as the biggest benefit—which is by far the largest proportion among all benefits.

- Retailers understand the importance of effective merchandising execution in creating localized promotions and events; it achieved the second-place ranking, with 52% of respondents citing it as a benefit of effective retail merchandising execution.

Note: Position cited above is obtained by taking a weighted average of all responses, with “Rank 1” carrying the highest weight.

Note: Position cited above is obtained by taking a weighted average of all responses, with “Rank 1” carrying the highest weight.Base: 180 global retail merchandising decision-makers

Source: Coresight Research[/caption]

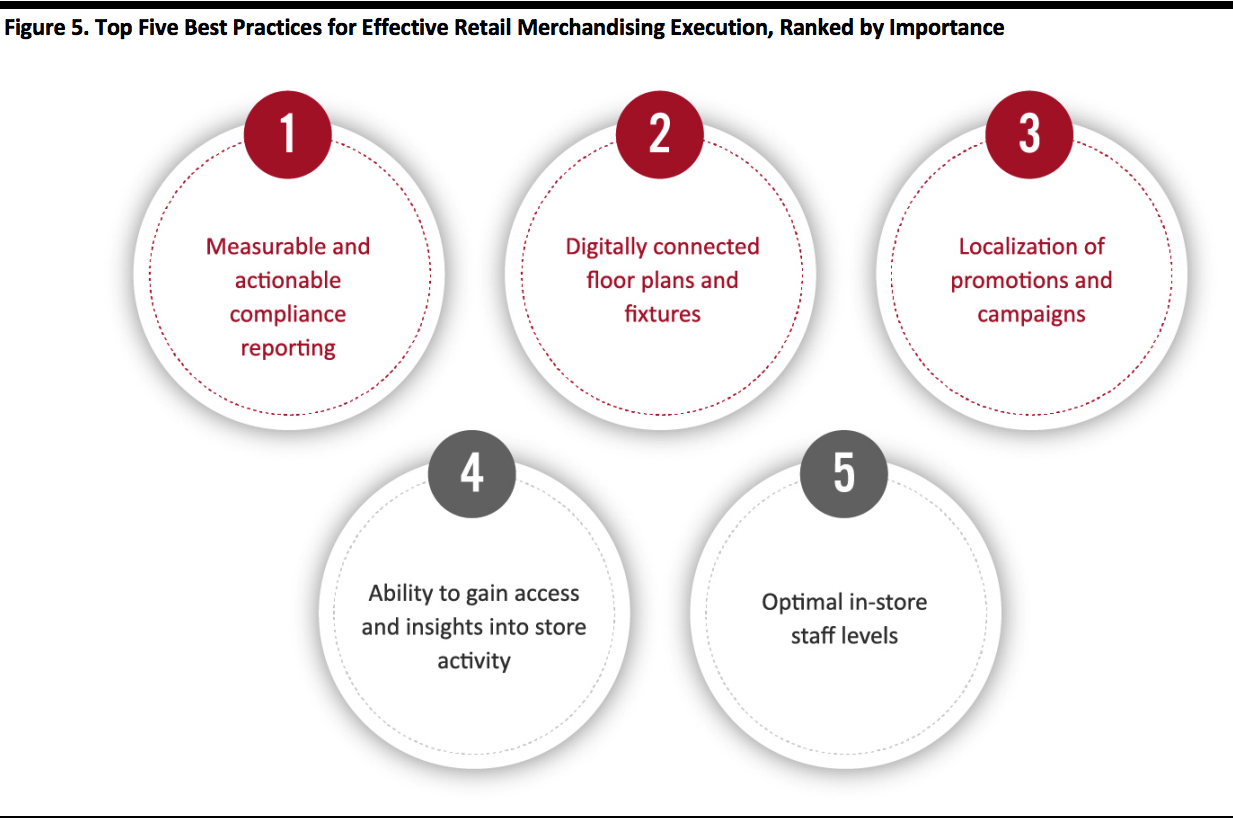

Best Practices Revolve Around Leveraging Data Efficiently and Digitalization

There are clear root causes for retail merchandising execution challenges. Store associates receive a lot of information—such as instructions from headquarters and vendors—through multiple streams of communication, and it is often difficult for retailers to ensure the completion of work; and when they do, accuracy remains questionable in most cases. We asked respondents about best practices of merchandising execution and found the following:- Measurable and actionable compliance reporting emerged as the topmost best practice, with 48% of respondents citing it as a best practice. Retailers understand the importance of compliance reporting in ensuring effective merchandising execution—and for that reporting to be measurable and actionable.

- Digital floor plans and fixtures emerged as the second-most important best practice. With an option to digitally access floor plans and fixtures, retailers can improve guidance from headquarters to individual stores, and associates can benefit from viewing instructions down to the bay and notch levels.

- 47% of respondents cited localization of promotions and events as a best practice. Localization can help retailers reach the right customer with the right promotion, translating to sales.

Note: The ranking of best practices is based on the weighted average of all responses, where “Rank 1” carries the highest weight.

Note: The ranking of best practices is based on the weighted average of all responses, where “Rank 1” carries the highest weight.Base: 180 global retail merchandising decision-makers

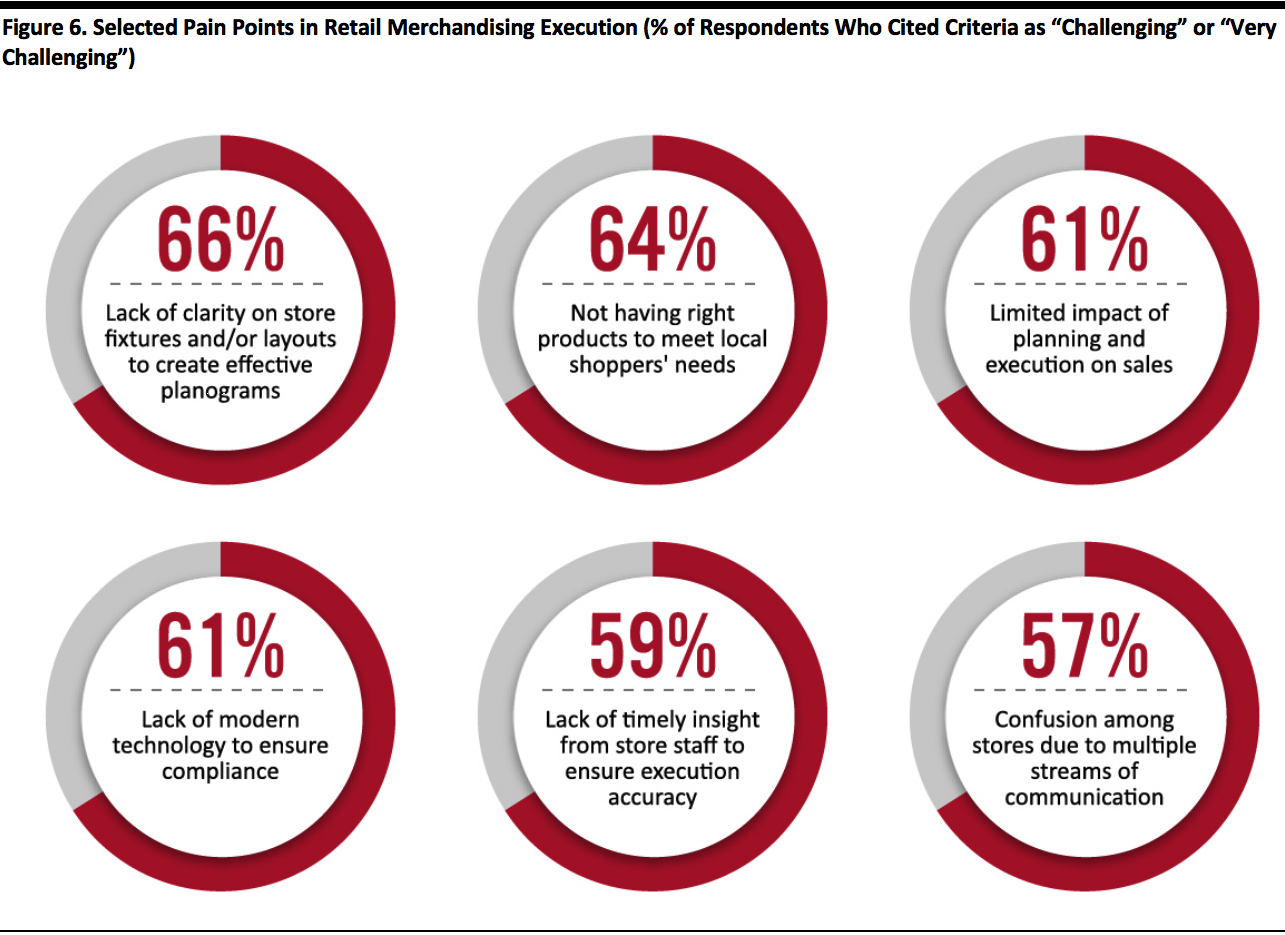

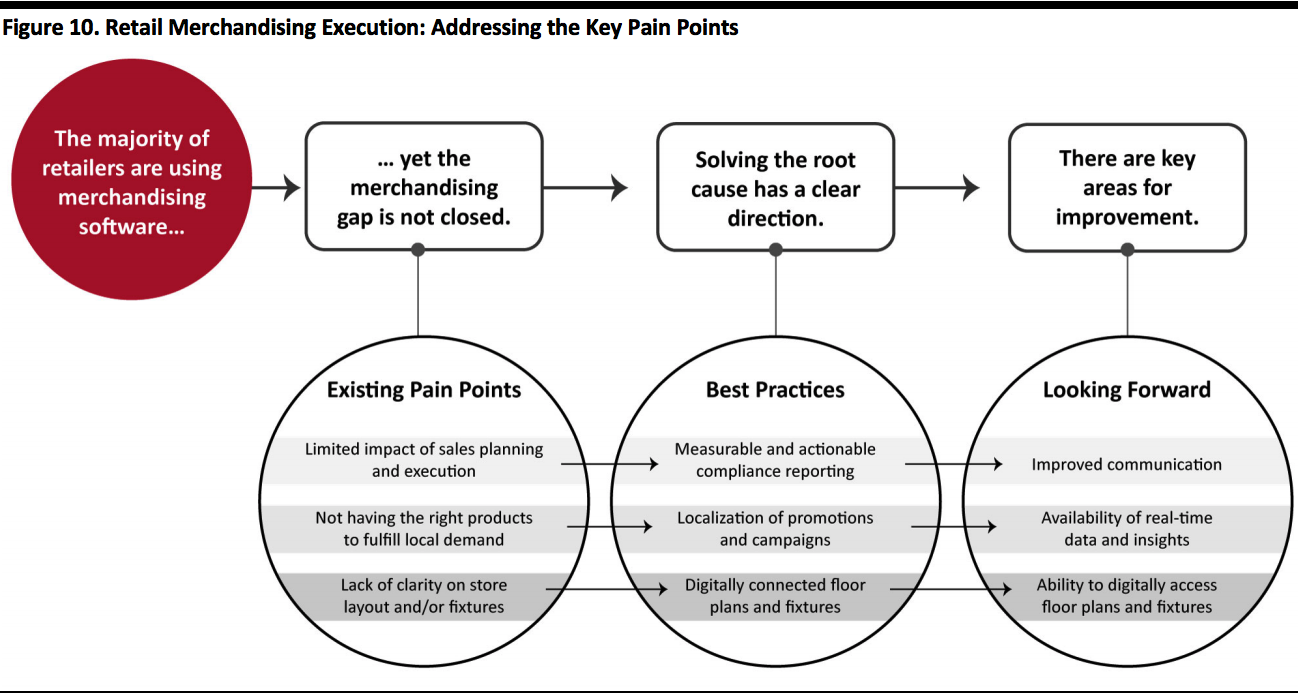

Source: Coresight Research[/caption] However, our survey findings reveal that despite retailers having a clear understanding of the best practices for effective retail merchandising execution, they find the execution tasks challenging. We asked respondents about their existing pain points in retail merchandising execution. The majority of the surveyed retailers (66%) cited lack of clarity on store fixtures and layouts as the biggest execution pain point. Similarly, while five in 10 respondents cited localization as a best practice of merchandising execution, 64% of respondents find meeting the needs of local shoppers to be a key pain point. Three of the top six pain points pertain to communication, including real-time insights and compliance reporting: 61% of respondents cited a lack of modern technology to ensure compliance as a pain point in merchandising execution; 59% cited not having real-time insights from store staff; and 57% cited confusion among stores due to multiple communication streams. [caption id="attachment_118013" align="aligncenter" width="700"]

Base: 180 global retail merchandising decision-makers

Base: 180 global retail merchandising decision-makersSource: Coresight Research[/caption]

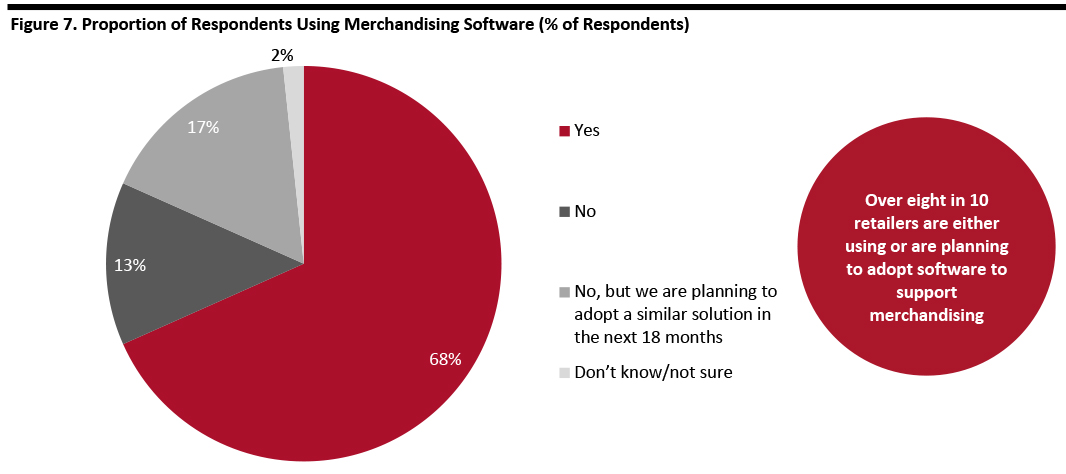

The Majority of Retailers Are Using Some Type of Merchandising Software

Retailers understand the importance of using an integrated software tool or platform to support merchandising initiatives such as space planning, localization of promotions and in-store execution. Furthermore, with a rise in BOPIS (buy online, pick up in store) and curbside-pickup orders in light of the Covid-19 pandemic, retailers are struggling to carry out all store operations efficiently. We asked survey respondents whether they are using a software tool or platform to support any of their retail merchandising processes, ranging from space planning to compliance reporting. We found that:- The majority of retailers—seven in 10—reported that they are using retail merchandising software to support some, or all, of their retail merchandising processes.

- Some 17% of respondents said that they are planning to adopt a similar solution within the next 18 months.

Base: 180 global retail merchandising decision-makers

Base: 180 global retail merchandising decision-makersSource: Coresight Research[/caption]

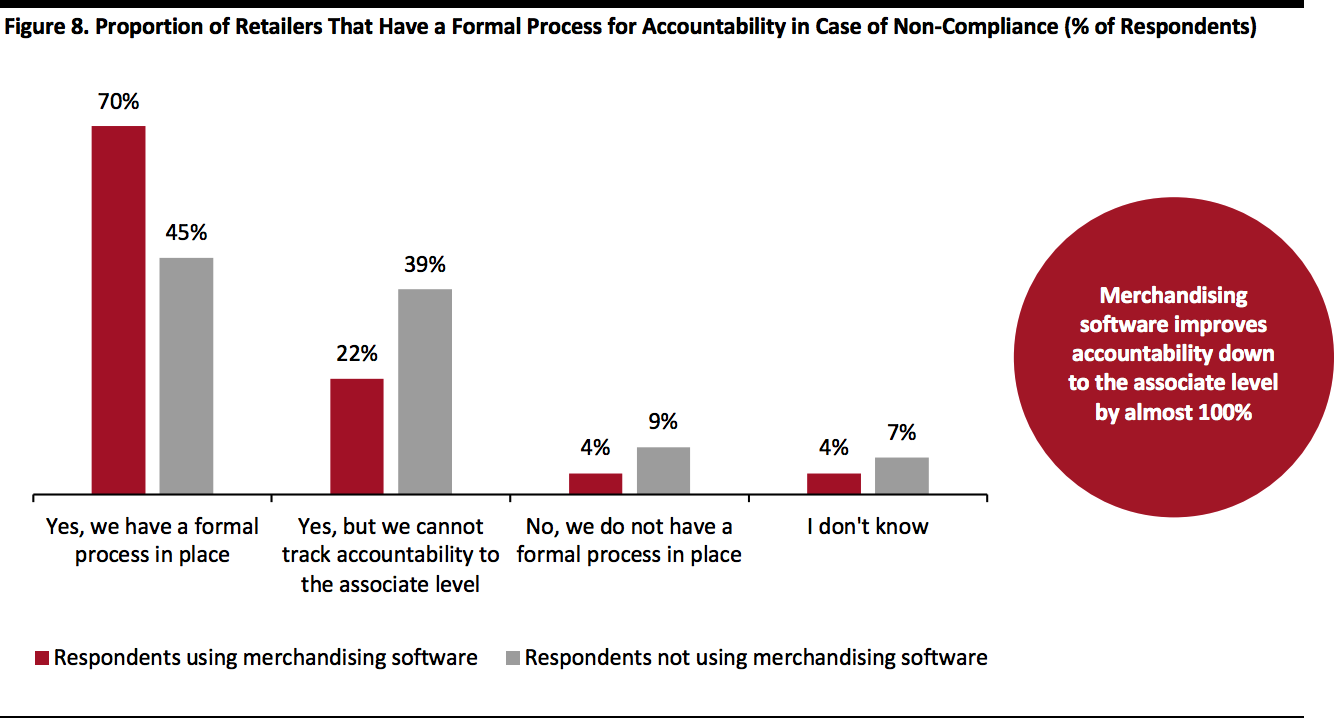

Merchandising Software Improves Accountability in Case of Non-Compliance

With a large store fleet, it becomes a tedious task for retailers to have accurate in-store visibility on compliance. With growing competition and pressure from e-commerce, brick-and-mortar retailers must ensure that promotions, displays and planograms across stores are compliant with instructions. Actionable insights are important—very important in fact—but are not enough for effective merchandising execution; accountability plays a pivotal role. Having an organized accountability process in place allows retailers to quickly implement corrective actions in case of non-compliance. We asked survey respondents whether they have a formal accountability process in place in case of non-compliance. We found that:- Fully 70% of the respondents that are using merchandising software cited having a formal process in place, while 22% said they cannot track accountability down to the associate level.

- Just 45% of the respondents that are not using merchandising software cited having a formal accountability process in place, while 39% said they cannot track accountability down to the associate level.

Base: 180 global retail merchandising decision-makers

Base: 180 global retail merchandising decision-makersSource: Coresight Research[/caption]

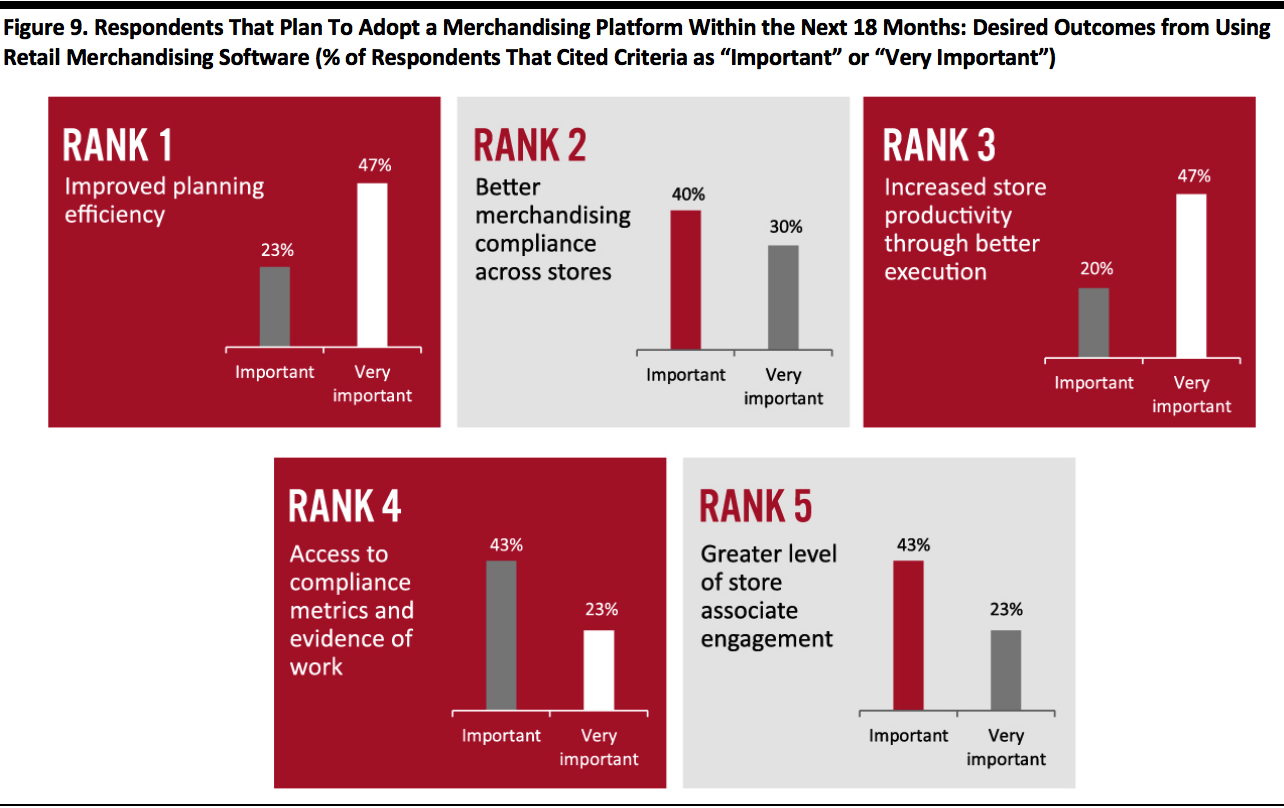

Clear Winners in What Retailers Seek in Merchandising Software

Based on our survey findings up to this point, we can conclude that retailers struggle to understand the completion of work and its accuracy across stores, meaning that there is a need for modern technology to ensure compliance. In addition, sending clear instructions to store associates across stores is a big challenge for retailers; multiple communication streams add to confusion among store associates and there is no real-time feedback—this slows the overall merchandising execution process. We also discovered that retailers feel they are not able to plan efficiently due to time constraints. To understand market interest in merchandising software, we asked the respondents that plan to adopt a merchandising platform within the next 18 months about their desired outcome from using such software. We found the following:- Improved planning efficiency emerged as the topmost desired outcome, with seven in 10 respondents citing it as “important” or “very important.” Also, 47% of respondents cited better planning efficiency as the “most important” outcome.

- Better merchandising compliance took the second spot in desired outcomes from using merchandising software—40% of respondents said it is “important,” while 30% cited it as “very important.”

- Just under seven in 10 respondents cited increased productivity as a result of better merchandising execution as either an “important” or “very important” desired outcome from using merchandising software.

Note: The ranking of responses in based on the weighted average of proportion of respondents who selected criteria as “Important” or “Very Important,” where “Very Important” carries higher weight. To separate Ranks 4 and 5, we based our decision on respondents who cited criteria as “Not Important.”

Note: The ranking of responses in based on the weighted average of proportion of respondents who selected criteria as “Important” or “Very Important,” where “Very Important” carries higher weight. To separate Ranks 4 and 5, we based our decision on respondents who cited criteria as “Not Important.”Base: 30 global retail merchandising decision-makers

Source: Coresight Research[/caption]

Retail Merchandising Execution: Key Insights and the Path Forward

Our survey findings reveal clear existing gaps in retail merchandising execution. According to the survey, the majority of retailers are using merchandising software to support their business operations but have not been able to eliminate persisting pain points in merchandising execution—leaving the gap open. [caption id="attachment_118017" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Based on our survey analysis, we underline the key opportunities in retail merchandising execution:

Source: Coresight Research[/caption]

Based on our survey analysis, we underline the key opportunities in retail merchandising execution:

- There is a need for improved communication. Having a clear stream of communication among store associates and between headquarters and individual stores is non-negotiable for effective merchandising execution. Some 45% of respondents cited a lack of clarity in communicating instructions as a retail merchandising challenge.

- Measurable and actionable insights are required. Retailers can improve their execution efforts only if data insights from across stores are measurable and actionable. Retailers realize this, citing it as the topmost best practice for effective merchandising execution; however, retailers’ execution pain points include a lack of real-time insights to ensure compliance accuracy and confusion among store associates due to multiple communication streams. We believe that modern AI-based technologies can help retailers to solve this problem—our survey respondents agree, with six in 10 citing a lack of modern technology to ensure compliance as an execution pain point.

- Retailers want better planning efficiency, compliance and store productivity. Retailers’ expectations from merchandising software underline the need for improved technology to help them access real-time and actionable insights across stores, thus enabling them to improve planning efficiency. Five in 10 respondents that plan to adopt merchandising software within the next 18 months cited improved planning efficiency as the “most important” desired outcome from using the software.

Closing the Retail Merchandising Loop

One Door’s retail merchandising platform leverages advanced technologies—including AI and computer vision—to help retailers manage their end-to-end merchandising execution efforts. Below, we list the key benefits of One Door’s AI-powered solution, Store Board, for retailers to improve their merchandising execution capabilities.- Compliance Management: One Door’s Store Board provides retailers with the store-level data about compliance across individual stores for a set time period. Such data can help retailers understand which stores are performing better than others and those that are less compliant.

- Real-Time Resolution of Issues: With a unified platform such as Store Board, headquarter teams can identify issues across stores—including with fixtures, merchandise, installation items and demo devices, among others. Using Store Board, retailers can easily communicate with their store teams to resolve issues in real time and keep track of unresolved issues.

- Measurable Engagement: The first step to ensuring merchandising compliance involves identifying the stores that are least compliant and then working towards improving compliance. According to a recent study by One Door, there is a strong correlation between associate engagement and compliance; stores that used One Door’s merchandising platform for one more day than others saw a 1.5% increase in their overall compliance. Quantifying engagement is not easy. However, Store Board enables retailers to access metrics such as the number of stores that viewed announcements and/or comments, accessed resources, completed questionnaires and uploaded compliance photos. This helps retailers to identify the stores that require corrective actions. For more information, visit onedoor.com

Methodology

This study is based on the analysis of data from an online survey of 180 global retailers. We selected respondents based on the following criteria:- Based in China, Germany, the UK and the US, with around 40 respondents per country.

- Position focus on brick-and-mortar and e-commerce.

- Employed in companies with an annual turnover equal to or exceeding $100 million in the most recent fiscal year.

- Holding senior positions (owners, C-suite, VP/EVP, directors, senior managers).

- Responsible for category management, merchandising, retail marketing, customer insights and analytics, space management and store operations.

- Holding roles with significant strategic decision-making responsibilities.